Market Segment

February 9, 2023

January Steel Imports Up 12.7%, 3MMA Slips to 22-Month Low

Written by David Schollaert

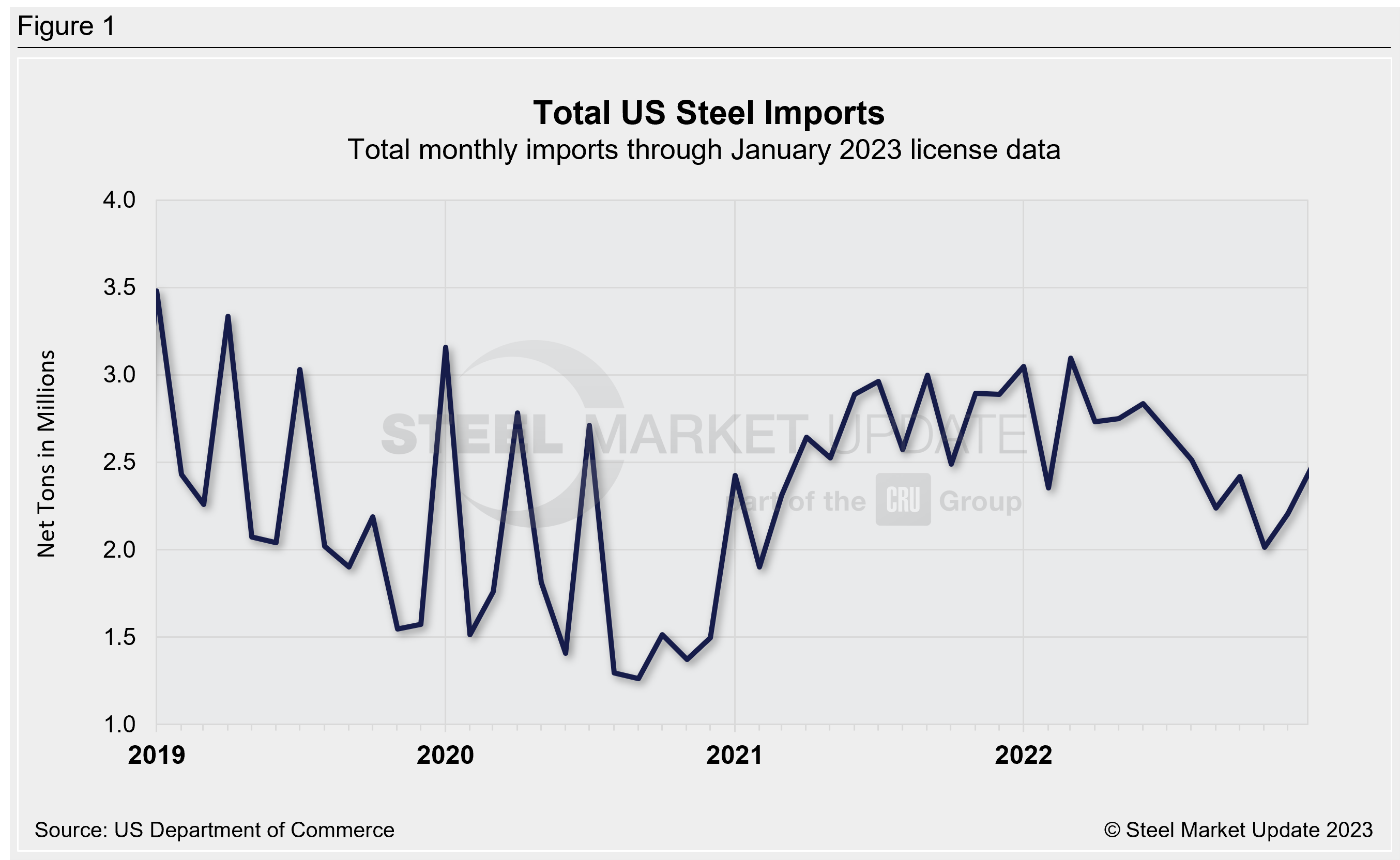

Preliminary Census data indicate that steel imports will have totaled 2.48 million net tons for the month of January. While up nearly 13% from the prior month, January levels are still down more than 3% compared to the previous 12-month average.

Recall that monthly import levels declined nearly 17% month on month (MoM) in November, before rebounding more than 9% in December. January figures are still down 19.7% compared to March 2022’s 26-month high of 3.09 million tons.

