Analysis

November 29, 2022

Final Thoughts

Written by Michael Cowden

Is the market at a bottom or not? Cleveland-Cliffs and US Steel have each announced price hikes of $60 per ton ($3 per cwt). And we’re told other mills might follow.

If this isn’t a bottom, it sure looks like domestic mills are trying to create one with a floor of ~$600 per ton for HRC and ~$800 per ton for CR and coated.

We’ve seen this movie before, or at least a version of it.

Cliffs on Aug. 24 announced a price hike of $75 per ton. HR prices, which had been falling since late April, increased modestly from $770 per ton pre-increase to $785 per ton in mid-September.

Prices then resumed their downward drift. It was a classic “dead-cat bounce.” Will domestic mills hold the line at $600/ton HR and $800/ton CR and coated? Or will prices continue to drift lower even as lead times stretch into 2023?

In the short-term, that hinges in part on market sentiment, what scrap prices do in December, and what people expect steel prices to do in Q1. I wish I had a clear narrative to offer you.

Respondents to SMU’s most recent survey are feeling bullish. Our sentiment index is at its highest level in five months. We’ve also seen that optimism spread into other areas.

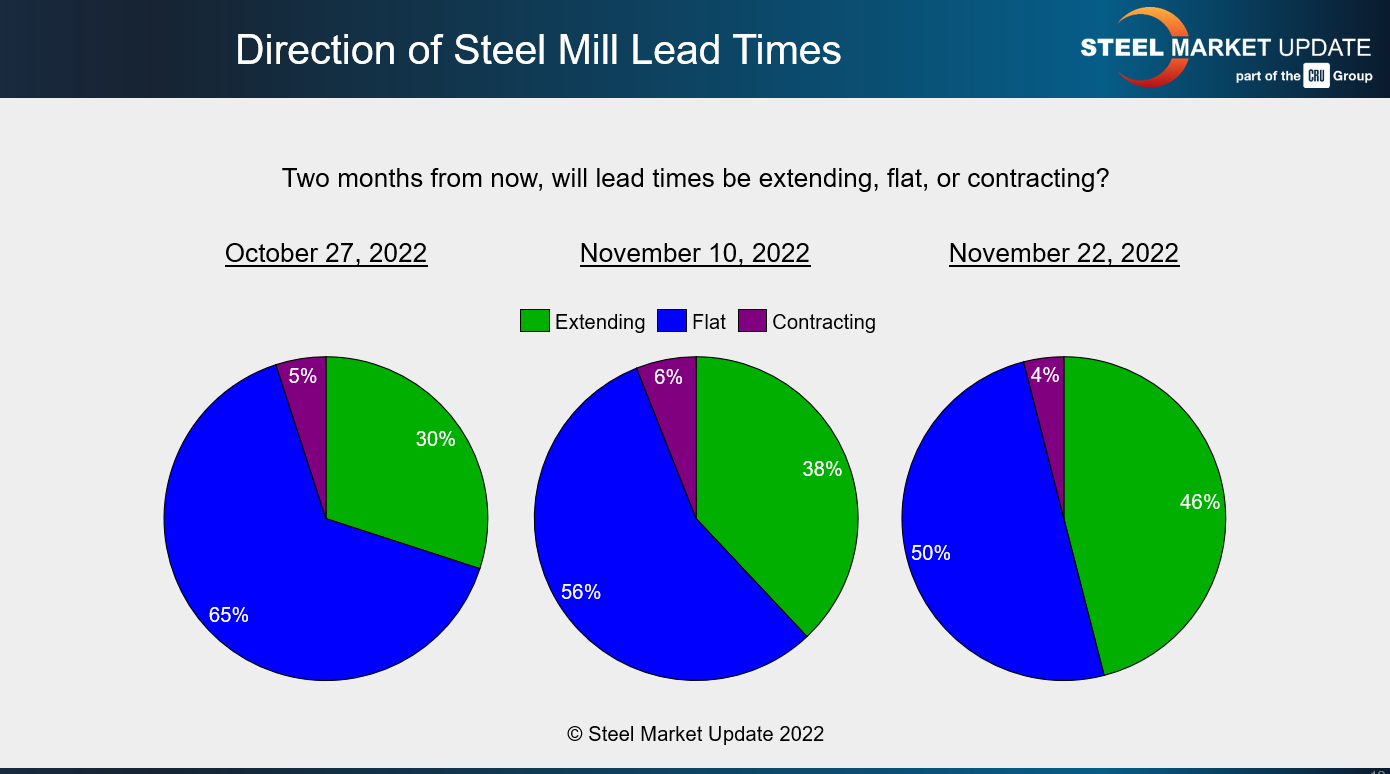

Case in point: More and more people expect that lead times will extend in the first quarter.

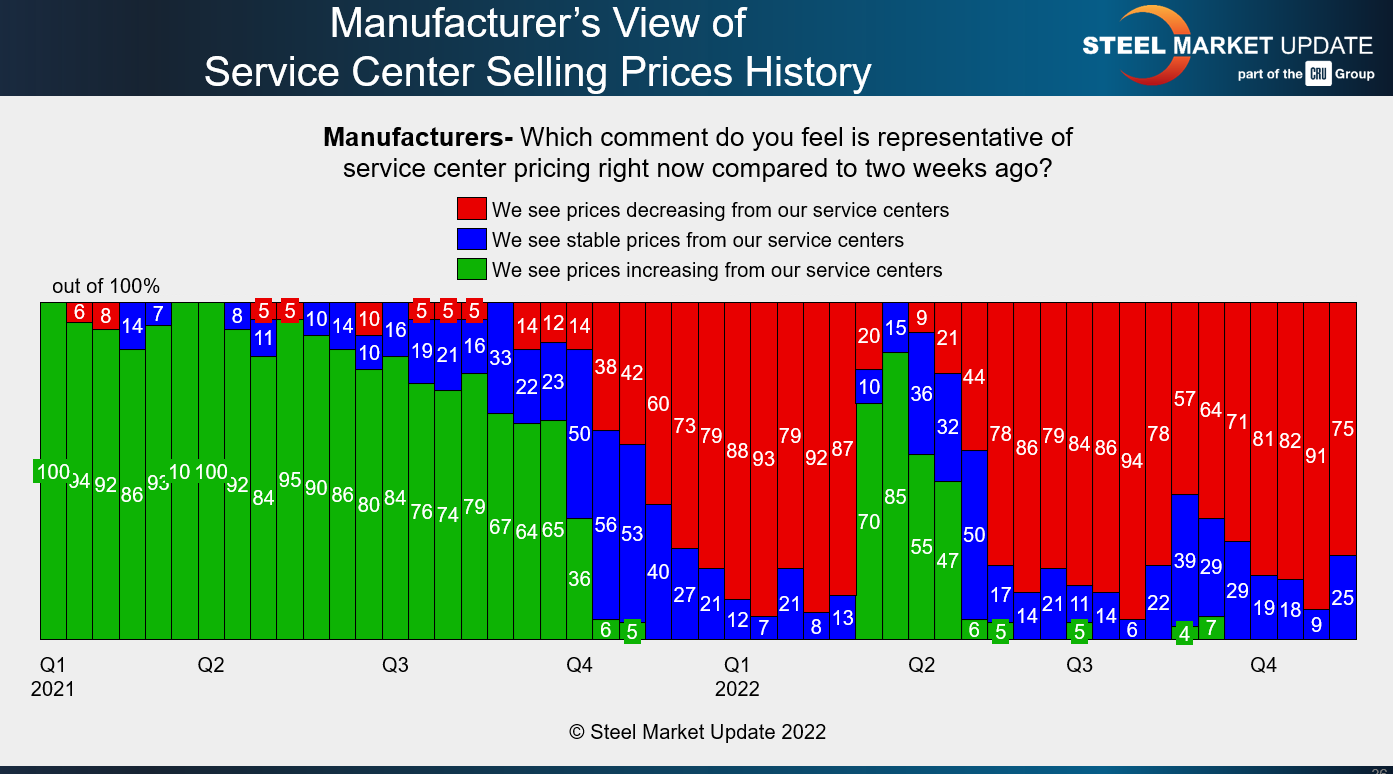

We’ve in addition seen a modest increase in the number of manufacturers reporting that service centers are holding the line on prices rather than decreasing them. There is a logic to that. At a certain point, service centers capitulate and want to see higher prices just as much as mills do. They’re more willing to support a price increase.

