Market Data

December 8, 2022

Sheet Imports Slow, Plate Imports Grow in November’s License Count

Written by Laura Miller

Sheet imports into the US slowed noticeably in November, while imports of plate and semifinished slab rose, according to the latest license figures released by the US Department of Commerce’s International Trade Administration.

All steel imports into the US require an import license to enter through Customs. The license count provides a first look into the amount of imports that entered the country during a particular month. Commerce later releases preliminary figures and then final import figures. Therefore, licensing data should not be considered as final data but as providing an idea as to import tonnages.

Sheet Imports

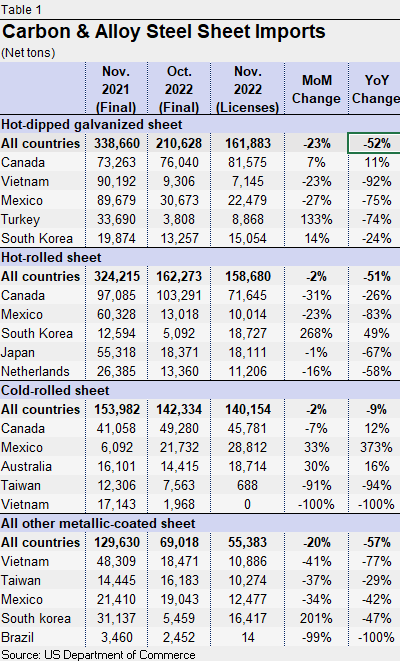

Table 1 shows November license data with month-on-month (MoM) and year-on-year (YoY) changes for relevant sheet products, and data for the top five countries shipping the most of each product to the US.

Imports of hot-dipped galvanized sheet and strip dropped 23% from October’s final count of 210,628 net tons to 161,883 tons in November’s license count. Despite MoM increases from Canada and Turkey, significant declines were seen in HDG shipments from Mexico (-27%), Brazil (from 10,360 tons in October to 0 tons in November), South Africa (-97%), and Austria (-91%). Compared to year-ago levels, November licenses declined by more than half.

Hot-rolled sheet imports dropped just 2% MoM but showed a 51% YoY drop to 158,680 tons of November licenses. A notable spike in shipments from South Korea was not enough to offset shipments falling by 31% from top trading partner Canada.

November licenses for cold-rolled sheet imports totaled 140,154 tons, down just 2% from October’s final count and down 9% from November 2021.

All other metallic-coated sheet imports, meanwhile, dropped 20% from October to 55,383 tons of November licenses. November’s count is 57% below year-ago levels. Shipments were down from four of the five top countries shipping this product to the US.

Plate Imports

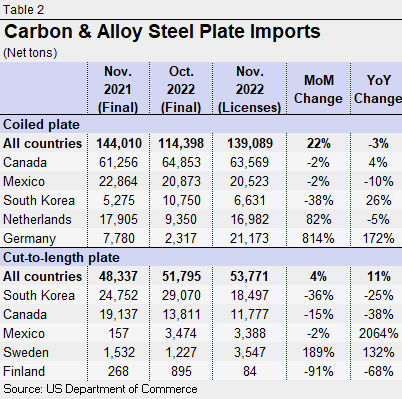

Table 2 shows November license data with MoM and YoY changes for relevant plate products, and data for the top five countries shipping the most of each product to the US.

Imports of both coiled and cut-to-length plate rose from October’s final count.

Licenses to import coiled plate reached 139,089 tons in November, a 22% MoM rise, and down just 3% YoY. Noteworthy MoM increases were seen in shipments from the Netherlands, Germany, as well as Sweden, France, and Belgium.

Cut-to-length plate import licenses rose 4% from October’s final tally to 53,771 tons in November. Licenses were up 11% from 48,337 tons of imports in November 2021. Despite the total MoM rise, imports dropped from three of the top CTL plate trading partners – South Korea, Canada, and Mexico.

Slab Imports

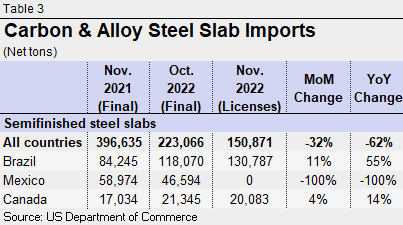

Table 3 shows November license data with MoM and YoY changes for semifinished slab imports, and data for the top three countries shipping the most of each product to the US. Brazil and Canada were the only two countries to apply for slab import licenses during the month of November, according to the government data. No slabs have arrived from Russia — once a major source of steel slab shipped to the US — since June of this year.

No licenses to import slabs from Mexico were registered in November after 46,594 tons were imported in October. This resulted in a 32% MoM and 62% YoY decline in total slab imports, with 150,871 tons of licenses in November’s count. Slab imports from Brazil were up 11% MoM and 55% YoY, with 130,787 tons accounting for the majority of November slab licenses.

Total Steel Imports

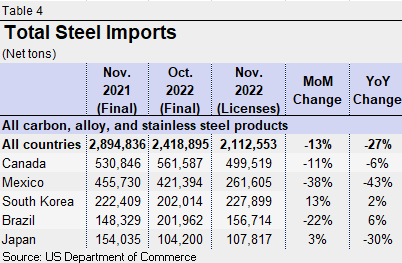

Table 4 shows November license data and updated final October figures with MoM and YoY changes for all steel products, along with data for the top five countries shipping the most steel to the US.

Total steel import licenses of more than 2.11 million tons declined 13% from October’s final figure and 27% from year-ago levels, with double-digit MoM declines seen from three of the top five trading partners.

By Laura Miller, Laura@SteelMarketUpdate.com