Market Data

August 4, 2022

Buyers Report Mills Maintain High Willingness to Negotiate

Written by Brett Linton

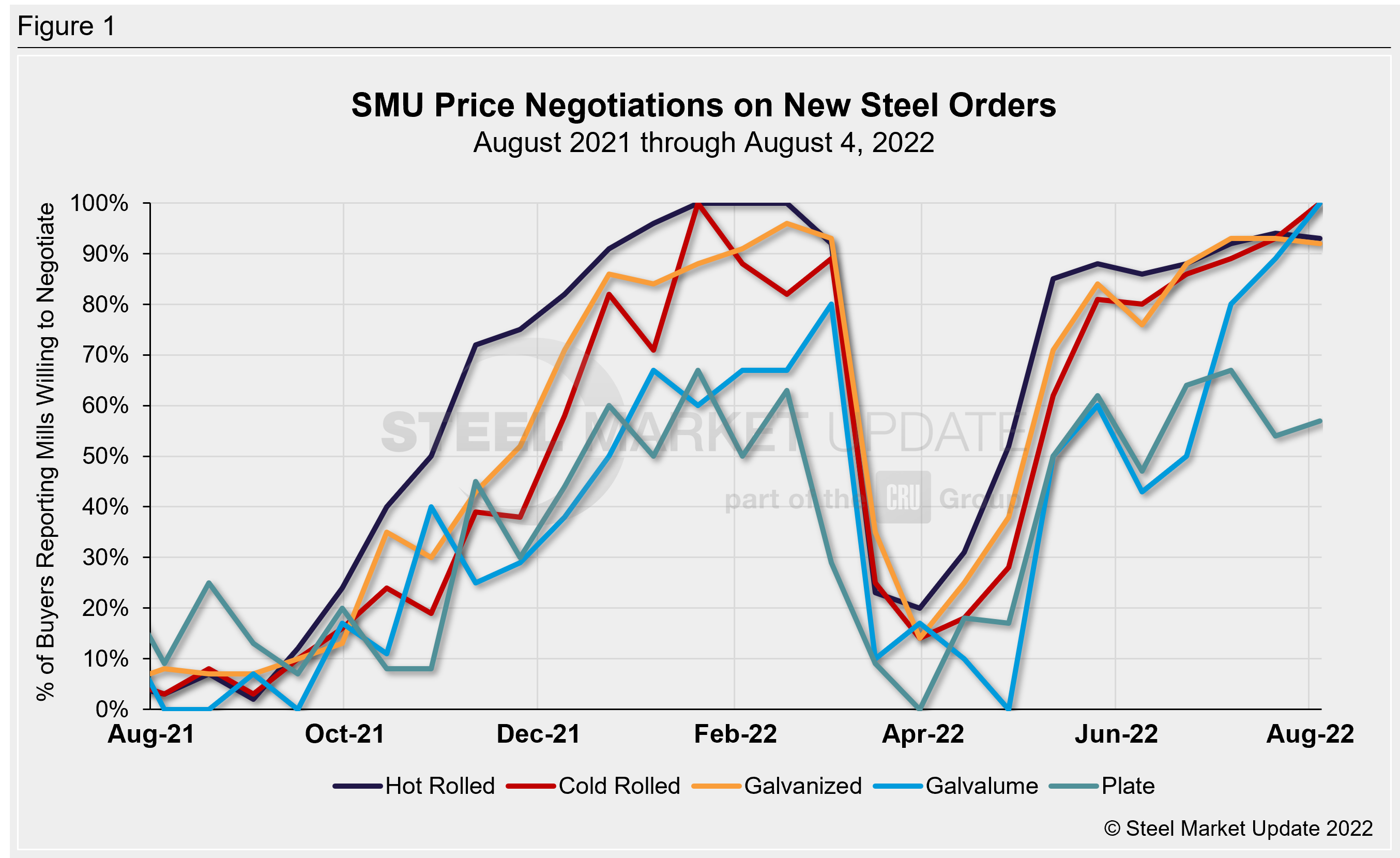

As has been the case for six weeks now, nearly nine out of ten steel executives polled this week reported that mills are willing to talk price to secure an order. According to our steel market surveys, a high willingness to negotiate has been evident in each of our checks since early May.

SMU polls hundreds of steel buyers every other week with the question: Are you finding domestic mills are willing to negotiate spot pricing on new orders? On average this week, 89% of steel buyers report that mills were willing to negotiate lower prices on new orders, relatively unchanged compared to our two polls in July. Recall we saw negotiation rates as low as 16% in March.

Broken down by product, 93% of hot rolled buyers surveyed are now responding that mills are willing to negotiate lower prices. The mid-July rate of 94% was the highest rate seen since mid-February of this year. Every single cold rolled and Galvalume buyer polled reported that mills were willing to bargain. Galvanized respondents sing the same tune as hot-rolled buyers, with 92% of buyers reporting that mill prices are now negotiable, unchanged since early July.

Negotiations have been slightly less common in the plate market, with 57% of buyers reporting a willingness to negotiate this week. This is slightly up compared to our previous survey’s 54% rate. Plate negotiation rates have been between 54–67% since late June. Recall we saw plate negotiation rates of 0–18% in March and April.

SMU’s Price Momentum Indicator remains at Lower since our adjustment on May 10, indicating we expect prices to decline over the next 30–60 days.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.

By Brett Linton, Brett@SteelMarketUpdate.com