Plate

February 26, 2023

Plate Report: Spread Over HRC Fades, New Increases Coming?

Written by David Schollaert

US plate prices have remained mostly flat this week, a trend we’ve seen since Nucor announced a plate price cut in late November.

Recall that in late November, Nucor said it would be lowering plate prices by $140 per ton ($7 per cwt) with the opening of its January order book. Plate tags have varied little since, by just $20 per ton on average. The Charlotte, N.C.-based steelmaker has updated customers twice more since then, keeping prices unchanged.

During that span, SSAB Americas, another leading US plate producer, has hiked its plate prices twice. Last month, SSAB said it would be increasing plate prices by $60 per ton. That was followed by a second $60-per-ton price hike on Friday afternoon, Feb. 24.

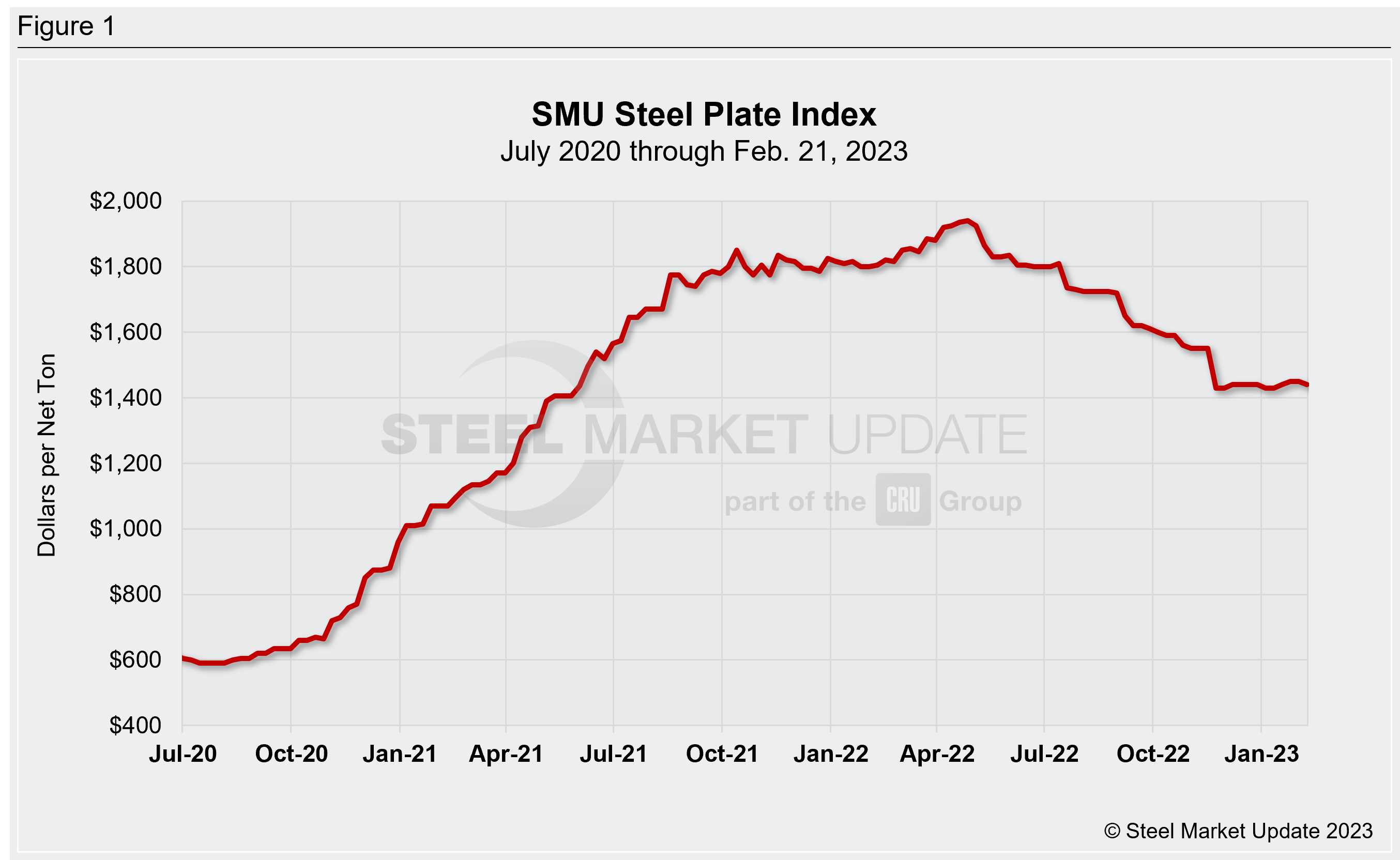

SMU’s most recent check of the market on Tuesday, Feb. 21 placed plate prices between $1,400-1,480 per ton with an average of $1,440 per ton FOB mill east of the Rockies – down $10 per ton week-on-week (WoW), according to our interactive pricing tool (Figure 1).

We will next update prices on Tuesday, and so that figure does not yet reflect SSAB’s latest price notice.

We haven’t seen anything (on the plate side) like SSAB’s two price hikes in the span of roughly a month in some time. Plate prices have been under pressure since last summer when HRC began to erode and have not increased in earnest since mid-March 2022.

One thing to keep in mind: SSAB Americas’ pricing before its announcements was at or near the bottom of our range, at roughly $1,400 per ton ($70.00 per cwt). In theory, SSAB’s price hikes bring its plate prices to $1,520 per ton, roughly $40 per ton above Nucor’s price point.

This is noteworthy because Nucor has essentially been the unofficial top end of the range for domestic plate prices. It will be interesting to see what Nucor does with its next price notice. Will Nucor follow SSAB’s move and announce a plate increase of their own?

Recall that Nucor said on an earnings conference call with analysts in late January that it would continue to try to decouple discrete plate from hot band.

Nucor has separated coil and cut-to-length plate from discrete plate to ensure that the latter—which can only be made at their plate mills—collects a premium over other products that can be more influenced by hot band pricing.

