Market Data

April 16, 2023

Final Thoughts

Written by Michael Cowden

I sometimes think of Steel Market Update as an early-warning system for big market moves, and our most recent survey data clearly points to a market inflection.

Take these three slides from our latest steel market survey.

SMU Steel Market Survey Highlights

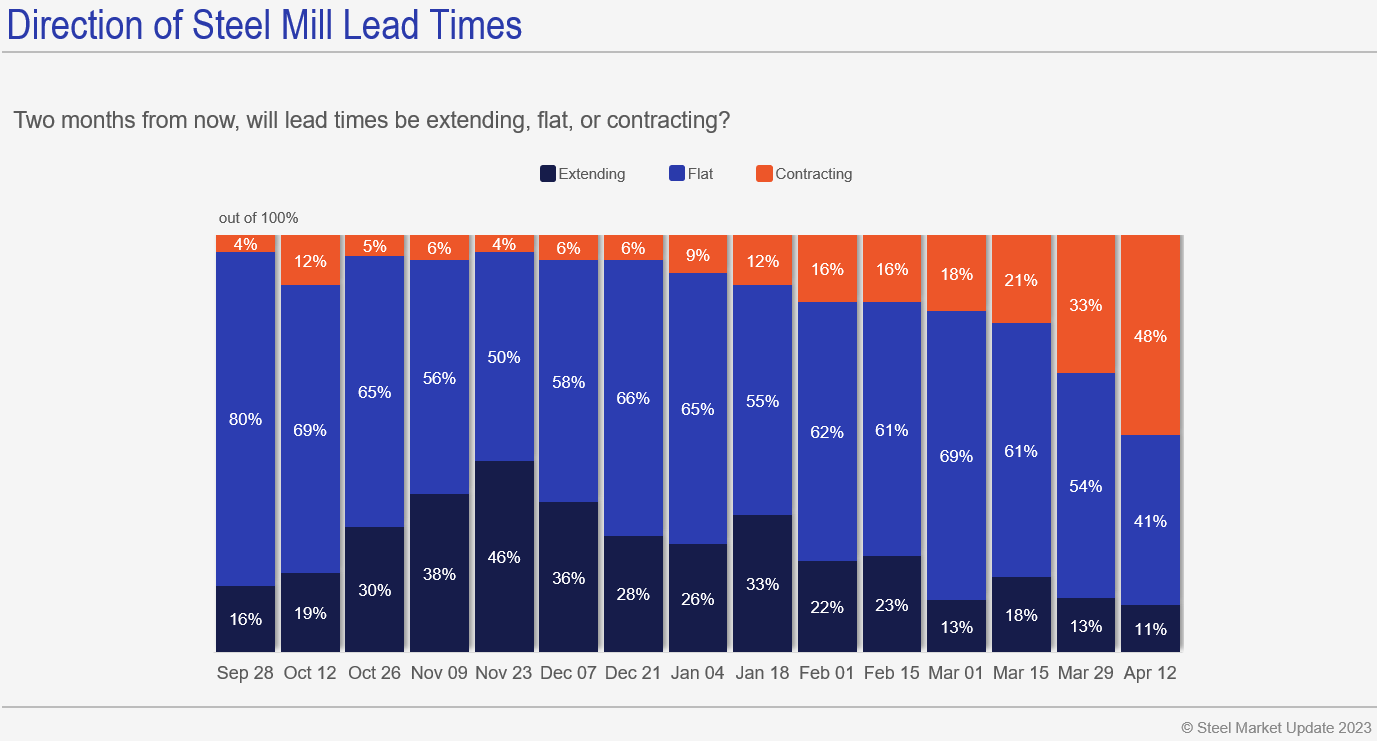

For starters, nearly half of respondents to our latest survey think lead times will be contracting two months from now:

There are some seasonal reasons for that – namely, the “summer doldrums.” Still, lead times often lead price moves, and you could make this case that this data series leads lead times.

