Market Data

November 22, 2022

Steel Mill Lead Times Remain Low

Written by Brett Linton

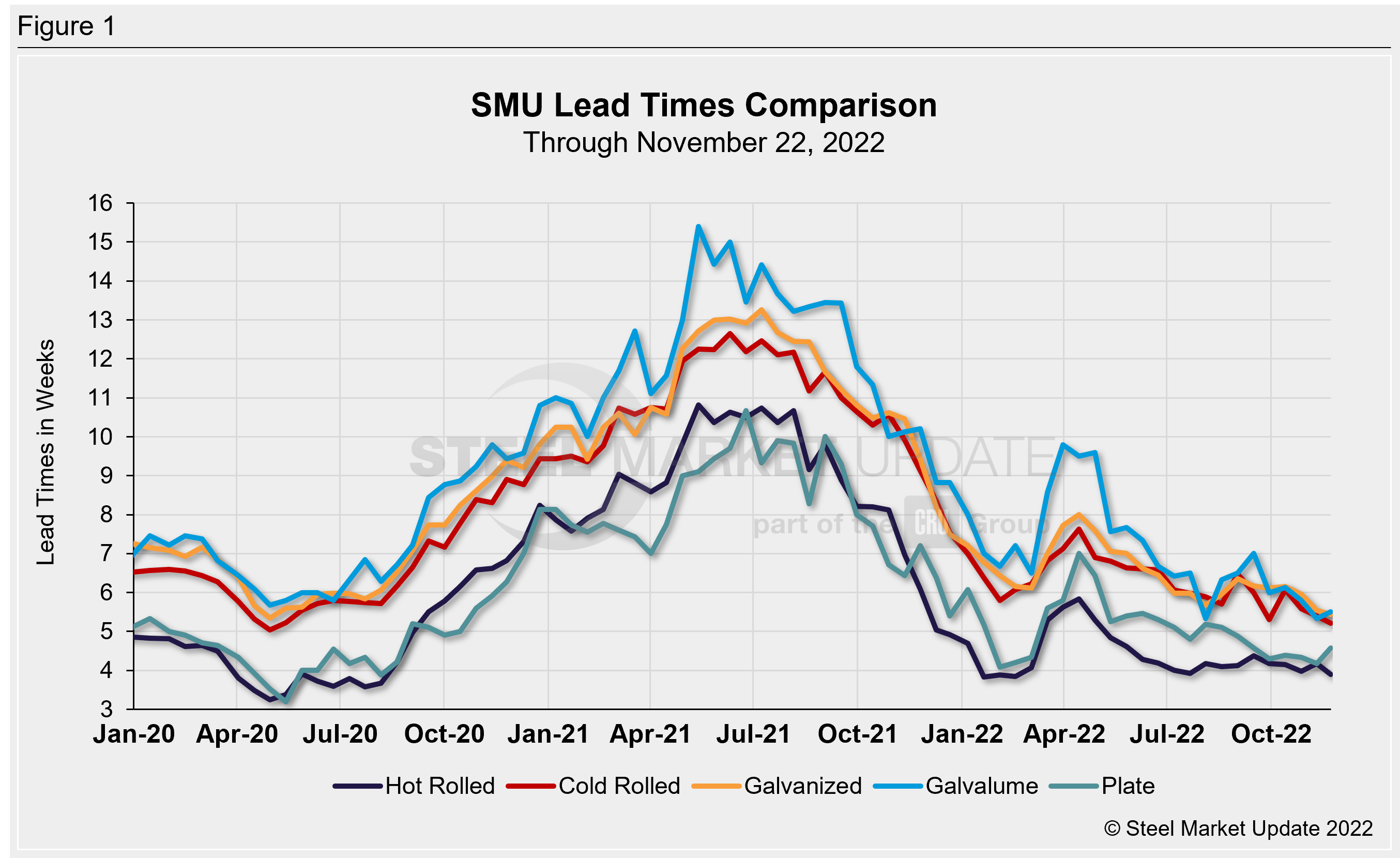

Steel mill lead times were mixed this week compared to our previous market check, with production times slightly shrinking for three products and marginally extending for two. Hot rolled, cold rolled, and galvanized lead times are now at or near multi-year lows.

