Market Data

August 15, 2022

Service Center Shipments and Inventories Report for July

Written by Estelle Tran

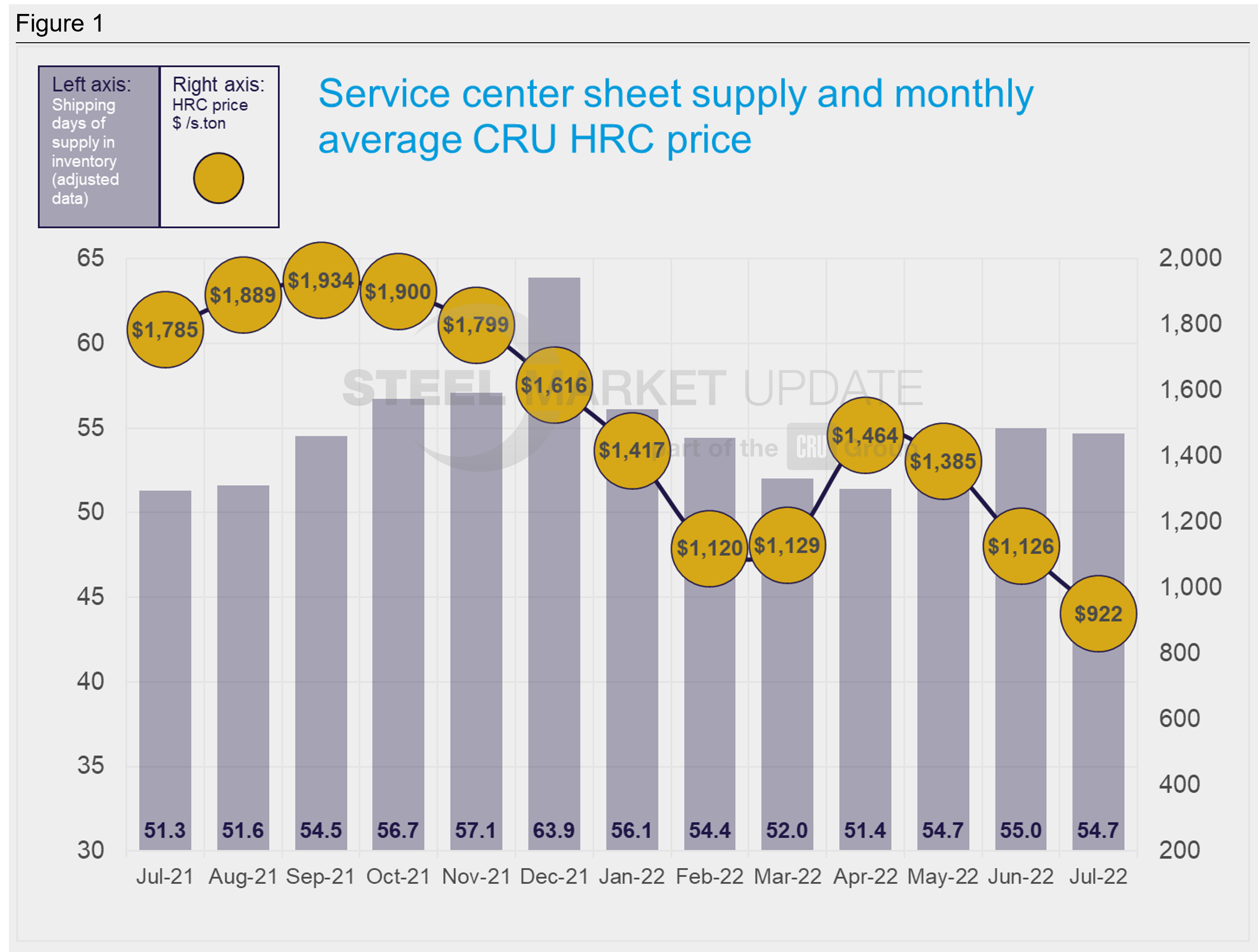

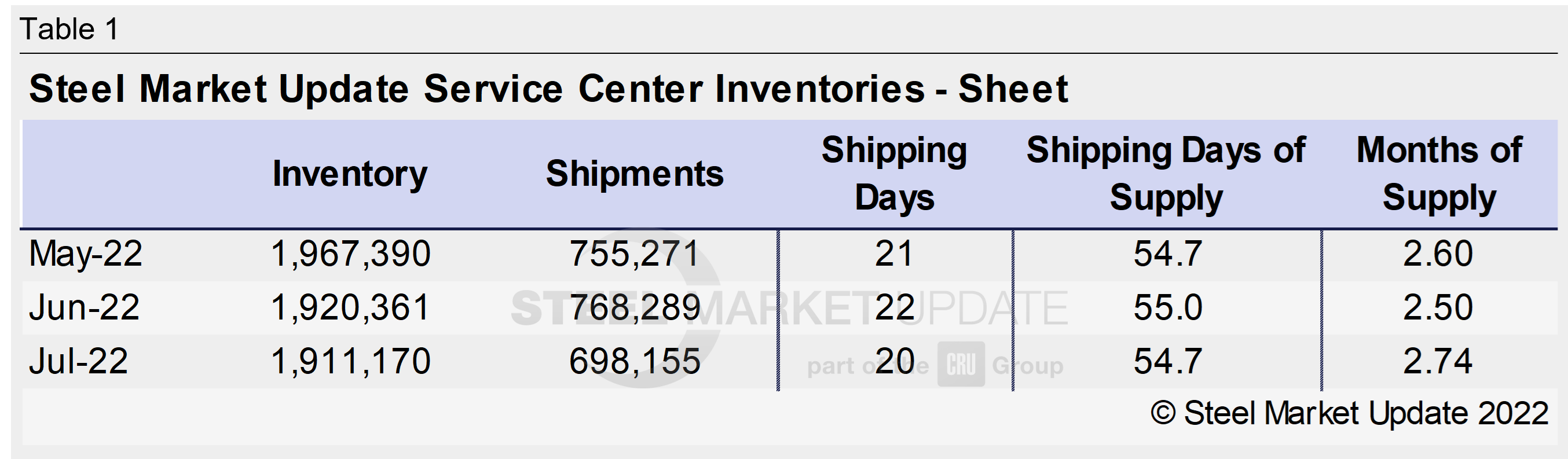

Flat Rolled = 54.7 Shipping Days of Supply

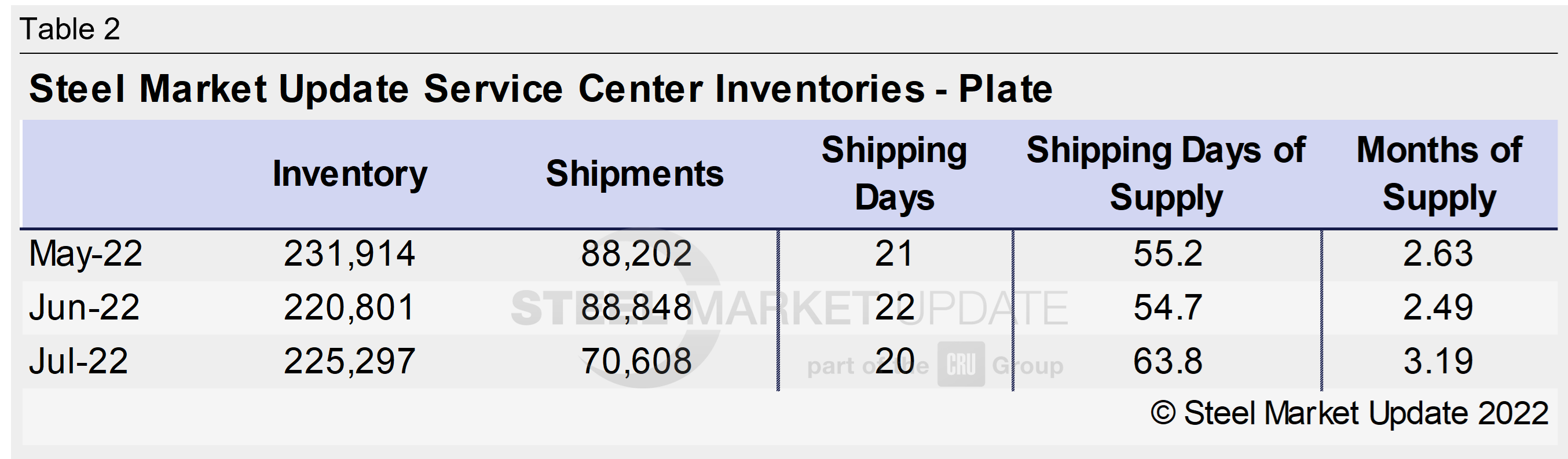

Plate = 63.8 Shipping Days of Supply

Flat Rolled

US service center flat rolled inventories declined slightly in July as service centers worked to align inventories with slowing demand. At the end of July, service centers carried 54.7 shipping days of supply, down from 55 shipping days in June on an adjusted basis. In terms of months on hand, sheet supply represented 2.74 months of supply, compared with 2.5 months of supply in June.

July had 20 shipping days, compared with June’s 22. July also tends to be a slower month for shipments, which, along with the two fewer shipping days, explains the 9% drop in shipments month-on-month (MoM).

With prices declining rapidly, service centers have been quickly drawing down high-priced inventories. We are hearing more service centers are expecting mini cycles over the next several months as the market adjusts to mill capacity changes and other catalysts. We have already seen Nucor announce a $50 per ton price increase for new orders effective on Aug. 8.

Most service centers are expressing concerns about real demand. There has been some evidence that component shortages are holding back demand not just for automotive but also for heavy equipment and other sectors. Because of OEMs revising forecasts lower, service centers have expressed unease about their inventory levels being too high relative to demand.

This hesitancy can be seen in the decline in flat-rolled steel on order. The amount of sheet steel on order dropped MoM.

