Market Segment

December 11, 2022

Final Thoughts

Written by Michael Cowden

Steel sheet prices have bottomed or soon will, according to most respondents to our latest market survey. We’ve also seen an uptick in expectations about future prices.

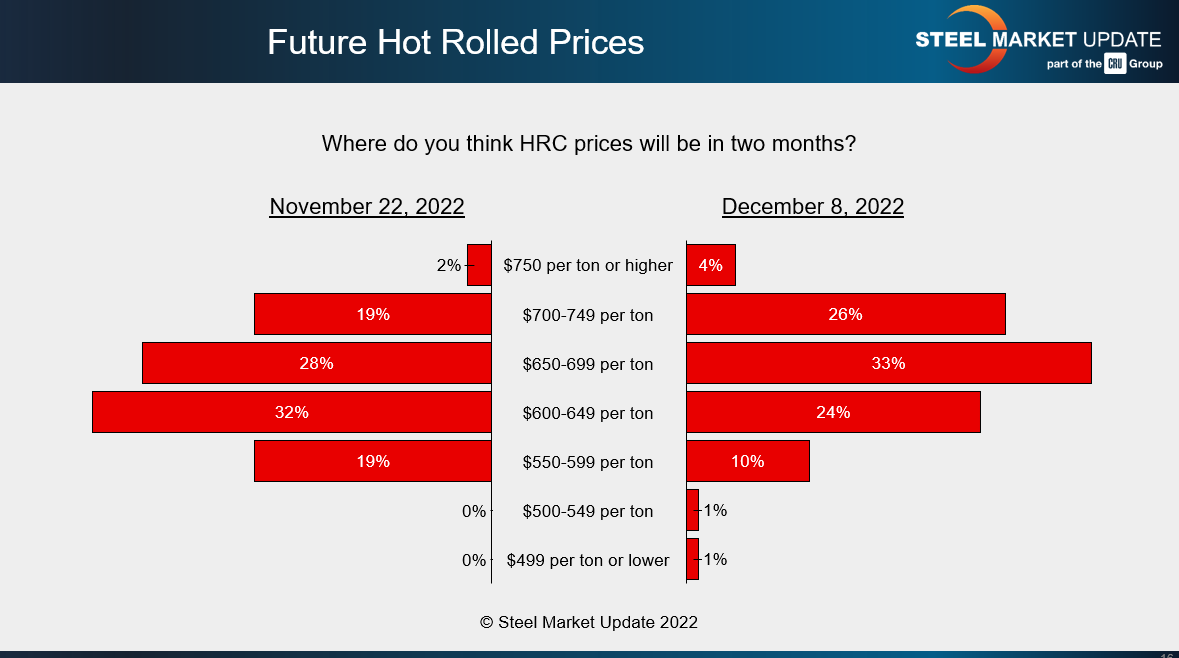

The chart below provides a quick before/after snapshot of expectations for prices ahead of Thanksgiving and then following price hikes of $60 per ton ($3 per cwt) announced the following week.

Before the price increases were announced, forecasts were divergent. About 60% of people thought prices would remain roughly where they were – that’s not uncommon. Notable was that nearly 20% thought they would go above $700 ton ($35 per cwt) while another roughly 20% predicted they would fall into the $500s per ton. That surprised me at the time because $500s per ton is getting close to breakeven for some integrated mills, especially once you consider that contract prices are done at a discount to spot prices.

The $700s-per-ton crowd (30%) has grown, and only about 12% of respondents think that prices in two months will be in the $500s per ton or lower. Also interesting is that some people are predicting prices will be even higher than the aggressive target prices of $700 per ton announced by certain mills. That result reads to me like some are expecting another round of price hikes – and that those additional hikes will gain traction.

