Overseas

December 8, 2022

Mills Less Willing to Negotiate on Sheet Prices, More Eager on Plate

Written by Brett Linton

There has been a reduction in the percentage of sheet buyers reporting that mills are willing to talk price on new orders, according to Steel Market Update’s latest market questionnaire. Mill willingness to negotiate on sheet products is now at the lowest rate recorded since May. Negotiation rates on plate products went in the opposite direction, climbing to the highest rate since mid-September.

Every other week, SMU asks survey respondents: Are you finding domestic mills are willing to negotiate spot pricing on new orders? On average, 73% of steel buyers polled this week reported that mills were willing to negotiate on new order pricing. This is down from a rate of 86% when polled two weeks ago. One month ago we saw an average negotiation rate of 91%, the highest recorded since January. As shown in Figure 1, negotiation rates continue to remain relatively high and have been so for over seven months.

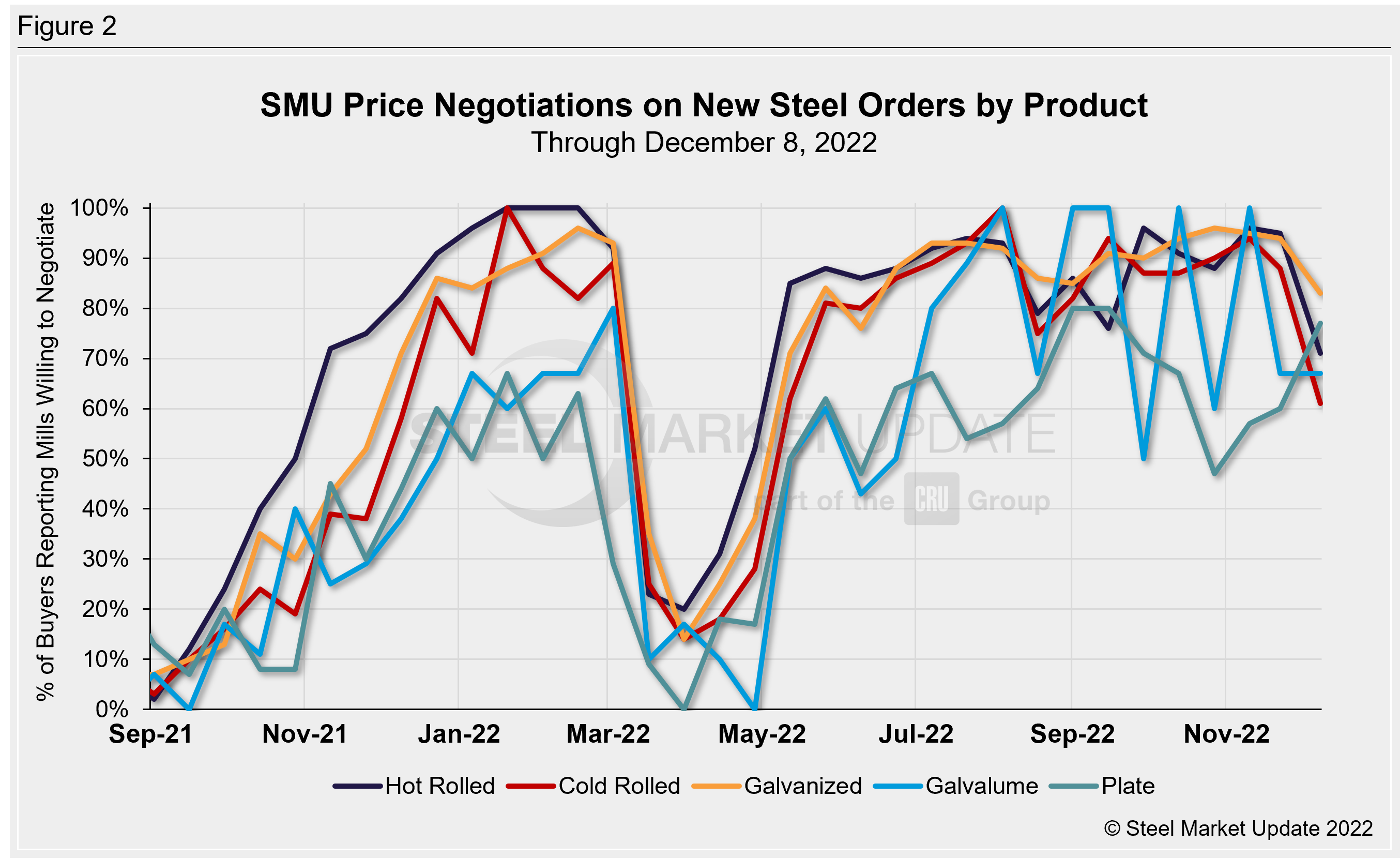

Figure 2 below shows negotiation rates by various products. This week, 71% of hot rolled buyers responded that mills are willing to negotiate on new order prices. This is down from a rate of 95% two weeks ago, which was one of the highest rates seen since February. The last time hot rolled negotiation rates were this low was back in April.

61% of cold rolled respondents reported that mills were willing to talk price. This is down from 88% two weeks ago and down from 94% one month prior. Like hot rolled, this is the lowest cold rolled negotiation rate recorded since April.

For galvanized buyers, 83% responded that mill prices are negotiable this week. This is down 11% from two weeks ago. Recall that in late October our galvanized negotiation rate reached 96%, the highest rate recorded in over eight months. The last time we saw galvanized negotiation rates this low was in May.

Galvalume negotiation rates tend to be more volatile due to the smaller market size. 67% of buyers reported that mills are negotiable on new orders this week. This is unchanged from our rate two weeks prior, but down from a rate of 100% one month ago.

Negotiations have been slightly less common in the plate market, but ticked up this week to reach a three-month high. 77% of buyers reported a willingness to negotiate in our latest survey, up from 60% two weeks earlier, and up from 57% one month ago. Plate negotiation rates were as high as 80% back in September. Recall we saw plate negotiation rates between 0–18% in March and April.

SMU’s Price Momentum Indicator was adjusted from Lower to Neutral on Nov. 29 for sheet products, until the market determines whether recent mill price hikes will hold. Our plate momentum indicator, in contrast, continues to point Lower.

Note: SMU surveys active steel buyers every other week to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.

By Brett Linton, Brett@SteelMarketUpdate.com