Market Data

January 17, 2023

November Shipments and Supply of Steel Products Analysis

Written by David Schollaert

Editor’s note: Steel Market Update is pleased to share this Premium content with Executive members. For information on how to upgrade to a Premium-level subscription, email Info@SteelMarketUpdate.com.

Total US mill shipments of steel products slipped in November and reached their lowest total year to date (YTD). Mill shipments have been fluctuating up and down all year with little consistency, and November was no different.

Shipments totaled 7.34 million tons in November, a 4% decrease from October’s 7.65 million tons, and the lowest total since February 2021. Apparent supply also saw a month-on-month (MoM) decrease in November, down 6.3% vs. the prior month.

This analysis is based on steel mill shipment data from the American Iron and Steel Institute (AISI) and import-export data from the US Department of Commerce (DOC). The analysis summarizes total steel supply by product from 2009 through November 2022 and year-on-year (YoY) changes.

The supply/demand differential remains in place, with supply still well ahead of demand, even though both moved down in November. Apparent supply (domestic shipments plus imports) in November was just about 5.8% above domestic shipments totals, down 2.6 percentage points MoM.

Export totals rose just 1.1% over the same period, while imports decelerated MoM, down 12.1% in November, falling after a slight rebound the month prior.

Domestic mill utilization averaged 73.3% through November, down 1.9 percentage points from October’s 75.2% and down 12.5% vs. the same year-ago period.

Prices began sliding in May once raw material availability adjusted to the war in Ukraine. The declines accelerated into September and October, falling further throughout November as supply steadily outpaced demand.

SMU’s benchmark hot-rolled coil price declined roughly $70 per net ton ($3.50 per cwt) in November. It peaked at $1,480 per ton during the week of April 19, 2022, and had been declining since recovering through December and into the new year. HRC prices closed out in November at an average of $665 per ton FOB mill, east of the Rockies on Dec. 1. Prices declined at a rapid pace throughout the month before, rebounding in late November as several mills increased their price tags to stop the erosion.

