Market Segment

January 25, 2023

Hot Rolled and Galvanized Price Spread Narrows

The spread between hot-rolled coil (HRC) and galvanized coil base prices has narrowed week over week, but has hovered around the $200-per-ton range since the end of November.

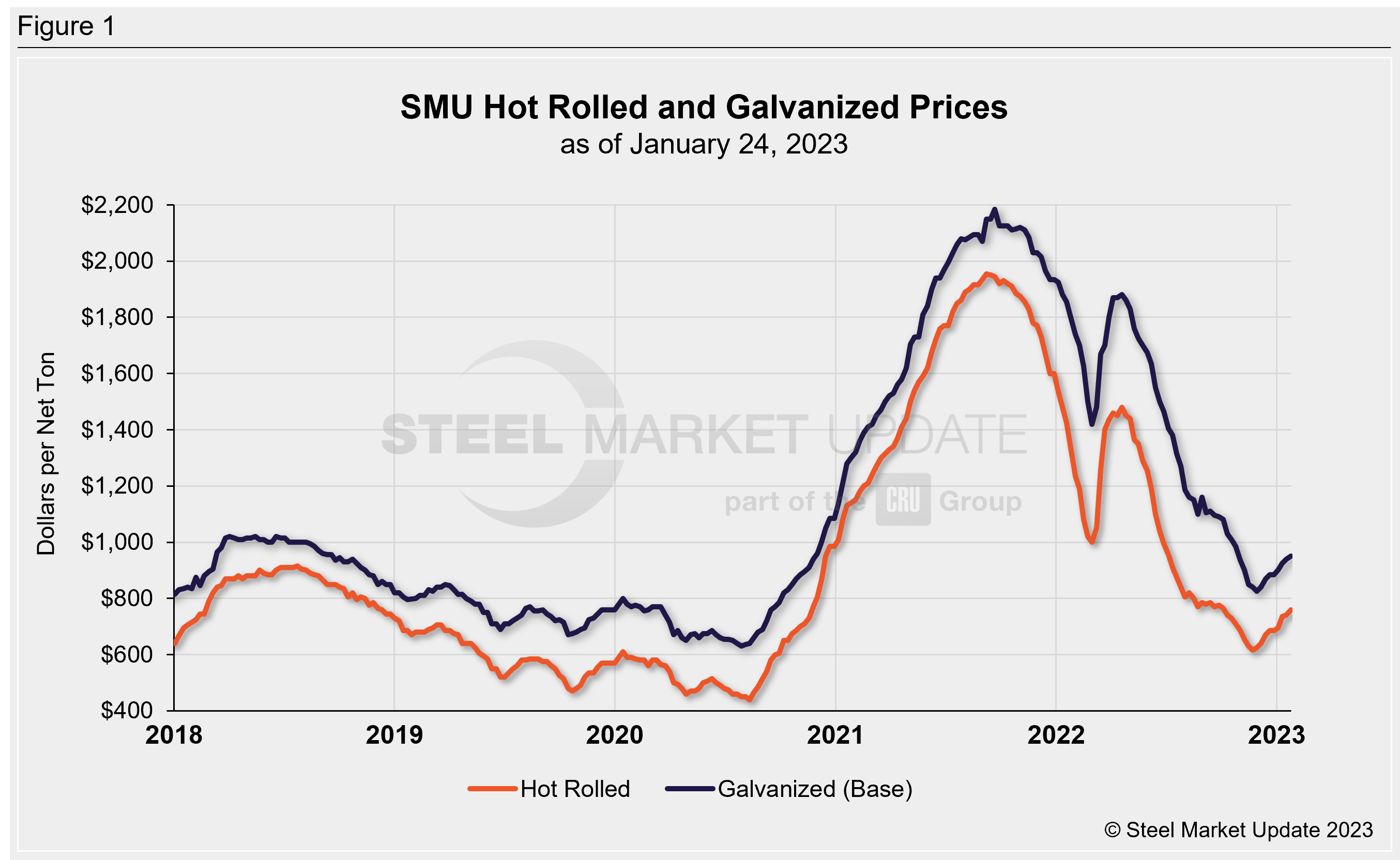

Figure 1 shows both SMU’s hot rolled and galvanized prices.

