Canada

May 10, 2023

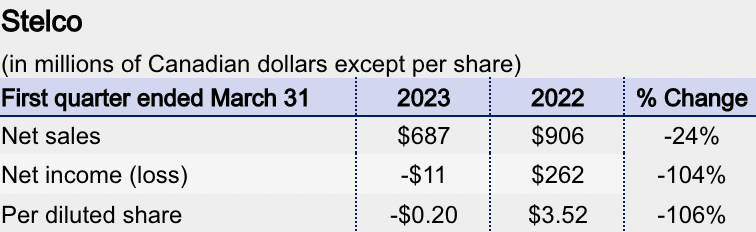

Stelco Swings to Q1 Loss, Predicts Better Q2

Written by Michael Cowden

Canadian flat-rolled steelmaker Stelco swung to a loss in the first quarter on lower selling prices and increased costs.

The Hamilton, Ontario-based steelmaker said that increased shipments weren’t enough to offset those headwinds. It predicted better times in the second quarter.

“Prices in the second quarter have improved to more favorable levels, lead-times have normalized, and we have begun to see some relief from certain inflationary pressures,” CEO and executive chairman Alan Kestenbaum said in a statement released with earnings results on Wednesday, May 10.

“Prices in the second quarter have improved to more favorable levels, lead-times have normalized, and we have begun to see some relief from certain inflationary pressures,” CEO and executive chairman Alan Kestenbaum said in a statement released with earnings results on Wednesday, May 10.

“We anticipate a significantly more robust level of earnings in the second quarter and a continued buildup in cash,” he added.

Stelco posted a net loss of Canadian $11 million ($8.23 million USD) in Q1’23, down from a profit of C$906 million in Q1’22 on revenue that fell 24% to C$687 million over the same period.

Average selling prices in Q1’23 were C$960 ($713 USD) per ton, down 56% from $1,493 per ton in Q2’22 but roughly on par with $963 per ton in Q4’22.

Stelco shipped 695,000 net tons in the in Q1’23, up 17% from 594,000 tons in Q1’22. Hot-rolled coil shipments led the way. They were up 23% to 512,000 tons.

Full shipment details are below:

By Michael Cowden, michael@steelmarketupdate.com