Plate

US service center plate inventories rebounded in July with a drop in shipments. At the end of July, service centers had 63.8 shipping days of supply of plate. This was up from 54.7 shipping days in June. In terms of months on hand, service centers had 3.19 months of supply in July, up from 2.49 in June.

Service center plate shipments fell about 20% MoM in July. In addition to a shorter shipping month and seasonality, service center intratrade slowed in July. Also, with prices for plate so elevated, customers have been waiting on the sidelines for prices to fall. On July 28, Nucor announced a price decrease of $120 per ton for discreet and normalized plate.

We have also heard of plate orders arriving earlier than planned, contributing to the inventory build in July. This may have been reflected in recent SMU lead time data. In the survey published July 21, plate mill lead times fell to 4.8 weeks from 5.11 two weeks before.

The latest survey published August 4 showed lead times back up to 5.18 weeks. The amount of plate on order is still on the higher side, which could be related to imports.

Demand dropped off significantly in July from service center and OEMs. Some still are optimistic that demand is steady and was held back by high prices that were expected to fall, but others view demand to be cooling. With the elevated level of material on order and moderate demand, we expect that plate inventories will build again in August.

With the downward price trajectory, there could be further slowdown in shipments in August as well as a decline in the amount of material on order.

By Estelle Tran, Estelle.Tran@CRUGroup.com