That said, the latest survey results don’t paint a clear picture of a market inflecting. Not yet anyway.

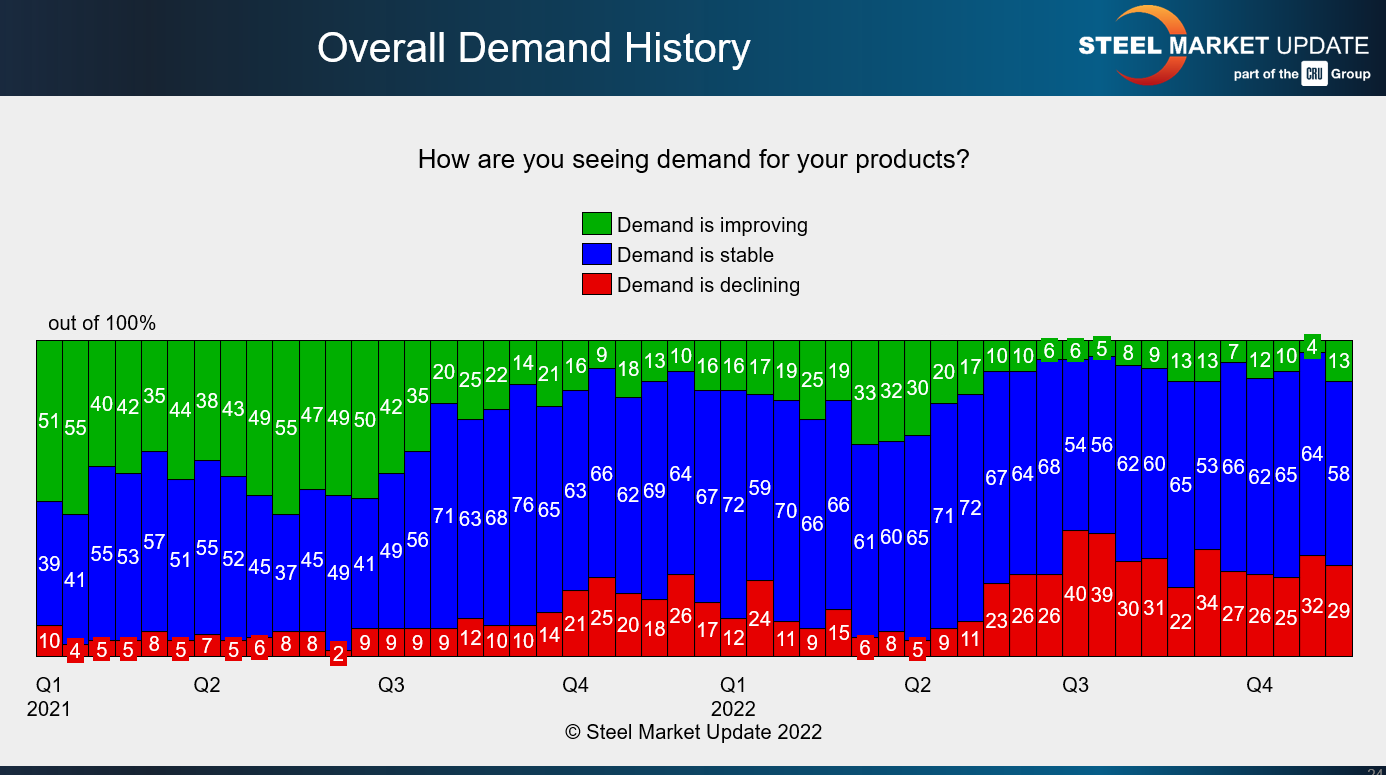

We haven’t seen much change in overall demand:

Most people (58%) continue to say that it’s stable. But those saying it’s declining (29%) still outnumber those who say that it’s increasing (13%).

