Analysis

October 18, 2022

Final Thoughts

Written by David Schollaert

What a difference a week can make. The lack of clarity in the short-to-medium-term direction presently in steel seems to be stumping maybe even the best and the brightest of flat-rolled buyers.

And perhaps as Michael Cowden indicated in SMU’s prior Final Thoughts, the steel market might be somewhere in the middle — in-between bearish and bullish. But our latest survey results indicate that confidence might be even more fickle than we originally thought.

If you go back just about 45 days, nearly 47% of respondents in our Sept. 1 survey expected the market to bottom out in Q3. Fast forward just a few weeks to Sept. 29, 27% of survey respondents believed HRC prices had already bottomed while 41% expected prices to bottom out between October and November.

Though prices have somewhat ebbed and flowed most recently, hot-rolled coil prices have been on a 27-week decline since reaching their most recent high of $1,480 per ton ($74 per cwt) on April 19.

For starters, it’s not surprising that many believed prices had or were just about at the bottom. We saw HRC tags bounce around $25 per ton for about 8–9 weeks. Most felt we were at an inflection point and that a turn was on the horizon. But prices have now decreased repeatedly, albeit somewhat controlled, over the past three weeks and have reached $730 per ton on Oct. 18, according to the SMU interacting pricing tool — the lowest level since Nov. 17, 2020.

Granted, at the time prices were only at the beginning of what would become a historic run, but nevertheless, not only are HRC prices still waning, but they have also no longer been in unprecedented territory for some time. They have normalized and could start slipping towards more uncomfortable levels.

There’s a level to which decreases are necessary, some would say — where they normalize a market. That certainly was the sentiment when prices first started declining from their historic run in mid-August 2021. And then there are levels in which decreases start making everyone just a little uneasy.

There is some uneasiness to the market, but by no means am I saying we’re there or even near that profoundly uncomfortable place in which price declines are starting to make the marketplace fearful or tense. No not at all. But the lack of fundamental clarity to demand has certainly given way to fluctuating sentiment on what seems to be a weekly basis.