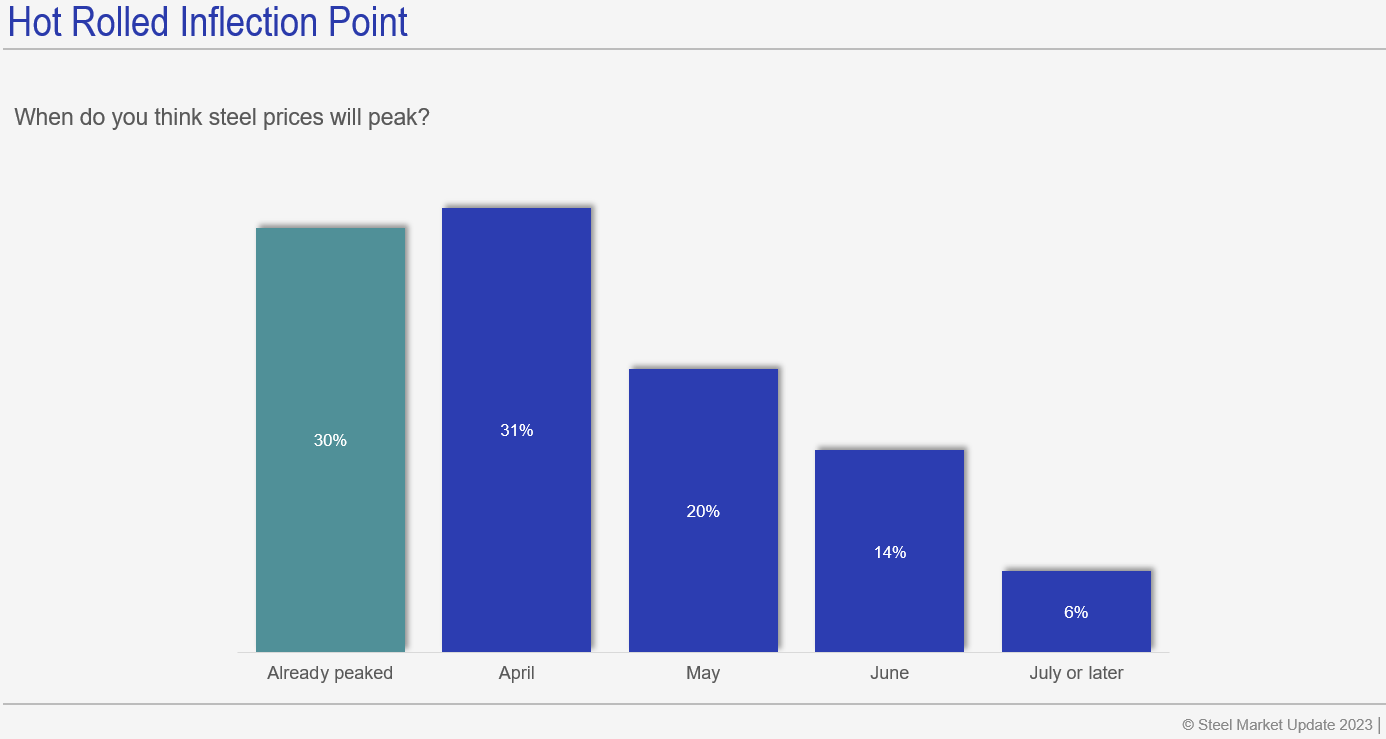

Also, more than 80% of survey respondents think that HRC prices have already peaked or will before Memorial Day.

