Analysis

September 18, 2022

Final Thoughts

Written by Michael Cowden

Has the US steel market reached another downward inflection point?

I ask because our survey data has turned a little bearish following an upsurge in sentiment that, in retrospect, might have crested not long after Steel Summit.

It wouldn’t be the first time that we saw post-conference euphoria in late August fizzle out in September.

Last year, the talk of Steel Summit was whether HRC would hit $2,000 per ton. Prices crested at $1,955 per in September and then fell through the end of the year and into early 2022.

You’ll recall that several mills announced price hikes immediately after the close of the event this year, perhaps just as some of you were boarding your flights home.

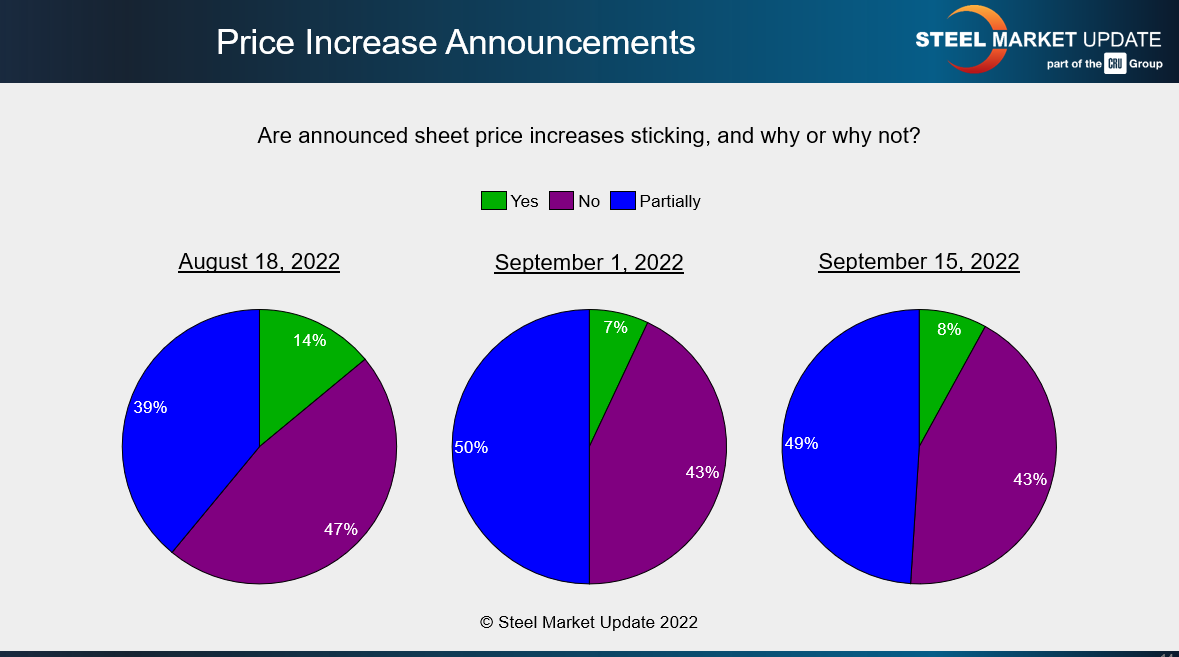

Did the August increases – of $50-75 per ton depending on the mill – stick? With a month of survey data behind us now, the consensus is that they stuck in part, or perhaps not at all.

Those survey result roughly match trends in our pricing data. Our HRC price was at $800 per ton a month ago. And it’s since stagnated just below that level. Up a little one week, down a little the next, and not managing to cross that $800/ton threshold since.

Don’t get me wrong. That’s way better than the $40-50/ton per week declines we were seeing earlier this year when prices were in freefall. But, as far as price increases go, that last round looks like it didn’t do much more than stop the bleeding.

Could mills announce another round of price hikes to shore up the first? That’s a tried-and-true trick from the old mill playbook. But it’s harder to pull off in the immediate aftermath of scrap prices falling. It’s also hard to do when 86% of buyers report that producers are willing to negotiate lower prices.