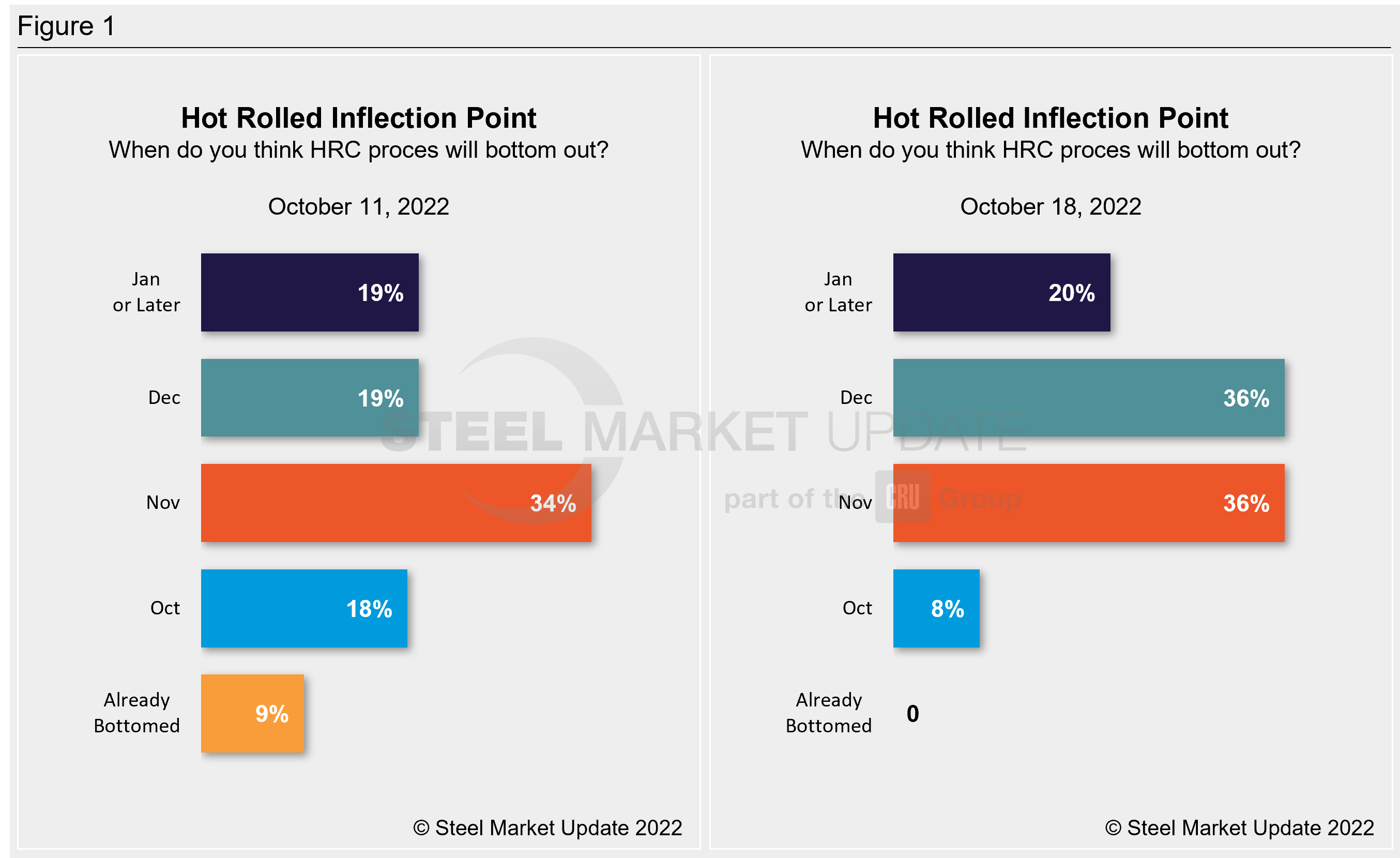

Take a look at the chart below.

There’s no scientific explanation for the side-by-side comparison in Figure 1 above. But what I think it highlights is the lack of clarity. In some ways, our survey results have emphasized that market players are just kind of ‘kicking the can down the road’ when it comes to when they think prices will bottom out.

At this point, we’re nearly $300 per ton below where some suggested the new normal would be, while others may feel vindicated that tags are finally near where they had forecasted they’d be, albeit slightly delayed.

Here’s what just a few survey respondents had to say about when and where prices will bottom out:

“Further down, looks like they will continue to digress until the econd quarter of 2023.”

“I have been thinking we were at the bottom. Looks to still be trending down. It likely bottoms in December. Demand is still stable for now.”

“Soon, we are going see lead times start to hit early January in the next couple of weeks and that normally causes mills to tighten up.”

“Nov/Dec, In the $600’s, lack of demand.”

“December 2022. Too much capacity, too little orders.”

“After midterms for sure but more than likely February 2023.”

“We are close. The amount of outages in Q4 and dropping import levels should help us find a floor.”

“No idea now.”

“Hot rolled will bottom out around $700–720. Outages along with mill maintenance will force demand to grow.”

“Bottom in Q4 2022, probably November, at around $700.”

“I think when lead times hit December and demand slows for the holidays, pricing comes under another attack.”

