Government/Policy

September 29, 2022

Commerce Finalizes AD/CVD Rates in OCTG Trade Case

Written by Laura Miller

The US Department of Commerce has issued its final determinations in the trade case investigating the dumping of OCTG imports from Mexico, Argentina, and Russia, and the subsidization of OCTG from Russia and South Korea. The investigations include both welded and seamless OCTG.

Antidumping Case

In the final results of the case investigating Mexico, Commerce found that imports from the country are being sold in the US at less than fair value, setting final weighted-average dumping margins of 44.93% for mandatory respondent Tubos de Acero de Mexico and for all other Mexican companies. Additionally, Commerce found that critical circumstances exist in the case. Critical circumstances mean that exporters were flooding the market during the trade investigation. To offset the import surges, the affirmative finding allows the duties to now be applied retroactively 90 days before they were actually imposed, which in these cases was May 11.

Commerce determined that OCTG imports from Argentina are also being sold at less than fair value, but found that critical circumstances do not exist in that case. Final dumping margins were set at 78.3% for Siderca and all other Argentinean companies.

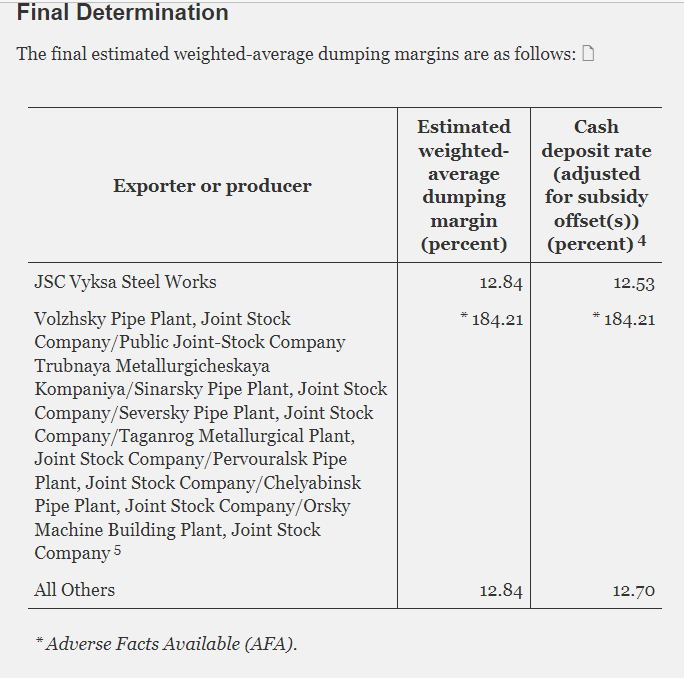

OCTG imports from Russia are also being sold at less than fair value, Commerce found, noting that critical circumstances exist only for certain Russian companies. Dumping margins were set at 12.84% for JSC Vyksa Steel Works and for the all-others rate. A handful of companies (see chart below) had rates set at 184.21%.

The periods of review in the antidumping cases were Oct. 1, 2020 through Sept. 30, 2021.

Countervailing Duty Case

Commerce also found that OCTG producers and exporters in Russia are being provided countervailable subsidies, setting subsidy rates at 1.30% for Volzxhsky Pipe Plant, Sinarsky Pipe Plant, Seversky Pipe Plant, Taganrog Metallurgical Plant, Orsky Machine Building Plant, and PAO TMK. JSC Vyksa Steel Works’ rate was set at 1.59% and the all-others rate was found to be 1.43%. Critical circumstances were not found to be present in this case.

South Korean OCTG producers and exporters were also found to be receiving countervailable subsidies. CVD rates were set at 0.25 de minimis for Hyundai Steel, 1.33% for SeAH Steel, and 1.33% for all others. De minimis rates below 0.5% mean duties will not be collected on those imports. Critical circumstances were not alleged and thus not found in this case.

In the CVD cases, the periods of review were the 2020 calendar year.

Final Results

As a result of Commerce’s determinations, AD and CVD duties will now be collected by US Customs and Border Control on OCTG imports from these countries at the rates set above. The final rates differ somewhat from the preliminary rates determined by Commerce earlier this year.

The US International Trade Commission will make the final injury determinations for its portion of these cases. If injury is taking place or threatening to take place to the domestic industry, these ADs and CVDs will be officially put in place for the next five years. If negative injury determinations are made by the ITC, the cases will be terminated completely and duties will not be applied.

The OCTG market in the US is a major consumer of flat-rolled steel and plate. The market has been undersupplied for some time now, resulting in high prices and extended lead times, and this is expected to continue for the foreseeable future.

By Laura Miller, Laura@SteelMarketUpdate.com