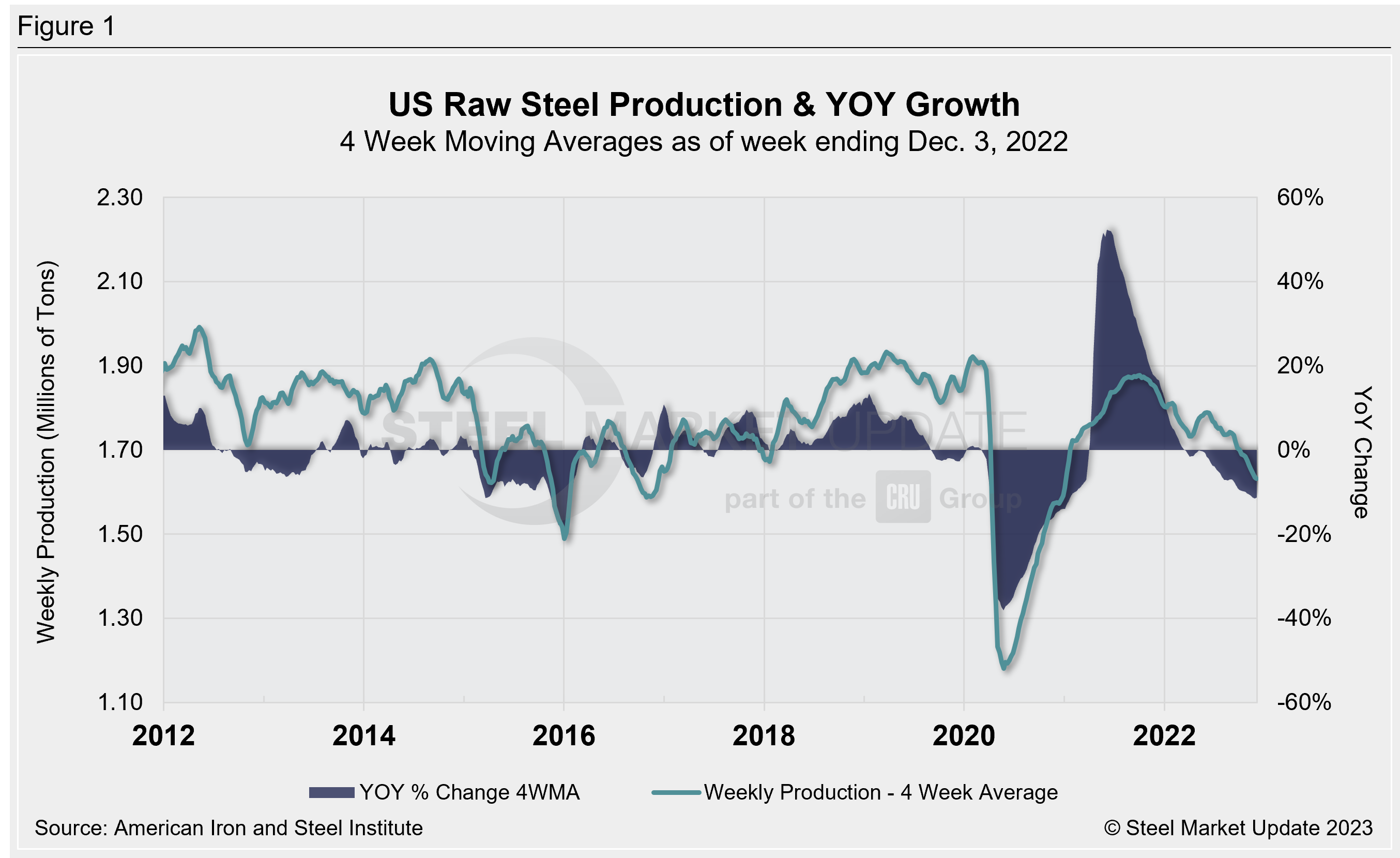

According to SMU’s latest check of the market on Jan. 10, the price for HRC is $6,735 per ton on average. Raw steel production, shown below in Figure 1, is based on weekly data from the AISI. It is displayed here as four-week moving averages through Oct. 30.