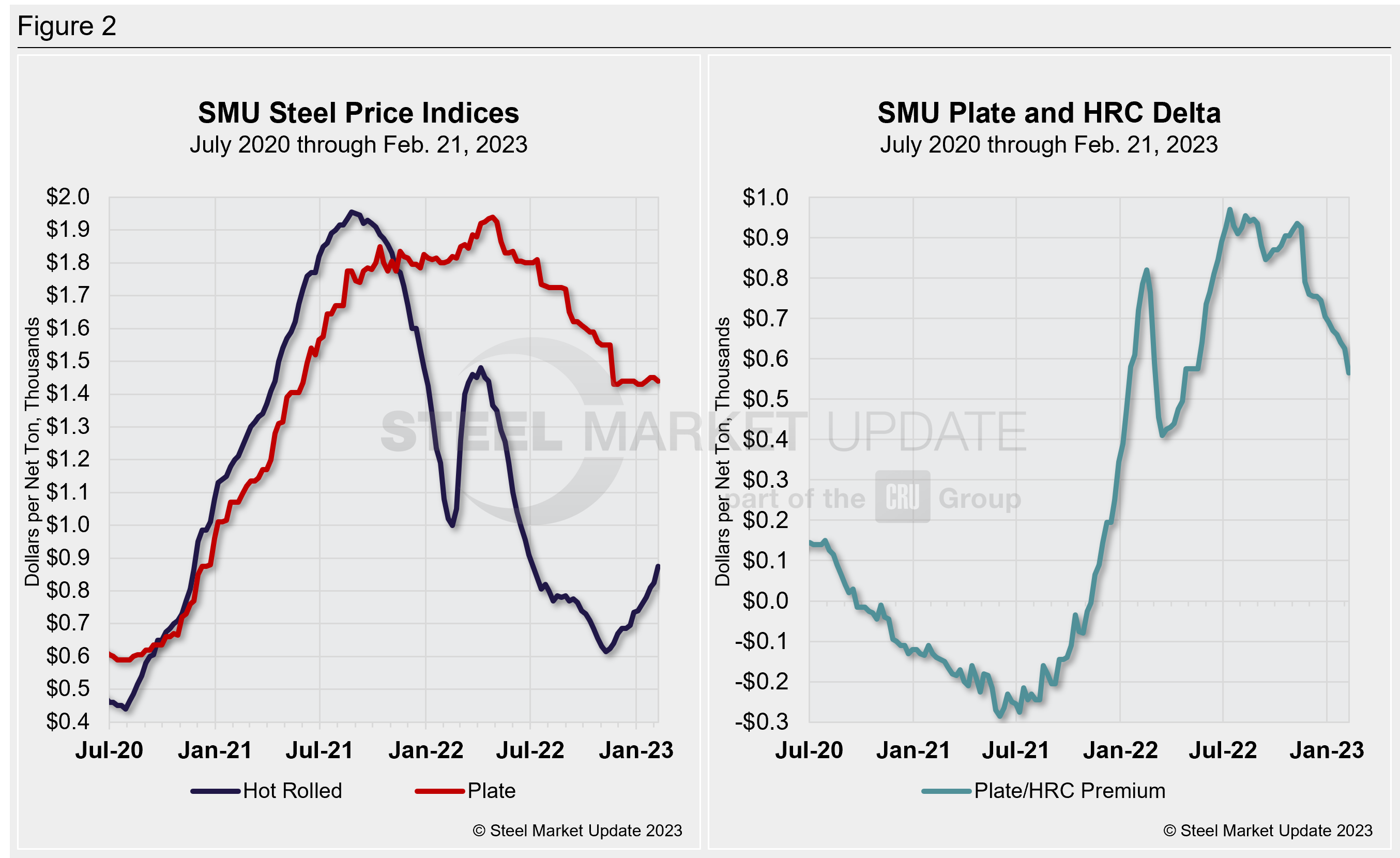

That strategy has been successful to date. We’ve seen the spread (Figure 2) between plate and hot-rolled coil (HRC) reach as high as $970 per ton last summer. It was still high, $935 per ton, as recently as Thanksgiving.

But the recent HRC price rally—driven by repeated mill increases—has cut the spread nearly in half. That premium could decrease further should mills achieve target HRC base prices of $1,000 per ton.

Steel Market Update’s hot-rolled coil price stands at $875 per ton on average as of Feb. 21, up $50 per ton from the week prior and up $190 per ton since the beginning of the year. The latest round of sheet price increases, $100 per ton announced early last week, has yet to be reflected in our pricing. But $1,000 per ton for HRC now appears less far fetched than it would have been just a month ago.

Also, there is speculation from multiple market sources that mills might roll out another flurry of HRC price increases as lead times start to stretch out in response to supply-side constraints.

Hot-rolled coil lead times now stand at 5.41 weeks as of Feb. 16—at their highest point since mid-April 2021— and up from 4.94 weeks in our prior survey. (Results of our next lead time review will be posted on March 2.)

Given that context, plate sources have told SMU that they expect Nucor’s next plate price announcement to be an increase. That’s not necessarily because of robust demand or plate supply constraints but because of a desire to maintain a premium over HRC.

“Nucor has put a lot of work in delineating discreet plate from hot-rolled,” said a source. “Plate prices are not going to just sit back on the sidelines and watch. They’ll be up soon.”

“The premium between HRC and plate has gone from $1,000 per ton to about $450 per ton,” said another source. “It’s not going to stay there. Not if Nucor has a say it in.”

Discrete plate lead times are also starting to push out. They stand presently on average at 5.23 weeks as of Feb. 16, up from 4.67 weeks in mid-January.

By David Schollaert, david@steelmarketupdate.com