SMU’s HRC price averaged $760 per ton ($38 per cwt) as of Tuesday, Jan. 24, an increase from $740 per ton ($37 per cwt) one week earlier and $685 per ton ($34.25 per cwt) at the end of December.

Our latest galvanized price index averaged $950 per ton ($47.50 per cwt) Tuesday, up from $940 per ton ($47 per cwt) a week earlier and $885 per ton ($44.25 per cwt) a month ago.

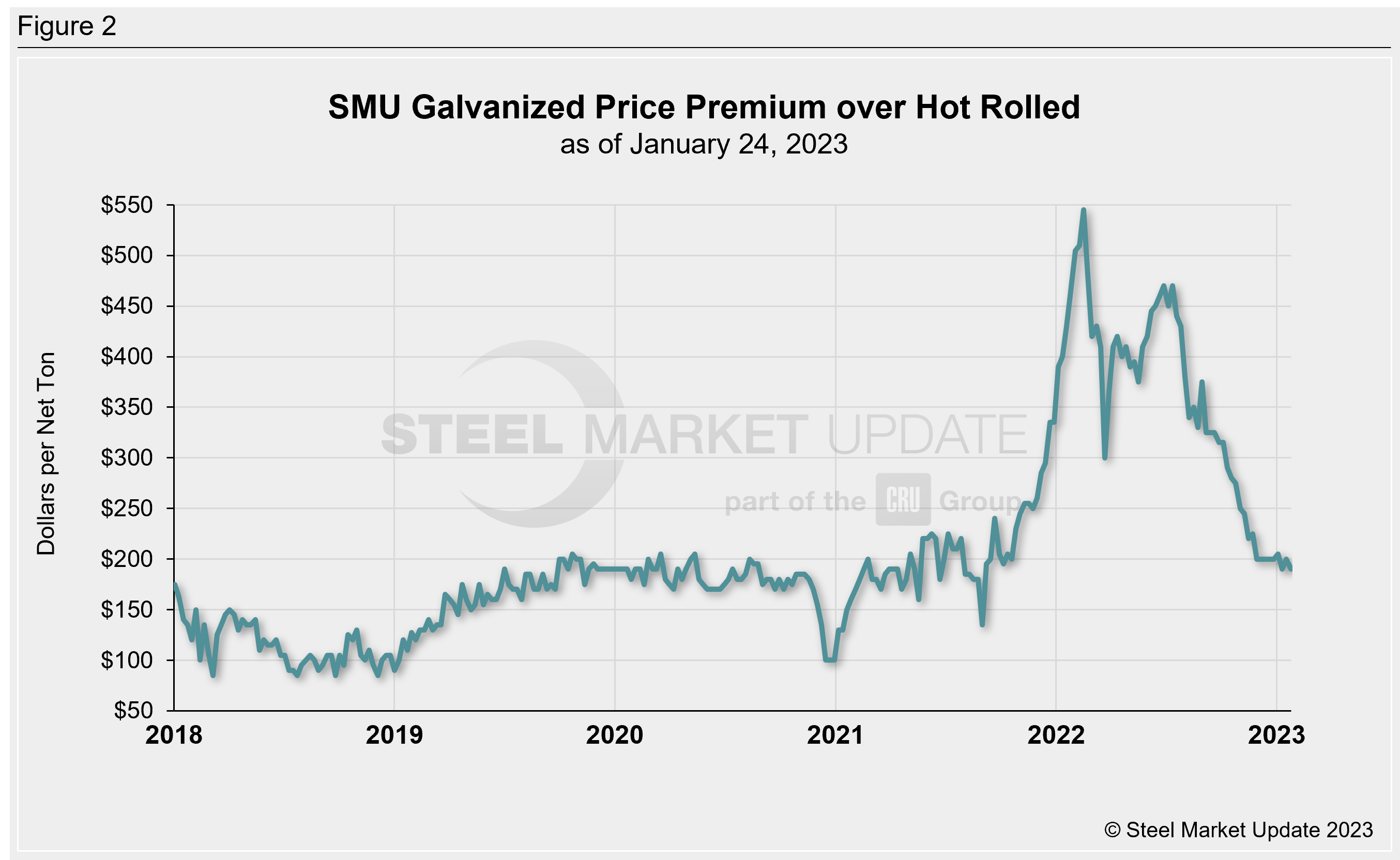

Figure 2 details the premium of the galvanized price over hot rolled, according to SMU data.

