Analysis

October 2, 2022

Final Thoughts

Written by Michael Cowden

Our latest survey results are decidedly mixed. Lead times (like prices) continue to move modestly lower. You can find reasons to support your case in the latest data whether you’re an optimist or a pessimist.

Let’s take the case for optimism first.

Most survey respondents expect lead times to flatten out soon. Some even expect them to extend. Almost no one foresees further lead time contraction.

That’s a positive sign given that lead times are often a leading indicator of price moves.

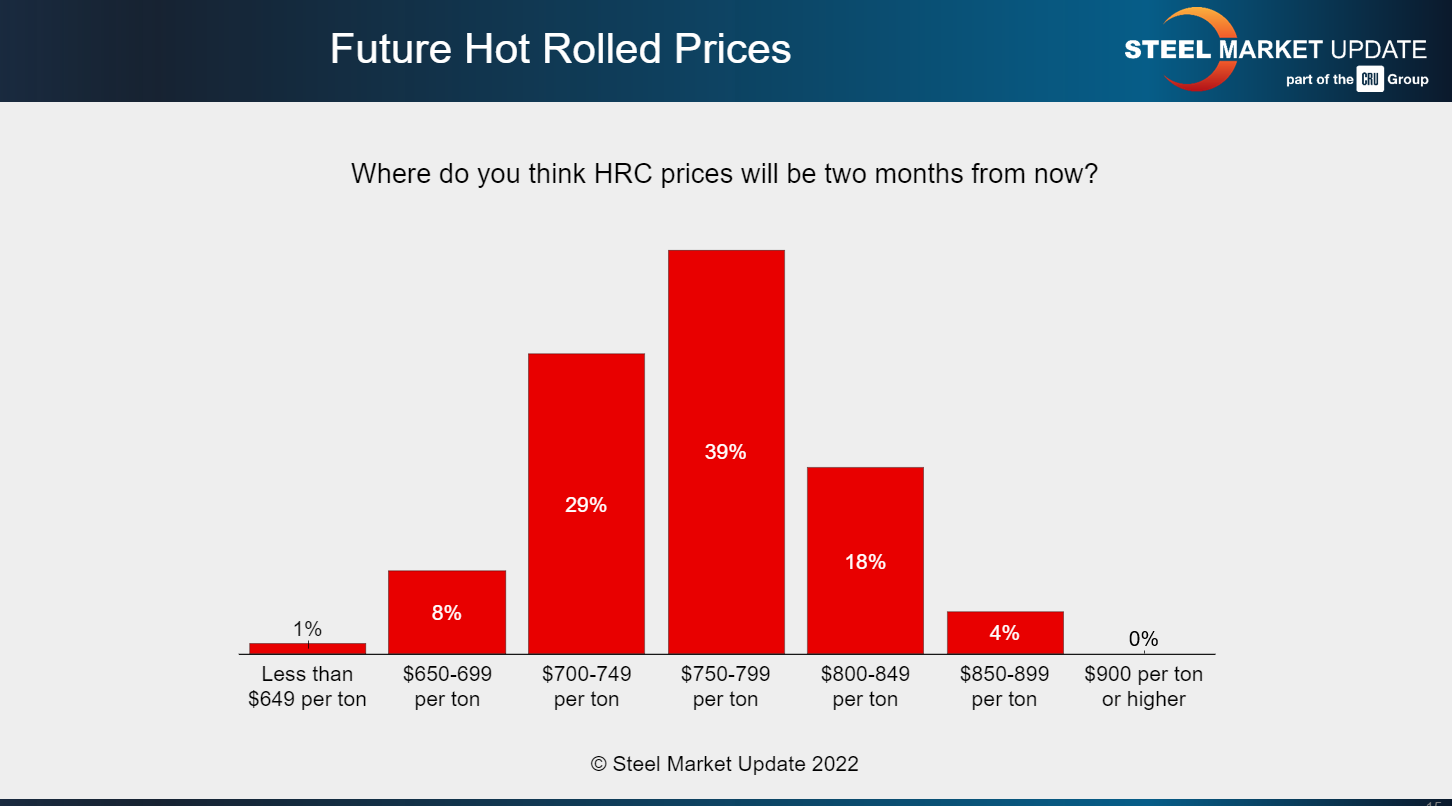

And a clear majority respondents think HRC prices will hold in the $700-800/ton range two months from now.

