Market Segment

November 3, 2022

Nucor Aims To Keep Plate Prices Flat, Rift With HRC Widens

Written by Michael Cowden

Nucor Corp. hopes to hold plate prices steady with the opening of its December order book.

That’s the same approach the Charlotte, N.C.-based steelmaker took last month with the opening of its November book.

Nucor said unchanged plate prices were effective Thursday, Nov. 3, in a letter to customers dated the same day.

“We reserve the right to review and re-quote any offers that are not confirmed with either a Nucor sales acknowledgement or written acceptance by both parties,” the company said.

Nucor has aimed to keep plate prices flat since announcing a $120-per-ton ($6-per-cwt) price cut on discrete plate on Sept. 19.

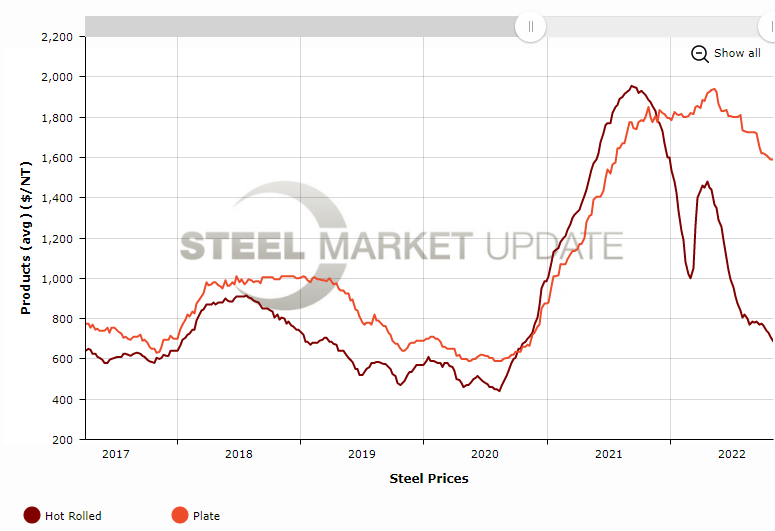

SMU’s discrete plate price stands at $1,590 per ton, down 1.9% from $1,620 per ton a month ago and down 18% from a 2022 high of $1,940 per ton recorded in May, according to our interactive pricing tool.

Plate prices have decoupled from hot-rolled coil prices. The two products used to trend together over time. That has not been the case this year.

SMU’s hot-rolled coil price is at $685 per ton, down 11.6% from $775 per ton a month ago and down 53.7% from a post-Ukraine war peak of $1,480 per ton in late April.

You can see the disconnect in the chart below.

By Michael Cowden, Michael@SteelMarketUpdate.com