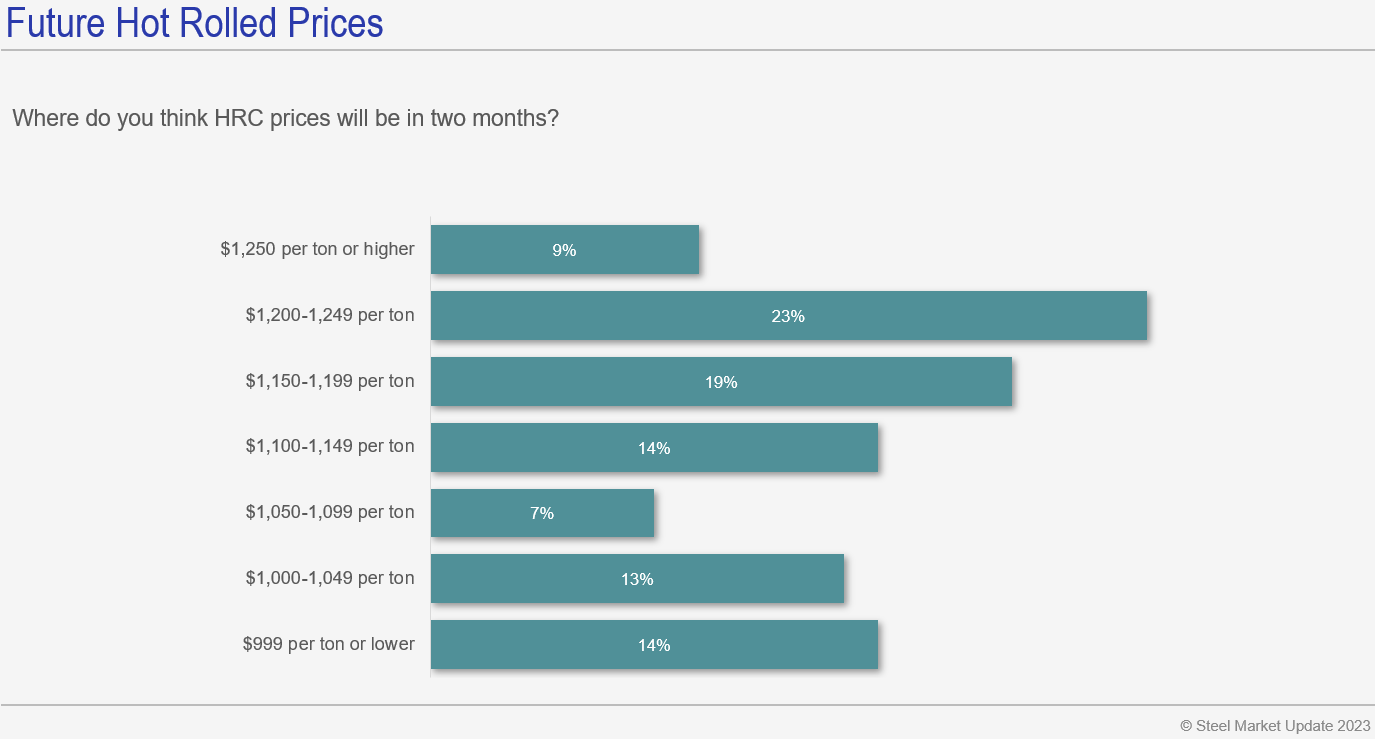

Finally, only 9% of respondents think HRC prices at or above $1,250 per ton ($62.50 per cwt) are in the cards:

That’s notable because Cleveland-Cliffs announced that it was raising spot HRC prices to $1,300 per ton earlier this month. Yet fewer steel buyers expect to see such a price point now than a month ago – before that increase – when 20% thought $1,250+ HRC was likely.

It’s not like these results are occurring in a vacuum. We’ve seen a host of important indicators change direction this month.

As we noted in this newsletter, future sentiment readings remain below current sentiment. That’s sort of our version of an inverted yield curve.

We also reported that scrap prices fell in April for the first time since December. It’s not unusual to see that happen this time of year. But it’s one less reason for mills to hold on to current high prices.

And as I noted in my last Final Thoughts, lead times, which stopped extending in the second half of March, have fallen significantly for the first time since late November. The dip in lead times comes as mills are more willing to negotiate spot prices, another big trend change.

What They’re Saying

That’s the data. What are people saying? The anecdotes I’ve gleaned are mostly in sync with our survey results.

A Midwest service center source, for example, told me a northern mill was offering $1,100 per ton or less for larger orders (think thousands of tons). That’s at least $60 per ton below our current HRC price of $1,160 per ton.

The absolute numbers there matter less than the trend. When the market is moving upward, we typically hear that offer prices are higher than our latest published price. (We update our prices every Tuesday evening.) When the market is falling, the reverse is true.

Another example: A service center exec in the Ohio Valley told me that a domestic mill had reduced his base price for galvanized product by ~$30 per ton since we last spoke. That might not be worth noting at another point in the cycle. But it is notable now because he’d seen almost nothing but increasing prices since late last year.

There are some wild cards to keep an eye out for. We reported in a prior issue about lengthy unplanned outages at ArcelorMittal’s blast furnaces in Europe. I thought I might be writing this week that things were tighter than expected because of that.

Recall that unanticipated production problems at AHMSA were among the catalysts for sharply higher prices in the first quarter. Maybe the reduction in European supply will have knock-on effects here. But to date, I’m not hearing much.

Are some people having trouble finding certain niche items that they might have bought from ArcelorMittal Europe? Yes. Are they having trouble getting enough steel in general? No.

