Logistics

March 15, 2023

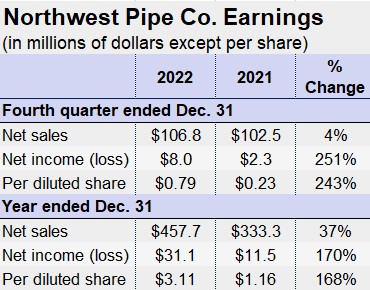

Northwest Pipe Logs Strong 2022, Sees Challenging Q1

Written by Laura Miller

Despite a record backlog, Northwest Pipe Co. is experiencing a challenging start to the year, with customer-driven delays and severe weather hampering production at its various facilities.

The Vancouver, Wash.-based company noted the challenges as it released its fourth-quarter and full-year 2022 results.

Q4 brought higher production tonnages but lower selling prices within Northwest’s engineered steel pressure pipe segment, resulting in the segment’s quarterly sales inching 0.8% higher year on year (YoY) to $72.1 million.

For the year, the segment saw YoY sales growth of 18% to $307.6 million. This was driven primarily by a 20% rise in selling prices due to higher raw material costs but was partially offset by a 1% decline in tons produced due to project timing changes.

The company as a whole posted $31.1 million in net income for all of 2022, a notable increase from the $11.5 million earned the year prior. Sales were 37% higher YoY at $457.7 million for 2022.

When asked about steel pricing on the company’s first-quarter earnings conference call on Thursday, March 16, president and CEO Scott Montross said higher pricing leads to higher gross profit levels, “so we’re good with higher steel prices. We just don’t like a lot of volatility,” he said. He predicted hot-rolled coil prices will start to drop after May-June, anticipating pricing to be around $850 per ton for the rest of the year, with an average price of $900-950 per ton.

As for steel availability, Montross said shipment delays are not really an issue at the moment, and they’re certainly not seeing delays in shipments as often as they were in 2021 “when steel was really, really tough to get,” he said.

“As prices go up and demand goes up it could get a little bit tighter but I think we’re pretty well positioned with multiple steel suppliers to be able to handle any sort of steel requirements that we have,” he added.

“After a slow first quarter, we’re pretty much on the same trajectory revenue-wise that we were in 2022 in steel pressure pipe,” he commented, and they are looking forward to a pretty good last three-quarters of the year.

Northwest Pipe has 13 manufacturing facilities across the US.

By Laura Miller, laura@steelmarketupdate.com