Analysis

January 10, 2023

Sheet, Plate, and Slab Import Licenses Mixed in December

Written by David Schollaert

Sheet imports into the US varied in December, a similar trend also seen in imports of plate and semifinished slab, according to the latest license figures released by the US Department of Commerce’s International Trade Administration.

All steel imports into the US require an import license to enter through Customs. The license count provides a first look into the number of imports that entered the country during a particular month. Commerce later releases preliminary figures and then final import figures. Therefore, licensing data should not be considered as final data but as providing an idea as to import tonnages.

Sheet Imports

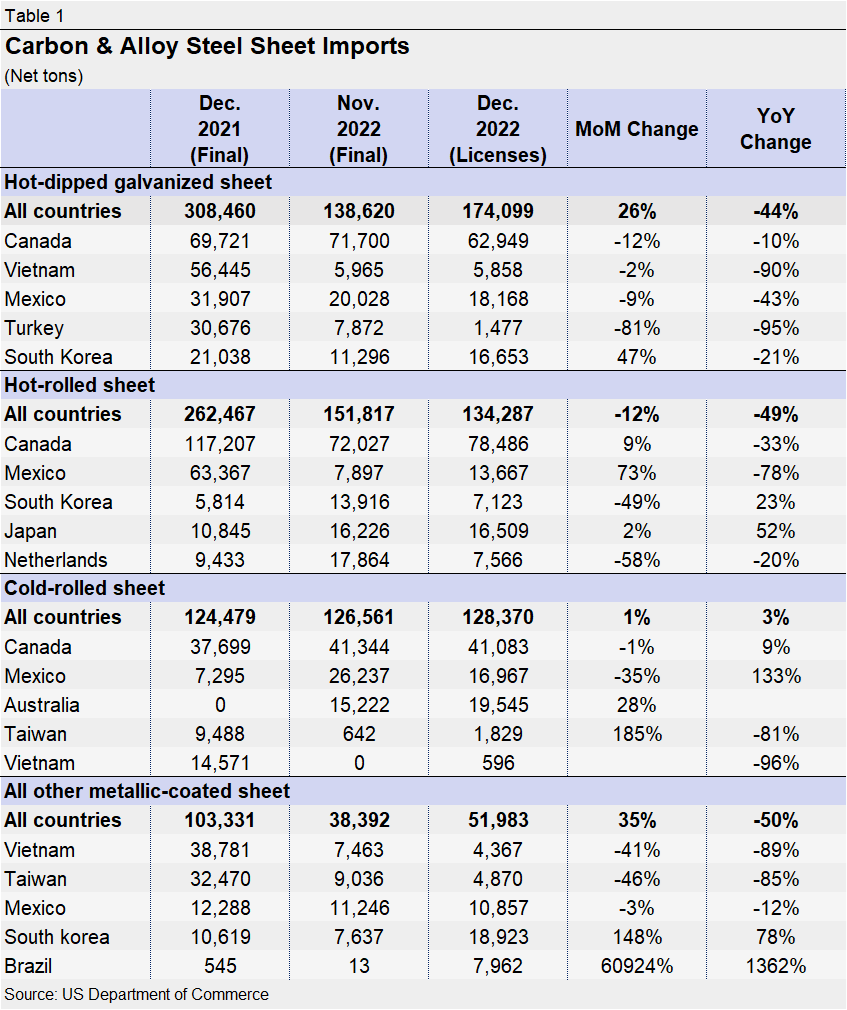

Table 1 shows December license data with month-on-month (MoM) and year-on-year (YoY) changes for relevant sheet products, and data for the top five countries shipping the most of each product to the US.

Imports of hot-dipped galvanized sheet and strip rose 26% from November’s final count of 138,620 net tons to 174,099 tons in December’s license count. Despite a MoM boost from South Korea, noticeable declines were seen in HDG shipments from Turkey, Canada, and Mexico. Compared to year-ago levels, December licenses declined by nearly half.

Hot-rolled sheet imports dropped 12% MoM, and showed an even more accentuated decline YoY, a 49% drop to 134,287 tons of December licenses. A notable spike in shipments from Japan was a bright spot, but not enough to offset shipments falling by 33% from top trading partner Canada.

November licenses for cold-rolled sheet imports totaled 128,370 tons, up just 1% from November’s final count, and up 3% from December 2021.

All other metallic-coated sheet imports, meanwhile, rose 35% from November to 51,983 tons of December licenses. December’s count is, however, 50% below year-ago levels. Shipments were down from four of the five top countries shipping this product to the US.

