Market Data

August 18, 2022

Steel Mill Lead Times Sideways

Written by Brett Linton

Steel mill lead times were relatively flat this week compared to our previous market check, with some products slightly up and others down. Hot rolled, cold rolled and plate lead times slightly declined compared to levels seen two weeks ago, while coated lead times increased.

On average this week, lead times increased by 0.2 weeks across the board compared to early-August, and are overall unchanged compared to one month ago. Having gradually declined from the April peak, lead times generally remain in line with early 2022 levels.

Buyers surveyed this week reported mill lead times ranging from 3–6 weeks for hot rolled, 4–8 weeks for cold rolled, galvanized, Galvalume, and 4–6 weeks for plate.

SMU’s hot rolled lead times fell 0.1 weeks compared to two weeks ago, now averaging 4.1 weeks. HR lead times are up 0.2 weeks compared to one month prior, down from a peak of 5.8 weeks in April. The lowest hot rolled level this year was 3.8 weeks seen in January and in February. The record low in our ~11-year data history was 2.8 weeks in October 2016.

Cold rolled lead times declined 0.2 weeks to 5.7 weeks, now the lowest level seen since Aug. 2020. Galvanized lead times bounced back to 6.0 weeks (they were as low as 6.1 weeks back in March, and our record low was 4.8 weeks in February 2015). The average Galvalume lead time jumped considerably (after falling considerably in early-August), up 1.0 weeks to 6.3 weeks. Note that Galvalume figures can be more volatile due to the limited size of that market and our smaller sample size. One month ago Galvalume lead times were 6.5 weeks.

Mill lead times for plate declined by 0.1 weeks to 5.1 weeks. Recall that in mid-July, plate lead times fell to 4.8 weeks, the first time seeing a sub-5 week figure since early March. The lowest plate lead time this year was 4.1 weeks in early February. In our four-year history of plate lead times, the lowest figure we have recorded was 3.2 weeks in May 2020.

Approximately 76% of the executives responding to this week’s questionnaire told SMU they were seeing stable lead times, up from 61% in our previous survey. 17% said lead times were slipping, down from 36% in early-August. 7% of buyers reported lead times as extending, relatively unchanged. Here is what a few of our respondents had to say:

“Lead times are very short but stable.”

“They’re stable, but at a crazy short level.”

“Slightly extending.”

“They couldn’t get any shorter.”

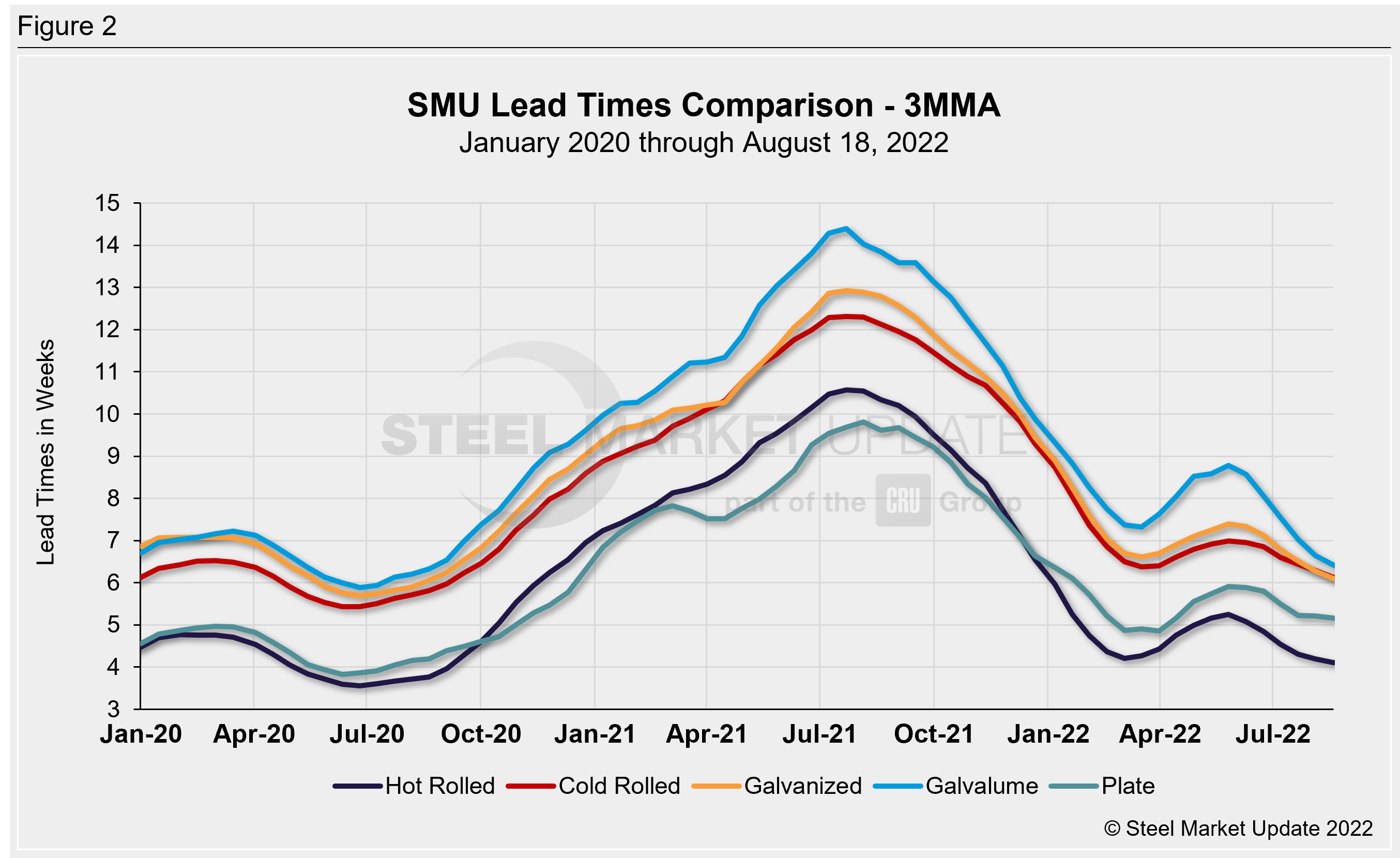

Looking at lead times on a three-month moving average can smooth out the variability in the biweekly readings. As a 3MMA, all products were flat to down 0.2 weeks compared to two weeks prior and down as much as 0.6 weeks compared to mid-July. The current 3MMA for hot rolled is down 0.1 weeks to 4.1 weeks, cold rolled and galvanized both eased 0.2 weeks to 6.1 weeks, Galvalume declined 0.3 weeks to 6.4 weeks, and plate remained flat at 5.2 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Brett Linton, Brett@SteelMarketUpdate.com