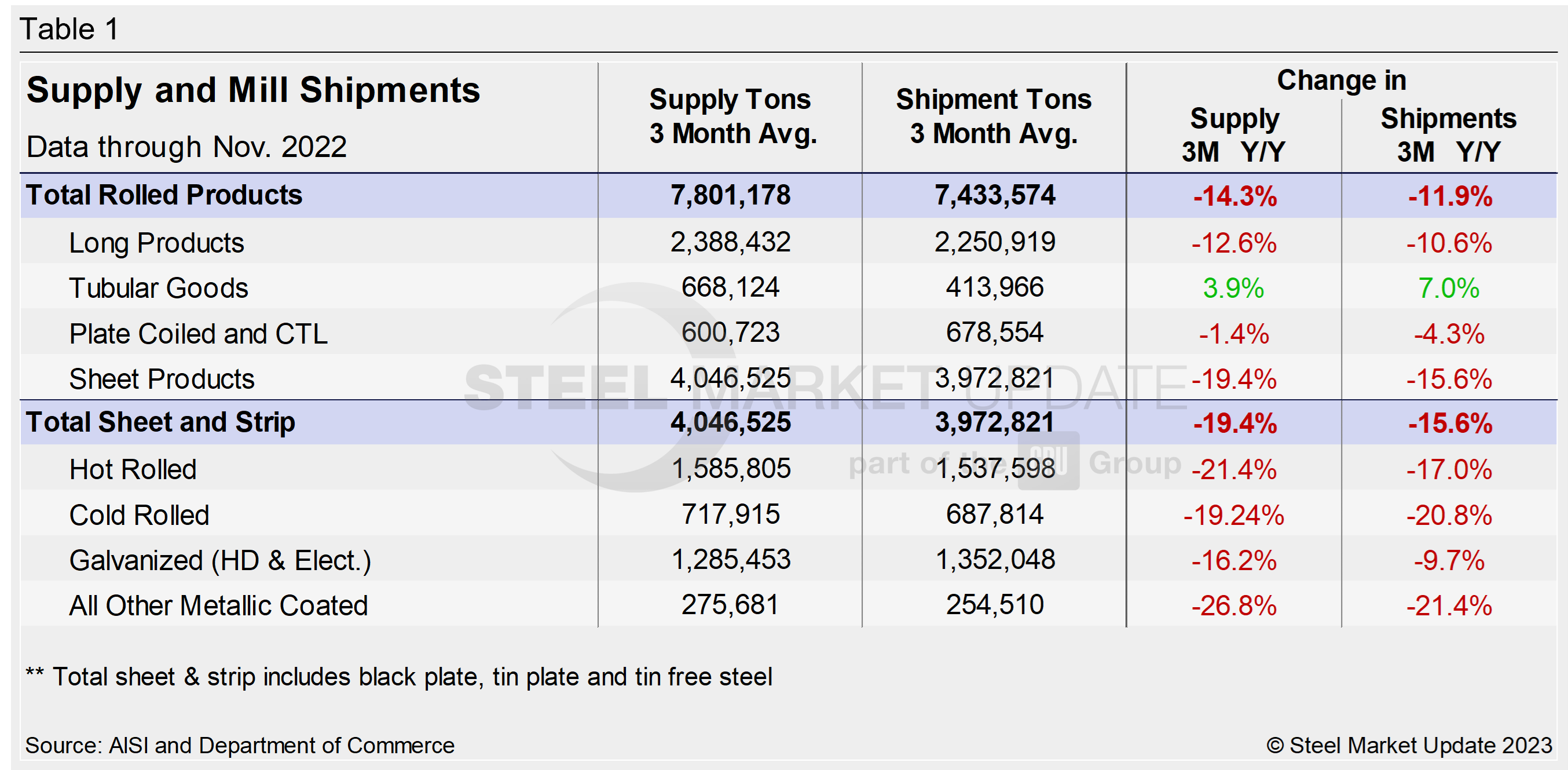

Monthly shipment data for all rolled steel products and exports are noted in Figure 2. Measured as a three-month moving average (3MMA) of the monthly data, the November total was 7.43 million tons, down 3.7% vs. 7.72 million tons in October. Monthly shipments have increased only once monthly YTD for the 3MMA analysis. Shipments declined 11.9% in November vs. the year prior when shipments were 8.3 million tons. The recovery from Covid-related shutdowns two years ago was meaningful. November’s shipments were just 5.3% above the Covid-induced lows of November 2020. And they are 8.8% below the same pre-pandemic period in 2019.

All rolled product exports totaled 7.26 million tons in November, down 3.8% MoM and 11.9% lower vs. the same year-ago period. November’s total is the lowest mark for the year.