I know some of you are warning of the possibility of a strike or lockout at US Steel given that the Pittsburgh-based steelmaker and the United Steelworkers (USW) union are now well past the Sept. 1 expiry of a prior contract.

A strike remains a real possibility. And we have been conditioned by the pandemic and the war in Ukraine to expect the unexpected – and to expect the worst. But that instinct hasn’t been helpful when it’s come to labor contract negotiations this year.

We saw brinksmanship, negotiating past deadlines, and heated rhetoric in talks between Canadian steelmakers and USW over the summer. And more recently we saw the same between railroads and the unions representing railway workers.

In each case, a deal was hammered out at the last minute. In other words, it was par for the course. That’s not to say we couldn’t have a Black Swan with US Steel and the USW this fall. But I wouldn’t bet the farm on it.

So what about some of the softer indicators that are useful in providing context around the price?

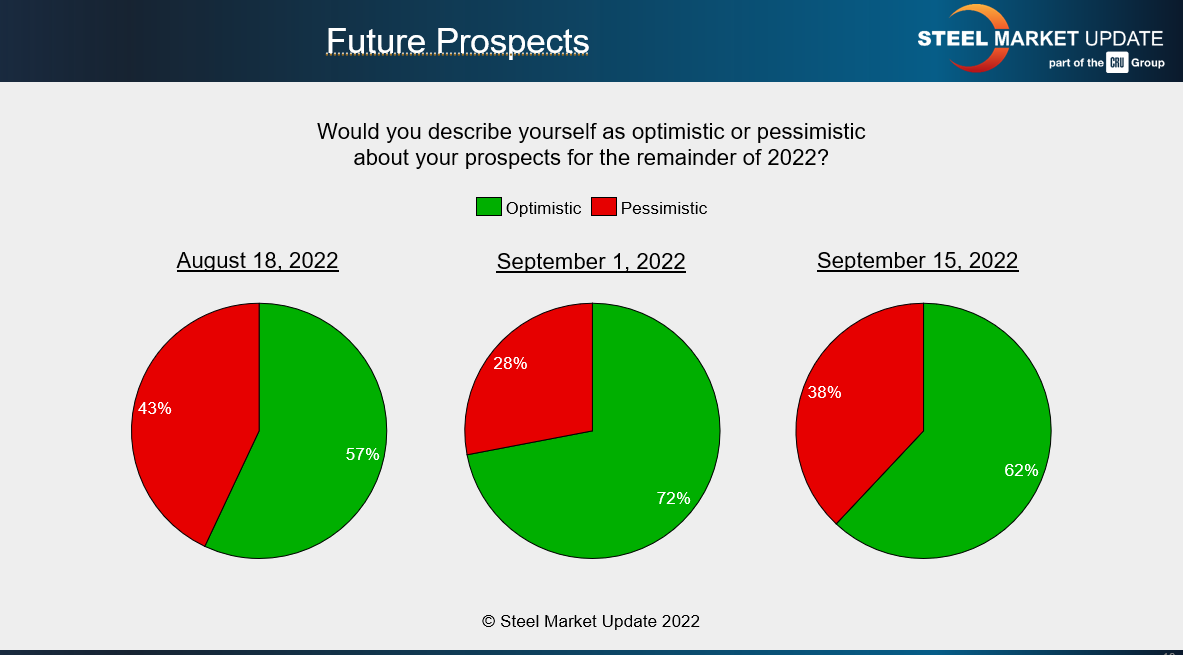

That’s where we might be seeing not just a plateau but some real deterioration. Check out the slide below. I’d want to see another survey showing worsening sentiment before I’d call a trend. But it’s one to keep an eye on in the meantime.

And that is especially because that increase in pessimism is occurring against a backdrop of headlines that are anything but bullish. Last week was guidancepalooza. And it was not pretty.