Price and lead time stability would be welcome news. A durable floor should give people the confidence they need to jump back into the spot market.

Not so fast. Now we get to the case for pessimism.

About 85-95% of survey respondents report that mills are still willing to negotiate lower prices on HR, CR and galv. How do you square that with expectations that price will hold roughly where they are today?

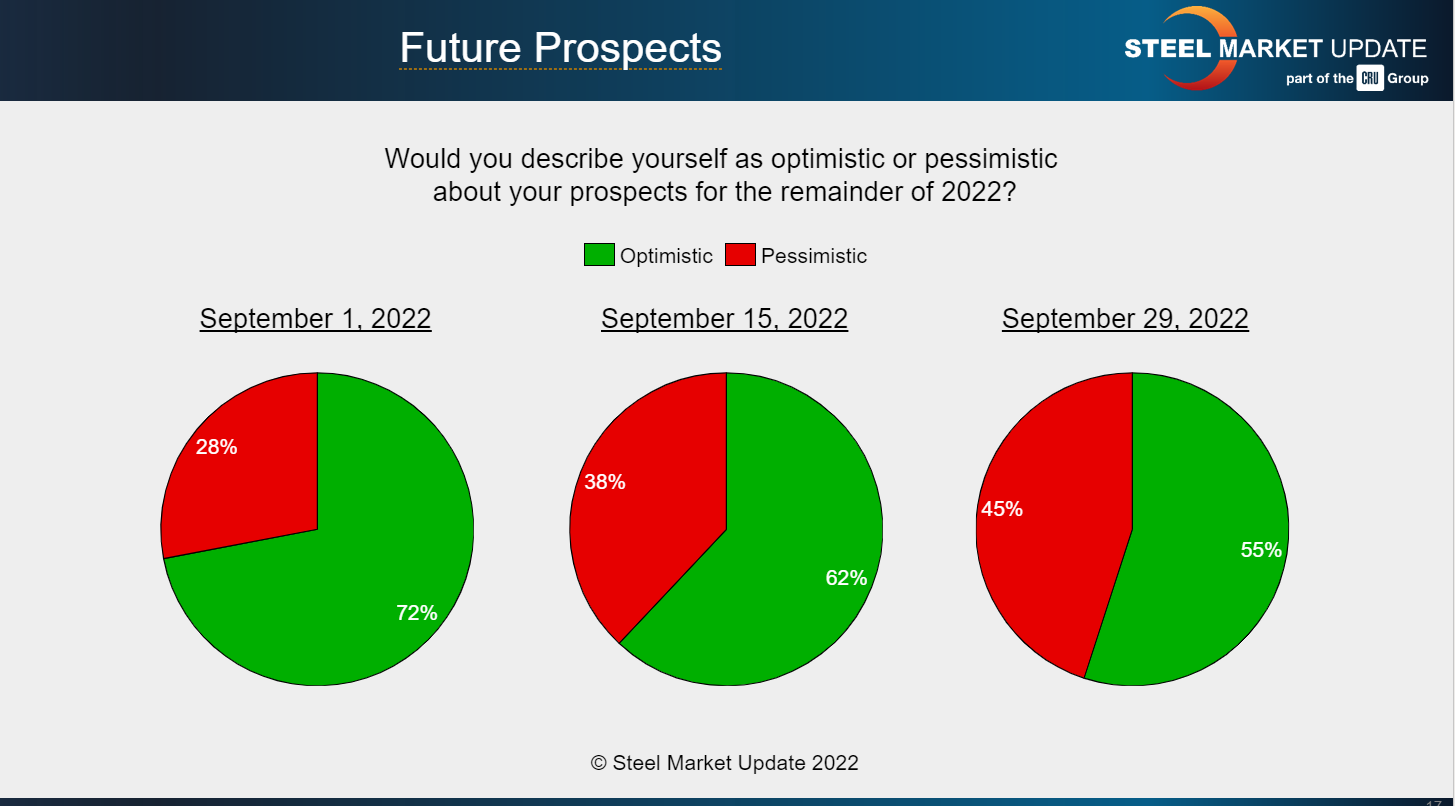

Also, the number of people reporting they are pessimistic about the remainder of this year continues to grow.

You could make the case that the gloom is driven by emotions and by factors not directly tied to the steel industry. Think rising fears of recession, stock market declines, the war in Ukraine – any number of worrisome headlines that we all see almost every day.