Lead times are down by an average of 0.2 weeks compared to one month ago. Following their peak in April, sheet lead times have been relatively stable since July/August. Plate lead times had gradually moved lower over the past six months, but slightly ticked up this week.

Surveyed buyers reported mill lead times ranging from 3–6 weeks for hot rolled and plate, and 4–7 weeks for cold rolled, galvanized, and Galvalume.

SMU’s hot rolled lead time declined 0.3 weeks from early November to 3.9 weeks, the lowest level recorded in 18 weeks. The shortest hot rolled production time seen this year was 3.8 weeks in January/February. Hot rolled lead times have averaged between 3.9–4.4 weeks since June. Recall the record low in our ~11-year data history was 2.8 weeks in October 2016.

Cold rolled lead times fell by 0.2 weeks to 5.2 weeks, now the lowest reading since May 2020. One month ago, cold rolled lead times were at 5.6 weeks.

Galvanized lead times declined 0.2 weeks to 5.4 weeks. This is the shortest lead time recorded since April 2020 when it was 5.3 weeks. The record low was 4.8 weeks in February 2015.

Galvalume lead times inched up to 5.5 weeks. The previous lead time of 5.3 weeks was tied with early August for a 7.5-year low, and our record low was in February 2015 at 5.1 weeks. Note that Galvalume figures can be volatile due to the limited size of that market and our smaller sample size.

Plate lead times rose 0.4 weeks to 4.6 weeks. Recall the early November reading of 4.2 weeks was the lowest lead time recorded since February (4.1 weeks). In our four-year history, the shortest plate lead time we have on record was 3.2 weeks in May 2020.

