Market Segment

February 9, 2023

HRC Futures: $800/Ton Ceiling Smashed as Spot Market Tightens

Written by Michael D'Angelo

Editor’s note: SMU Contributor Michael D’Angelo is a researcher and trader at Marex. In his role, Mike performs fundamental and quantitative analysis, which directly leads to actionable trading/risk management strategies across the base, precious, and ferrous metals derivative spaces. Prior to joining Marex, Mike received a BA in economics with a minor in finance from Princeton University. Mike can be reached at mdangelo@marex.com for comments/questions.

CRU’s weekly Midwest HRC index climbed to $782 per ton ($39.10 per cwt) this week, continuing the uptrend to the highest level since September after several producers announced price hikes last week including Cleveland-Cliffs, NLMK USA, Nucor, and ArcelorMittal.

Scrap prices have been on a tear with mill production in Iskenderun, Turkey, being delayed due to damage caused by the earthquake. Mills in Iskenderun account for roughly 20% of Turkish scrap imports and the country’s GDP is taking a serious hit from the natural disaster.

Some mills are experiencing maintenance issues or outages, which harsh weather conditions have not helped with. This has stretched lead times although they vary significantly from mill to mill.

Those who were speculating late last year that prices would quickly reach $800 per ton were proven right. Many deals are already being done at $800 per tone and above as spot market supply has tightened considerably. Sentiment now seems to be mixed, with a good amount of uncertainty on where prices will move beyond Q1. That’s because the demand side of the equation remains murky.

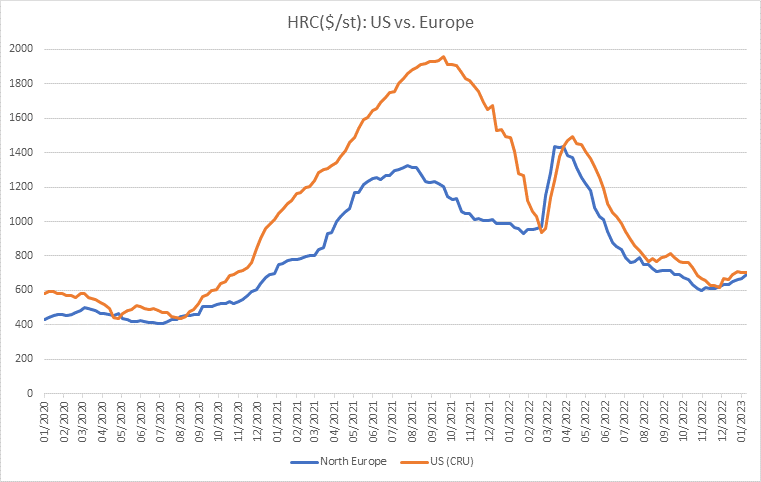

US prices are now back at a premium to European prices by about $50/short ton. Trading activity has been muted in Europe over the past week as consumers are reluctant to accept higher prices, but many believe that price hikes in the European Union are imminent.

Nonfarm payrolls massively beat expectations last week, which has increased the likelihood of further rate hikes. Wards Total Vehicle Sales for February beat expectations slightly as well, while factory orders came in below expectations. Durable goods orders were in line with expectations.

Tightening spot supply has caused the March contract to spike up to about $860 per ton, while February is valued about $60 per ton lower. However, from March onwards the curve goes into backwardation, with the December contract trading at an $80-per-ton discount to March.

The busheling curve remains relatively flat around $480 per ton. March is valued at about $500 per ton, up $40 per ton from a month ago and $100 per ton from the October lows.

Futures volumes have been minuscule on busheling but respectable on HRC. On Wednesday, 805 lots of the March HRC contract were exchanged when the price closed at $850 per ton.

Domestic steel production (as reported by the American Iron and Steel Institute) is finally beginning to show some signs of life, coming in at 1.635 million tons last week – 40.000 tons higher than the low reading in early January. US steel capacity utilization rose to 74.1% from last week’s 73.1%

Imports (click the image above to expand it) rose for the third straight month in January, according to license data, although they were coming off the lowest readings since early 2021.

By Michael D’Angelo, Marex, mdangelo@marex.com