Market Segment

November 10, 2022

Strong Steel Market of '20-22 'Deteriorated' in Q3: ArcelorMittal

Written by Michael Cowden

ArcelorMittal reported sharply lower revenue and profits in the third quarter on falling prices, customer destocking, and weaker demand – notably in Europe.

“The strong market conditions enjoyed for much of the past two years deteriorated in the third quarter,” company CEO Aditya Mittal said.

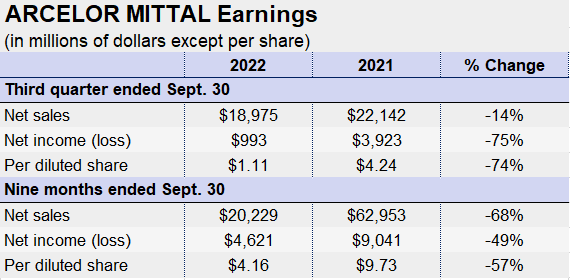

All told, ArcelorMittal – the world’s largest steelmaker outside of China – reported net income of $993 million in the third quarter of 2022, down 75% from $3.9 billion in the same quarter last year on revenue that fell 14% to ~$19 billion in the same comparison.

The company shipped 13.6 million tons of steel in the third quarter of this year, down 5.6% from 14.4 million tons in the year-ago quarter.

Arcelor Mittal’s North American operations fared slightly better. They also recorded lower sales and shipments. But the declines were not as steep as those recorded across the company as whole.

The North American wing posted operating income of $616 million in the third quarter of this year, down 24.6% from $817 million in the year-ago quarter on sales that slipped 5.9% to $3.4 billion in the same comparison.

The division shipped 2.33 million tons of steel in the third quarter of this year, down 4.9% from 2.45 million tons in the same quarter last year. It recorded average selling prices of $1,191 per ton in the quarter, down 9.6% from $1,317 per ton in the prior-year quarter.

Looking forward, ArcelorMittal said it expects apparent consumption to fall by 1% in the US in 2022 on greater-than-expected customer destocking in the second half of the year.

That’s better than the outlook for Europe, where inflation is forecast to result in apparent consumption falling by 7%. That’s the same rate at which the company thinks apparent consumption will fall in the Commonwealth of Independent States, a region that includes war-torn Ukraine. Brazil, meanwhile, is expected to see apparent consumption drop by 10% or more.

India is among the few bright spots, with ArcelorMittal predicting that apparent consumption there will increase by 7.5-8.5%.

The company forecast that demand would improve once customers have whittled down their inventories and resume buying.

North America Operations Update

On the operations side, the company said the $1.35 billion decarbonization project at ArcelorMittal Dofasco remains on track.

The goal is to end integrated steelmaking at the Hamilton, Ontario, mill and to switch to steelmaking via direct-reduce iron (DRI) and electric-arc furnace (EAF).

ArcelorMittal has broken ground for that project. Construction will begin in January 2023. The DRI-EAF combo is expected to be completed by 2026, with the DRI unit slated to by “hydrogen ready.”

The new DRI unit will have capacity of 2.5 million tons per year and the new EAF capacity of 2.4 million tons per year. ArcelorMittal said it would run both current integrated (blast furnace and basic oxygen furnace) and the new DRI-EAF steelmaking operations through 2028 – when it plans to discontinue the integrated side.

At AM/NS Calvert – a joint venture with Japanese steelmaker Nippon Steel in Alabama – work continues on a new EAF with capacity of 1.5 million tons per year. The company thinks that $775 million project will be completed in 2023.

The new EAF will allow Calvert to replace some slabs it currently sources externally with semi-finished product that is melted and poured on site. That will allow the facility to make steel compliant with more stringent regional content standards specified in the US-Mexica-Canada Agreement (USMCA) and to hot-charge slabs into the plant’s hot-strip mill.

ArcelorMittal noted that the expansion at Calvert includes the option to add a second EAF.

By Michael Cowden, Michael@SteelMarketUpdate.com