The premium this week is $190 per ton, down from $200 per ton a week earlier and at the end of December.

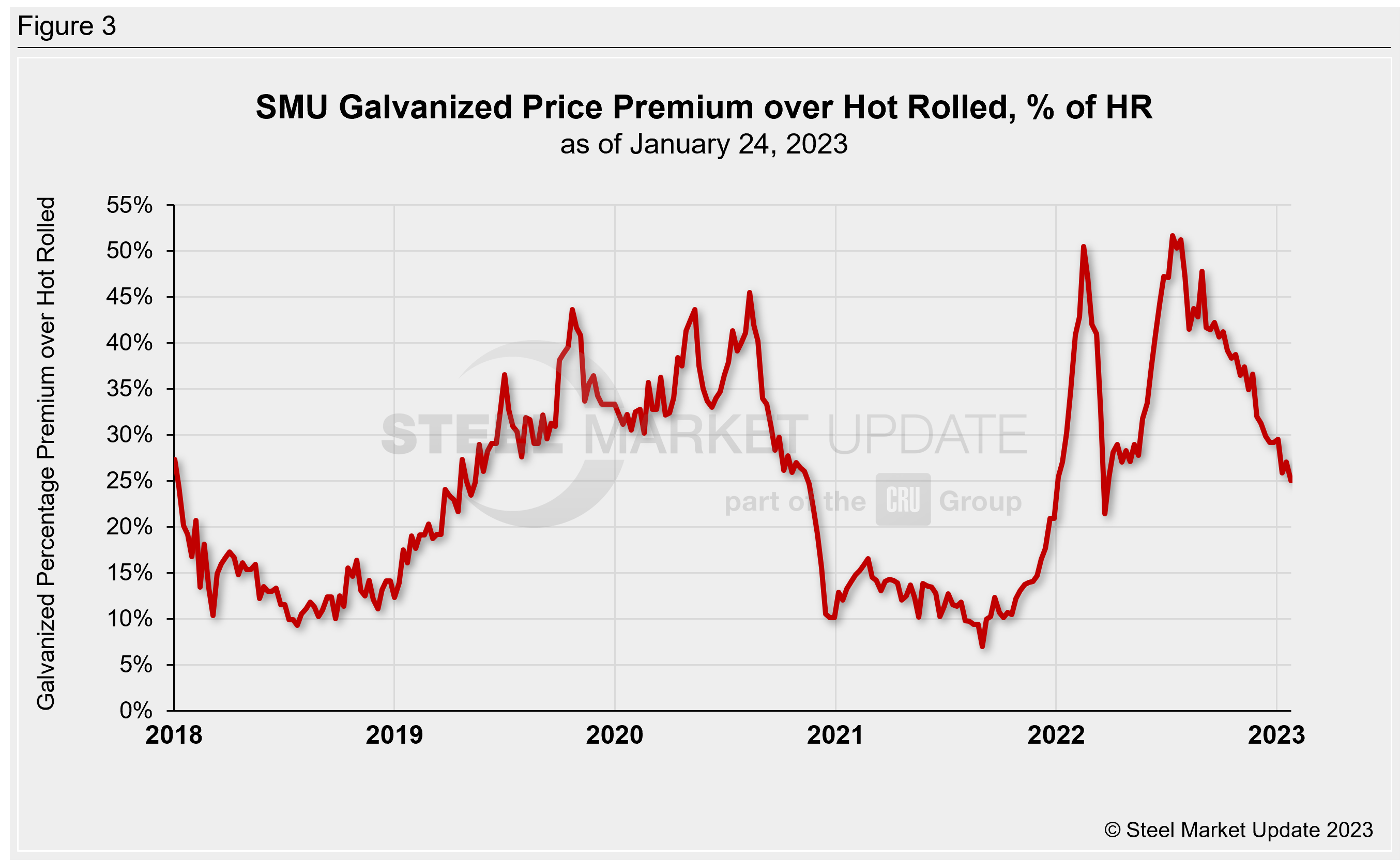

We calculated the galvanized price premium over hot rolled as a percentage of hot-rolled prices, as shown in Figure 3. This is an attempt to paint a clearer comparison against historical pricing data.

The latest premium stands at 25% vs. 27% last week and 29% at the end of 2022.

By Ethan Bernard, ethan@steelmarketupdate.com