Prices

May 9, 2023

SMU Price Ranges: Sheet Prices Fall Again, Where Is the Floor?

Written by Michael Cowden

Sheet price continued to decline this week on increased supply, shorter lead times, and aggressive pricing from some domestic mills.

Also pressuring steel prices were expectations of lower scrap prices and import competition.

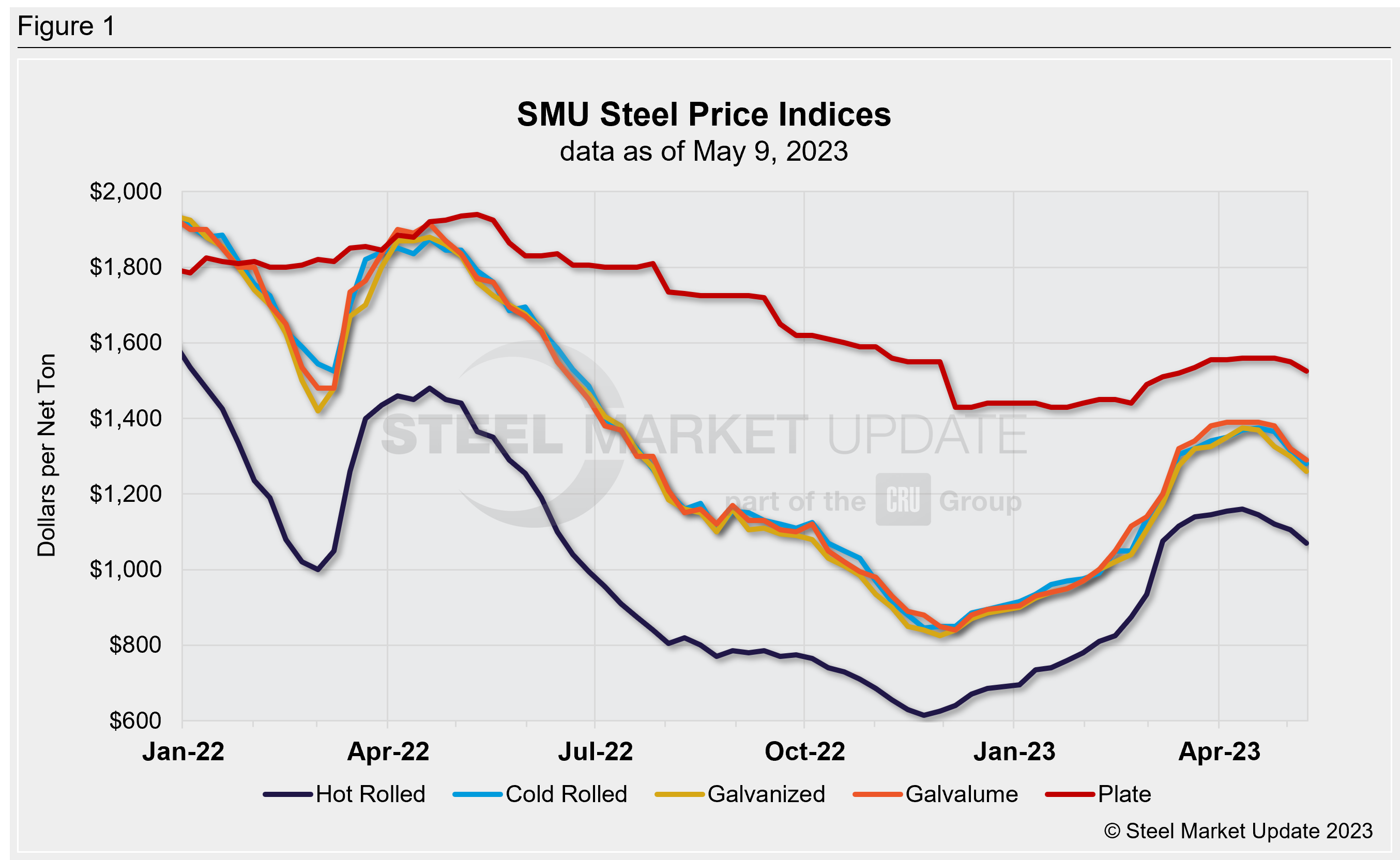

SMU’s hot-rolled coil price now stands at $1,070 per ton ($53.50 per cwt), down $35 per ton from $1,105 per ton last week and down $90 per ton from a 2023 high of $1,160 per ton in mid-April.