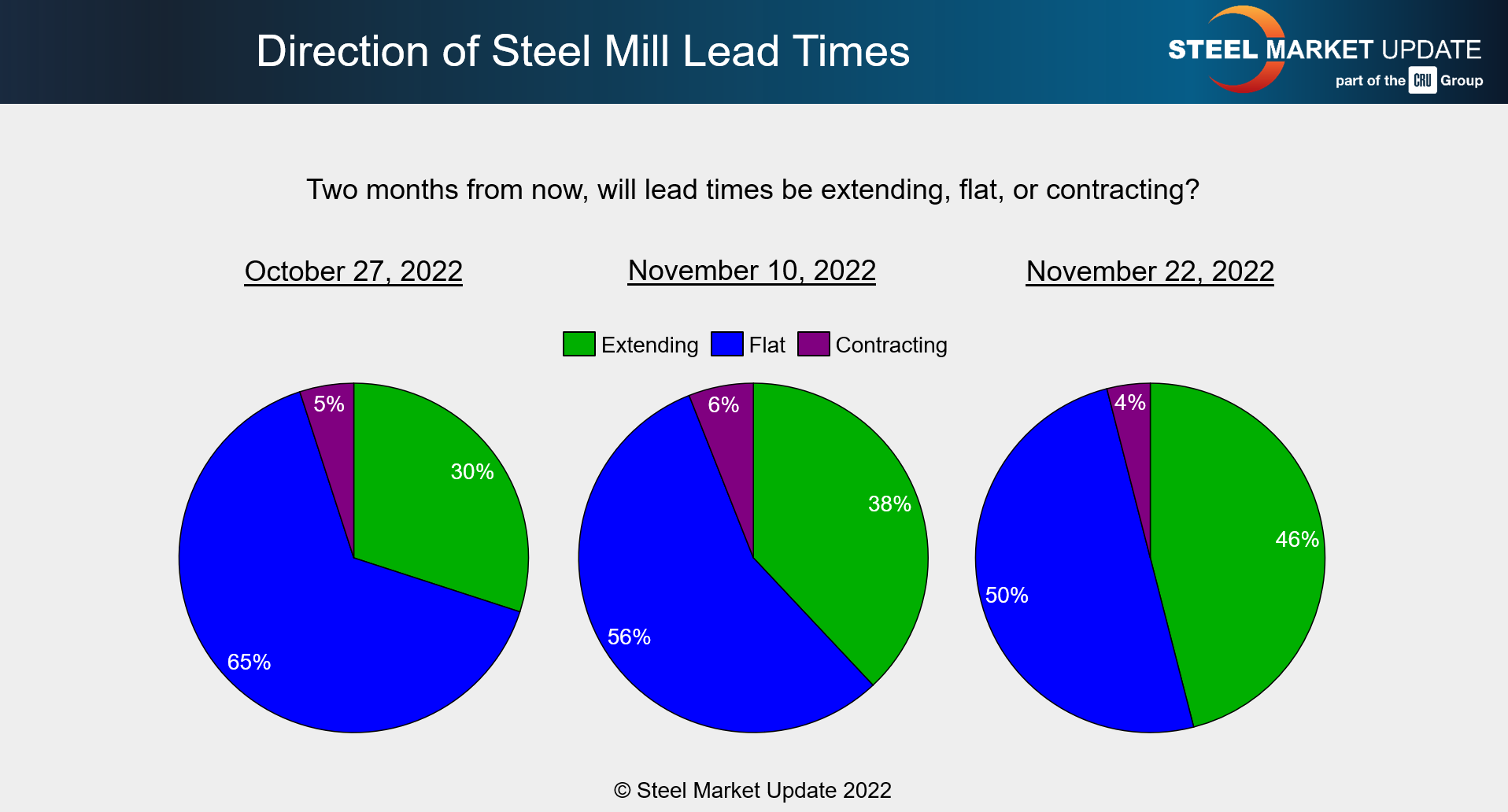

When asked about the future direction of lead times, 50% of the executives responding to this week’s questionnaire said lead times will be relatively flat into January. This is down from a rate of 56% from our previous survey. 46% of buyers believe lead times will be extending, up from 38% compared to two weeks ago. Just 4% said lead times will be contracting, relatively unchanged since late October. Below is a sample from our ongoing market trends report:

When asked about the future direction of lead times, 50% of the executives responding to this week’s questionnaire said lead times will be relatively flat into January. This is down from a rate of 56% from our previous survey. 46% of buyers believe lead times will be extending, up from 38% compared to two weeks ago. Just 4% said lead times will be contracting, relatively unchanged since late October. Below is a sample from our ongoing market trends report:

Here are comments from a few respondents:

“They can’t get shorter.”

“I expect order books to improve in the future.”

“’Flat and still extremely short — that is the biggest problem in this market.”

“Finished inventories are low; spot buying will resume in Q1.”

“In January lead times will be extending to Mar-Apr.”

“I assume the domestic mills will idle some lines.”

“Not sure how much, but extending incrementally.”

“Extending but not massively extending.”

Analyzing lead times on a three-month moving average (3MMA) basis can smooth out the variability in the biweekly readings. As a 3MMA, lead times for all products slightly declined from early November levels. The latest 3MMA lead time for hot rolled fell 0.1 weeks to 4.1 weeks, and has been in this territory since August. Cold rolled lead times eased 0.2 weeks to 5.6 weeks, now the shortest seen since July 2020. Galvanized lead times fell 0.2 weeks to 5.9 weeks, the lowest level seen since August 2020. Galvalume lead times fell 0.1 weeks to 6.0 weeks, the shortest seen since July 2020. Plate lead times held steady at 4.4 weeks, the lowest 3MMA measure recorded since September 2020.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Brett Linton, Brett@SteelMarketUpdate.com