Market Segment

October 19, 2022

SDI’s Q3 Results Helped by Steel Fabrication Segment

Written by Laura Miller

A strong performance from its steel fabrication operations offset lower earnings within its flat rolled steel business, resulting in another strong quarter for Steel Dynamics Inc.

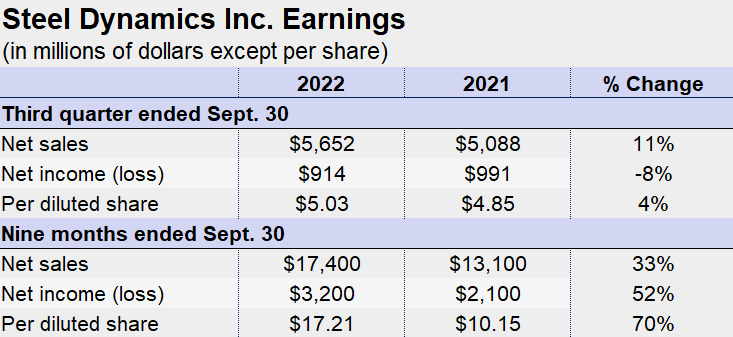

The Fort Wayne, Ind.-based steelmaker and recycler reported net income of $914 million on sales of $5.65 billion in the third quarter ended Sept. 30. While sales were 11% higher year-on-year (YoY), net income was down 8%, as the company continued to be impacted by the start-up of the company’s newest sheet mill in Sinton, Texas.

![]()

Mark Millett, SDI’s chairman, president, and CEO, said the Sinton mill has been running at a rate of 65% during October, and expectations are for the mill to achieve a run rate of at least 80% for full-year 2023.

SDI reported Q3 steel shipments — including both flat and long products — were 12.6% higher YoY at a record 3.155 million tons. Flat-rolled shipments of 1.767 million tons were 22% higher YoY for the Butler, Columbus, and Sinton flat roll divisions, and the flat steel processing division saw a 24% rise to 425,304 tons. Q3 operating income within the steel segment was down by half from the year-ago quarter to $658.3 million.

In the metals recycling division, ferrous shipments declined 3.7% YoY to 1.32 million gross tons. The segment’s earnings have been lower as a result of monthly declines in the price of ferrous scrap since May. While its average realized ferrous scrap pricing declined nearly 30% during Q3, SDI does believe prices have stabilized and will remain steady for the remainder of the year. The metals recycling segment’s Q3 operating income dropped 79% YoY to $9.9 million.

The steel fabrication segment saw a 3.4% YoY increase in shipments to 218,441 tons, while the average sales price jumped 124% to $5,245 per ton. The segment posted record operating income of $677 million during the quarter, which was a 13% sequential increase and a large leap from the $89.4 million achieved in the year-ago quarter.

Looking forward, “Customer order entry activity continues to be healthy across our businesses, with expectations for seasonally moderated volume for our steel and metals recycling operations in the coming months,” Millett said.

“Despite weaker flat-rolled steel pricing, our order activity and backlogs remain solid. We believe North American steel consumption will remain steady, and that demand for lower-carbon, US produced steel products coupled with lower imports will support steel pricing,” he added.

SDI said the non-residential construction market remains strong and that its fabrication segment’s order backlog extends well into the first half of 2023.

In the second half of next year, two new paint lines and two new galvanizing lines are set to begin operating within SDI’s flat roll division. Two will be located at the Sinton mill and the other two at its Heartland division in Terre Haute, Ind.

By Laura Miller, Laura@SteelMarketUpdate.com