Canada

August 10, 2022

Stelco Posts Big Q2 Profit, Warns of H2 Bust on Falling Steel Prices

Written by Michael Cowden

Stelco Holdings Inc. reported stellar second quarter earnings but warned that the second half of the year won’t be nearly as bright.

The Canadian flat-rolled steelmaker pinned the dreary outlook on falling steel prices, lackluster demand, and rising costs for natural gas, coal and alloys.

![]()

“We are faced now with even stronger headwinds, including the sharply negative reversal in pricing trends that began early in the quarter,” company executive chairman and CEO Alan Kestenbaum said in a statement released along with earnings figures.

“We will work tirelessly to mitigate and overcome some of these challenges,” he added.

All told, Stelco recorded net income of $554 million CAD ($433.65 million USD) in the second quarter ended June 30, up 53% from $363 million CAD in year-ago quarter on revenue that rose 13% to $1.04 billion CAD over the same period.

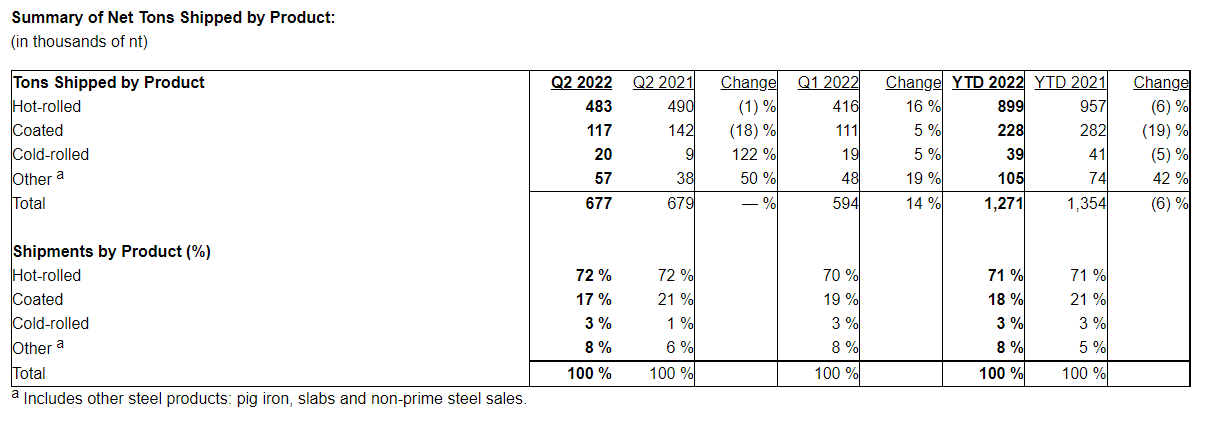

The gains came despite shipments being roughly flat year-over-year at 677,000 short tons.

One reason: higher prices. Stelco posted average selling prices of $1,453 CAD per ton in Q2 ’22, up 12% from $1,292 CAD per ton in Q2 ’21. Another reason: Stelco netted $260 million CAD in Q2 ’22 from the sale of land and buildings at its Hamilton Works in Ontario. That sale and leaseback transaction was announced on June 1.

Good news, right? The problem: SMU’s hot-rolled coil price stands at $820 USD per ton, down nearly 45% from a post-Ukraine war peak of $1,480 USD per ton in mid/late April. And Stelco doesn’t expect that trend to reverse.

The steelmaker expects that Q3 adjusted earnings before interest, taxes, depreciation, and amortization (ebitda) will be “materially below” Q2 results – and that “further weakening” will occur in Q4, chief financial officer Paul Scherzer said.

“This assumes that the lower prices and shorter lead-times being experienced currently fully impact results and prevail through the remainder of 2022,” he said.

Stelco made no mention of contract negotiations with the United Steelworkers (USW) union in its earnings release.

USW Local 87282, which represents Stelco’s Lake Erie Works in Nanticoke, Ontario – the company’s only steelmaking location – is legally authorized to strike at 12:01 a.m. on Sunday, Aug. 22. Local 1005, which represents it processing and finishing operations in Hamilton, is legally authorized to strike as of 11:50 p.m. on Monday, Aug. 15. A prior labor contract between Stelco and the unions expired on June 30.

Nearly two-third of Stelco’s sales are of hot-rolled coil, as the chart below shows:

By Michael Cowden, Michael@SteelMarketUpdate.com