Market Data

October 27, 2022

Steel Mill Lead Times Remain Short

Written by Brett Linton

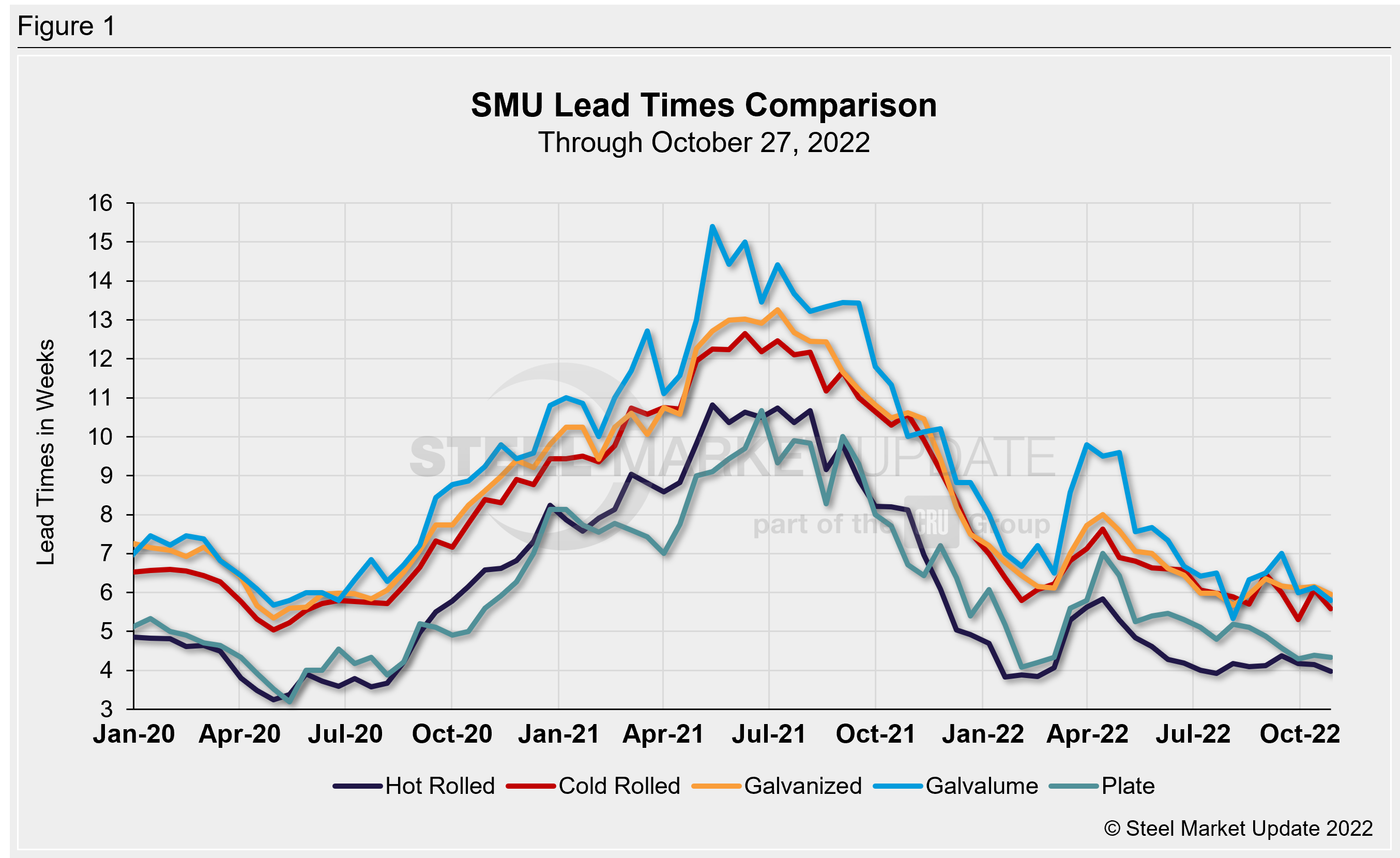

Steel mill lead times declined across the board this week for all products tracked by SMU. Our latest lead times analysis shows that production times on sheet products decreased by 0.2–0.5 weeks compared to our previous market check two weeks ago, while plate lead times dipped 0.1 weeks.

