Market Segment

February 20, 2023

Hot Rolled vs. Prime Scrap Price Spread Jumps in Feb

The spread between hot-rolled coil (HRC) and prime scrap prices has widened in February, according to Steel Market Update data.

Prices for both products increased in February month over month.

Our hot-rolled coil price average rose $15 per ton week over week to $825 per ton per net ton ($41.25 per cwt) as of Feb. 14.

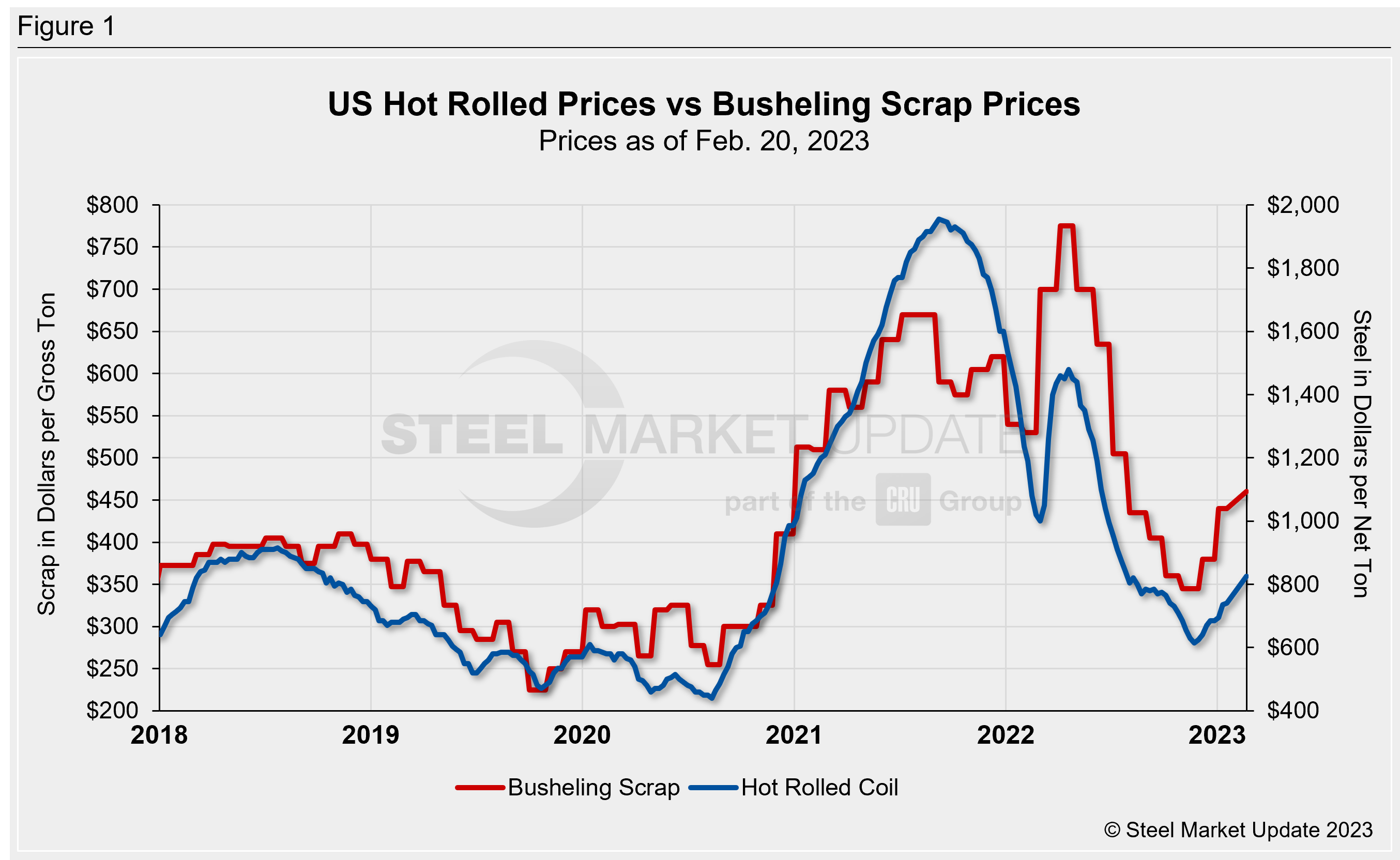

February scrap prices settled last week, with busheling prices increasing $20 per gross ton to $460 per ton from January. Figure 1 shows price histories for each product.