Steel Dynamics Inc. (SDI) predicted lower third quarter earnings in part because of lower flat-rolled steel prices. It was a similar story at Nucor, which significantly lowered its Q3 earnings guidance in large part because of reduced margins and shipping volumes for sheet and plate.

US Steel also predicted a much weaker showing in Q3, with EBITDA expected to be down nearly 50% from Q2. The company in addition idled the No. 8 blast furnace at its Gary Works in Northwest Indiana because of weak market conditions.

That move followed the idling of a tin line at Gary Works and a maintenance outage that was pulled forward at the company’s Mon Valley Works in western Pennsylvania. Pulling forward maintenance is the kind of thing a mill might to buy time in hopes of market conditions improving. The next step, if the market doesn’t turn upward, is often an idling.

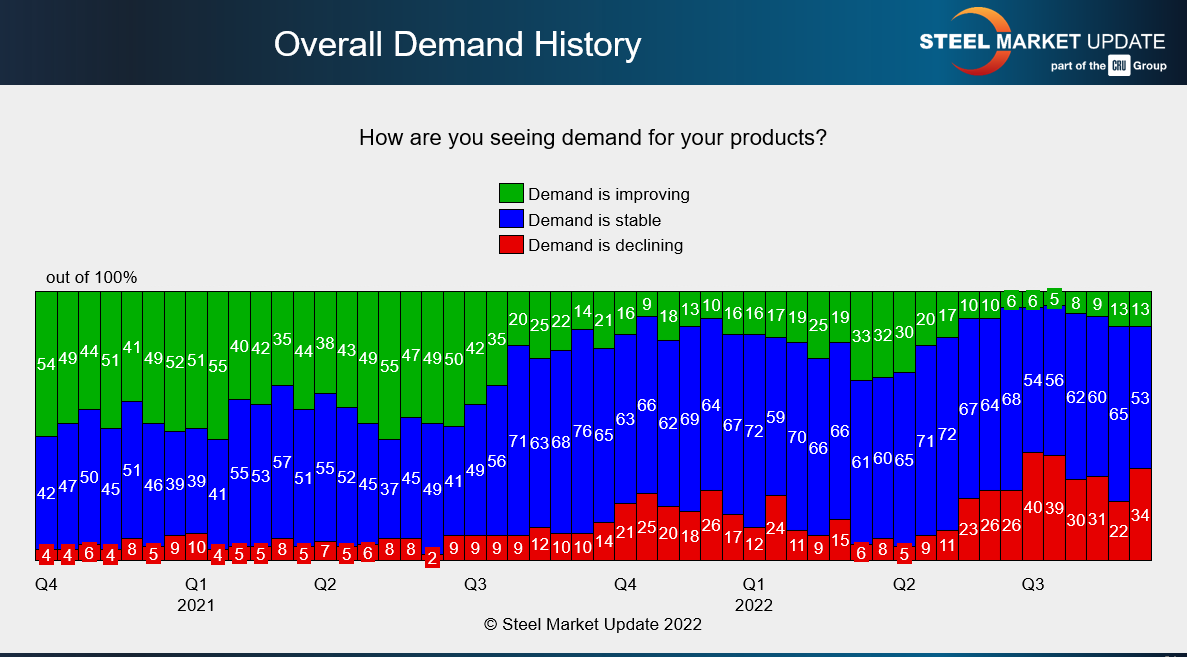

So what about overall demand? After all, strong demand is the magic ingredient that makes volatility easy (or at least easier) to digest.

I had pinned some hopes on survey respondents reporting if not better, then at least more stable demand.

We had a welcome reprieve following a summer in which as many 40% of respondents reported declining demand. That trend of more stable demand is now in question.

We’ve again seen a noticeable uptick in the number of people reporting declining demand – nearly 35%. Again, one week of survey data does not make a trend. But I’d keep a close eye on this one too the next time we release full survey data on Sept. 30.

By Michael Cowden, Michael@SteelMarketUpdate.com