Even if you think the gloom is irrational, it’s important not to disregard the impact of market psychology on short-term buying patterns and price trends. This is why topics like behavioral economics – which combines economics, anthropology, and psychology – are a big deal at top business schools.

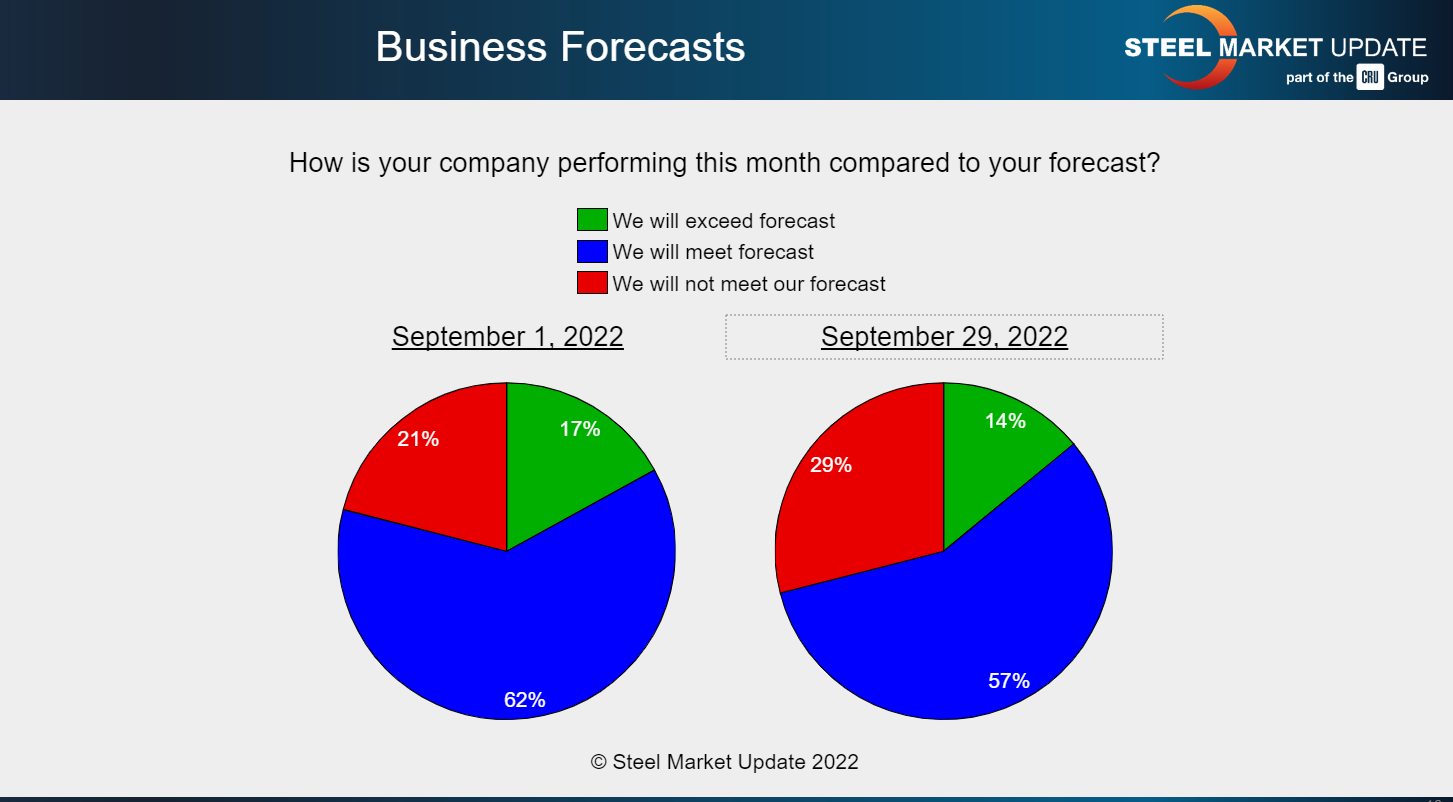

As for the nuts and bolts of the steel industry, what I find more worrisome is that a significant minority continues to report that they’re not hitting forecast:

