Government/Policy

December 3, 2022

Friedman Reports Sharply Lower Profits on Compressed Coil Margins

Written by David Schollaert

Friedman Industries continues to see benefits of its April acquisition of Plateplus Inc., but sharply declining steel prices significantly suppressed earnings.

The Longview, Texas-based steel processor and manufacturer said the fiscal 2023 second quarter ended Sept. 30, 2022 was a “period of considerable margin compression” driven by sharply declining hot-rolled coil (HRC) prices.

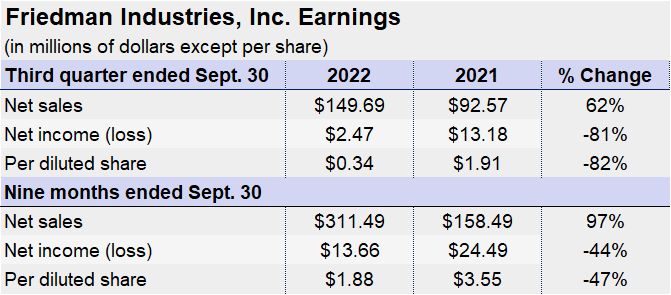

Friedman reported net earnings of $2.47 million for the second quarter on sales of $149.7 million. That’s down sharply from earnings of $13.18 million in the same year-ago period, according to quarterly data released on Friday, Dec. 2.

“The 2022 quarter presented significant challenges due to the declining HRC price trend entering the quarter and continuing throughout the quarter,” Friedman president and CEO Michael Taylor said. “A combination of sales strategy, inventory management, and hedging protection allowed us to remain profitable in a period of significant headwinds to profitability.”

Tons sold in the company’s coil segment were up 147% in the quarter to 106,500 tons, with Plateplus shipments accounting for 65,000 of those tons. The segment posted an operating loss of roughly $1.1 million for Q2 FY22 versus an operating profit of $24.3 million in the year-ago period, Friedman noted.

Higher selling prices in the tubular segment were offset by an 8.7% year-on-year (YoY) decline in tons sold to 10,500 tons during the quarter. The segment saw operating profits surge 67.8% YoY to $3.34 million for the quarter as a result.

For the third quarter, the market remains under pressure. But margin improvement could be seen in the fourth fiscal quarter should higher HRC prices gain acceptance, the company said.

By David Schollaert, David@SteelMarketUpdate.com