Overseas

March 12, 2023

CRC Imports Extend Competitive Advantage, US Prices Surge

Written by David Schollaert

The price advantage domestic cold-rolled coil (CRC) had recently enjoyed over imported steel was short-lived, as US mills continue to drive prices higher, according to Steel Market Update’s latest foreign vs. domestic price analysis of the CRC market.

Repeated mill price hikes through February and into March has seen the US CRC price advantage over foreign cold-rolled shift as domestic CRC tags continue to rise at a much faster clip than prices abroad.

Domestic cold-rolled is now roughly 26% more expensive than foreign material (except for Japan-origin CR, which is roughly 17% more expensive due to a 71% tariff). That premium is wider than just four weeks ago when domestic CRC was ~9% more costly than imported product.

US prices had been cheaper than foreign prices for two of the four regions we follow (Germany and Japan) since the beginning of the year after adding freight costs, trader margins, and applicable tariffs. That changed when US CRC prices rose $285 per ton since January, accentuated by another $60 per ton through the first week in March.

Domestic CRC held, on average, a $77-per-ton disadvantage over imported steel as recently as early February. That has swelled to a $268-per-ton disadvantage this week as US prices have continued to rise.

SMU uses the following calculation to identify the theoretical spread between foreign CRC prices (delivered to US ports) and domestic CRC prices (FOB domestic mills): Our analysis compares the SMU US CRC weekly index to the CRU CRC weekly indices for Germany, Italy, and eastern and south-eastern Asian ports (South Korea and Japan). This is only a theoretical calculation because costs to import can vary greatly, influencing the true market spread.

In consideration of freight costs, handling, and trader margin, we add $90 per ton to all foreign prices to provide an approximate CIF US ports price to compare to the SMU domestic CRC price. Buyers should use our $90-per-ton figure as a benchmark and adjust up or down based on their own shipping and handling costs. If you import steel and want to share your thoughts on these costs, we welcome your insight at david@steelmarketupdate.com.