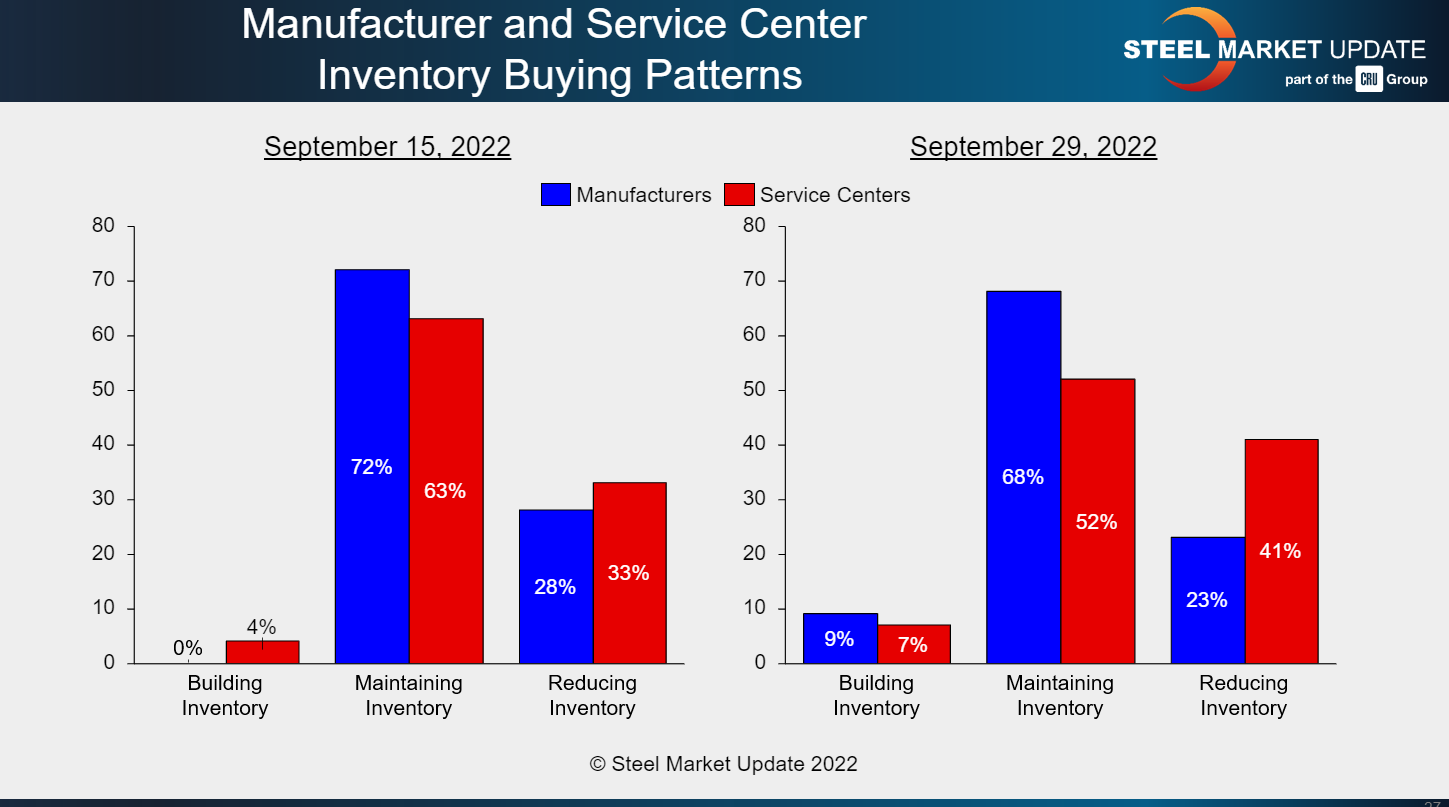

Also, more service centers report that they are reducing inventories. That’s probably not something you would do if you were confident prices were at or near a floor.

This might be a case where actions speak louder than words. People might be telling us that they think prices are at or near a bottom – perhaps because they genuinely want that to be the case. But they’re not acting that way, not yet anyway.

