Canada

November 16, 2022

Stelco Posts Lower Q3 Profits on Falling Prices, Higher Costs

Written by Michael Cowden

Canadian steelmaker Stelco posted sharply lower earnings in the third quarter on falling steel prices and higher raw material tags.

The Hamilton, Ontario-based integrated sheet producer expects lower prices and short lead times to characterize the market through the end of 2022.

He made the remark in comments released along with earnings data after the close of markets on Tuesday, Nov. 15.

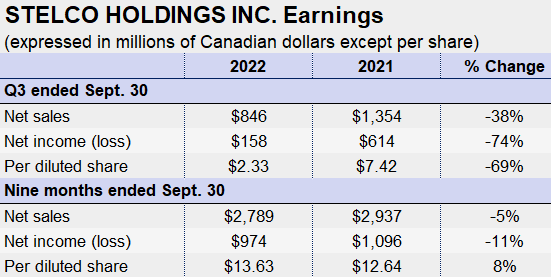

All told, Stelco recorded net income of Canadian $158 million ($118 million USD) in Q3 2022, down 74% from $614 million in the same quarter last year on sales that fell 38% to $846 million over the same period.

The company posted average steel selling prices of $1,162 per ton in Q3 2022, down 36% from $1,808 per ton in the year-ago quarter.

Shipments were 686,000 tons in Q3, down 3% from 710,000 tons in the second quarter but up 1% from 677,000 tons in Q3 2021. Complete shipment detals are here.

Kestenbaum said the $900 million Stelco has invested in its operations since 2017 began to pay dividends in Q3. Those investments include an upgraded coke battery and an electricity congeneration facility. Both projects “provide us excellent opportunities to improve productivity and to reduce our costs and carbon footprint,” he said.

Stelco is hardly alone in posting skinnier Q3 profits on lower steel prices. Canadian sheet and plate producer Algoma Steel Inc. noted a similar trend when it reported quarterly earnings earlier this month, as did global steelmaking giant ArcelorMittal, which also has a significant presence in Canada.

By Michael Cowden, Michael@SteelMarketUpdate.com