Analysis

October 11, 2022

Final Thoughts

Written by David Schollaert

On Friday the Bureau of Labor Statistics released its latest report card on the US economy’s performance with its September jobs report. The results, though surprisingly upbeat, point to potentially more troublesome days ahead, both personally and collectively for the steel industry.

So here are just a few thoughts to ponder as October nears the halfway mark, and the fourth and final quarter of 2022 is well underway.

Don’t Look Now, but Flat-Rolled Steel Prices Are Falling Again

Over the past two-plus years, we’ve seen and felt some of the most bearish and bullish of times in steel: Near-historic lows as the market responded to the onset of a global pandemic, followed by a $1,500 per ton 24-month historic price run.

In some ways, prices have since been more resilient than we anticipated. For the past couple of months, hot-rolled coil prices have ebbed and flowed by just about $25–30 per ton, leading most to suspect a floor had been reached. But renewed price erosion is underway due to weaker underlying demand, and SMU’s latest check of the market notes the change.

According to SMU’s interactive pricing tool, our benchmark HRC prices are at an average of $740 per net ton ($37 per CWT) FOB mill, east of the Rockies as of Oct. 11. That’s a decrease of $25 per ton week-on-week (Figure 1).

And SMU’s latest survey results may further underscore that decreases are again on the horizon. The floor might be a ways away and a renewed downturn underway.

In short, inflation might be finally starting to slow down demand, thus cutting into steel pricing.