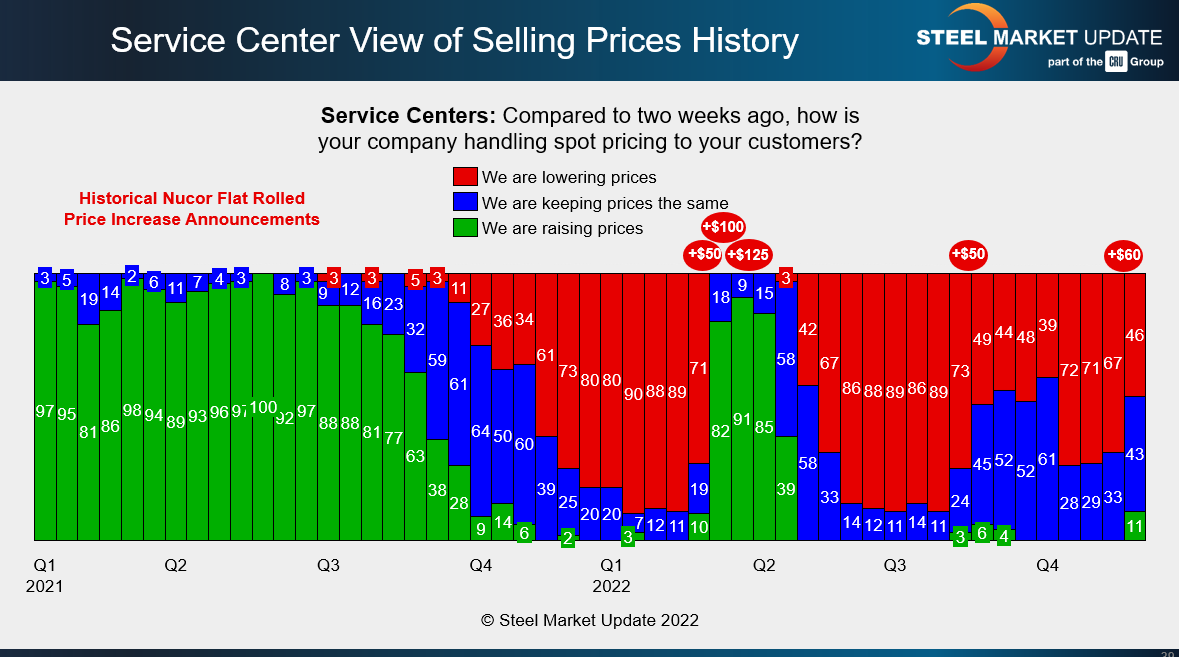

We’ve seen an improvement in pricing expectations not only at the mill level but also among service centers.

Namely, the number of service centers reporting that they are increasing prices has grown. And fewer are cutting prices. We saw that in August/September following a prior round of mill prices increases. Those fizzled. And one week does not make a trend. So I’ll be keeping a close eye in the weeks ahead on whether the green bars – service centers increasing prices – continue to grow. I’d expect them to, especially if we continue to see fewer mills willing to negotiate lower prices.

