Market Data

November 2, 2022

CRU Economics: Outlook Darkens Further Despite Positive Q3 Data

Written by Alex Tuckett

By CRU Principal Economist Alex Tuckett, from CRU’s Global Economic Outlook

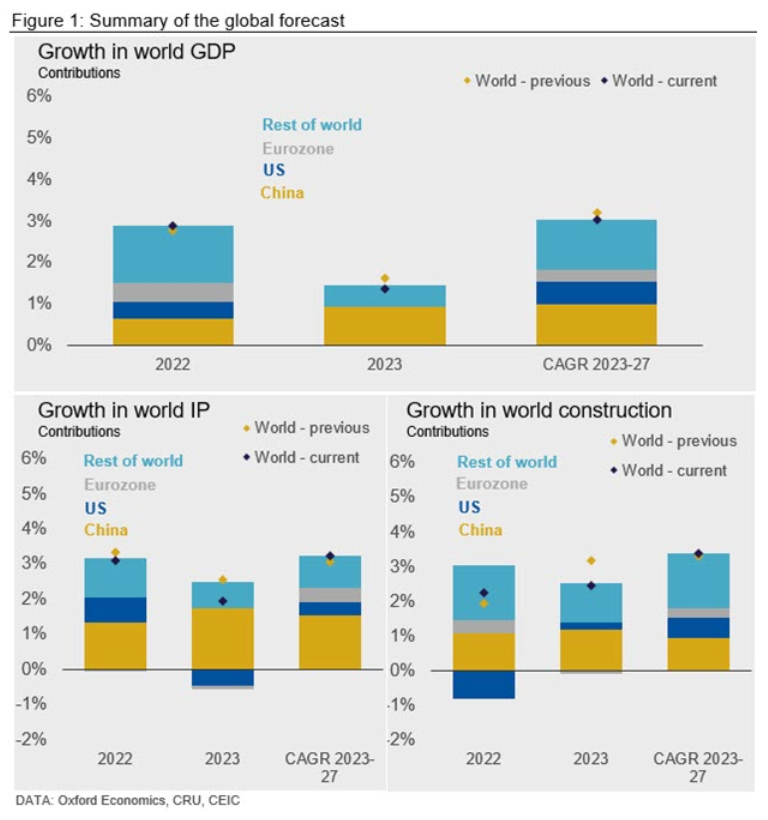

Despite some slightly better-than-expected data for Q3, we have further revised down our forecast for 2023. We continue to believe that stubbornly high inflation, the energy crisis, and China’s domestic problems will lead to a sharp slowdown in world growth, with outright recessions in Europe and the US. What is more, higher frequency data (for example monthly PMIs) have deteriorated since the end of the third quarter, particularly in Europe and China.

China’s third-quarter GDP showed growth of 3.9% year-on-year (YoY), slightly above our forecast and well above consensus. However, the outcome of the party congress gave little reassurance that the zero-Covid policy will be eased, or that policy generally will become more growth-friendly.

Third quarter GDP data for Europe was more positive than expected. Germany in particular surprised with growth of 0.3%. However, we continue to expect the region to slide into recession this winter. Given that Europe could face tight gas supplies for years, we have downgraded the speed of recovery in 2023 in the industrial sector.

The US also saw stronger-than-expected GDP growth in Q3, of 0.7% quarter-on-quarter (QoQ). But core inflation rose again. More momentum and higher inflation mean the Fed must squeeze demand even harder. Furthermore, weak productivity growth since the pandemic sends a negative signal for growth in the medium run.

We have slightly upgraded our forecast for world GDP growth in 2022 to 2.9% (from 2.8% in our September GEO) but have downgraded 2023 growth to 1.4% (from 1.6%). We expect industrial production to grow by 3.1% this year (down from 3.3%) and 1.9% in 2023 (down from 2.6%).

Stronger data for China have led us to revise up growth in world construction output to 2.3% for this year (from 1.9% previously), but we have revised it down to 2.5% in 2023 (from 3.2%). We now expect global light vehicle production to increase by 5.8% in 2022 (up from 4.8%), and by 4.1% in 2023 (down from 5.4%).

This article was originally published on Oct. 31 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com