On average, lead times retracted by 0.3 weeks compared to two weeks prior, down 0.1 weeks compared to one month ago. Following their peak in April, sheet lead times have remained somewhat stable since July/August. Plate lead times have gradually moved lower over the past six months.

SMU expects these short lead times to hold somewhat steady throughout the remainder of the year, due to seasonal slowdowns as well as flat to declining demand. Once we approach 2023 delivery dates, we expect lead times to marginally extend.

Surveyed buyers reported mill lead times ranging from 3–6 weeks for hot rolled, 4–8 weeks for cold rolled and galvanized, 4–7 weeks for Galvalume, and 3–6 weeks for plate.

SMU’s hot rolled lead time declined 0.2 weeks from mid-October to 4.0 weeks, the lowest level since July. One month ago HR lead times were at 4.2 weeks. Recall that the lowest level this year was 3.8 weeks in January/February. The record low in our ~11-year data history was 2.8 weeks in October 2016.

Cold rolled lead times fell by half a week to 5.6 weeks. One month ago, cold rolled lead times were at 5.3 weeks, the lowest level recorded since May.

Galvanized and Galvalume lead times both slipped, falling 0.2 and 0.3 weeks, respectively. Galvanized lead times are now at 6.0 weeks, Galvalume at 5.8 weeks. Both are at the lowest levels recorded since August. Our record low for both products was in February 2015, when galvanized was 4.8 weeks and Galvalume was 5.1 weeks. Note that Galvalume figures can be volatile due to the limited size of that market and our smaller sample size.

Plate lead times declined 0.1 weeks to 4.3 weeks. This is tied with late September level for the lowest level seen since February (4.1 weeks). Prior to February, the last time plate lead times were this low was in August 2020. In our four-year history, the lowest plate lead time we have on record was 3.2 weeks in May 2020.

Regarding the future direction of lead times, 65% of the executives responding to this week’s questionnaire think that lead times will be relatively flat two months from now. This is down from a rate of 69% when polled two weeks ago. And 30% of buyers reported lead times would be extending, up from 19% in our previous survey. Another 5% said lead times would be contracting, versus 12% two weeks prior. Here is what a few of our respondents had to say:

“Mills will start shutting down furnaces if demand keeps going down.”

“Mills will control output and spot buy opportunities.”

“3-6 Weeks for HRC is still insanely short, but that is probably where we’ll be for a while – short a work stoppage or other ‘Black Swan’ event.”

“Artificially extending due to holidays and maintenance. By late Feb., they will back to what we have now.”

“Extending – this is my wishful thinking.”

“Lead time will extend as we get into later 1st quarter 2023 mill bookings.”

“The truth is, what they quote and what actually happens are two different things.”

