Overseas

January 31, 2023

Final Thoughts

Written by Michael Cowden

Hot-rolled coil prices have now risen for 10 consecutive weeks. Let’s put that in perspective.

That’s a longer run than the price spike we saw following Russia’s invasion of Ukraine last February. It also marks the longest sheet price rally we’ve seen since the boom times of early 2021 – when a snapback in demand collided with low inventory levels across the steel supply chain.

But key differences between the current market and past upward cycles aren’t hard to find.

Take capacity utilization. It continues to inch upward but remains well below the ~80% we saw a year ago.

This is not like 2021 when mills struggled to catch up with demand. Instead, it seems instead like they’re metering supply so as not to outstrip demand. Some of that might be intentional. Some of it isn’t. Case in point: Sheet price gains have been driven not only by mill price increases but also by production issues at a major Mexican producer, as well as US mills struggling to ramp up new capacity.

Lead times are also an issue. They might not be in February anymore. But hot-rolled coil lead times, according to SMU’s interactive pricing tool, haven’t climbed to the nearly six-week level seen following the initial shock of the war in Ukraine. I’d have more confidence in the staying power of higher prices if we saw lead times extend further.

Finally, how is demand? Let’s just say it’s hard to gauge. For every person who tells me that it’s solid or much better than expected, another says it’s soft or, my favorite, “squishy,” given questions about the accuracy of some customer forecasts.

Does this mean that mills won’t get hot-rolled coil prices to $800 per ton, Cleveland-Cliff’s publicly announced target price, or higher? If they don’t, it would come as a surprise to most of the people responding to our survey this week.

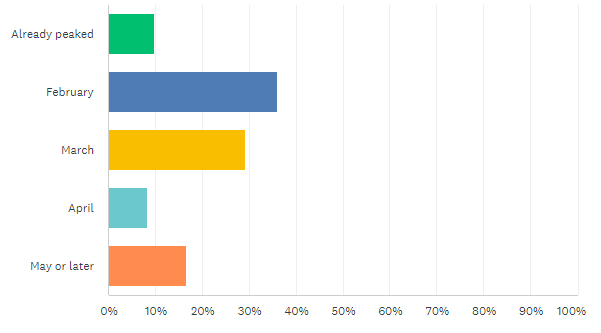

Below is a preview of those results. (Full results will be released on Friday. You will be able to find them here.) We asked people where they thought HRC prices would be in two months.

About 60% of survey respondents think we’ll hit or exceed $800 per ton over the next two months.

But it’s also worth noting that about two-thirds of respondents think that prices will peak in either February (~36%) or March (~30%).

Here’s what a few respondents had to say about prices and when the market might peak:

“600s (per ton) is a trigger for mills to put out increases. They have become good at getting in line behind them. Service centers seem to support it as long as they have aged inventory to dilute.”

“I expect to see pricing get right around $800 per ton and then ebb and flow for a while around those figures. Demand is the biggest question mark, of course.”

“Now waiting for fundamentals to either support increases, or make a correction.”

“A lot of this is capacity/supply related – so as new capacity comes on, prices will stop going up.”

“I initially thought pricing would top out just shy of $800/ton. We might break through that now in the indices.”

“I think demand is not as questionable as many think. And as the spring buying kicks in, prices will continue to rise.”

“Global metallics prices are still rising. US demand is better than advertised. Expect a slow increase from here and not massive rapid-fire hikes.”

Editor’s Note: If you’d like to participate in our surveys, please email us at info@steelmarketupdate.com. Don’t just read the data, see your company’s experience reflected in it!

Tampa Steel

We’re just a few days away from the Tampa Steel Conference, which SMU and our parent company CRU organize along with Port Tampa Bay.

We’re expecting approximately 500 people, which would mark the highest attendance in more than a decade. We might even break the all-time record. If you haven’t registered, be a part of history and do so today! You can learn more about the event and register here.

PS – Thanks from all of us at SMU for your business. We really do appreciate it!

By Michael Cowden, michael@steelmarketupdate.com