Market Segment

March 15, 2023

Service Center Shipments and Inventories Report for February

Written by Estelle Tran

Flat Rolled = 52.2 Shipping Days of Supply

Plate = 45 Shipping Days of Supply

Flat Rolled

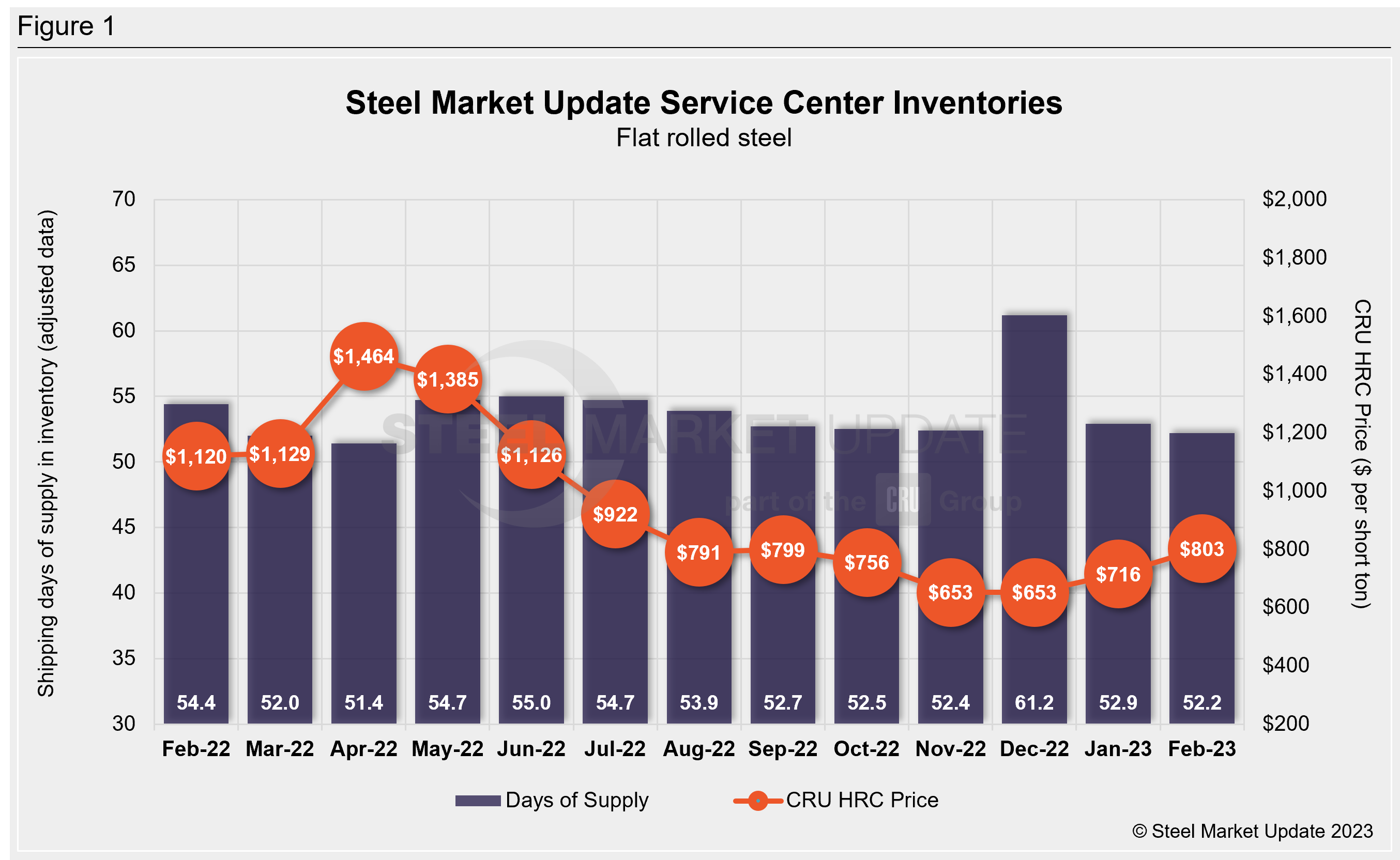

US service center flat-rolled steel supply in February edged down slightly, while the amount of material on order surged. At the end of February, service centers carried 52.2 shipping days of supply, according to adjusted SMU data. This is down from 52.9 shipping days of supply on an adjusted basis in January.

Flat-rolled steel inventories in February represented 2.61 months of supply, compared to 2.52 in January. February had 20 shipping days, though, compared to January’s 21. The daily shipping rate in February slowed slightly, but aside from January 2023 was the strongest rate seen since April 2022, the peak of the panic buying after Russia invaded Ukraine.

