Prices

July 29, 2022

SMU Hot Rolled vs Galvanized Price Spread Analysis

Written by Brett Linton

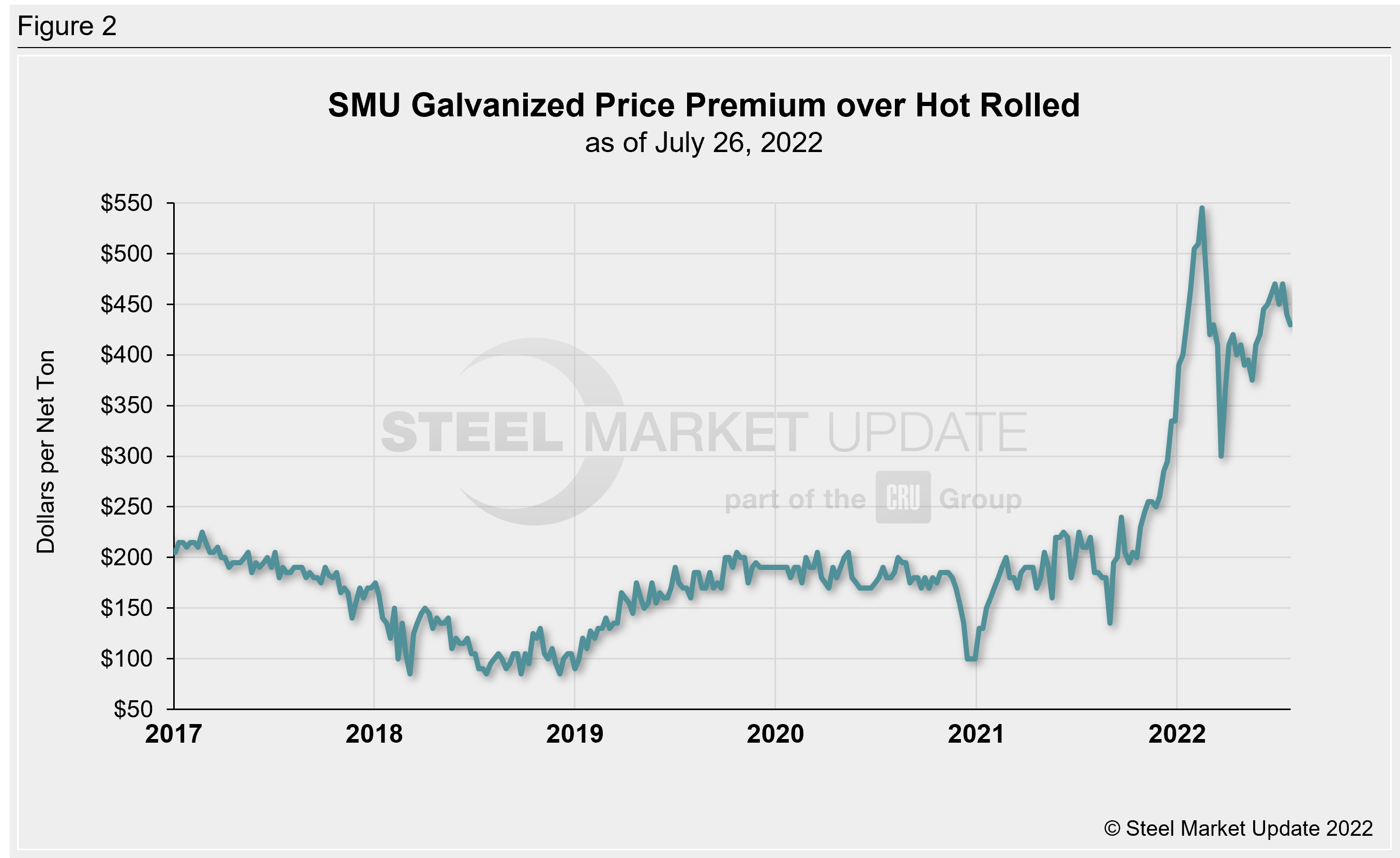

The relationship between hot rolled and galvanized steel prices has been unstable since late 2021, with galvanized selling at a premium of anywhere between $135-545 per ton ($6.75-$27.25 per cwt) over hot rolled in the past year. The premium reached a record high in February but then quickly narrowed in March. Although steel prices have been declining for the past three months, the spread between hot rolled and galvanized prices continues to grow, hovering in the $400/-per-on range for the last ten weeks.

