Market Segment

November 7, 2022

Algoma Fiscal Q2 Profits Fall on Lower Prices, Operational Issues

Written by Michael Cowden

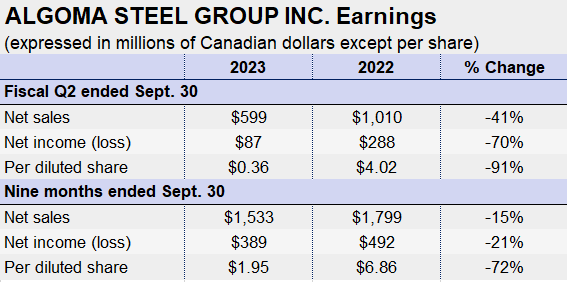

Canadian sheet and plate producer Algoma Steel Inc. posted sharply lower profits for the second quarter of its 2023 fiscal year.

The Sault Ste. Marie, Ontario-based steelmaker said the drop resulted from falling steel prices, operational problems, and higher costs.

The company had warned in September that its fiscal Q2 earnings would be substantially below prior quarters.

All told, Algoma posted net income of Canadian $87 million ($64.43 million USD) in fiscal Q2, down 70% from CA$288 million in the year-ago quarter on revenue that fell 41% to CA$599 million over the same period. That’s according to earnings figures released after the close of markets on Monday, Nov. 7.

The company shipped 435,202 tons in its fiscal ’23 Q2, down 25.9% from the same quarter last year.

Algoma said the shipment drop stemmed from significant delays in a plate mill modernization project, lower output at its direct strip production complex, and a temporary shortage of workers.

Meanwhile, prices fell amid higher costs.

Algoma recorded average selling prices of CA$1,266 per ton in its fiscal ’23 Q2, down 20.6% from CA$1,594 per ton in the year-ago quarter. Costs per ton of steel sold, in contrast, rose to CA$1,033 per ton in fiscal Q2 ‘23, up 20.7% from CA$857 per ton in the same quarter last year.

The higher costs resulted largely from a coal conveyor fire, which Algoma said forced it to replace internally produce coke with purchased coke. Costs were also higher for natural gas, alloys, and scrap.

Algoma estimates that those operational issues will cost it CA$130 million in adjusted EBITDA, with ~60% incurred in the fiscal Q2 and the rest in fiscal Q3.

Despite those headwinds, the company said it remains on track to replace its blast furnaces and basic steelmaking furnaces with two new electric-arc furnaces (EAFs). The CA$700 million project, announced in November 2021, is expected to take two years to complete and to reduce Algoma’s carbon emissions by 70%.

“Despite near-term challenges on pricing, we will continue to focus on improving operational performance and disciplined execution,” Algoma CEO Michael Garcia said in a statement.

By Michael Cowden, Michael@SteelMarketUpdate.com