Prices for value-added products also slipped, with cold rolled down $35 per ton, galvanized down $40 per ton, and Galvalume off by $30 per ton.

Plate, which has been steady compared to sheet, dropped $25 per ton after losing $10 per ton a week ago.

In sheet, some large consumers reported being offered tons at significantly lower numbers than our published prices. That left other buyers concerned that today’s “special” price could become the prevailing price for more repeatable spot buys. How quickly that might happen remained a matter of debate.

Yet even as market participants questioned how far and how fast prices might fall, most said demand remained steady and lower prices stemmed primarily from increased supply.

Our sheet price momentum indicators remain pointed downward on widespread consensus that prices will move lower in the weeks ahead. There was less consensus on the direction of plate prices, and so our plate momentum indicator remains at neutral.

Hot-Rolled Coil: The SMU price range is $1,000–1,140 per net ton ($50.00–57.00 per cwt), with an average of $1,070 per ton ($53.50 per cwt) FOB mill, east of the Rockies. The bottom end of our range decreased by $60 per ton vs. one week ago, while the top end was down $10 per ton week-on-week (WoW). Our overall average is down $35 per ton WoW. Our price momentum indicator for hot-rolled coil points downward, meaning we expect the market will be down over the next 30 days.

Hot-Rolled Lead Times: 4–8 weeks

Cold-Rolled Coil: The SMU price range is $1,210–1,350 per net ton ($60.50–67.50 per cwt), with an average of $1,280 per ton ($64.00per cwt) FOB mill, east of the Rockies. The lower end of our range was down by $70 per ton, while the top end was unchanged compared to a week ago. Our overall average is down $35 per ton WoW. Our price momentum indicator on cold-rolled coil points downward, meaning we expect the market will be down over the next 30 days.

Cold-Rolled Lead Times: 6–10 weeks

Galvanized Coil: The SMU price range is $1,170–1,350 per net ton ($58.50–67.50 per cwt), with an average of $1,260 per ton ($63.00 per cwt) FOB mill, east of the Rockies. The lower end of our range was down by $70 per ton WoW, while the top end of our range was down $10 per ton vs. one week ago. Our overall average is down $40 per ton vs. the prior week. Our price momentum indicator on galvanized steel points downward, meaning we expect the market will be down over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,267–1,447 per ton with an average of $1,357 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–10 weeks

Galvalume Coil: The SMU price range is $1,240–1,340 per net ton ($62.00-67.00 per cwt), with an average of $1,290 per ton ($64.50 per cwt) FOB mill, east of the Rockies. The lower end of the range was down $50 per ton WoW, while the top end of the range was down $10 per ton vs. the week prior. Our overall average is down $30 per ton when compared to one week ago. Our price momentum indicator on Galvalume steel now points downward, meaning we expect the market will be down over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,534–1,634 per ton with an average of $1,584 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8–10 weeks

Plate: The SMU price range is $1,480–1,570 per net ton ($74.00–78.50 per cwt), with an average of $1,525 per ton ($76.25 per cwt) FOB mill. The lower end of our range of our range was down $50 per ton compared to the prior week, while the top end of our range was unchanged WoW. Our overall average declined $25 per ton vs. the prior week. Our price momentum indicator on steel plate moved to neutral, meaning we are unsure what direction prices will go over the next 30 days.

Plate Lead Times: 5–10 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By Michael Cowden, michael@steelmarketupdate.com