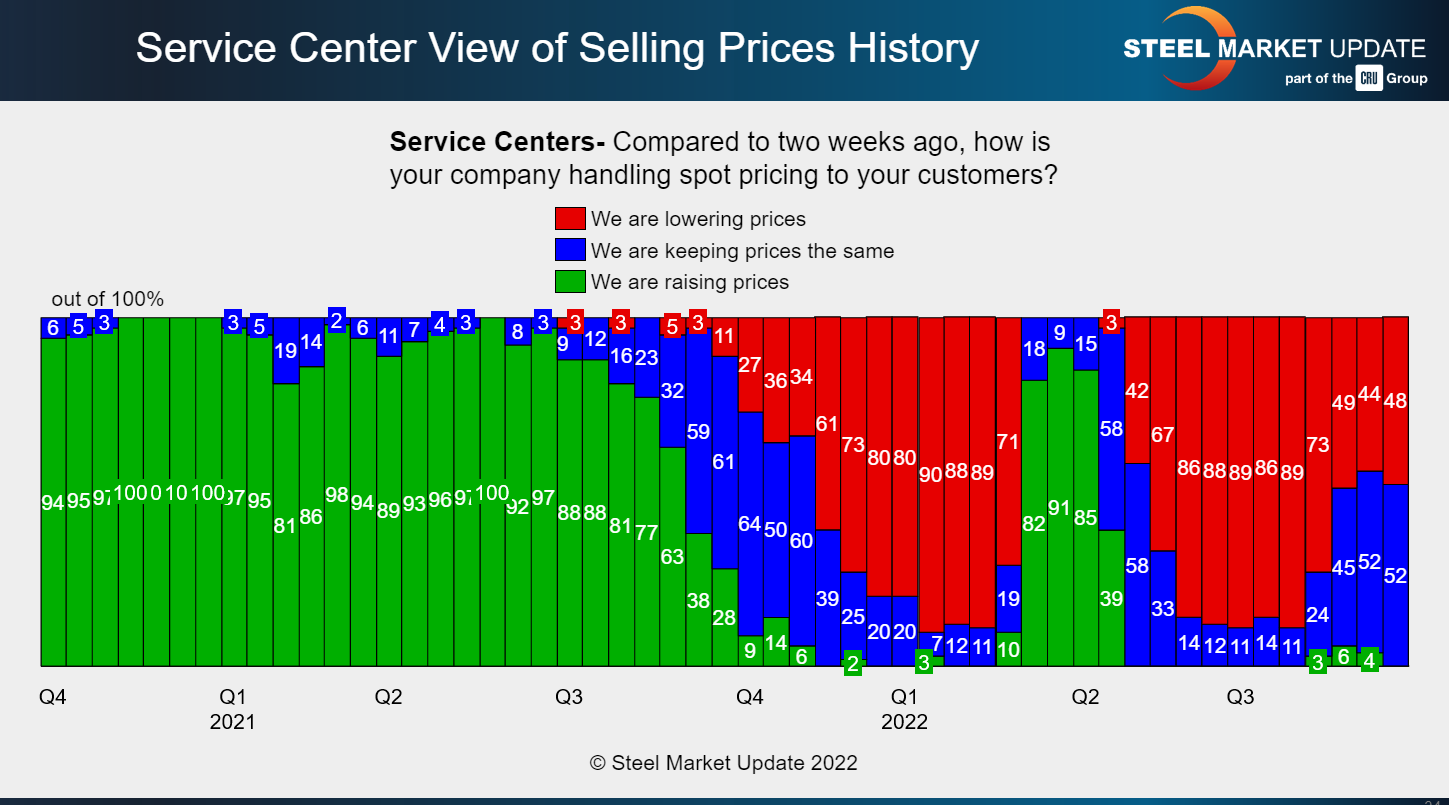

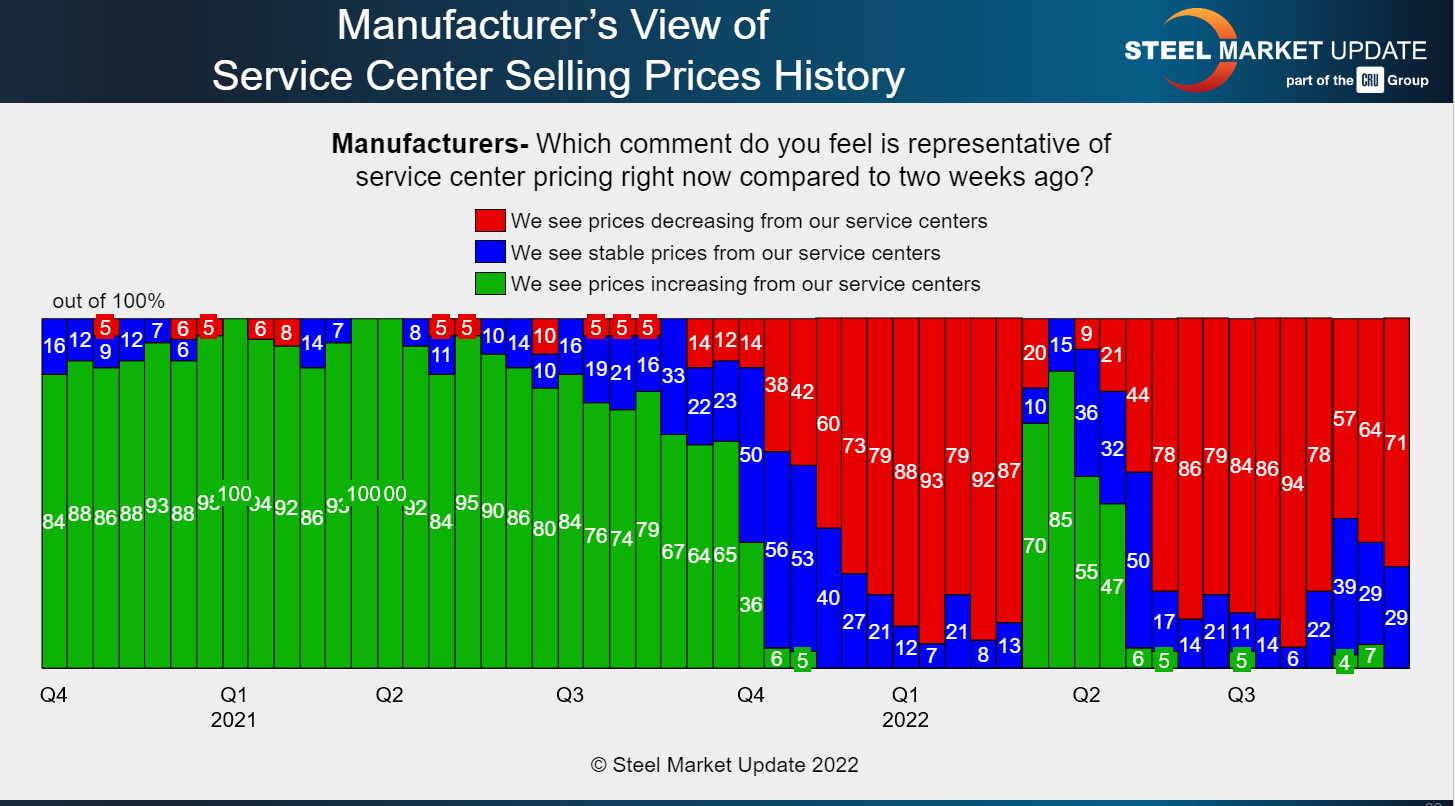

Another disconnect we’ve noticed lately is that fewer service centers report that they are lowering prices now after widespread discounting over the summer. That’s good because it means that mills and service centers are united in their efforts to stabilize prices.

Again, let’s not be too quick to jump to conclusions. SMU asks service centers and end users this question separately for a reason. Namely, to see whether service centers are really doing what they say they’re doing.

And this is where it gets a little interesting. More service center say they’re no longer decreasing prices. But their manufacturing customers continue to report that discounts abound.

What gives. Are manufacturers slow to get the message that prices aren’t going down anymore? Or are service centers trying to give the impression that prices have stabilized even as many continue to quietly discount? It’s a puzzle. And I’d be curious to know your thoughts. So don’t hesitate to drop me a line at the email below.

In the meantime, check out a few of our upcoming events, one virtual, the other in-person.

SMU Community Chat

Do you want to know what future markets have to say about the divergent trends we’re seeing in our surveys? Tune into the next SMU Community Chat with David Feldstein, president of Rock Trading Advisors, on Wednesday, Oct. 12, at 11 am ET. You can register here.

Steel 101

We still have a few spots left for our in-person Steel 101 training on Oct. 19-20 in Corpus Christi, Texas. Why Corpus? Because it’s the nearest city to Steel Dynamics Inc.’s new EAF sheet mill in Sinton, Texas, which we’ll tour as part of Steel 101. Don’t miss out, register here.

By Michael Cowden, Michael@SteelMarketUpdate.com