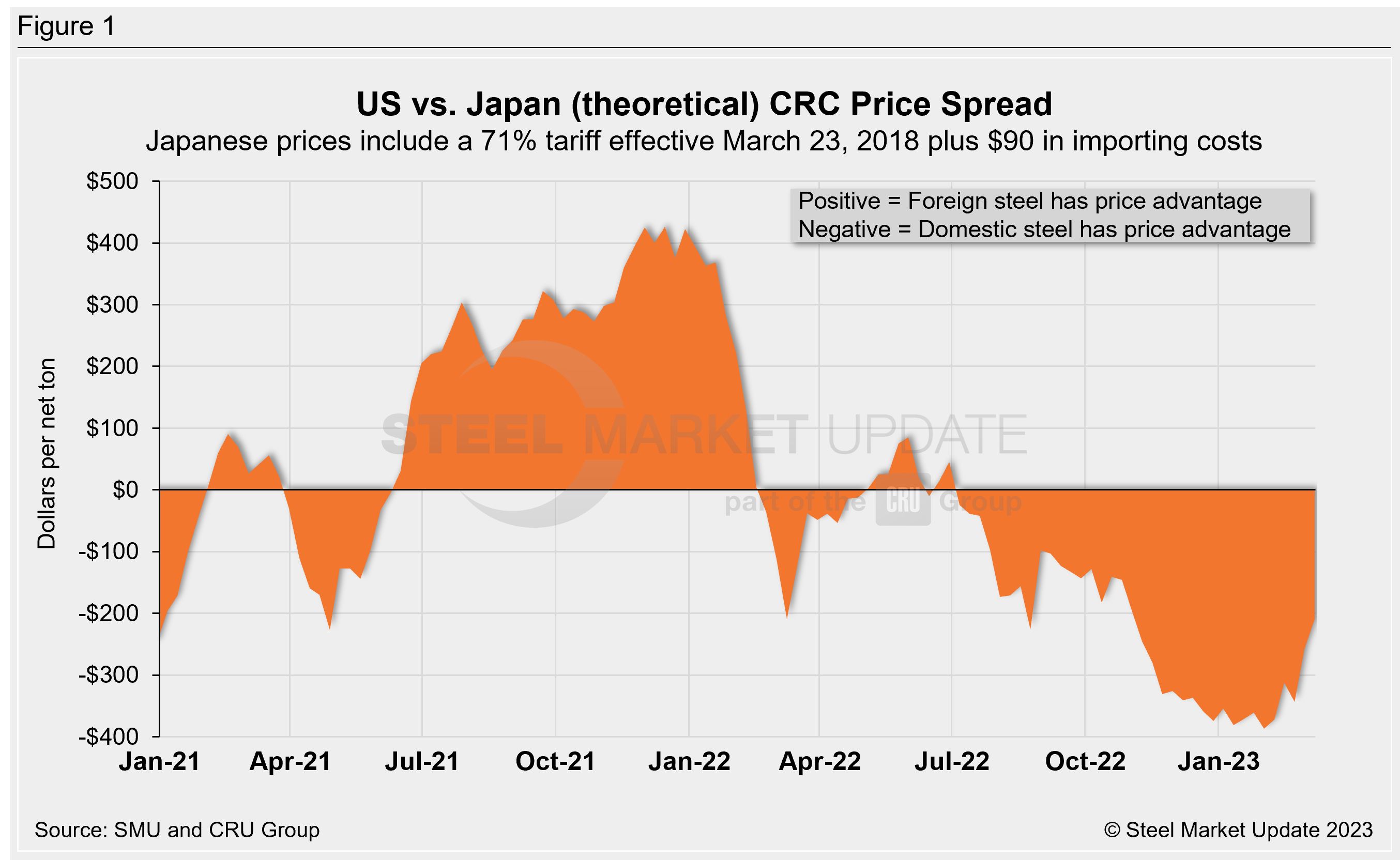

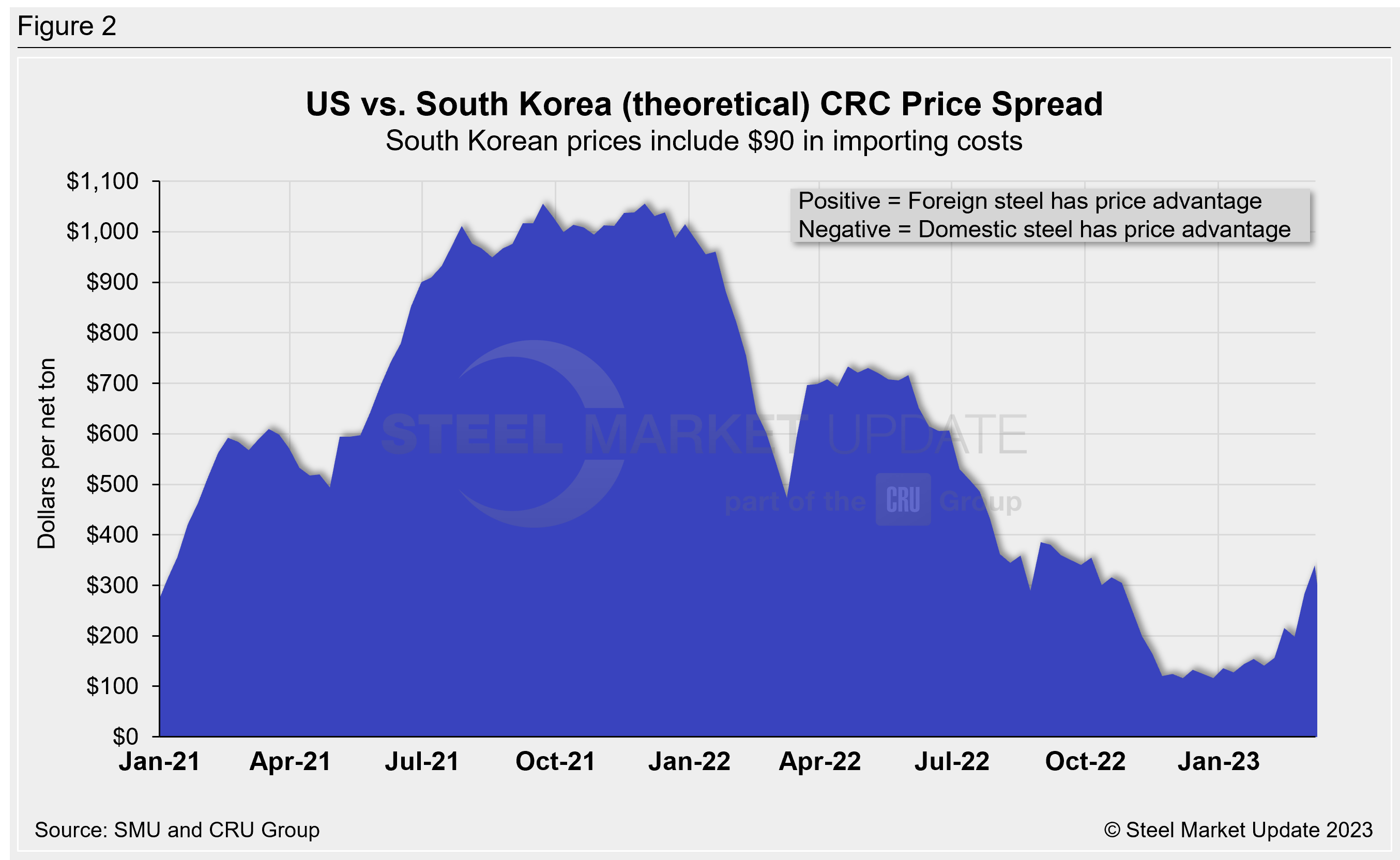

Asian Cold-Rolled Coil (South Korea and Japan theoretical)

As of Thursday, March 9, the CRU Asian CRC price increased by $9 per ton to $771 per net ton ($850 per metric ton) and was up $27 per ton from levels one month prior. Adding a 71% tariff (Japan theoretical), and $90 per ton in estimated import costs, the delivered price to the US is $1,109 per ton, though the South Korean theoretical is $861 per ton. The latest SMU cold-rolled average is $1,200 per ton, up $60 per ton week on week (WoW), and up $210 per ton compared to our price one month ago.

US-produced CRC is now theoretically $209 per ton cheaper than steel imported from Japan but $339 per ton more costly than cold-rolled imported tom South Korea. This is more than double its competitive disadvantage of $156 per ton from a month ago vs. South Korean CRC.