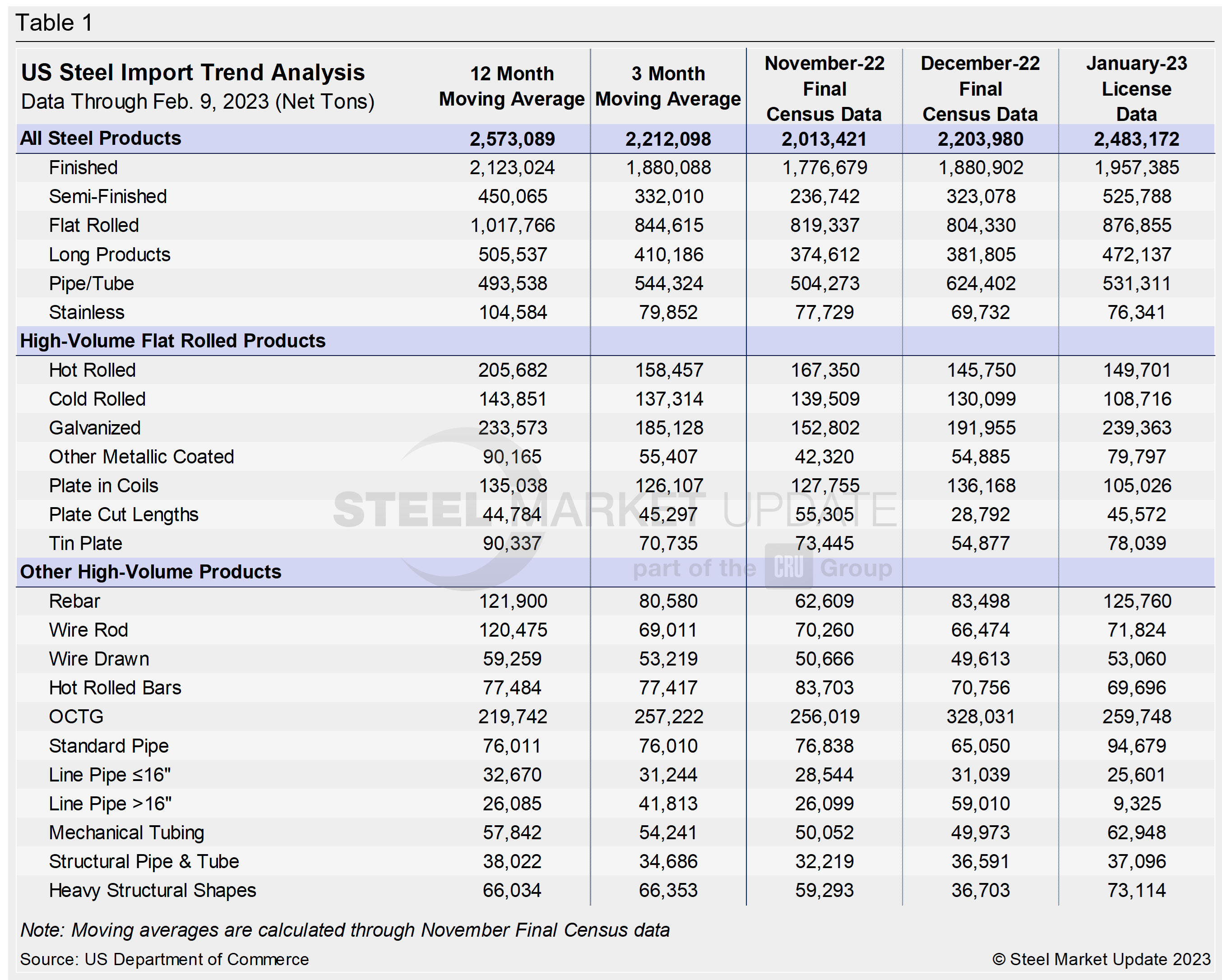

Broken down by product category, semifinished product imports in January surged by nearly 63% vs. the previous month, according to preliminary data, while long product imports in January are up 23% MoM. Imports of finished steel products rose 4.1% MoM, flat-rolled imports increased 9%, and stainless imports were up 9.5%. The only category to decrease MoM was pipe and tube, falling nearly 15%.

Although imports were down for long stretches in 2022, the monthly average for last year totaled 2.57 million tons for the year, down just 2.1% from the monthly average in 2021, but 39.7% and 10.7% above monthly averages in 2020 and 2019, respectively.