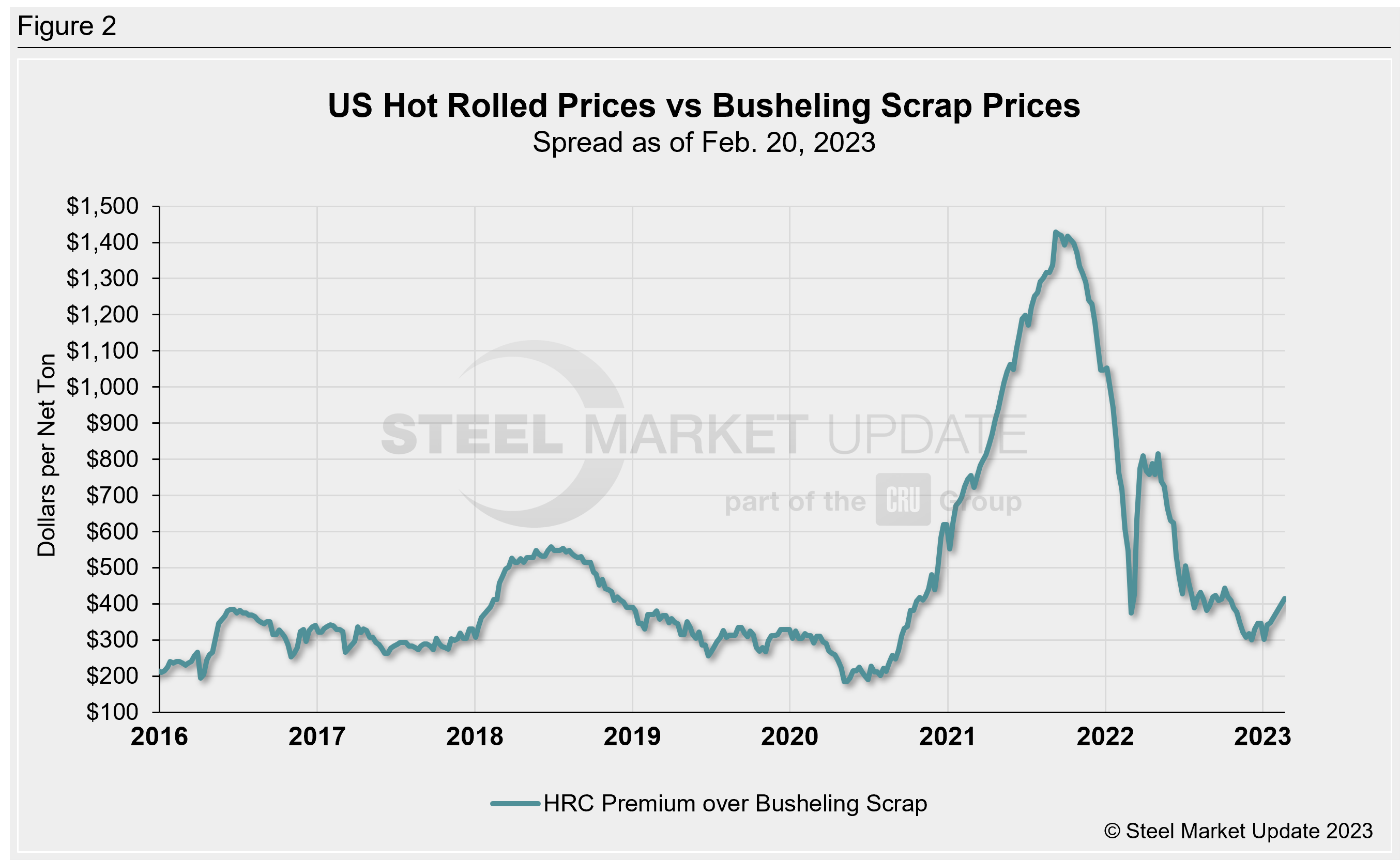

After converting scrap prices to dollars per net ton for an equal comparison, the differential between HRC and busheling scrap prices is $414 per net ton through Feb. 14, up $67 from $347 last month (Figure 2). This is the highest reading since the middle of October.

PSA: Did you know our Interactive Pricing Tool has the capability to show steel and scrap prices in dollars per net ton, dollars per metric ton, and dollars per gross ton?

