Market Data

August 14, 2022

SMU Steel Demand Index: Trend Shift or a Blip?

Written by David Schollaert

Steel Market Update is pleased to share this new Premium content – an index comparing lead time and demand data – with Executive members. For information on upgrading to a Premium-level subscription, email Info@SteelMarketUpdate.com.

Apparent demand for flat-rolled steel in the US turned in our early August reading, though it’s too early to note if it’s the beginning of a trend. The shift is notable because demand had been trending down at a steady pace since late April, according to SMU’s latest survey results.

July’s reading was mostly stable. August’s early move upward preceded Nucor’s price hike letter on Aug. 8 and a modest increase in SMU’s hot-rolled coil (HRC) price – the first gain in nearly four months.

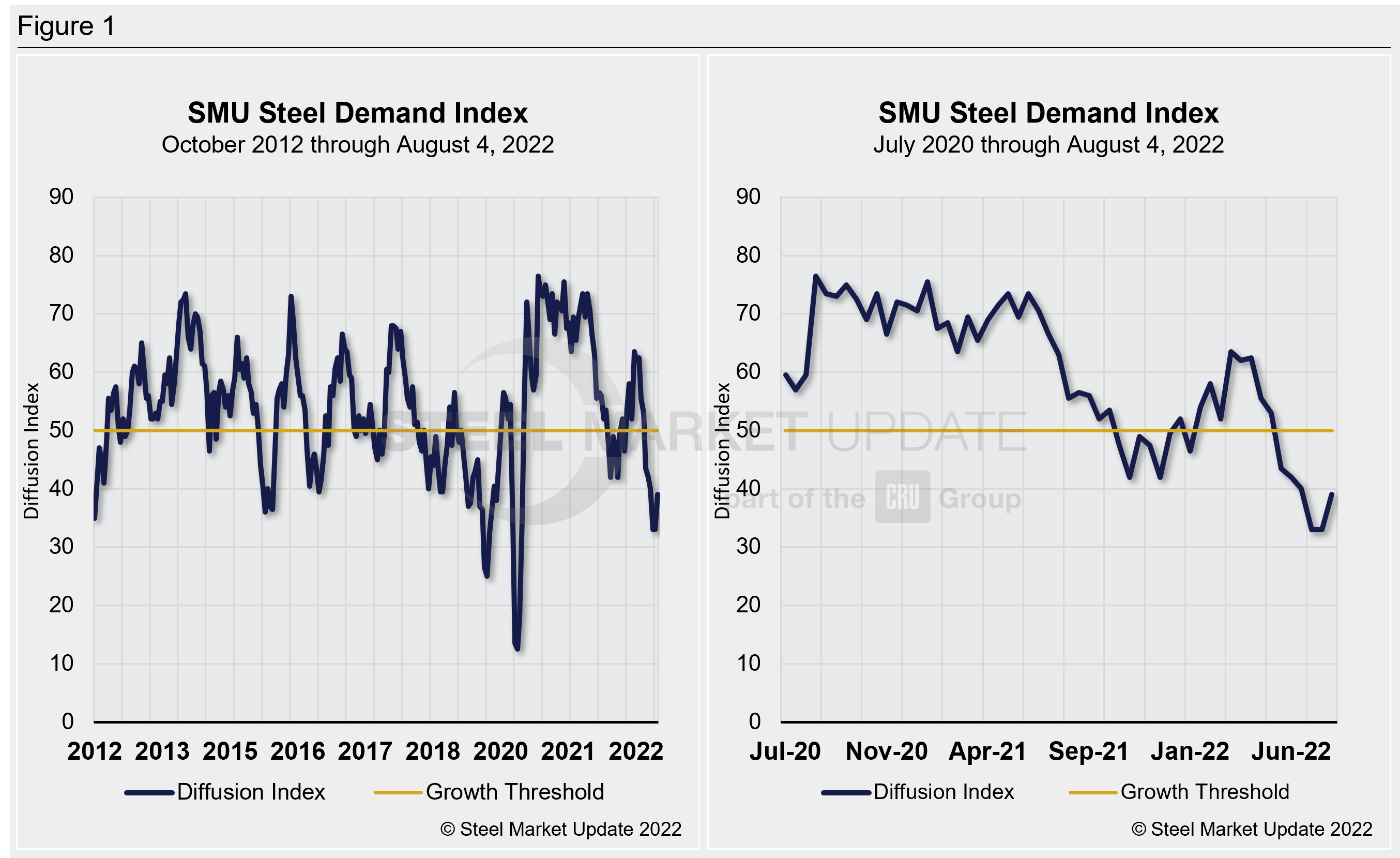

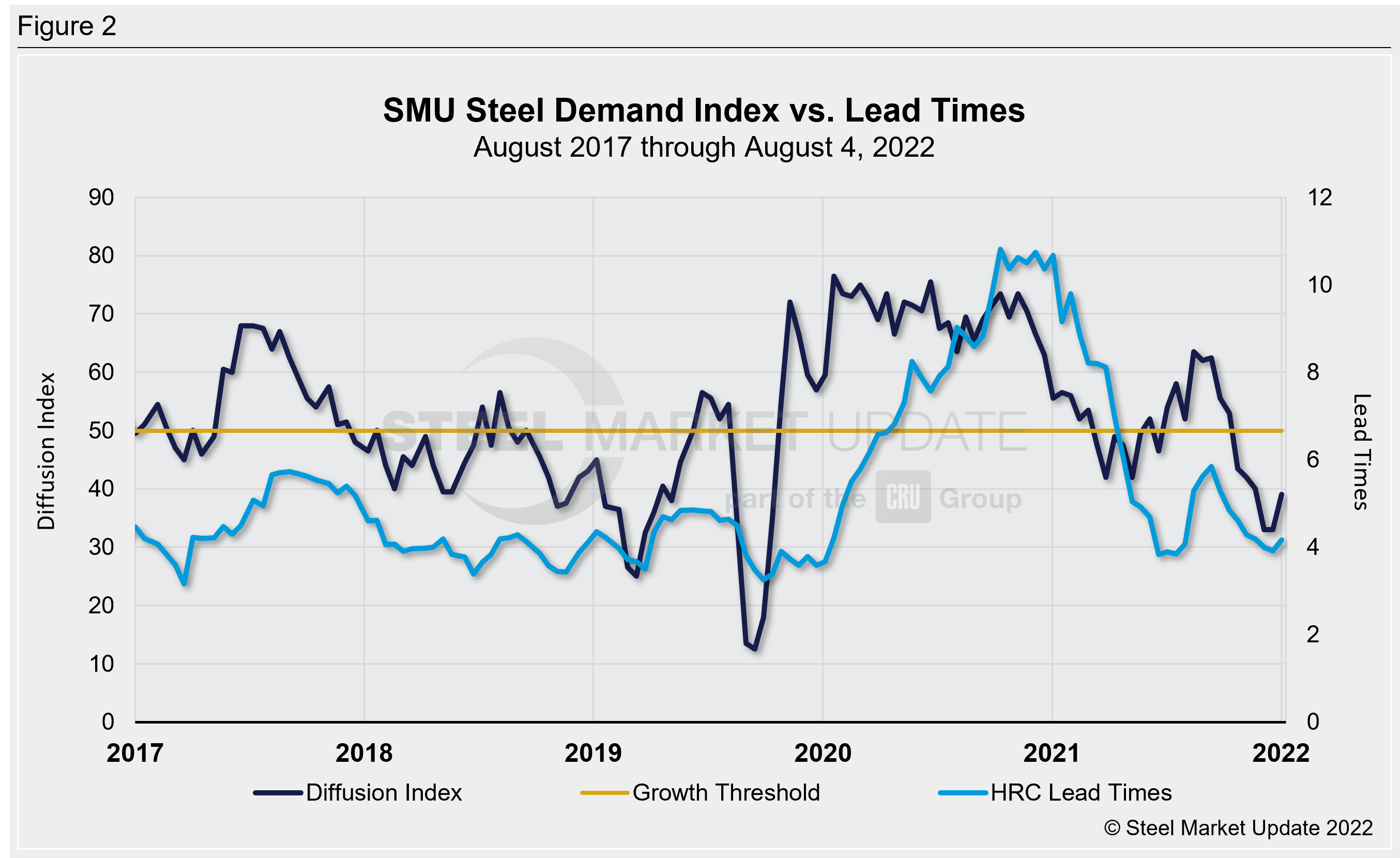

The Steel Market Update (SMU) Steel Demand Index, which compares lead times and demand, is a diffusion index derived from SMU’s market surveys. This index continues to precede lead times, which is notable given that lead times are typically a leading indicator of steel price moves.

An index score above 50 indicates an increase in demand, and a score below 50 indicates a decrease.

The latest demand index registered 39 on Aug. 4, a 6-point gain versus the prior reading of 33 on July 21. (SMU sends out full surveys to the market every two weeks.) Though improved, the result continues to highlight a weakening market that is still reporting down demand. The result was down seven points from a month-ago and down more than 10 points from mid-May.

The reading is just four points above recent lows, which were the lowest readings since 2020 – when the economy and the steel industry were still reeling from the early blows of Covid-19 pandemic. Detailed side-by-side in Figure 1 are both the historical views and the latest steel demand index.

