Market Segment

January 31, 2023

CRU Insight: US Sheet Price Volatility Has Peaked

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Sheet Products Monitor

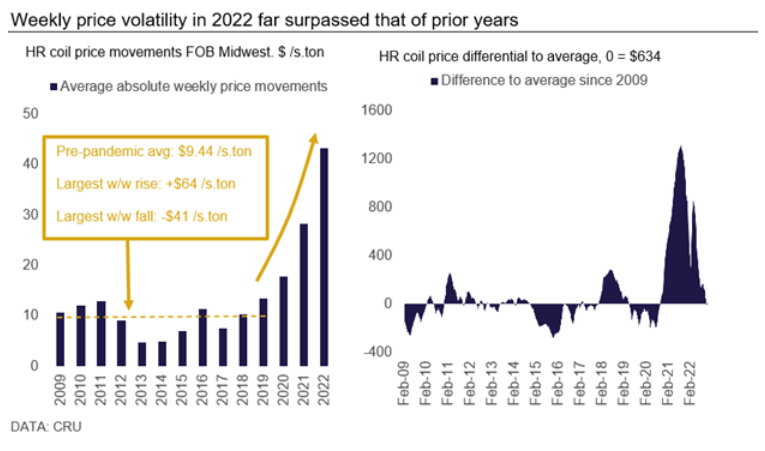

Steel sheet price volatility has peaked in the US after record average week-on-week (WoW) price changes during 2022. In our view, prices will trade in a much narrower band over at least the next five years (barring any further black swan events) – especially given some key structural changes within the domestic market itself.

Indeed, volatility is likely to evolve back to levels seen prior to the pandemic over the coming years. We expect steel sheet prices to eventually come back in line with their more historical relationship to underlying costs.

Markets Have Now Stabilized Following Immense Volatility

Stability has now by and large returned to the market after mills enforced price hikes in early December 2022. While prices will likely rise a bit more in early 2023, there are structural reasons that make a repeat of 2022 (or frankly 2021) highly unlikely.

Firstly, new sheet capacity in the US will keep domestic supply better matched to demand. In total, the net growth in North American sheet capacity should be around 10.5 million tons between 2021 and 2024. This means that even if availability from abroad becomes constricted, there will be enough new supply on the continent to make up for import shortfalls – even in the face of rising demand.

The threat of raw material disruptions will also be lower moving forward. The successful readjustment of pig iron supply chains away from Ukraine and Russia, alongside some pig iron production domestically, mean that impact of another disruption will not be as severe as in 2022. Indeed, it is likely that greenfield or brownfield expansions for direct-reduced iron (DRI)/ hot-briquetted iron (HBI) operations will continue to occur in the future, making risks to metallics access much lower from a geopolitical perspective.

How Did Last Year’s Volatility Compare to Other Years?

No doubt 2022 was the most volatile we have ever recorded in terms of weekly steel sheet price movements. This is because a specific set of circumstances, especially geopolitical ones, worked together to disrupt supply chains globally and within North America itself –albeit to a lesser extent for the latter.

While it is difficult, if not impossible, to forecast another black swan event like the war in Ukraine, developments within the North American market itself also mean that such a price shock is unlikely to occur again. As such, the extreme volatility last year will likely not be repeated anytime soon.

Last year’s intense price movements were partially the result of a comedown from record levels set in 2021. For a quick comparison, the average absolute price movement per week in 2022 was about $43 per ton – double the averages for 2021 and 2020, which were both volatile years in their own right.

From the record-breaking price level of $1,958 per ton set in the last week of September 2021, prices had crashed by over $1,000 per ton by the first week of March 2022. This was a steeper and faster price decline than during the Great Financial Crises between 2008-09 when prices took ten months to fall by $702 per ton.

This price collapse was halted by Russia’s invasion of Ukraine. Combined, both countries accounted for 60–70% of total annual pig iron exports globally. With sanctions and self-imposed embargoes hitting the former, and combat preventing exports from the latter, pig iron supply was substantially disrupted and mills around the world were forced to search for new sources.

In particular, US electric-arc furnace (EAF)-based sheet mills needed to locate new sellers as the country was nearly 100% reliant on imported pig iron to keep furnaces running. With mills making large offers to foreign pig iron providers, sheet prices underwent an unprecedented WoW price spike of $182 per ton from the second to the third week of March.

This article was originally published on Jan. 20 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com