Analysis

January 24, 2023

Preliminary Steel Imports Recover 11% From Recent Low

Written by David Schollaert

Preliminary Census data indicate that steel imports totaled 2.24 million net tons for the month of December. This is up 11% compared to November, a slight rebound month on month (MoM) after recording the lowest level since February 2021 the month prior. Import levels had been gradually falling since reaching a 26-month high in March 2022 of 3.09 million tons.

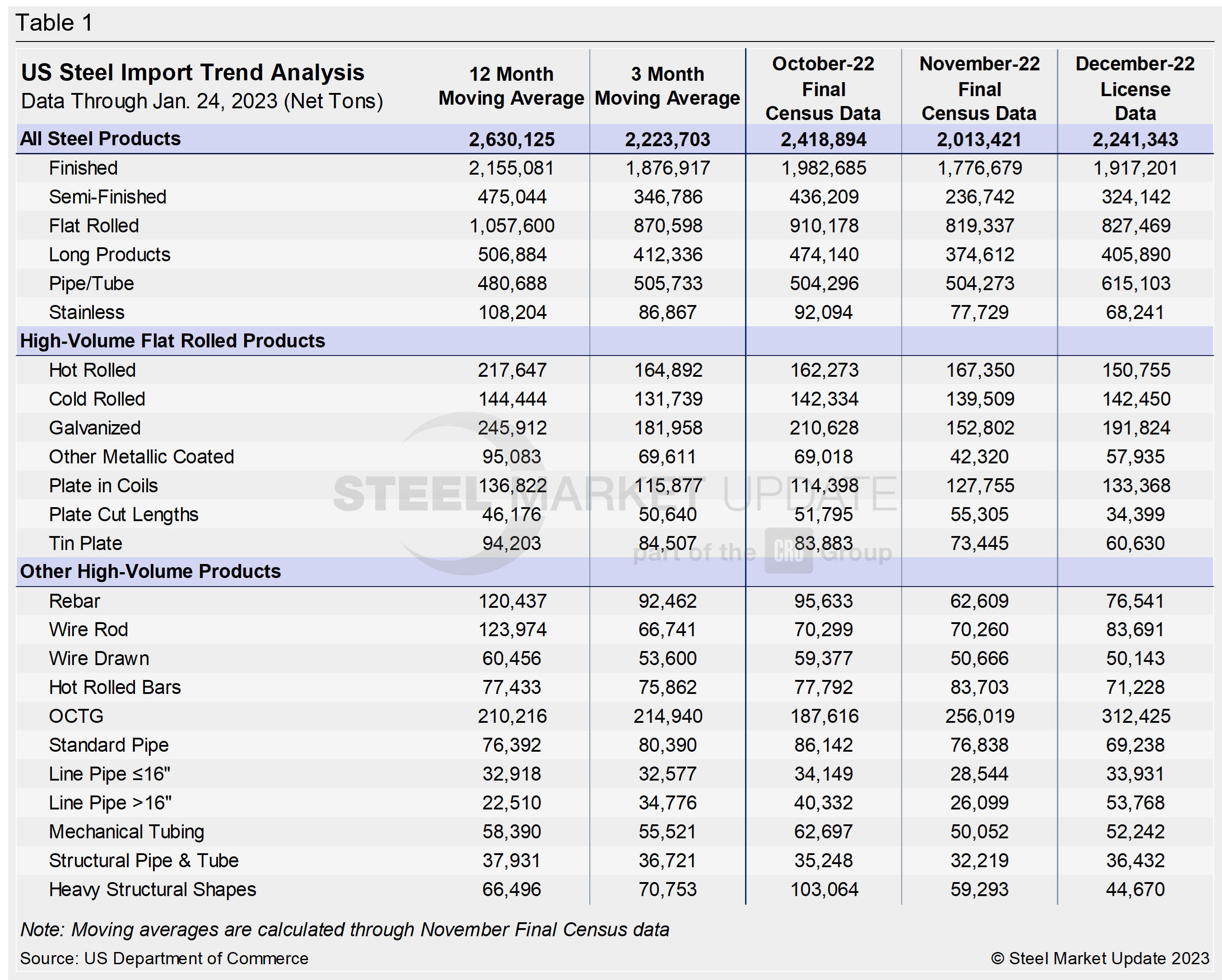

Broken down by product category, semifinished product imports in December surged, according to preliminary data, up 37% MoM, while long product imports rose 8% over the same period. Imports of stainless steel products declined 16% MoM, finished steel imports rose 8%, and flat-rolled imports were up just 1%, respectively. Pipe and tube product imports also jumped MoM, up 22% vs. November.

Total December import licenses are currently at 1.18 million tons through Jan. 24 data, potentially the lowest level seen in 22 months.