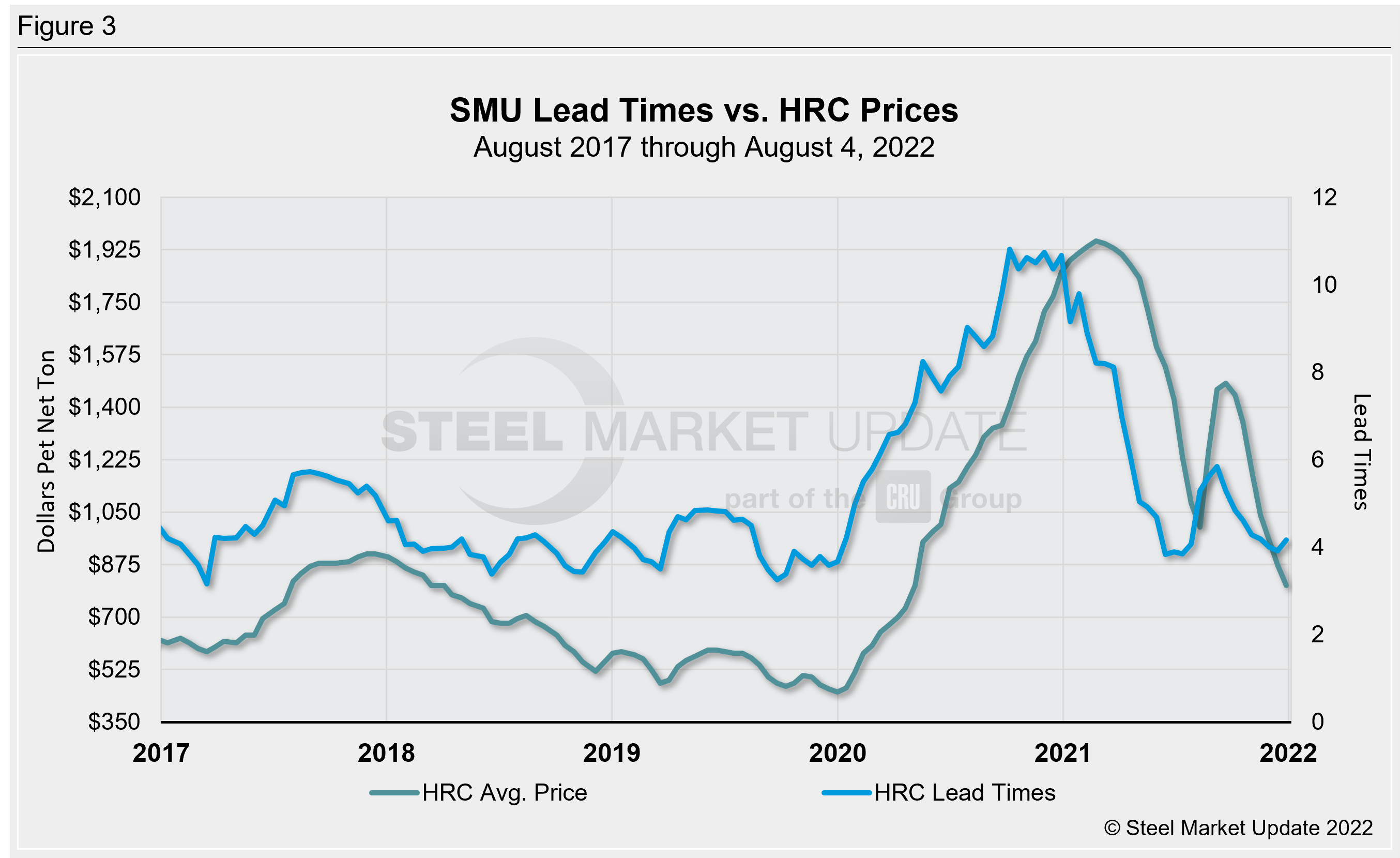

Steel buyers – mainly OEMs and service centers – were still reporting weakening demand as the calendar turned to August. But could a shift be in store? We have found that SMU’s steel demand diffusion index has for nearly a decade consistently preceded steel mill lead times (Figure 2 – featuring the past five years). Lead times have also historically been a leading indicator for flat-rolled steel prices, and hot-rolled coil (HRC) prices in particular (Figures 3 – featuring the past five years).

SMU’s average hot rolled coil price now stands at $820 per ton ($41/cwt), according to our latest check of the market on Aug. 9. Our overall average is up $15 per ton week on week.

Our hot rolled lead time averages 4.17 weeks, a marginal increase from 3.92 weeks in mid/late July. Overall, lead times are still low and not far from 2022 lows of ~3.8 weeks in late January and February. But they remain significantly higher than the record low in our ~11-year data history, which was 2.8 weeks in October 2016.

It’s too early to say if these markers are the start of a trend. But in addition to recent price increases and the narrowing of the gap between foreign HRC and US HRC prices, the possibility of labor turmoil could all play a role in squeezing the market in the interim.

The takeaway: Most (but not all) mill executives continue to report steady steel demand and remain bullish about their future prospects. Respondents to our surveys, mostly steel consumers, also report improved sentiment of late. So, while demand may still be down in our index, our latest data suggest there has been a shift. It’s just a matter of time before we know whether it was a blip or the start of an upward trend.

Note: Demand, lead times and prices are based on the average data from manufacturers and steel service centers who participate in SMU market trends analysis surveys. Our demand and lead times do not predict prices but are leading indicators of overall market dynamics and potential pricing dynamics. Look to your mill rep for actual lead times and prices.

By David Schollaert, David@SteelMarketUpdate.com