Market Segment

December 2, 2022

Plate Report: Nucor Catches Many by Surprise, Demand Still Poor

Written by David Schollaert

US plate prices were mostly flat this week, but more erosion could be on the horizon now that Nucor announced another round of price cuts.

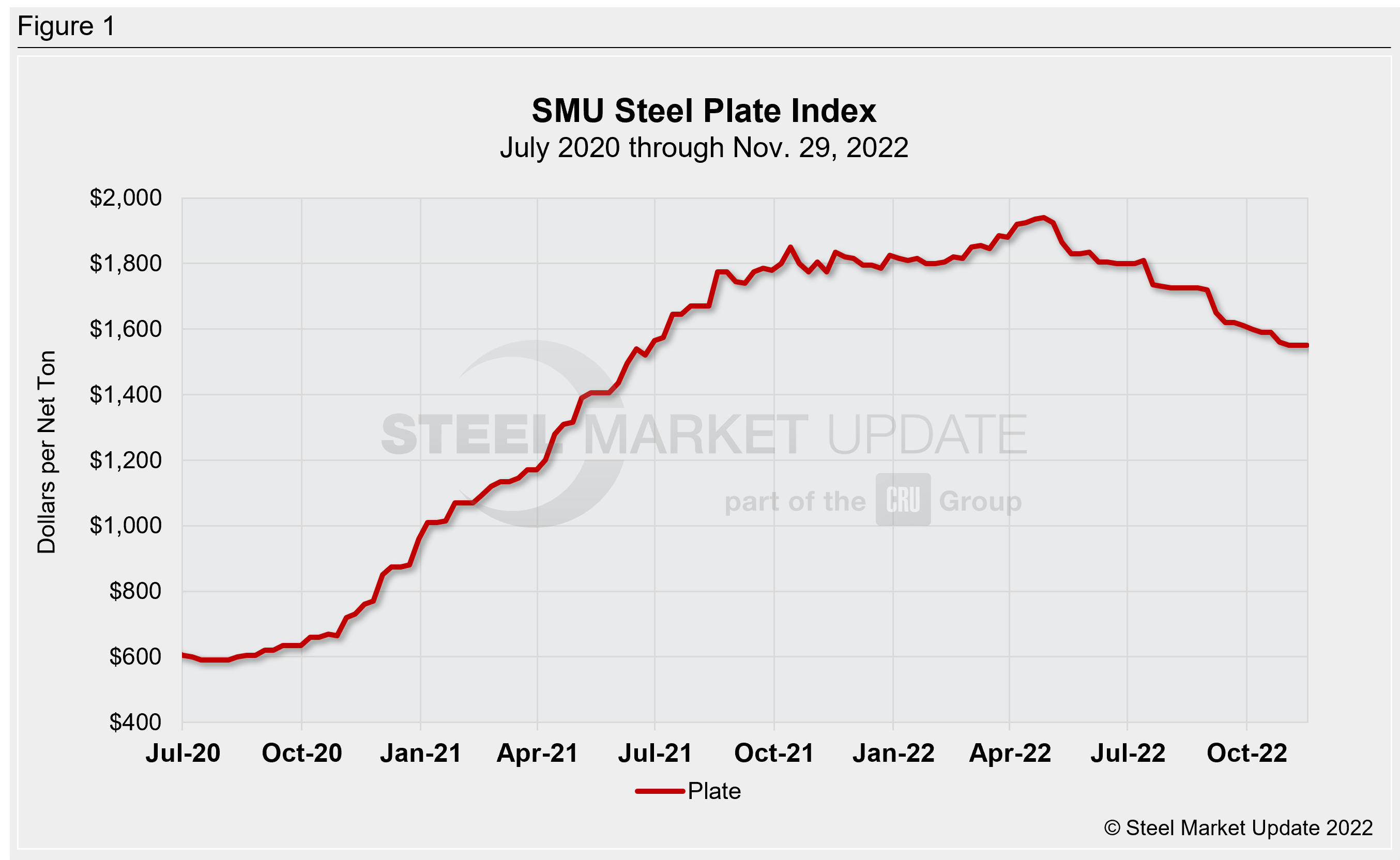

SMU’s most recent check of the market on Tuesday, Nov. 29 placed plate prices between $1,480-1,620 per ton with an average of $1,550 per ton FOB mill east of the Rockies – unchanged week-on-week (WoW) according to our interactive pricing tool (Figure 1). But tags were set before the surprise drop by the Charlotte, N.C.-based steelmaker.