Demand Sees a Sharp Shift

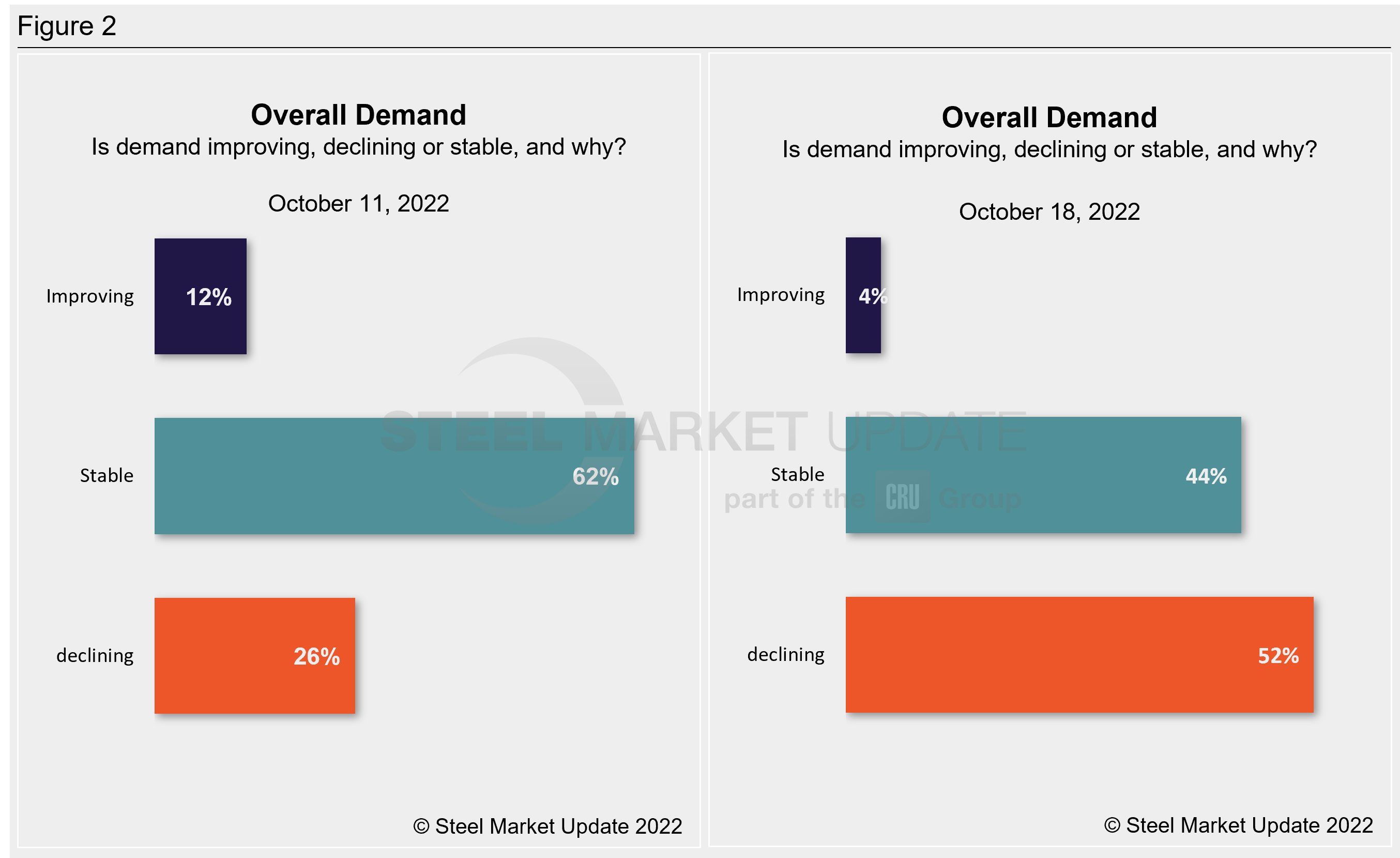

We’ve also seen survey respondents really shift or lower their sentiment when it comes to demand (Figure 2). And we certainly need another couple more survey results to come in over the next couple of weeks before we can say this is a clear demand shift or not, but roughly 4% of survey respondents — primarily service center and manufacturing executives — say demand is improving.

And the glaring change is noted in whether overall demand is stable or declining.

Just a week ago, 26% of respondents said demand was declining. Now 52% are reporting declining demand, while 44% say demand is stable.

Here’s what just a few survey respondents had to say about overall demand:

“Stable on our side…”

“Stable with a slight declining trend.”

“Declining — high interest rates, slowing economy.”

“Improving, but slowly.”

“Declining, recession fears, inflation and higher interest rates.”

“Declining because of overall business conditions. Inflation is rearing its ugly head.”

“Stable to slightly improving.”

“Demand is “Ok”. It certainly doesn’t sound like service centers are restocking much though.”

“Demand is declining, we are heading into the holidays.”

“Declining. Shipments remain strong, but bookings point to more challenging times ahead.”

Next week’s survey results, which will be released on Oct. 28, could be telling as we look for any signs of further declines or an inflection point.

SMU Events

Our Steel 101 training in Corpus Christi, Texas, kicks off tonight and includes a tour of SDI Sinton. Our next training will not be until April 2023. Be on the lookout for those details.

Also, don’t forget to mark Feb. 5–7 on your calendar. That’s when SMU, together with the Port of Tampa Bay, will be hosting the Tampa Steel Conference. It’s a growing event, and a great reason to get out of the cold and catch up with hundreds of your closest friends in steel. You can register here.

As always, a big thank you from all of us at SMU for your business.

By David Schollaert, David@SteelMarketUpdate.com