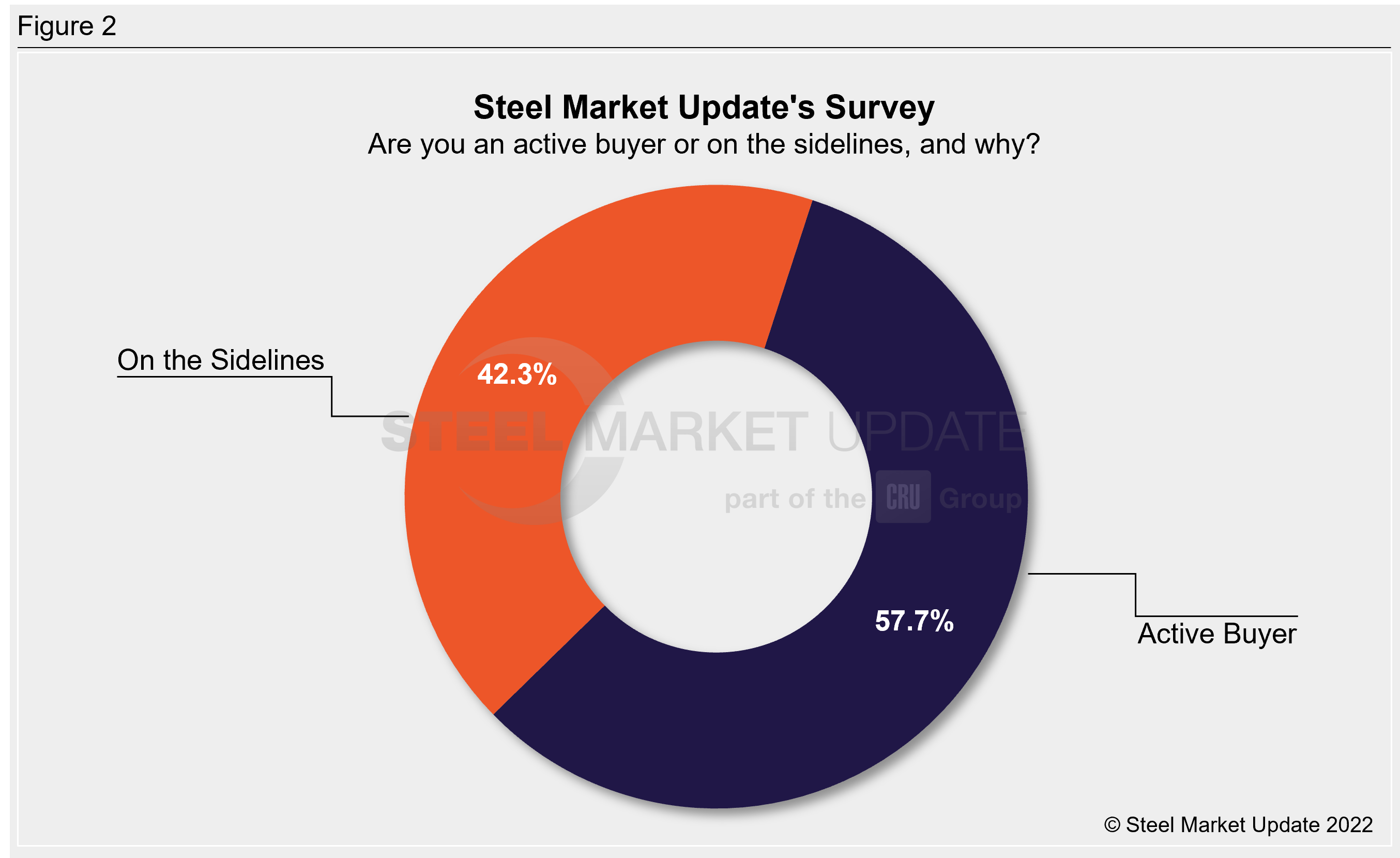

In SMU’s survey on October 10–11, we asked: Are you an active buyer or on the sidelines, and why? Not surprisingly, the results captured the pulse of the market and are detailed below in Figure 2.

But while roughly 43% of respondents — service center and manufacturing executives — said they are on the sidelines; it was the nearly 58% still active buyers that told a compelling story. Here’s what a few of the active buyers had to say:

“Buying what is needed…”

“Active for needs only. I do have material secured for backlog.”

“Only buying what we need with steel pricing uncertainty.”

“Lack of demand. Only buying what is needed.”

“Active when my customers want to buy.”

“Feel pricing will slide until the end of November”

“Fulfilling contractual obligations, nothing more.”

“Need to provide plate for active orders and forthcoming orders.”

“I have to buy because I am as low as I have ever been on coil.”

“Customer demand is low, so we are more focused on managing inventory.”

Though buying is still underway, at nearly a 60% clip, it’s clear that intake patterns are hand-to-mouth and project specific. No one is taking a position or adding volume. Inventory management is strictly ongoing, and it’s not a surprise that some sources have told SMU that mills could be running at just about 60–70% capacity.

The Well-Performing Jobs Report: A Double-Edged Sword

September’s jobs report was a welcome sight and came in mostly hotter than expected. It brought lots of surprises but not without some mounting concern.

Last month the US economy added 263,000 jobs (above the pre-pandemic average), and the payroll gains also pushed the unemployment rate back down two percentage points to 3.5%. The reading puts the unemployment rate back to its pre-pandemic level and tied for the lowest level since 1969.

And the positives didn’t stop there. The labor force participation rate edged lower to boot while average hourly earnings rose 5% from a year ago.

And though headwinds have been steady and, in some cases, mounting, September’s jobs report highlights both consumer and business resilience over the past six-plus months despite the ongoing Russia-Ukraine war, rising interest rates, and a slowing housing market.

Could the elusive “soft-ish” landing the Federal Reserve has fancied actually be in the cards for the US economy?

But the better-than-expected performance adds to concerns that it likely signals the Fed will have to do more to slow the economy and curb inflation.

The report comes amid repeated efforts by the Fed to bring down inflation running near its highest annual rate in more than 40 years. The central bank has raised rates five times this year for a total of three percentage points. And more hikes are likely in store.

The headwinds we’ve faced individually and collectively this year are unlikely to ease in the very near-term.

The Fed meets again in November to discuss monetary policy. The benchmark interest rate is widely expected to increase by another three-quarters of a percentage point. The move would be for an unprecedented fourth time in a row.

If the trend continues as expected, the Fed is likely to remain on course with its aggressive moves to tackle the inflation that has been plaguing the US economy. Added interest rate hikes will eventually slow the economy and in theory, drag steel down with it.

As always, a big thank you from all of us at SMU for your business.

By David Schollaert, David@SteelMarketUpdate.com