Prices

November 15, 2022

October Import Licenses Mostly Rise, But Down Year-On-Year

Written by Laura Miller

Most flat-rolled steel imports rose from September to October but were lower compared to year-ago levels. This is according to October import license application data released by the US Department of Commerce’s International Trade Administration.

All steel imports into the US require an import license in order to enter through Customs. The license count provides a first look into the amount of imports that entered the country during a particular month. Commerce later releases preliminary figures and then final import figures. Therefore licensing data should not be considered as final data but as providing an idea as to import tonnages.

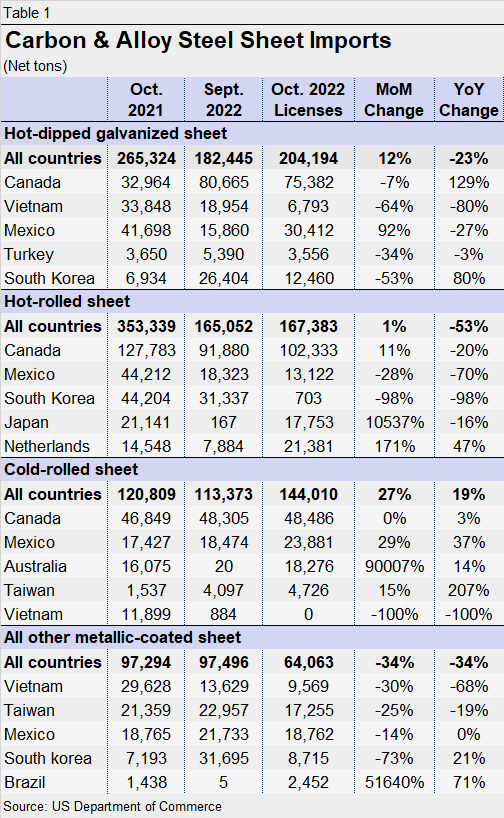

October licenses to import hot-dipped galvanized sheet and strip totaled 204,194 net tons. While showing a 12% month-on-month (MoM) rise, the total is 23% lower than October 2021 and still well below the monthly average of 249,722 tons in the first nine months of the year.

Hot-rolled sheet import licenses of 167,383 tons were basically flat MoM but were significantly lower than the 353,339 tons imported in October 2021 and the January through September 2022 monthly average of 221,424 tons.

Cold-rolled sheet import licenses in October, meanwhile, jumped both MoM and year-on-year (YoY), but were basically flat compared to the monthly average of 146,030 tons in the first three quarters of the year. CRC imports were at a recent low of 113,373 tons in September.

Imports of all other metallic-coated sheet declined to a recent low at just 64,063 tons of October licenses, with notably fewer shipments from Vietnam and South Korea. October’s license count was 37% below the nine-month monthly average of 101,751 tons.

Table 1 shows October license data with MoM and YoY changes for relevant sheet products, and data for the top five countries shipping the most of each product to the US.

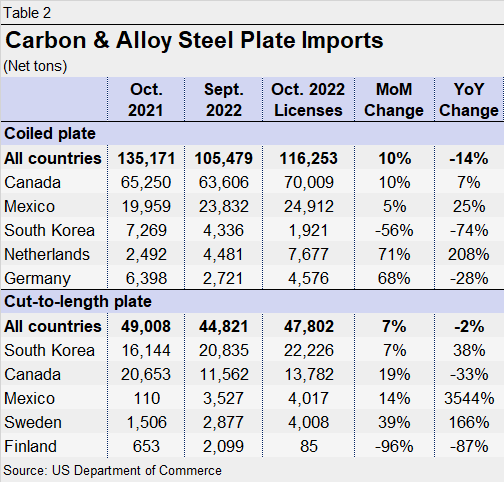

October coiled plate import licenses of 116,253 tons rose 10% MoM but were down 14% on-year and were well below the January through September monthly average of 138,015 tons.

While down 2% YoY, cut-to-length plate import licenses of 47,802 tons in October were 7% higher than both September’s level and the first nine-month monthly average.

Table 2 shows October license data with MoM and YoY changes for relevant plate products, and data for the top five countries shipping the most of each product to the US.

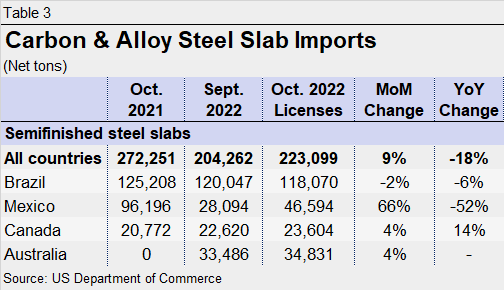

Although rising 9% MoM from September’s import level, October’s semifinished steel slab import licenses of 223,099 tons were 18% lower YoY and well below the average of 306,380 tons in the first three quarters of 2022.

Table 3 shows October license data with MoM and YoY changes for slab imports, as well as data for the top four countries shipping the most to the US.

By Laura Miller, Laura@SteelMarketUpdate.com