With the staggering number of mill price increases, service centers have been overwhelmed with orders from manufacturers looking to beat price increases. Market contacts are reporting that real demand is driving their shipments, as manufacturer inventories fell too low for the spring. We expect to see this trend of strong shipments continue into March, and we expect this to drive inventories into a deficit.

The total volume of flat-rolled steel on order at the end of February, based on a steady group of service center inputs, was the highest level seen since September 2021. This seems high, considering January’s on-order volume was lower, but speaks to the extended mill lead times.

Steel mill lead times continue to extend. The latest SMU survey published March 2 pegged hot-rolled coil (HRC) lead times at 5.95 weeks, up from 4.94 weeks a month before. However, with some mills listing “inquire” instead of publishing a lead time, these lead times are probably understated.

Some market contacts have said that demand is robust, and this rally is not driven solely by short supply. The supply tightness is expected to continue in the short term, though, which should help to keep prices supported.

Plate

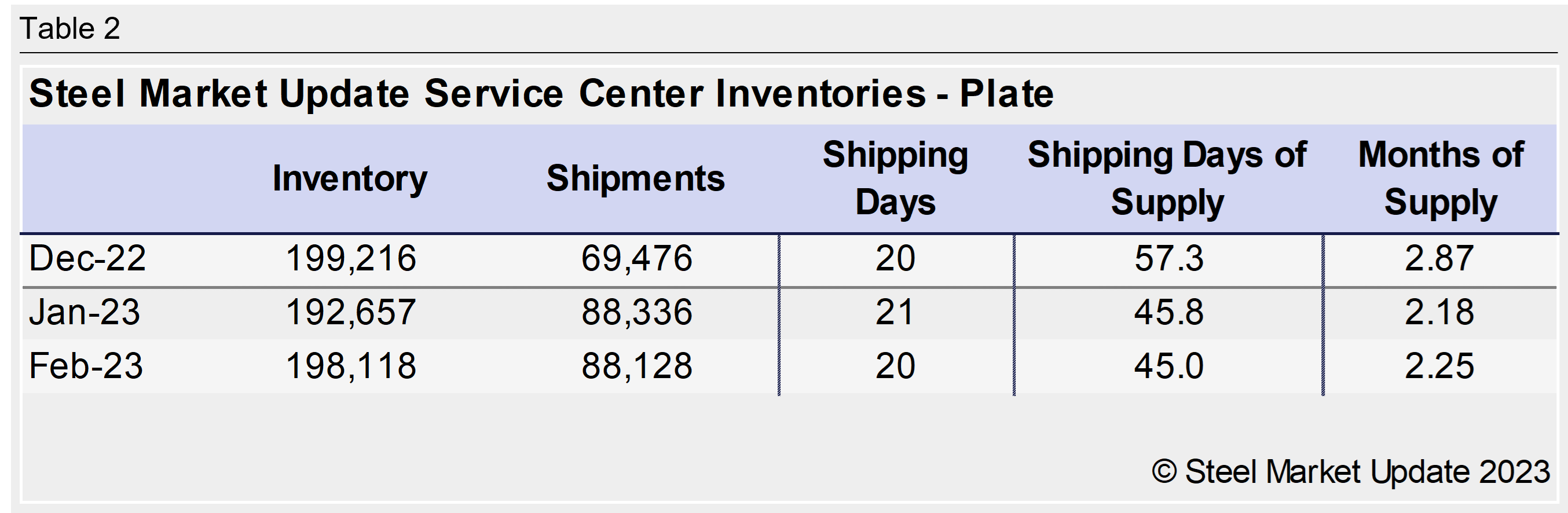

US service center plate inventories were already in a deficit at the end of January, and supply did not recover in February. At the end of February, service centers stocked 45 shipping days of supply of plate, according to SMU data. This is down from 45.8 shipping days of supply in January.

February inventories represented 2.25 months of supply, up from 2.18 in January.

Supply shortness is supporting US plate pricing similar to sheet, and steel mills recently announced $50-80-per-ton price increases for plate, following up on $60-per-ton price increases in February.

Lead times are similarly extending for plate. SMU reported the latest plate lead times at 5.67 weeks, up from five weeks in early February.

The latest SMU survey also found steel mills were less willing to negotiate lower prices for new orders compared to two weeks ago. Plate demand is steadier than sheet and less subject to the rapid demand fluctuations, though the amount of inventory on order has spiked.

At the end of February, service centers plate supply on order was up vs. January. The inventory deficit will continue to drive new orders for plate and should keep prices supported as well.

By Estelle Tran, estelle.tran@crugroup.com