Prices

November 15, 2022

SMU Price Ranges: Is This a Floor or a Head Fake?

Written by Michael Cowden

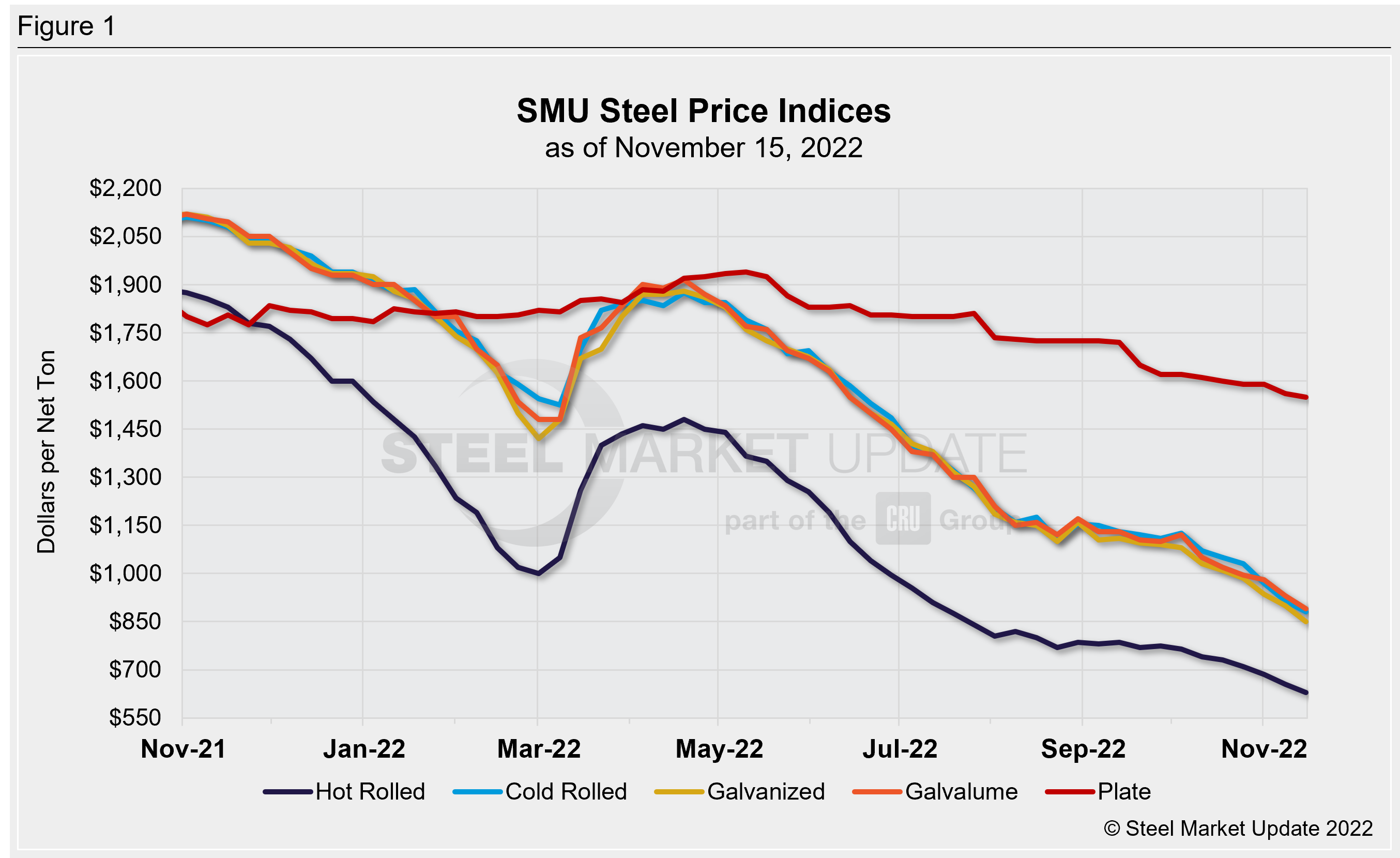

Steel sheet prices fell across the board again this week, with hot-rolled coil prices dropping to their lowest point since late September 2020 – more than two years ago.

But industry opinion about the direction of prices has diverged. That’s a significant shift from prior weeks, when sentiment was almost uniformly bearish.

Some market participants predict that prices are now at or near a floor – and a few say that mills might announce a round of price increases next week in attempt to at least firm up that floor.

Others said such a move would be premature given uneven demand. They questioned how any price hike could be enforced with lead times for HRC as low as three weeks at some mills.

All told, SMU’s average HRC price stands at $630 per ton ($31.50 per cwt), down $25 per ton from last week. Cold rolled fell to $880 per ton (-$35 per ton week-over-week), galvanized to $850 per ton (-$50 per ton WoW), and Galvalume is at $890 per ton (-$40 per ton WoW). Plate declines were more modest.

SMU’s price momentum indicators continue to point toward Lower. But we’re keeping a close eye on market dynamics now to see whether a shift to neutral might be warranted in the weeks ahead.

Hot-Rolled Coil: SMU price range is $600–660 per net ton ($30.00–33.00/cwt) with an average of $630 per ton ($31.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end decreased $30 per ton. Our overall average is down $25 per ton from last week. Our price momentum indicator on hot-rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot-Rolled Lead Times: 3–6 weeks

Cold-Rolled Coil: SMU price range is $820–940 per net ton ($41.00–47.00/cwt) with an average of $880 per ton ($44.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $60 per ton compared to last week, while the upper end decreased $10 per ton. Our overall average is down $35 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold-Rolled Lead Times: 4–7 weeks

Galvanized Coil: SMU price range is $800–900 per net ton ($40.00–45.00/cwt) with an average of $850 per ton ($42.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range decreased $50 per ton compared to one week ago. Our overall average is down $50 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $897–997 per ton with an average of $947 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4–7 weeks

Galvalume Coil: SMU price range is $860–920 per net ton ($43.00-46.00/cwt) with an average of $890 per ton ($44.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end decreased $80 per ton. Our overall average is down $40 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,154–1,214 per ton with an average of $1,184 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4–6 weeks

Plate: SMU price range is $1,480–1,620 per net ton ($74.00–81.00/cwt) with an average of $1,550 per ton ($77.50/cwt) FOB mill. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $10 per ton from last week. Our price momentum indicator on steel plate points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 3–6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com