Market Segment

November 3, 2022

Ternium’s Q3 Earnings Drop, Long-Term Outlook Intact

Written by Laura Miller

Latin American steelmaker Ternium saw a big earnings drop in the third quarter but remains upbeat on its position in and the fundamentals of the North American markets, according to the company’s Q3 earnings report and conference call with analysts on Thursday, Oct. 3.

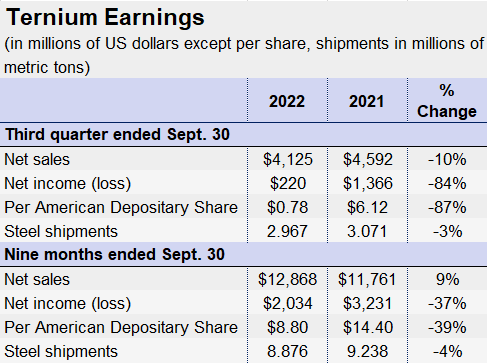

The Luxembourg-based company’s Q3 net income declined substantially, falling 84% year-on-year (YoY) to $220 million, as an adjustment of the fair value of certain Argentine securities resulted in a $95 million loss and Ternium’s investment in Brazilian steelmaker Usiminas took a $120.4 million write-down in the quarter. Net sales were down 7% sequentially and 10% YoY to $4.125 billion.

Quarterly shipments were comparable to the prior quarter and down just 3% YoY to 2.967 million metric tons. The YoY decline was attributed to fewer slab shipments to third parties. This was partially offset by higher shipments of finished steel products.

Although raw material costs are now lower than in the first part of the year, Ternium expects to continue to work through some high-cost inventory acquired earlier in the year through year’s end.

The company expects Q4 shipments within its main market of Mexico to rise slightly from Q3 levels due to market share improvements and restocking within the commercial sector as steel price volatility declines.

On steel prices, Ternium CEO Máximo Vedoya said on the earnings call that what happens in the short term will be a reflection of what’s happening in the economy over the next few quarters. And unfortunately some economies, notably Europe and China, are in trouble. He does not expect any recession in the US to be as harsh as in other areas of the world, but steel prices will be impacted.

In the medium to longer term, he believes base prices will be higher than in the past, perhaps in the $900–1,000 per ton range for hot-rolled coil.

Ternium expects to spend $1 billion on capex projects in 2023 and probably more than that in 2024. It remains committed to bringing all its facilities into USMCA compliance by 2027, “so that’s a huge investment to be making,” Vedoya noted.

On the M&A side, Vedoya said the company is analyzing opportunities and there are things on the table, but “we don’t have anything to inform today.”

No significant update on a planned electric arc furnace (EAF) in North America was provided. “To be honest, we have to have the facility running by 2027, as that’s the deadline of USMCA rule of origins, so we have time,” Vedoya commented. He reiterated that engineering work continues on the project, noting that he cannot provide exact timing of an announcement but that it “should be soon.”

Some positives Ternium is seeing in the market are the reshoring of manufacturing in both Mexico and the US as well as both new and old customers investing heavily in the region.

Although automotive demand remains high, production within Mexico’s auto industry remains subdued due to ongoing supply chain problems that are not easing at the pace Ternium had thought they would.

By Laura Miller, Laura@SteelMarketUpdate.com