Although imports have decreased for the bulk of 2022, the annual rate remains healthy compared to recent years. The average monthly import rate for 2022 is now 2.63 million tons per month through preliminary December data. Compare this to the monthly averages of previous years: 2021 at 2.63 million tons, 2020 at 1.84 million tons, 2019 at 2.32 million tons, 2018 at 2.81 million tons, and 2017 at 3.17 million tons.

Preliminary imports of finished steels increased to 2.16 million tons in December from 1.77 million tons in November. The latest license data shows finished steel imports at 908,542 tons in January, potentially the lowest level seen since August 2009.

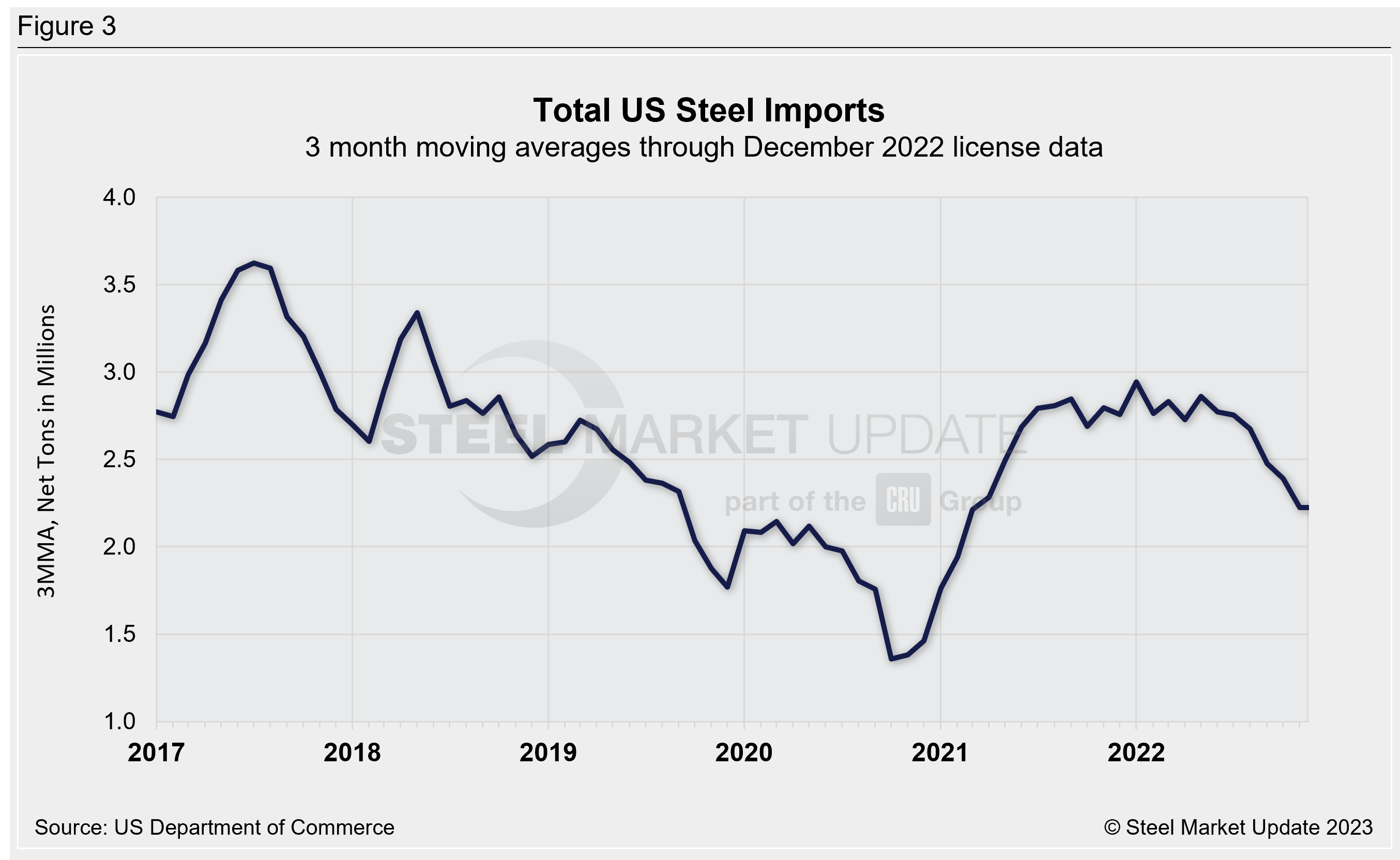

Due to large monthly swings in semifinished imports in recent years, the chart below shows total imports on a three-month moving average (3MMA) basis to display trends more accurately. The 3MMA is 2.22 million tons through preliminary December figures, near at a 20-month low. January license data suggests that the 3MMA could decline further to 1.42 million tons, potentially the lowest level since November 2020. Recall that in January of last year the 3MMA had reached a 42-month high of 2.94 million tons, while the lowest 3MMA level in SMU’s recent history was October 2020 at 1.36 million tons.