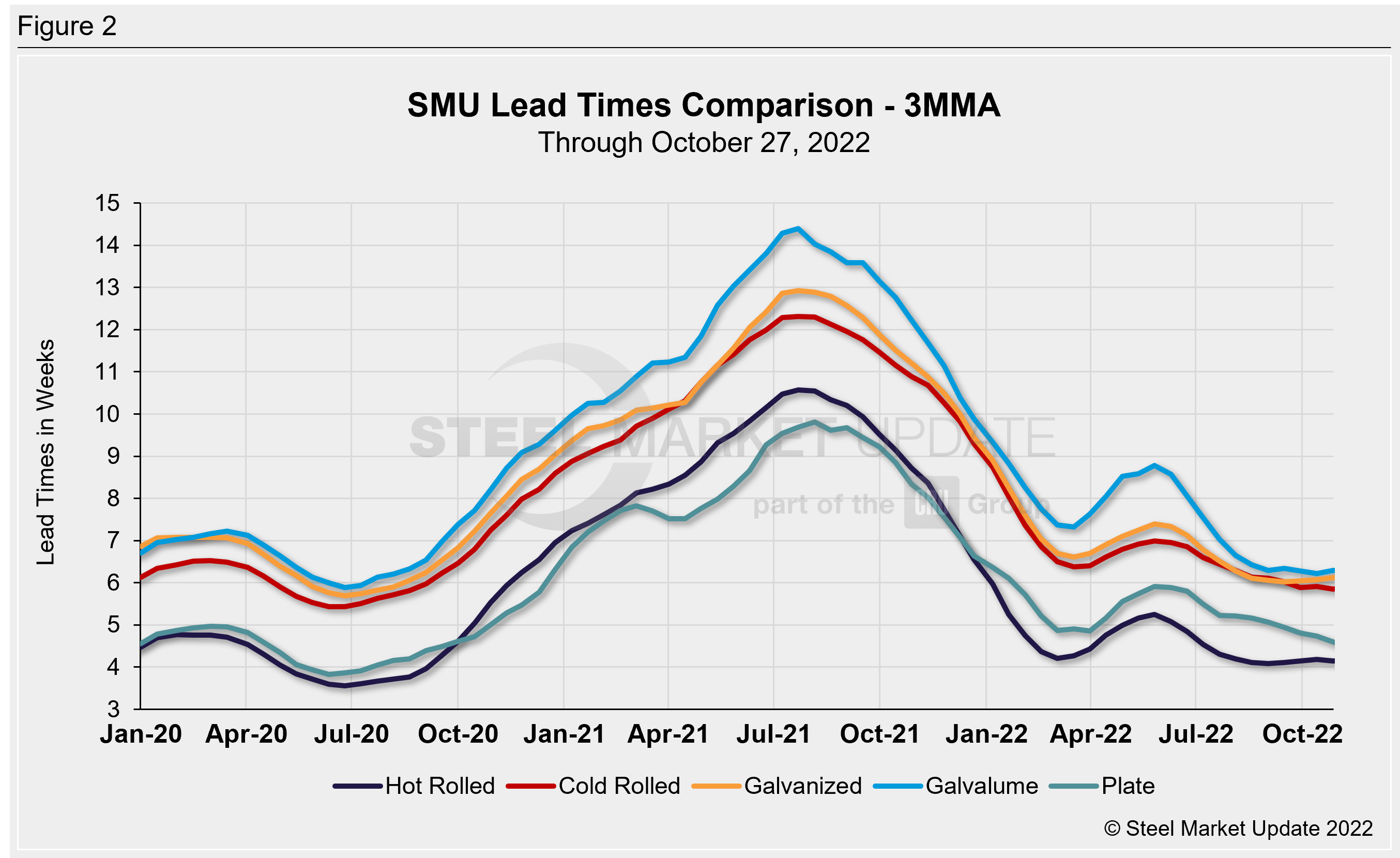

Looking at lead times on a three-month moving average (3MMA) can smooth out the variability in the biweekly readings. As a 3MMA, most products have been steady for the last two months. The latest 3MMA lead time for hot rolled fell 0.1 weeks to 4.1 weeks, in line with August and September levels. Cold rolled held steady at 5.9 weeks, holding onto a two-plus-year low since late September. Galvanized lead times were flat at 6.1 weeks (the mid-September 3MMA of 6.0 was the lowest level seen since August 2020). Galvalume lead times rose 0.1 weeks to 6.3 weeks, previously at the lowest level seen since August 2020. Plate lead times declined 0.1 weeks, now at 4.6 weeks, the lowest 3MMA measured since October 2020.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Brett Linton, Brett@SteelMarketUpdate.com