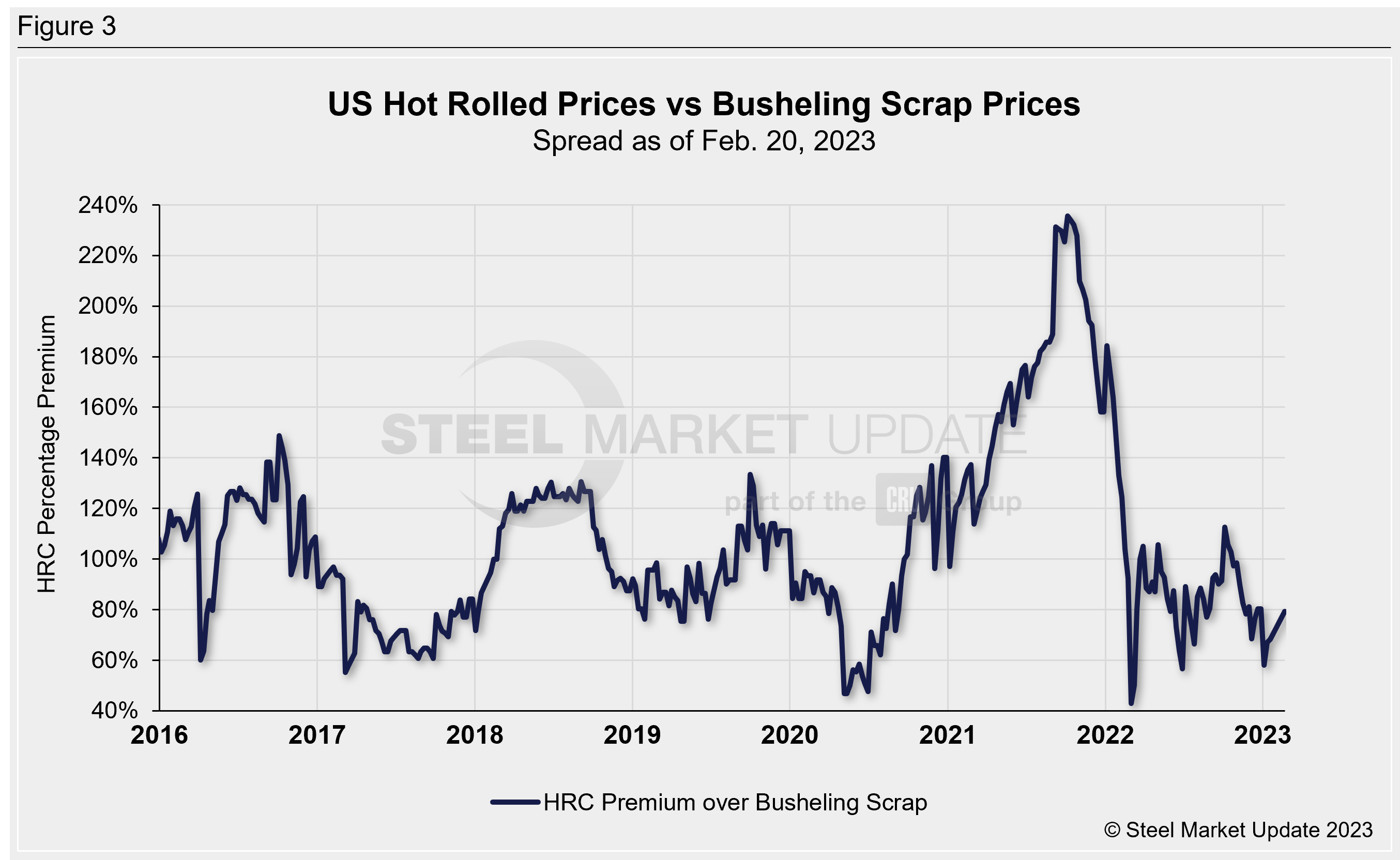

Figure 3 explores this relationship in a different way – we have graphed the spread between HRC and busheling scrap prices as a percentage premium over scrap prices. HRC prices now carry a 79% premium over prime scrap, increasing from 68% a month earlier.

This comparison was inspired by reader suggestions. If you would like to chime in with topics you want us to explore, reach out to our team at news@steelmarketupdate.com.

By Ethan Bernard, ethan@steelmarketupdate.com