Plate

November 20, 2022

Plate Report: Prices Slip, More Declines Ahead?

Written by David Schollaert

US plate prices were down marginally last week as spot tons garnered some discounting on limited demand.

Plate tags have been eroding slowly in recent weeks with buyers largely on the sidelines. That’s a shift from late October and early November, when prices were roughly flat.

Buyers’ focus remains almost exclusively on managing inventories as 2022 nears a close.

The last major price announcement was on Nov. 3, when Nucor said it would hold plate prices steady with the opening of its December book. The last official price cut announced was back in mid-September, when the Charlotte, N.C.-based steelmaker lowered tags by $120 per ton ($6 per cwt).

Since then, there have been deals cut across the domestic market (including from Midwest mills) in the mid/low $1,500s-per-ton range. There have even been some sub-$1,500-per-ton deals. Despite the lower tags being offered from some producers, buying is still hand-to-mouth and project-specific, market participants told SMU.

Nucor’s official price now serves as the top end of the market range.

“Currently Nucor’s pushing $1,620 FOB mill. But no one’s buying tons at the moment to push back on their price,” one source said.

“Seems as if the mills are trying to limp into 2023. And the sooner they can get there the better, but their order books are not real strong as I understand,” said another source. “Many thought Nucor would lower the price for December and then again in January. But their rationale was why lower December if no one is really going to purchase chunks of tons.”

Many reason that Nucor’s decision to hold prices unchanged was partly an effort not to devalue customer inventories – especially since business will be hard to come by for the remainder of the fourth quarter.