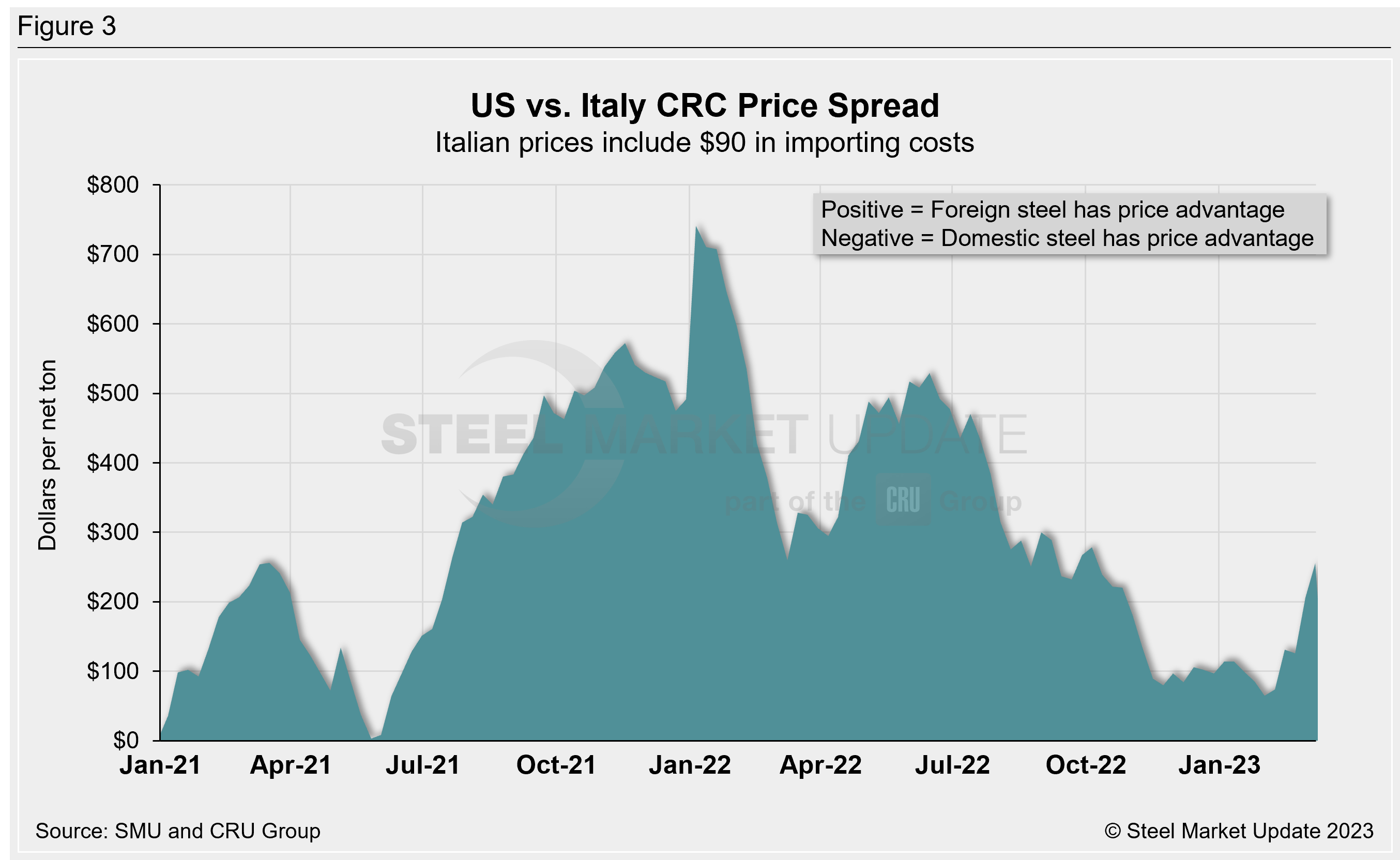

Italian Cold-Rolled Coil

Italian CRC prices increased by $16 per ton WoW to $855 per net ton ($942 per metric ton) this week, and are $29 per ton higher month on month (MoM). After adding import costs, the delivered price of Italian CRC is approximately $945 per ton.

Domestic CRC is now theoretically $255 per ton more expensive than imported Italian CRC. That spread is up $49 per ton WoW and represents a nearly $181-per-ton boost compared to four weeks ago when US CRC was $72 per ton more expensive than Italian product.