The table below displays flat-rolled product imports as well as other high-volume products, including rebar, tin plate, wire rod, structural pipe and tube, and other long products. We also provide data on imports divided into semifinished, finished, flat rolled, longs, pipe and tube, and stainless products.

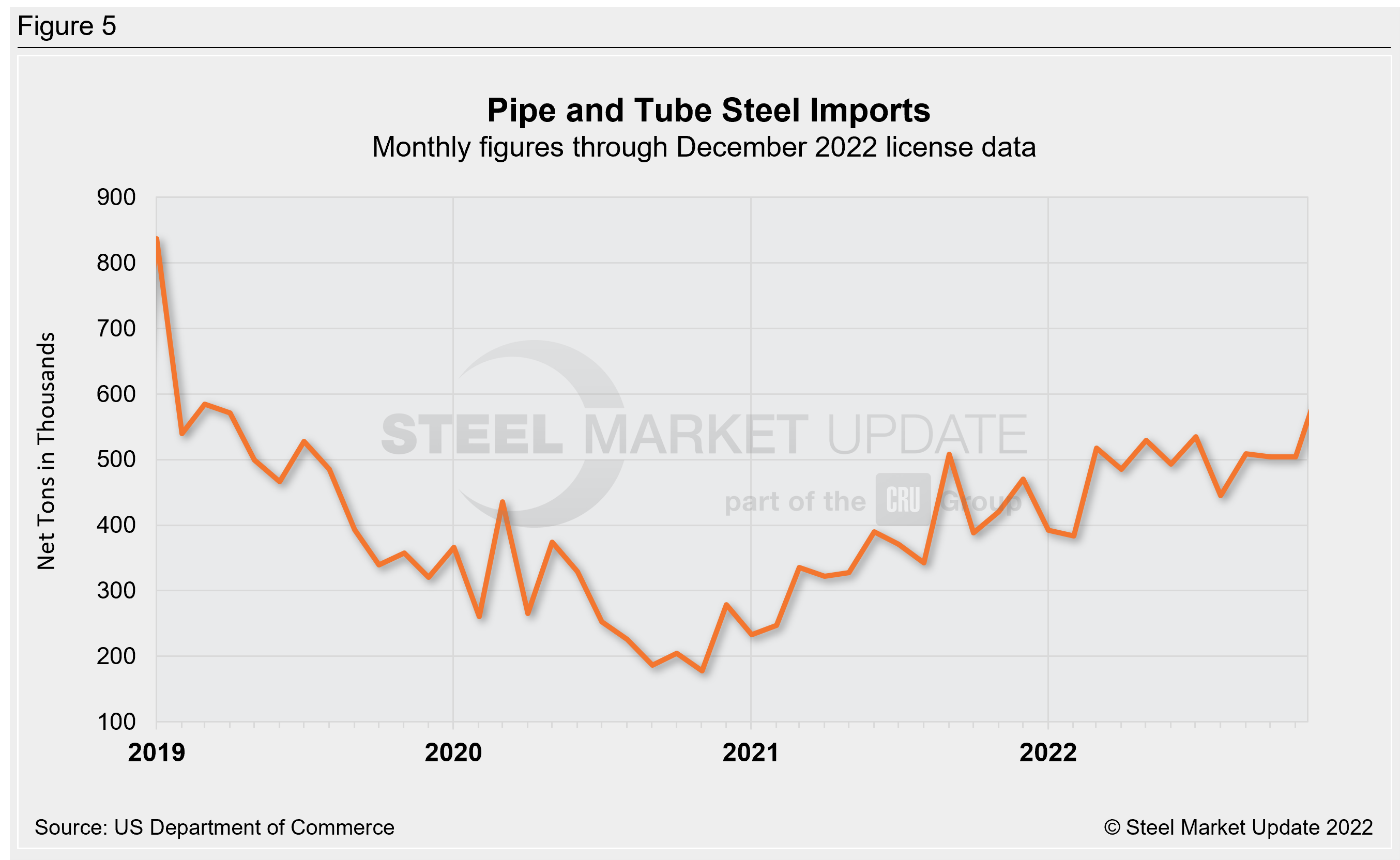

The charts below show monthly imports for two product groups: flat rolled and pipe and tube. Preliminary December flat-rolled imports totaled 827,469 tons, rebounding slightly from September’s 17-month low. January licenses are currently showing 362,273 tons of flat-rolled steel to have entered the country during the month. Pipe and tube imports were 615,103 tons in December, the highest total since January 2019. January pipe and tube licenses are currently at 291,858 tons.

PSA: We have an interactive graphing tool available here on our website, where readers can explore historical import data. If you need assistance logging into or navigating the website, contact us at info@steelmarketupdate.com.

By David Schollaert, david@steelmarketupdate.com