Prices

August 30, 2022

SMU Price Ranges: Sideways to Up, a Shift or Just a Blip?

Written by David Schollaert

Flat-rolled steel prices were steady to up based on the data points SMU collected this week. There’s undoubtedly been pressure from recent mill price hikes, but it’s still far too early to tell if they will stick or if this is just a blip.

Sheet prices rose for each of our products this week. The average hot-rolled coil price now stands at $785 per ton ($39.25 per cwt), up $15 per ton from last week, but still down $55 per ton from this time last month. Cold rolled and coated prices increased an average of $50-$60 per ton week-over-week, all down $110-130 per ton from late July.

Plate prices remained unchanged over last week, as they have since early August. Business is still relatively good especially at plate mills when compared to HRC. Expect spreads to hold for the time being. The market is waiting on bated breath for Nucor’s next plate price announcement (any day now). Word on the street is that they will keep plate prices lateral for October but no formal letter yet. The last time Nucor was rumored to keep prices lateral they dropped them by $120 per ton ($6/cwt).

In our ongoing market survey this week, we asked buyers if mill price increases are sticking or not. Over half of those polled so far responded that the increases are partially holding up, while 40% responded that they were not. Only 6% said that the increases are indeed sticking.

Time will tell whether or not prices have the momentum to increase, or if this is a temporary blip. Our price momentum indicator remains Neutral for all sheet products until the market establishes a clear direction. Our plate price momentum indicator continues to point towards lower prices in the coming weeks. But the market’s reaction to October order books could really change that.

Hot-Rolled Coil: SMU price range is $750–820 per net ton ($37.50–41.00/cwt) with an average of $785 per ton ($39.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $15 per ton from last week. Our price momentum indicator on hot-rolled steel points to Neutral until the market establishes a clear direction.

Hot-Rolled Lead Times: 3–7 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold-Rolled Coil: SMU price range is $1,130–1,180 per net ton ($56.50–59.00/cwt) with an average of $1,155 per ton ($57.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $80 per ton compared to last week, while the upper end increased $20 per ton. Our overall average is up $50 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Neutral until the market establishes a clear direction.

Cold-Rolled Lead Times: 5–9 weeks*

Galvanized Coil: SMU price range is $1,080–1,240 per net ton ($54.00–62.00/cwt) with an average of $1,160 per ton ($58.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end increased $90 per ton. Our overall average is up $60 per ton from last week. Our price momentum indicator on galvanized steel points to Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $1,177–1,337 per ton with an average of $1,257 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4–8 weeks*

Galvalume Coil: SMU price range is $1,100–1,240 per net ton ($55.00-62.00/cwt) with an average of $1,170 per ton ($58.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end increased $100 per ton. Our overall average is up $50 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,394–1,534 per ton with an average of $1,464 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4–8 weeks*

Plate: SMU price range is $1,700–1,750 per net ton ($85.00–87.50/cwt) with an average of $1,725 per ton ($86.25/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4–6 weeks*

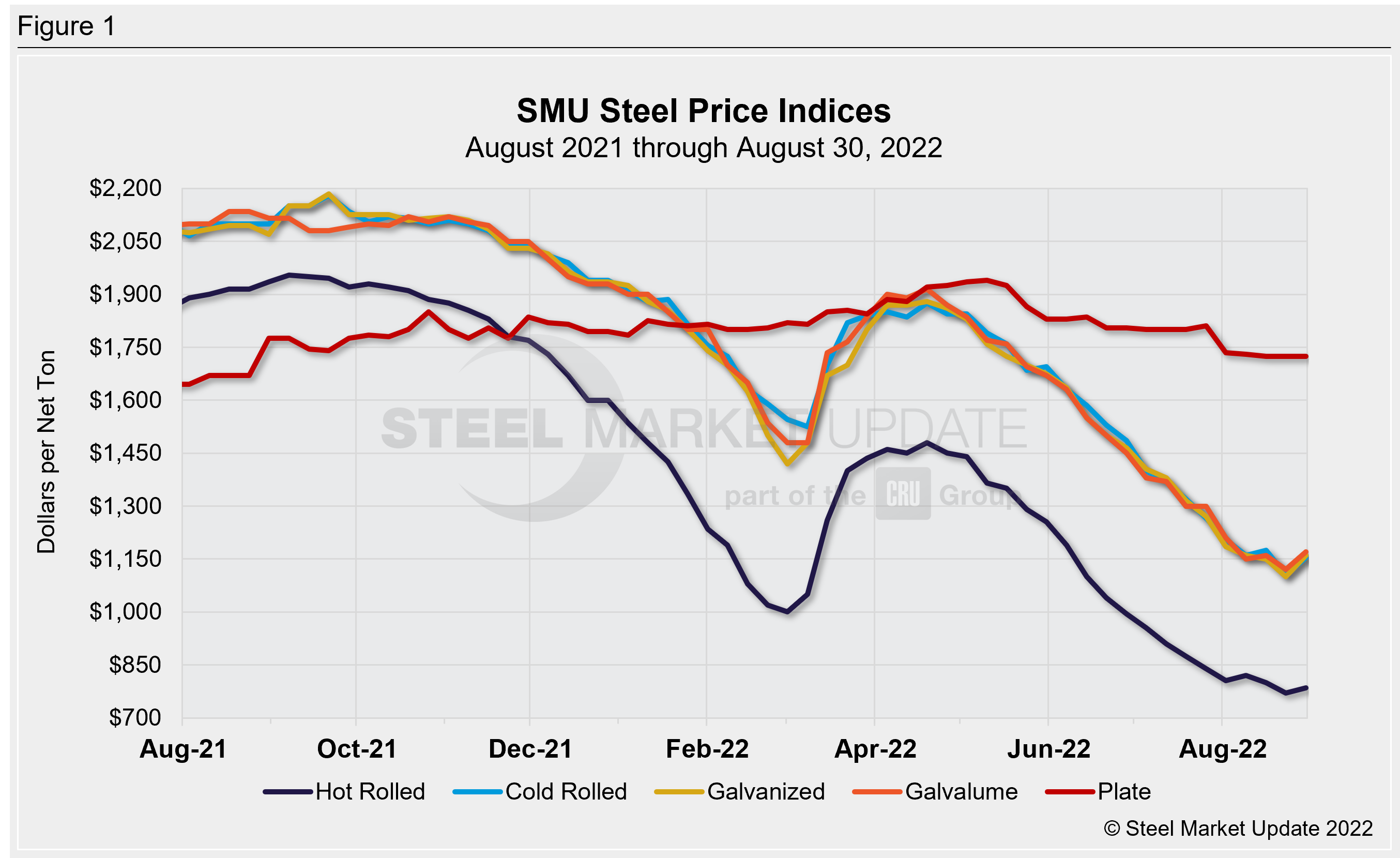

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com and Brett Linton, Brett@SteelMarketUpdate.com