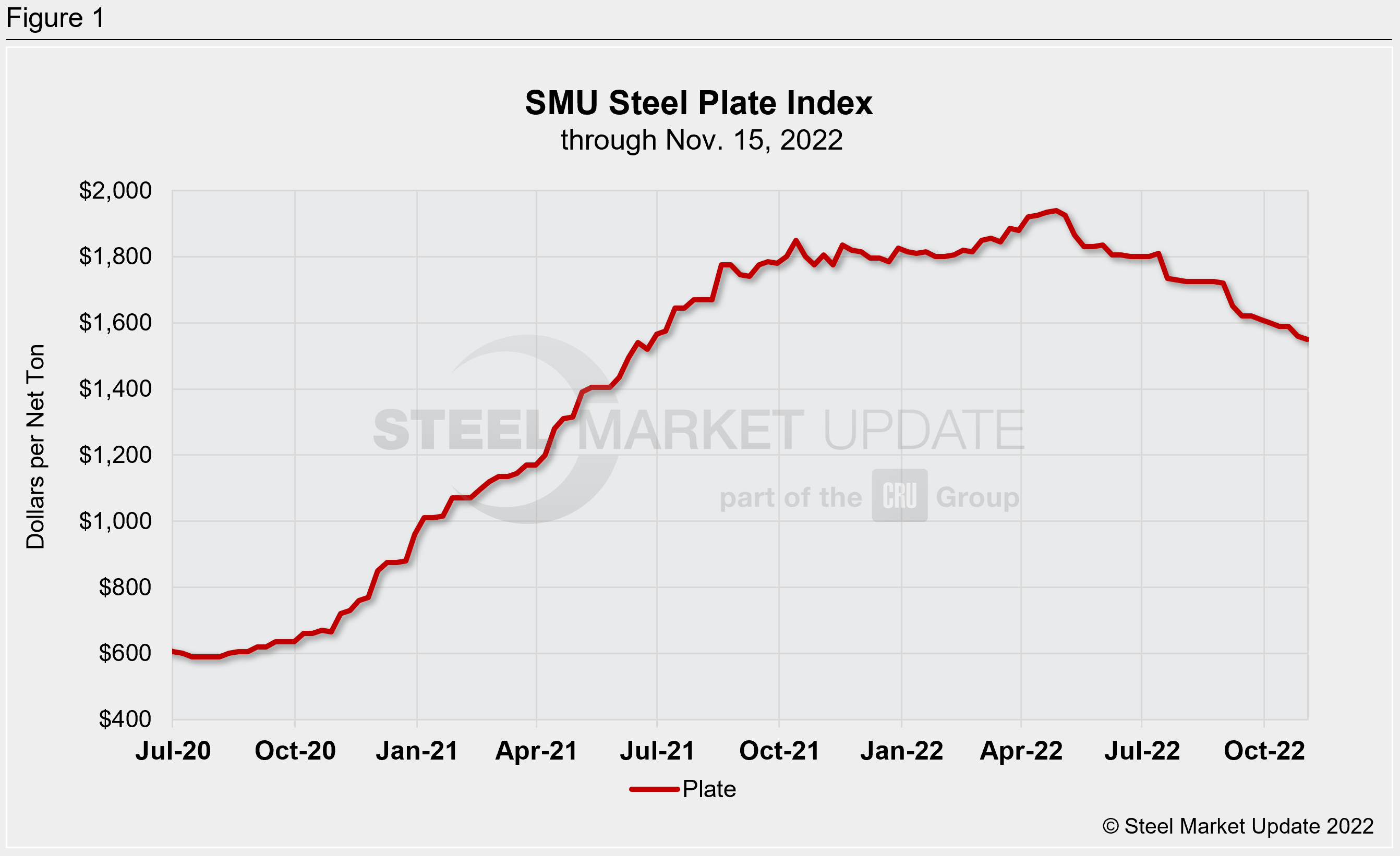

SMU’s most recent check of the market on Nov. 15 placed plate prices between $1,480 per ton and $1,620 per ton with an average of $1,550 per ton FOB mill east of the Rockies, according to our interactive pricing tool (Figure 1). No spot deals were confirmed at the top of the range, although Nucor’s official price was repeatedly mentioned by market sources.

With some mills holding a strong position on their offer price, there have been increasing reports of inter-trading among service centers and more interest in smaller spot lots as manufacturers and OEMs look to cover only immediate needs without building inventories.

“I don’t see anyone holding to Nucor’s prices. Really depends on the particular thickness and width of plate people have on hand,” said one source. “I think there is a little bit of inter-trading between service centers.”

“Pricing is down to $1,475 (per ton), and (I) feel pricing will continue to drop as demand is weak,” said another. “The issue is that service centers have high-cost offshore product that they need to move, making for a blended cost to the market.”

Sources continue to note that mills are dialing back production as much as possible, and the latest round of earnings reports pointed to that trend, which will probably intensify as we near the year-end holiday season. Some sources suggest plate mills might close to or even below 60% when it comes to capacity utilization.