Plate Imports

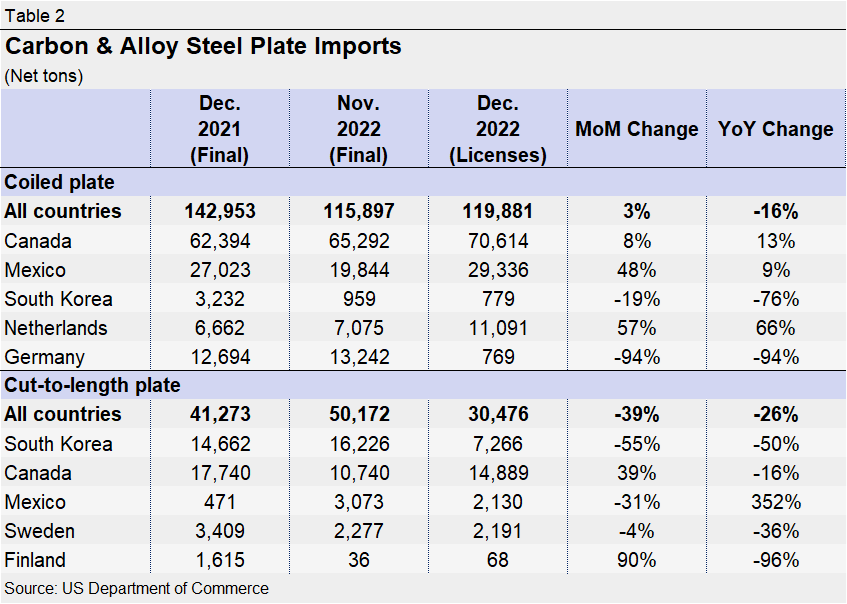

Table 2 shows December license data with MoM and YoY changes for relevant plate products, and data for the top five countries shipping the most of each product to the US.

Imports of coiled and cut-to-length plate varied from November’s final count, but on the year-ago comparison, both are down by double digits.

Licenses to import coiled plate reached 119,991 tons in December, just a 3% MoM rise, but a 16% decline YoY. Noteworthy MoM increases were seen in shipments from Mexico, the Netherlands, and Germany.

Cut-to-length plate import licenses fell 39% from November’s final tally to 30,476 tons in December. Licenses were down 26% from 41,273 tons of imports in December 2021. The total MoM decline resulted as imports dropped from three of the top CTL plate trading partners – South Korea, Mexico, and Sweden.

Slab Imports

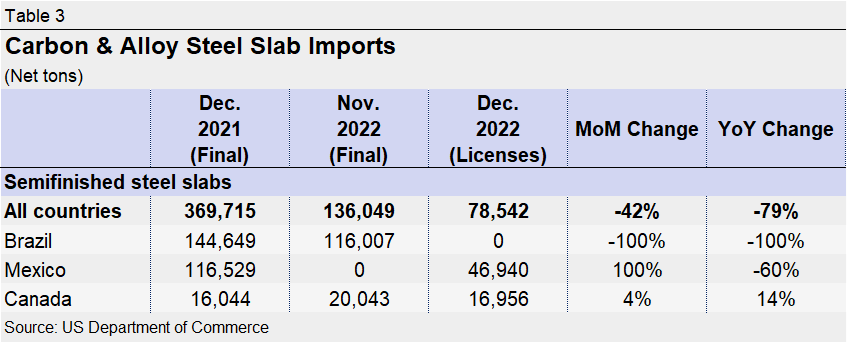

Table 3 shows December license data with MoM and YoY changes for semifinished slab imports, and data for the top three countries shipping most of each product to the US. Mexico and Canada were the only two countries to apply for slab import licenses during the month of December, according to government data. No slabs have arrived from Russia — once a major source of steel slab shipped to the US — since June of this year.

No licenses to import slabs from Brazil were registered in December after 116,007 tons were imported in November. This resulted in a 42% MoM and 79% YoY decline in total slab imports, with 78,542 tons of licenses in December’s count. Slab imports from Mexico saw a complete reversal after no tons were imported in November, but were still 60% down YoY, with 46,940 tons accounting for the majority of December slab licenses.

Total Steel Imports

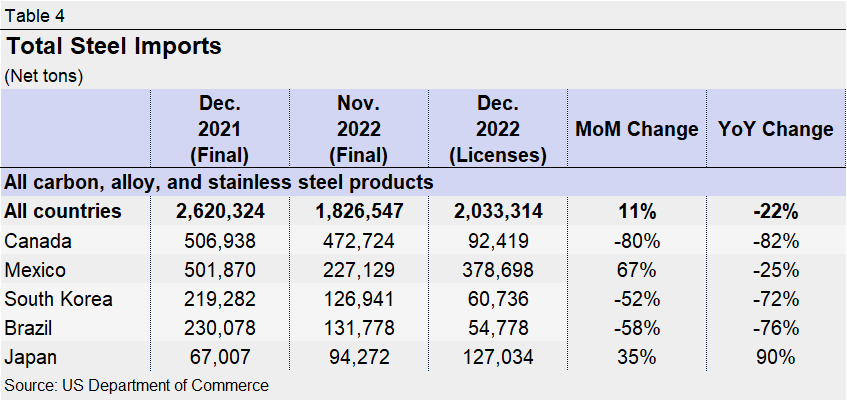

Table 4 shows December license data and updated final November figures, with MoM and YoY changes for all steel products, along with data for the top five countries shipping the most steel to the US.

Total steel import licenses of more than 2.03 million tons were up 11% from November’s final figure, but down 22% from year-ago levels, with double-digit MoM declines seen from four of the top five trading partners.

By David Schollaert, David@SteelMarketUpdate.com