Nucor sent out their price notice after the close of business on Tuesday, notifying customers of a $140-per-ton price cut on discrete plate, normalized plate, and quench & tempered plate. The change was effective immediately, the letter said.

Their prior price cut was announced back in mid-September when Nucor lowered tags by $120 per ton ($6 per cwt). Since then, Nucor’s official tags were serving as the top end of the market, but little-to-no business had been seen at $1,620 per ton.

Nucor’s newest price point is now in-line with the bottom of SMU’s range, leading many sources to speculate on the steelmaker’s motivation. The market’s response came hard and fast.

“I’m personally surprised by the timing and especially by the amount they lowered,” said a source. “Obviously, they are sending a strong message to somebody. I didn’t expect to see anything announced until Q1 of 2023 – I was wrong.”

“I didn’t see this coming especially after their reduction in October,” a second source said. “I’m not quite sure what Nucor is doing other than stopping their competitors from discounting anymore.”

“I’m not sure who ‘anticipated’ this drop in plate but they have a clearer crystal ball than I do obviously,” said another source. “The announcement was spurred by lack of discipline. Lack from mills, lack from service centers – lack all around.”

The surprise move by the steelmaker comes amid lower demand, especially as buyers look to manage inventories.

“Lowering plate prices down $140.00 per ton ($7.00/cwt) will only devalue inventories,” a fourth source added. “Year-end buying will come to a halt as a result. Nobody is going to ramp up buying activities unless they strike a deal well below the $74.00/cwt base price.”

“I do not believe they will generate any new business, especially this time of the year,” said another source. “I think buyers will sit on the sidelines until the first quarter and see where the market is at that time. Nucor didn’t help by devaluing people’s inventory. The thought on buyers’ minds now is: where’s the bottom?”

“I’m not really sure what all it will do in the market,” another source remarked. “I still don’t think there’s demand in the market to drive buying at this point. I see service centers staying on the fence until January, but I guess we’ll see what happens next.”

A few sources went as far as telling SMU that they are bewildered and upset with Nucor’s price cut, adding that many were sending letters to Nucor stating their grievances.

If recent demand dynamics stand true, little market movement will be seen because of the latest round of “official” price cuts. Plate tags have been eroding slowly in recent weeks with buyers largely on the sidelines, and that trend could carry throughout December.

Buyers’ focus remains almost exclusively on managing inventories as 2022 nears a close, though some deals have been reported below SMU’s low end, and a single sale below $1,400 per ton, buying may remain mostly inter-trading and peer-to-peer buying.

Nucor’s price drop also coincides with declining production, as mills to try dial back output as much as possible as 2022 nears a close.

Hot-rolled coil (HRC) prices and plate prices have almost remained decoupled from each other for much of the year. The delta is more than double what it has been historically (Figure 2), and it remains wide even as mills try to will HRC tags higher.

“Lots of unknowns right now, but one thing is for sure, the $1,000 per ton spread can’t last, but how it gets there and when, I sure can’t tell from where I sit,” said a source.

“Nucor is always hard to figure out why they do what they do and their timing is never consistent,” said another source. “Big steel is back to their old pattern of raising prices the first of the year and blowing them up the second half.”

“I think they killed all plate business for the remainder of this year,” the source added.

SMU’s average HRC price now stands at $625 per ton, according to our latest check of the market on Nov. 29. Our overall average is up $10 per ton week-on-week, on the heels of a wave of $60-per-ton sheet price hikes announced by mills in the US and Canada this week.

Prices had been trending down, and the move seems to be a strong push from North American mills to set the price floor and stop the downturn. It’s too early to tell if the change will have sustaining power in the near term, but it’s given the market a lot to talk about.

As for contract pricing on plate, we’re told talks for Q1 and H1 2023 are still active. Buyers tell us they’re looking at base prices in the mid-to-low $1,300s per ton ballpark, and potentially lower.

And don’t forget import prices. Current offers from South Korean producer Hyundai Steel are $1,320 per ton ($66/cwt) DDP West Coast for early first quarter 2023 ship dates. Will the latest round of price cuts mush import prices lower as well?

Discrete plate lead times are still running at four weeks on average. But sources told SMU that lead times at some plate mills are as short as three weeks.

By David Schollaert, David@SteelMarketUpdate.com