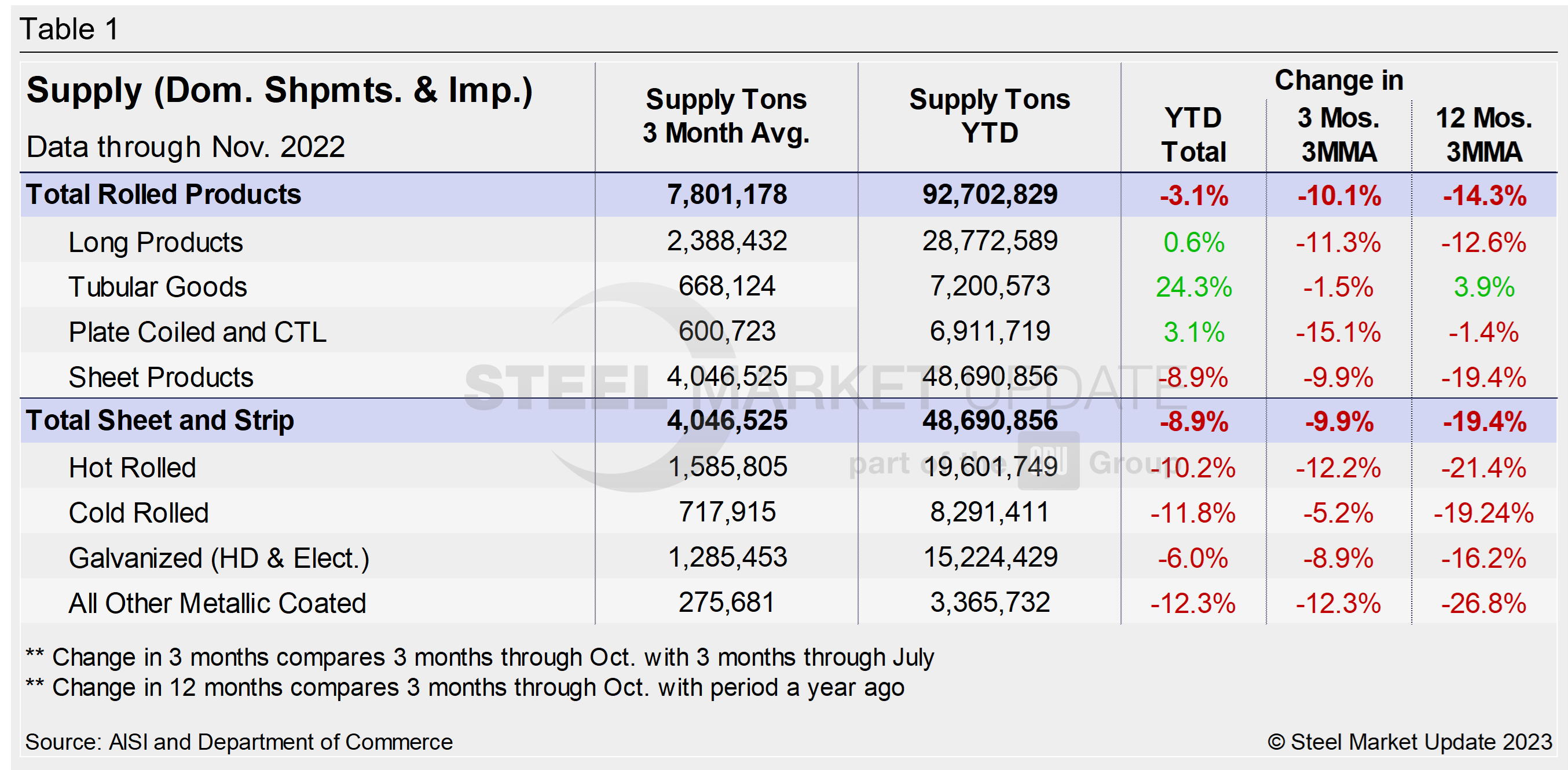

Shipment and supply details for all product groups and individual sheet products are noted in Table 1. Domestic supply (shipments and imports) is shown in Table 2. Total supply (a proxy for market demand) as a 3MMA was down YoY in November, and well behind the 31.9% growth seen the year prior when the market was rebounding from Covid shutdowns.

Apparent supply is defined as domestic mill shipments to domestic locations plus imports. Mill shipments were down nearly 12%, and a far cry from the 19.4% growth seen during the year-ago period in the same 3MMA comparison. The bright spots are tubular goods and plate products.

Total sheet and strip apparent supply is down YTD (Table 2) compared to 2021, and is similarly lower over the past three months. The same can be said for total rolled product apparent supply, which is notably down over the past 12 months on a 3MMA basis, and down over the same year-ago period. Note that YoY comparisons have seasonality removed.