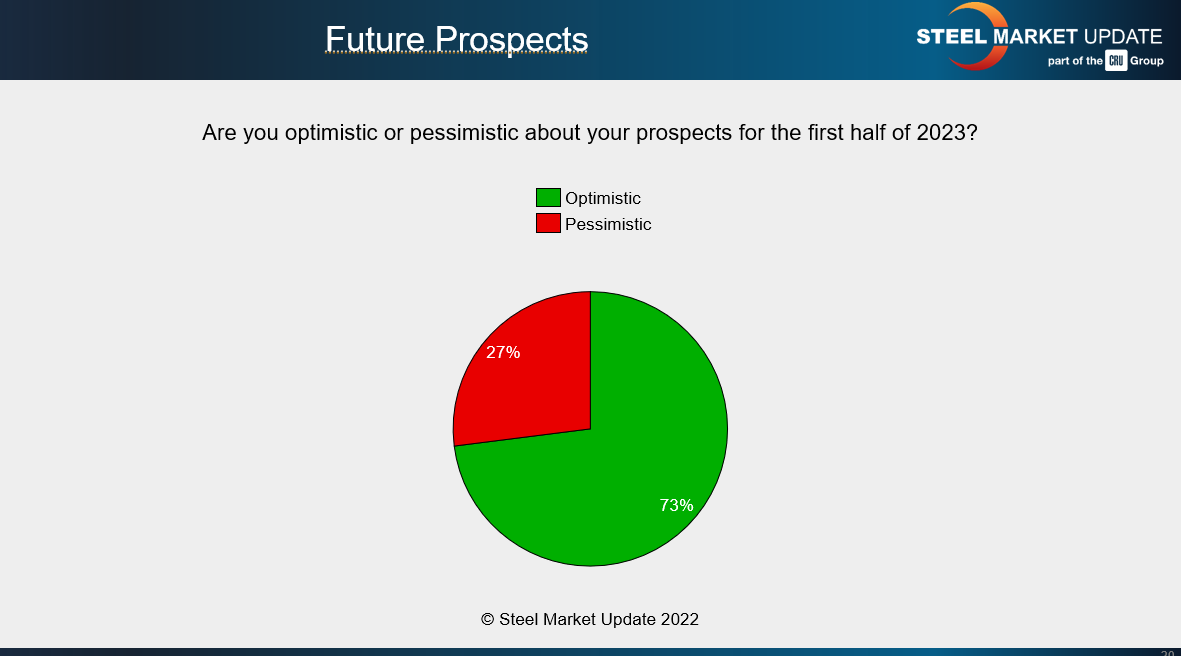

Remember, too, that sentiment can be a significant driver of prices in the short term. We’ve seen a big uptick in positive sentiment lately. Take a look at this poll. We asked people whether they were optimistic about their prospects in 1H 2023:

It’s not unusual to see optimism heading into the New Year given that Q1 is typically busy. Companies often restock ahead of construction season in the spring, automotive activity ramps back up again following the holidays, and concerns about year-end inventory taxes pass.

Still, I wasn’t expecting to see people this optimistic given headlines about war in Europe, higher interest rates, and a potential recession. What explains it? Is it optimism about infrastructure spending, provisions in the Inflation Reduction Act that will encourage the buildout of steel-intensive wind and solar power generation, or something else entirely? I’d be curious to know what your thoughts.

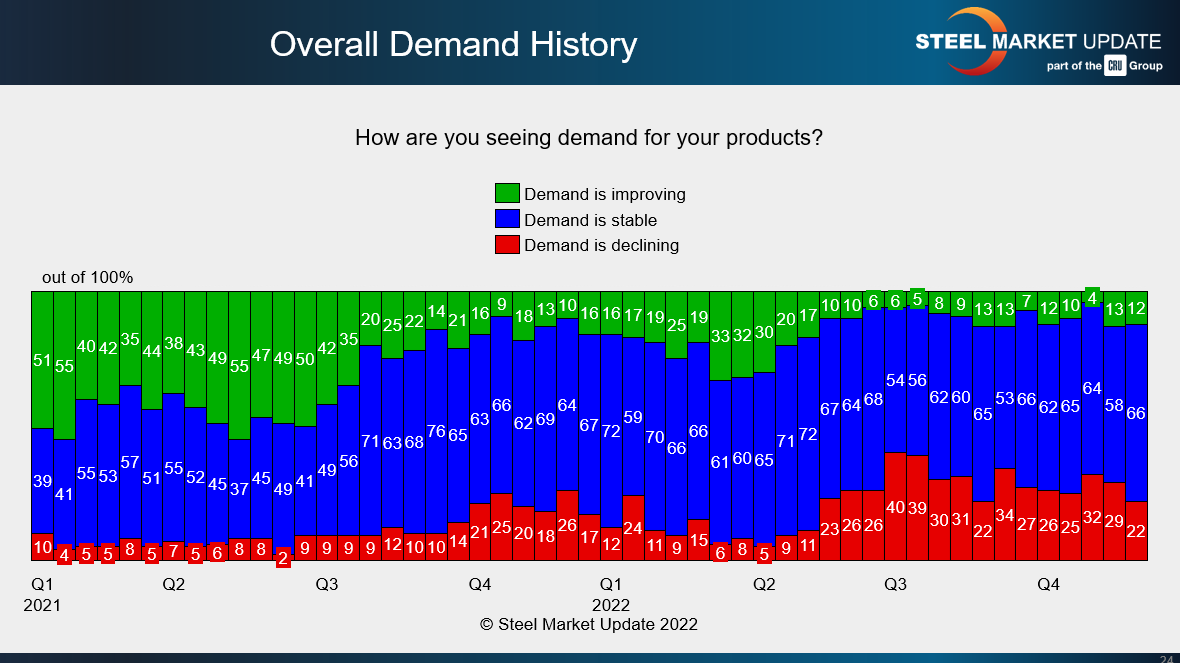

What worries me a little is that we haven’t seen much change in overall demand:

Most people (66%) continue to say that it’s stable. Those saying it’s declining (22%) still outnumber those who say that it’s increasing (12%). That’s actually the best reading we’ve had in a while. But if higher prices are going to stick, we’re going to need to see those green bars get longer and the red ones continue to shrink in the weeks ahead.