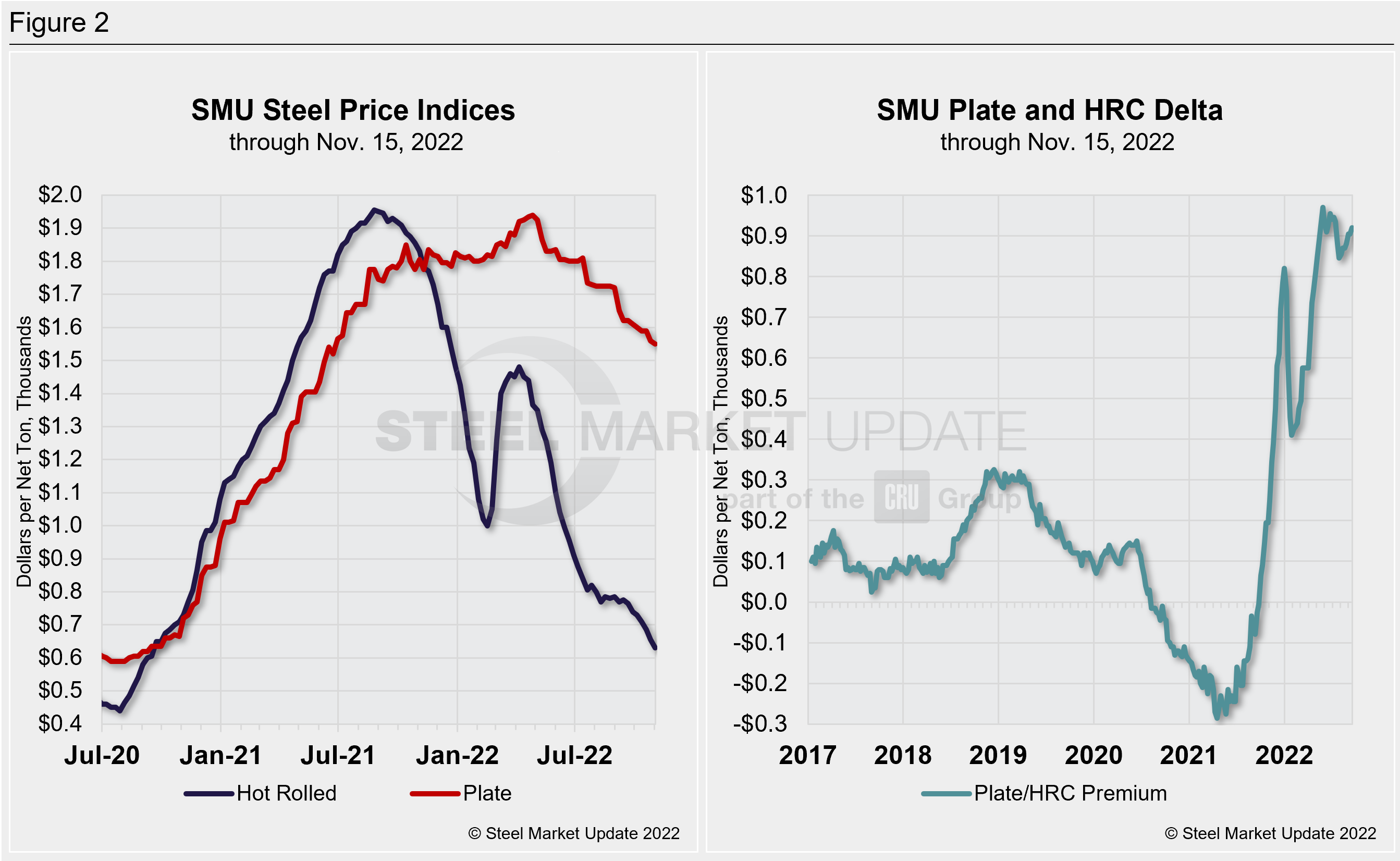

Hot-rolled coil prices and plate prices have almost completely decoupled from each other. The delta is more than double what it has been historically (Figure 2), and it remains wide given that HRC prices continue to fall at a sharp clip. Sources think the key to pricing going forward will still be scrap. And some now say we’re unlikely to see the traditional correlation between HRC and plate again because market dynamics for the products have diverged.

SMU’s average HRC price now stands at $630 per ton, according to our latest check of the market on Nov. 15. (We will update our price on Nov. 22.) Our overall average is down $25 per ton week-on-week. Prices have been trending down more recently after hovering in the mid-to-upper $700s per ton for nearly two months.

As for contract pricing, we’re told talks for Q1 and H1 2023 are still active. Buyers tell us they’re looking at base prices in the $1,360-$1,400 per ton ballpark, and potentially lower.

Another thing to keep an eye on are import prices. Current offers from South Korean producer Hyundai Steel are $1,320 per ton ($66/cwt) DDP West Coast for early first quarter 2023 ship dates. While those offers are unlikely to cause domestic mills to chase business, they could take some share of the market should US prices remain near current levels, sources said.

Discrete plate lead times are still running at four weeks on average. But sources told SMU that that lead times at some plate mills are as short as three weeks.

By David Schollaert, David@SteelMarketUpdate.com