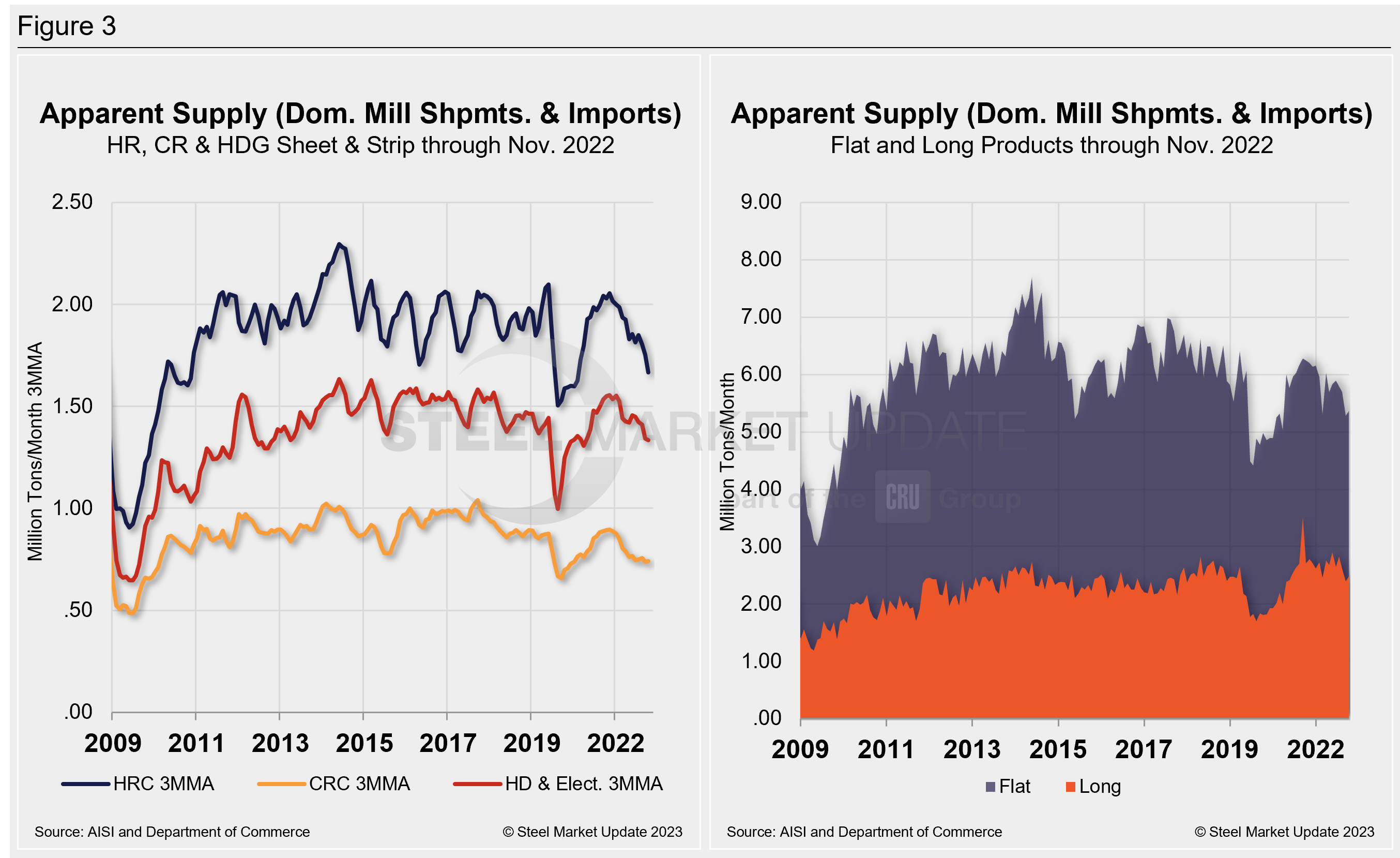

The supply picture for HRC, CRC, and HDG since January 2009 as three-month moving averages vs. the long-term comparison between flat and long products is shown side by side in Figure 3. On the left chart, all three sheet products are displayed. They had experienced some improvement since mid-2020 but have now been trending downward through November. When compared to the same pre-pandemic period in 2019, all three are down. Supplies of cold rolled have seen the largest percentage decline (-16.8%), followed by hot rolled (-14.1%), and galvanized (hot dipped and electrolytic: -8.2%), from the same pre-pandemic period in 2019. In the right chart, note that these are monthly numbers (not 3MMAs), which show the trend difference between long and flat products, including plate.

By David Schollaert, David@SteelMarketUpdate.com