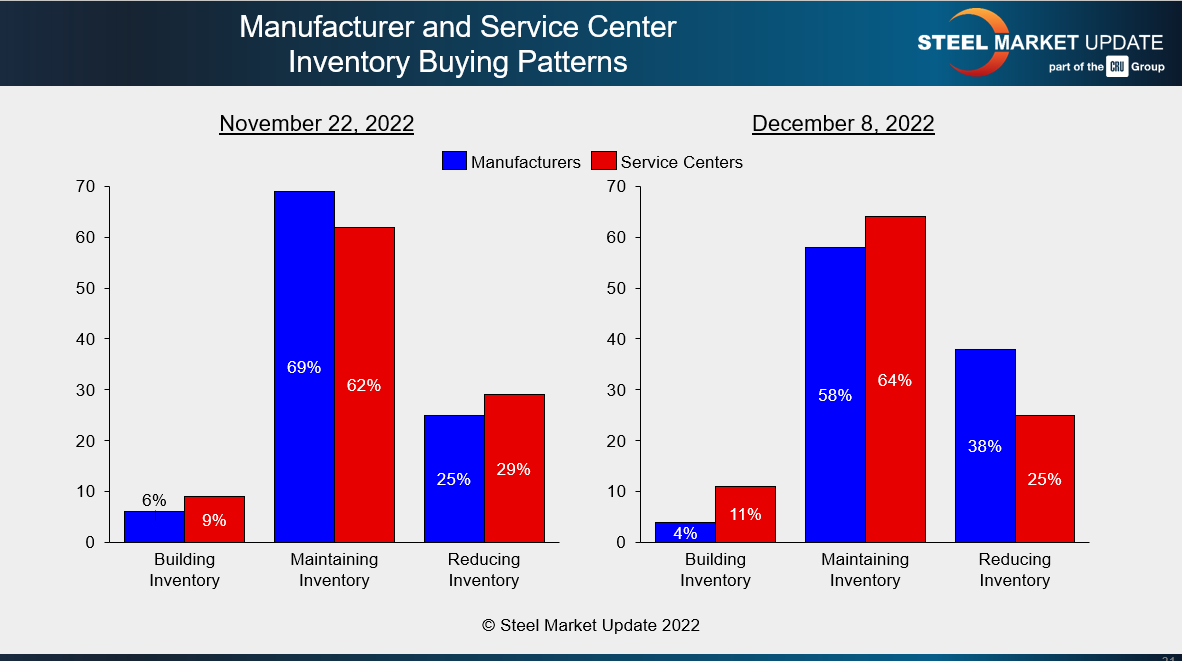

Another factor that gives me pause amid all the bullishness around ’23 is this poll on how service centers and manufacturers are handling their inventories:

I thought I might be able to say by now that 2021 was a restocking year, 2022 was a destocking year, and 2023 would bring a return of restocking.

That might still prove to be the case. But it’s not in the numbers yet. Most respondents to continue to report that they are maintaining inventory. And a significant number continue to slash stocks. Only a handful report that they are building inventories.

We’ll have more comprehensive data on November service center inventories crunched later this week for our premium members. I’m keen to see it. I noted last week that a lot could hinge on whether and when we see a restocking cycle. I think that’s still the case.

The Tampa Steel Conference

Don’t forget to register for the Tampa Steel Conference. You can do that here.

Remember it’s Feb. 5-7 in Florida. We’ll have C-level executives from mills in the US, Canada, and Mexico as well as leading experts on energy, trade policy, and geopolitics.

The event will kick off on Sunday with an outdoor networking reception. We’ll follow with golf and a harbor tour on Monday morning ahead of the start of the conference program on Monday afternoon.

It’s the high season for tourism in Florida, so consider booking soon. Hotel rooms are already getting scarce.

Also, Tampa Steel is a great place to get your company’s name in front of potential clients and customers. There are still a handful of booths left as well as some high-profile sponsorship opportunities. No one has claimed their spot on the lanyards yet. What’s up with that?!

Contact Jill Waldman at Jill@SteelMarketUpdate.com if you’d like to learn more about sponsorship and exhibition opportunities.

By Michael Cowden, Michael@SteelMarketUpdate.com