In short, we’ve seen just about everything flattening out and trending lower. The only thing that hasn’t yet is prices.

Don’t Take the Trend for Granted

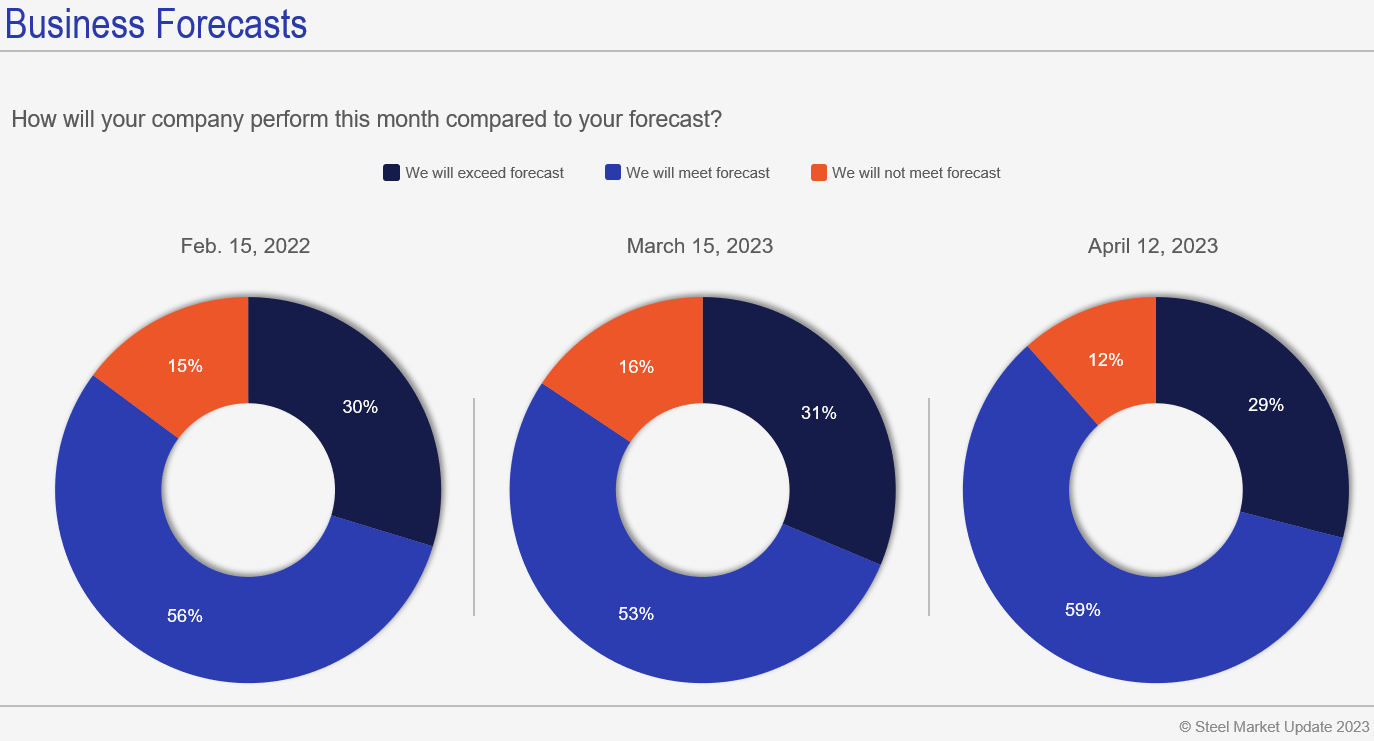

That said, it’s important not to get complacent about the market falling. I say that because most survey respondents continue to report that they are meeting or exceeding forecast:

It could be that the 6% who think prices won’t peak until H2 are onto something. Maybe they’re betting on fears of a price collapse extending the cycle? We’ve seen that happen before.

It could also be that they’re invested in higher prices. We’ve seen that happen before too.

Mills have charged sharply higher prices throughout the first quarter. Many of their customers accepted those high prices – and so the last thing they want is to see them fall quickly, taking inventory values down along with them.

In short, we can see why prices might fall. Saying exactly when that might happen is always tricky.

PS – Don’t just read our data, see your company’s experience reflected in it! Please contact us if you’d like to participate in our market survey at info@steelmarketupdate.com.

By Michael Cowden, michael@steelmarketupdate.com