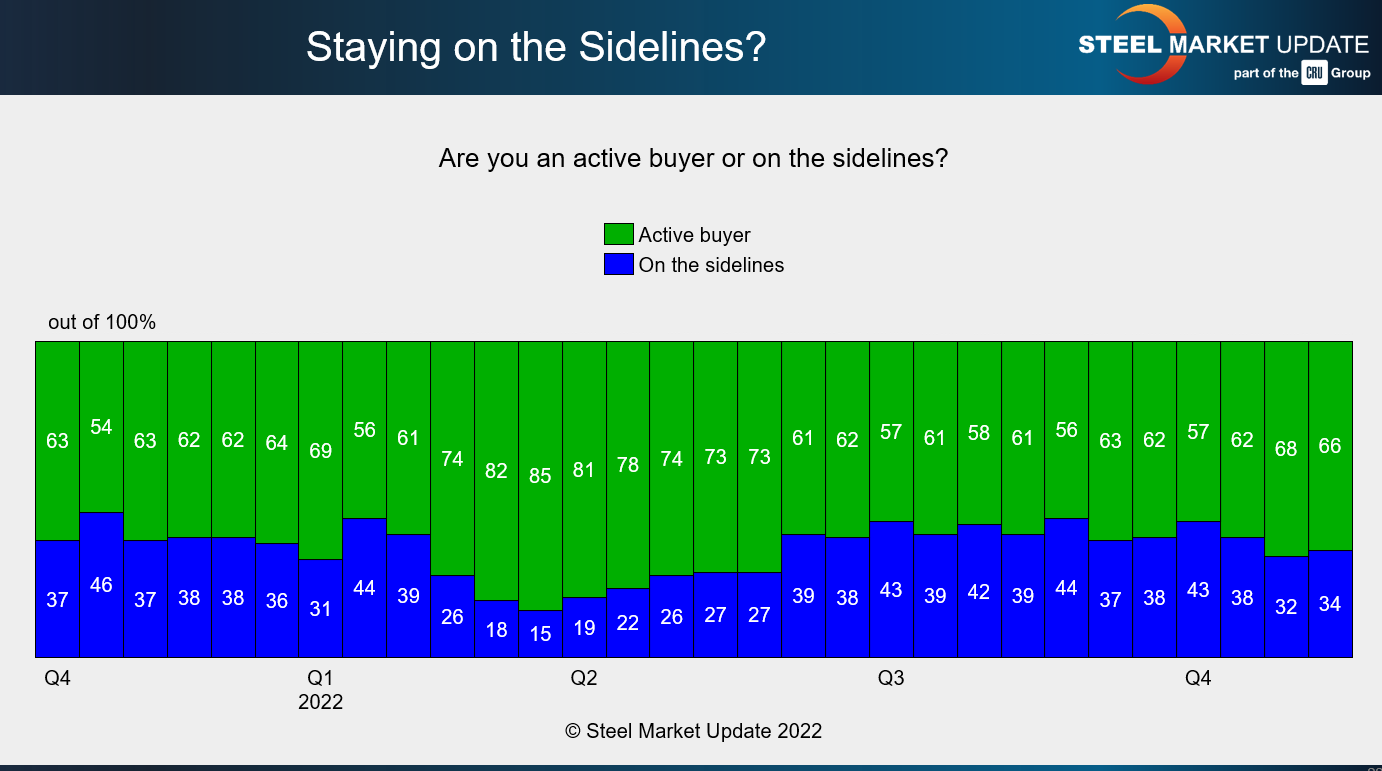

Also, we haven’t seen any appreciable increase in the number of respondents reporting that they are active buyers. We haven’t seen that figure noticeably increase since March/April – following the initial shock of the war in Ukraine.