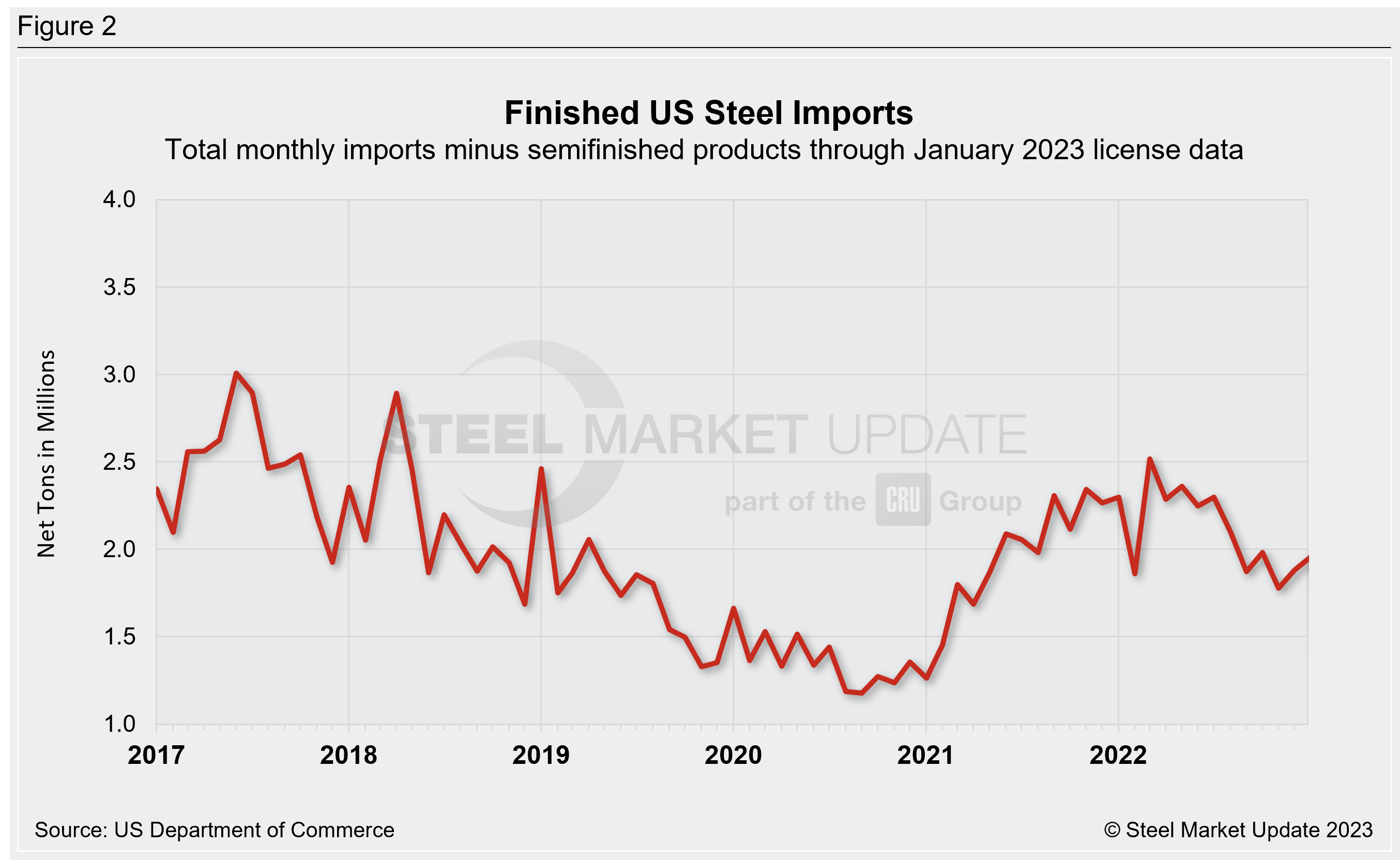

Preliminary imports of finished steel rose from 1.78 million tons in November to 1.88 million tons in December. The latest license data shows finished steel imports at 1.96 million tons in January, still in line with some of the lowest totals seen over the past 8-10 months.

Due to large monthly swings in semifinished imports in recent years, the chart below shows total imports on a three-month moving average (3MMA) basis in an attempt to more accurately display trends. The 3MMA is 2.23 million tons through preliminary January figures, the second-lowest total in nearly two years.

Though too early to tell, February license data suggests that the 3MMA could decline below the 2-million-ton mark for the first time, potentially the lowest level since February 2021. Recall that in January of this year, the 3MMA had reached a 42-month high of 2.94 million tons, while the lowest 3MMA level in SMU’s recent history was in November 2020 at 1.36 million tons.

The table below displays flat-rolled product imports as well as other high-volume products, including rebar, tin plate, wire rod, structural pipe and tube, and other long products. We also provide data on imports divided into semifinished, finished, flat rolled, longs, pipe and tube, and stainless products.