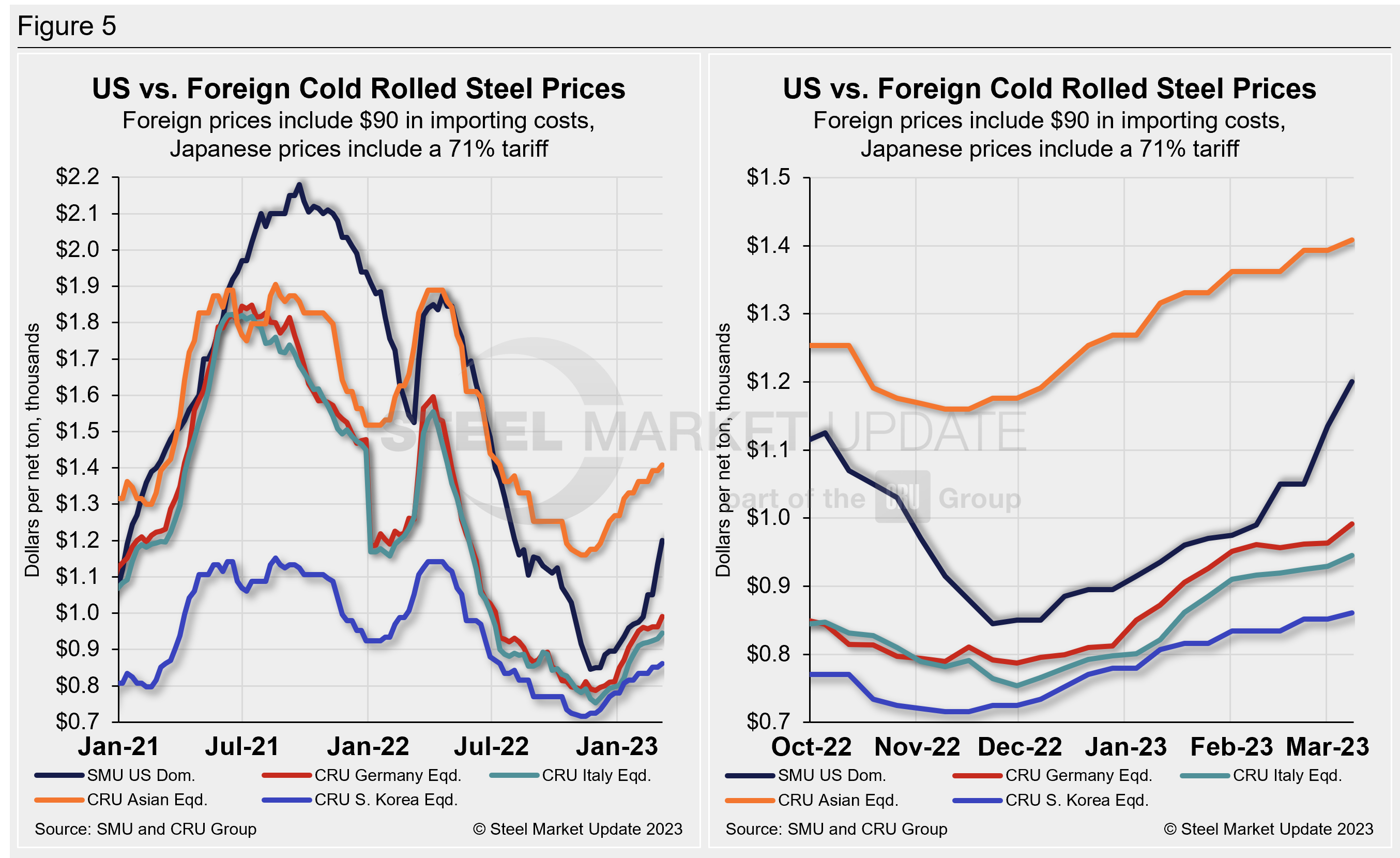

German Cold-Rolled Coil

CRU’s latest German CRC price rose by $28 per ton WoW to $901 per net ton ($994 per metric ton) and is up $30 per ton MoM. After adding import costs, the delivered price of German CRC is roughly $991 per ton.

Domestic CRC is now theoretically $209 per ton more expensive than imported German CRC. That’s a $180-per-ton jump from just a month ago.

The last time US CRC had held a price advantage over German product, was late May 2021.

Figure 5 compares all five price indices and highlights the effective date of the tariffs. The chart on the left shows historical variation from Jan. 1, 2021, through present. The chart on the right zooms in to highlight the recent surge of US pricing and its distancing from offshore CRC prices.

Notes: Freight is an important consideration in deciding whether to import foreign steel or buy from a domestic mill. Domestic prices are referenced as FOB the producing mill, while foreign prices are CIF the port (Houston, NOLA, Savannah, Los Angeles, Camden, etc.). Inland freight, from either a domestic mill or from the port, can dramatically impact the competitiveness of both domestic and foreign steel. It’s also important to factor in lead times. In most markets, domestic steel will deliver more quickly than foreign steel.

Effective Jan. 1, 2022, the traditional Section 232 tariff no longer applies to most imports from the European Union. it has been replaced by a tariff rate quota (TRQ). Therefore, the German and Italian price comparisons in this analysis no longer include a 25% tariff. SMU still includes Section 232 tariff on foreign prices from other countries where applicable. We do not include any antidumping (AD) or countervailing duties (CVD) in this analysis.

By David Schollaert, david@steelmarketupdate.com