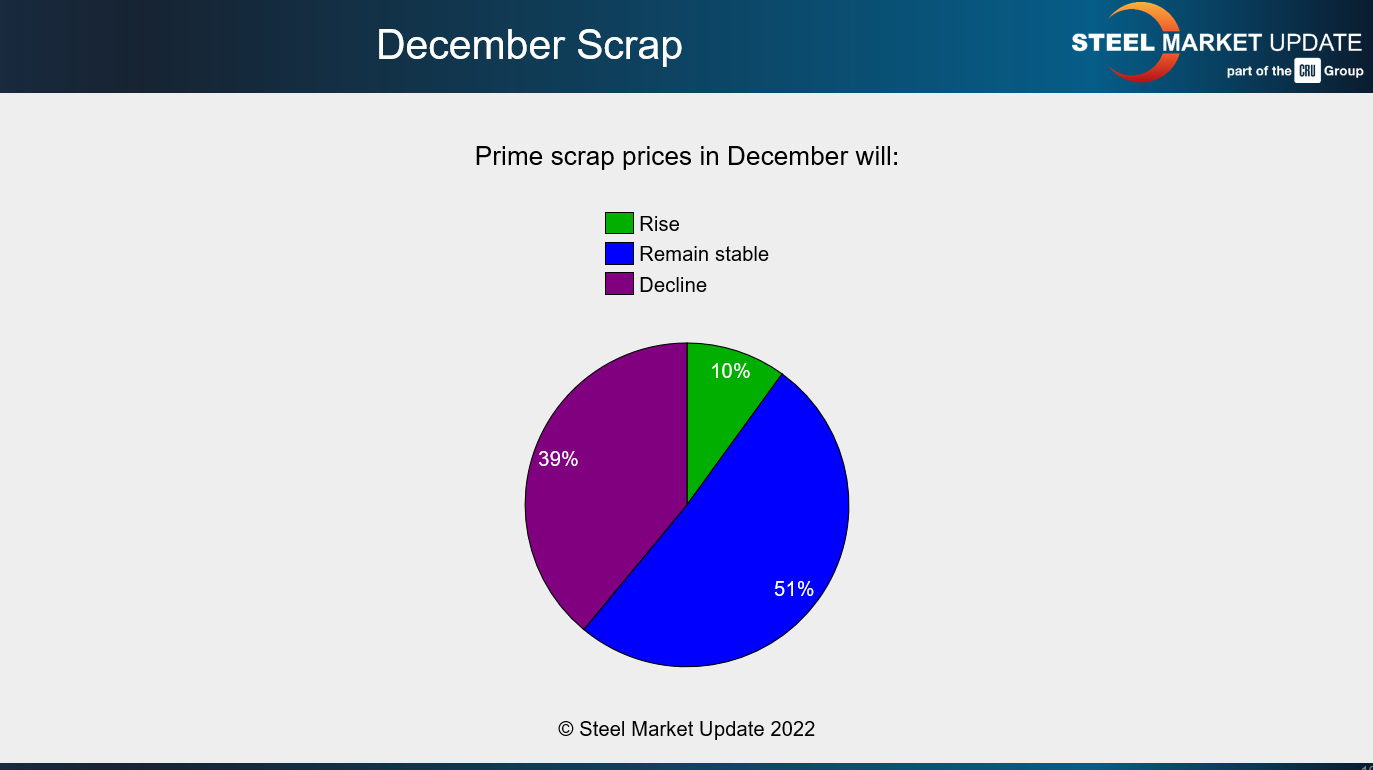

As for scrap, we left that one for our readers to predict. We asked which way they thought prime scrap prices would go in December. Here are the results:

I had expected that more would predict higher prime scrap prices at year end.

It’s worth noting here that, at least when this article was published, we hadn’t seen any price announcements from EAF mills – although we know some were quietly quoting higher.