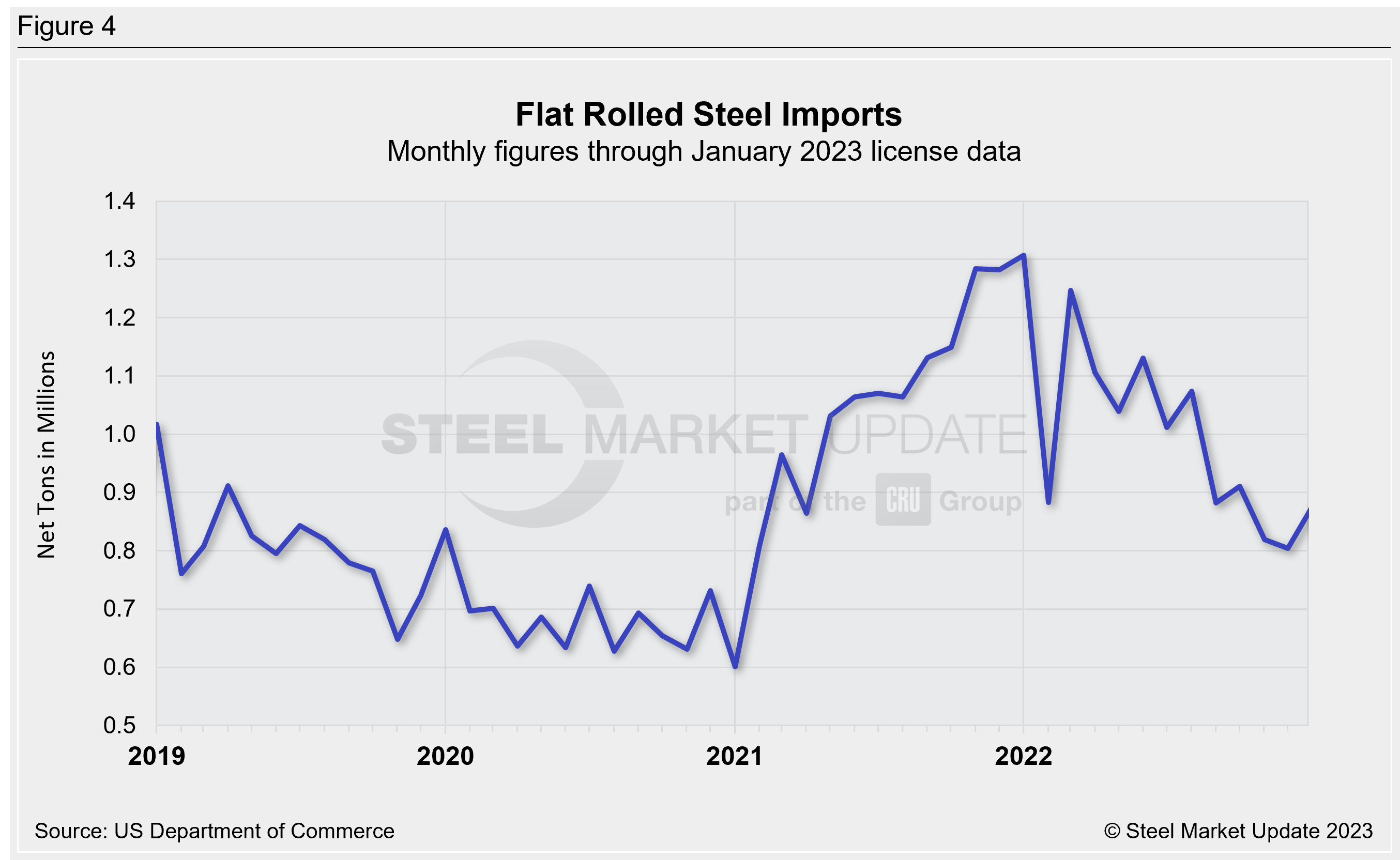

The charts below show monthly imports for two product groups: flat-rolled and pipe and tube. Preliminary January flat-rolled imports totaled 876,855 tons, rebounding slightly from the month prior but still among the lowest totals over the past 22 months.

Early February licenses indicate that totals could be down near the lowest totals in the past few years, as imports are currently showing just 147,037 tons of flat-rolled steel to have entered the country in the first two weeks of the month. Pipe and tube imports were 531,311 tons in January, in line with levels seen since March of this year. Early February pipe and tube licenses are currently at 199,238 tons.

PSA: We have an interactive graphing tool available here on our website, where readers can explore historical import data. If you need assistance logging into or navigating the website, contact us at info@steelmarketupdate.com.

By David Schollaert, david@steelmarketupdate.com