Keep in mind that it is rare for prime scrap to fall in December. Prime scrap was flat month-over-month in November-December 2018 as well as in 2015, 2014, and 2012. We haven’t seen prime scrap fall in December since 2004 and 2005.

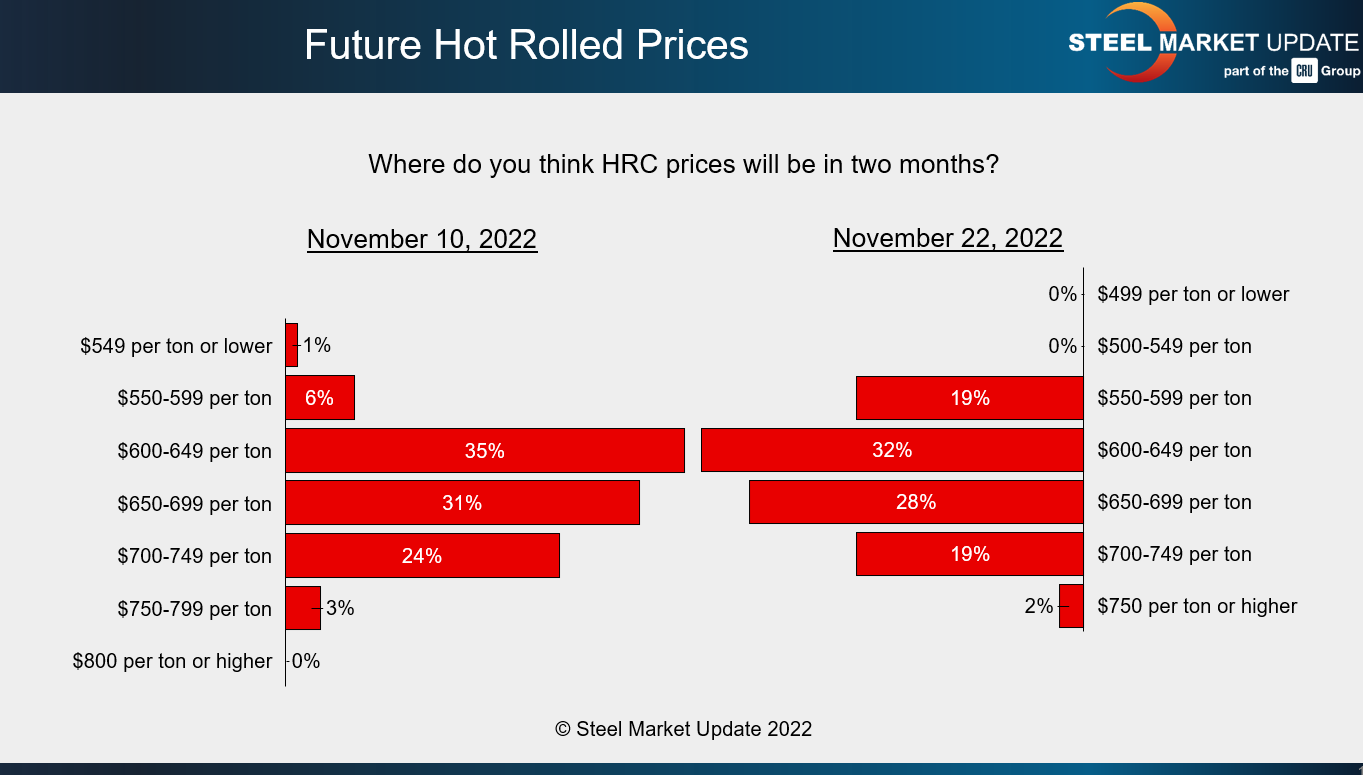

Another thing gives me pause: we’ve seen an increase in the number of people reporting that HRC prices will be below $600 per ton in two months.

I’ll be curious to see how these divergent trends play out in the weeks ahead. On the one hand, we have increased optimism and mill price hikes. On the other, we see subdued demand, little change in buying patterns, and significant differences of opinion in where steel and scrap prices will go from here.

By Michael Cowden, Michael@SteelMarketUpdate.com