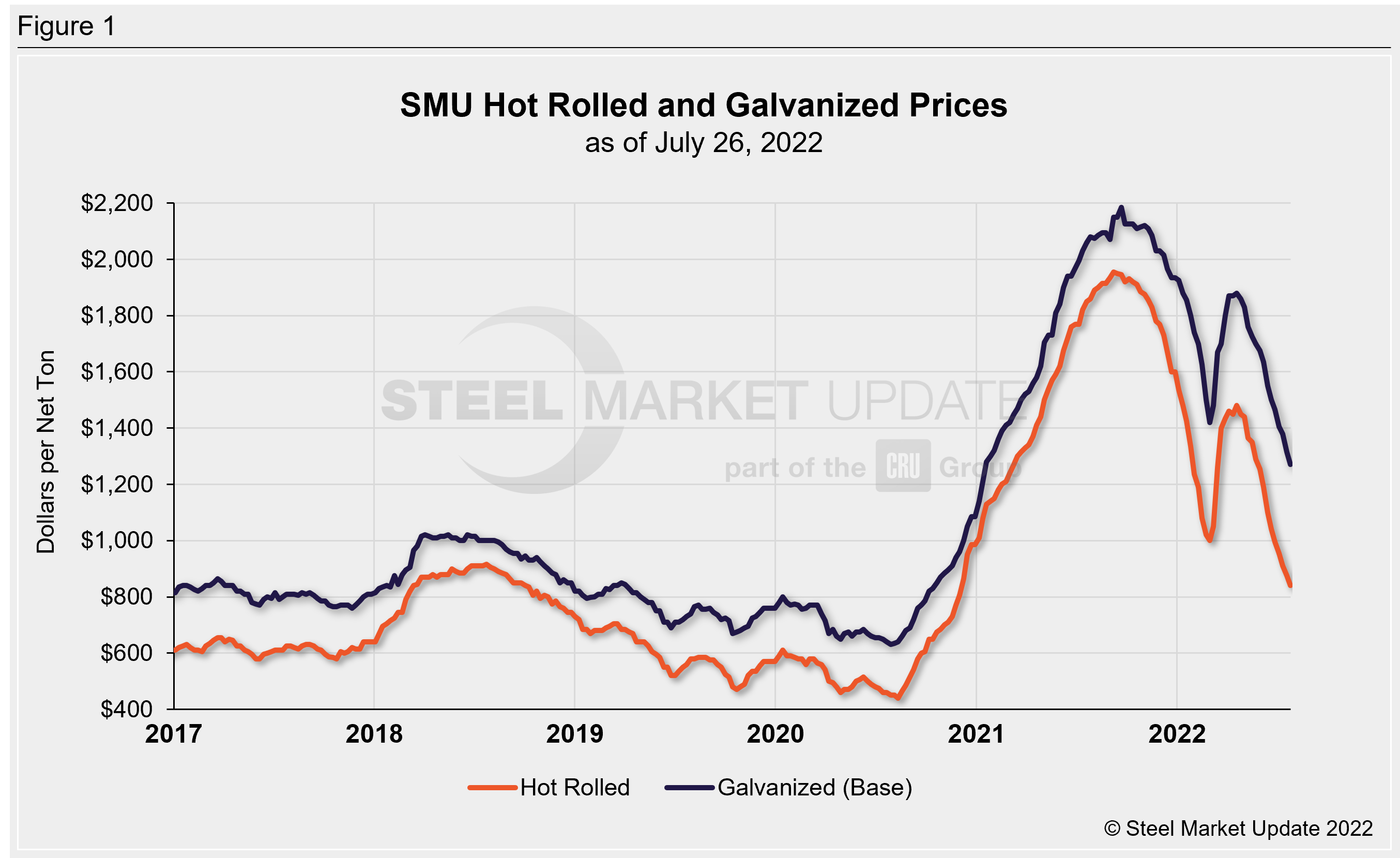

SMU’s hot rolled coil price averaged $840 per ton last week and has declined each of the past 14 weeks. Recall our index had reached a 14-month low of $1,000 per ton in the first week of March, following a record-high $1,955 per ton in September 2021. Our latest galvanized price index averaged $1,270 per ton ($63.50 per cwt) last week and has also decreased for the last 14 weeks. Galvanized prices peaked at $2,185 per ton last September and fell to a 12-month low of $1,420 per ton in early March.

As shown in the graph below, galvanized held a premium of $80-$220 per ton over hot rolled for the last few years, exceeding that range in late 2021. Recall the premium rapidly rose to a peak of $545 per ton in mid-February, falling almost as quickly thereafter to reach a low of $300 per ton on March 22. The premium last week was $430 per ton, a seven-week low. The average premium in July was $448 per ton, compared to $456 per ton in June and $400 per ton in May.

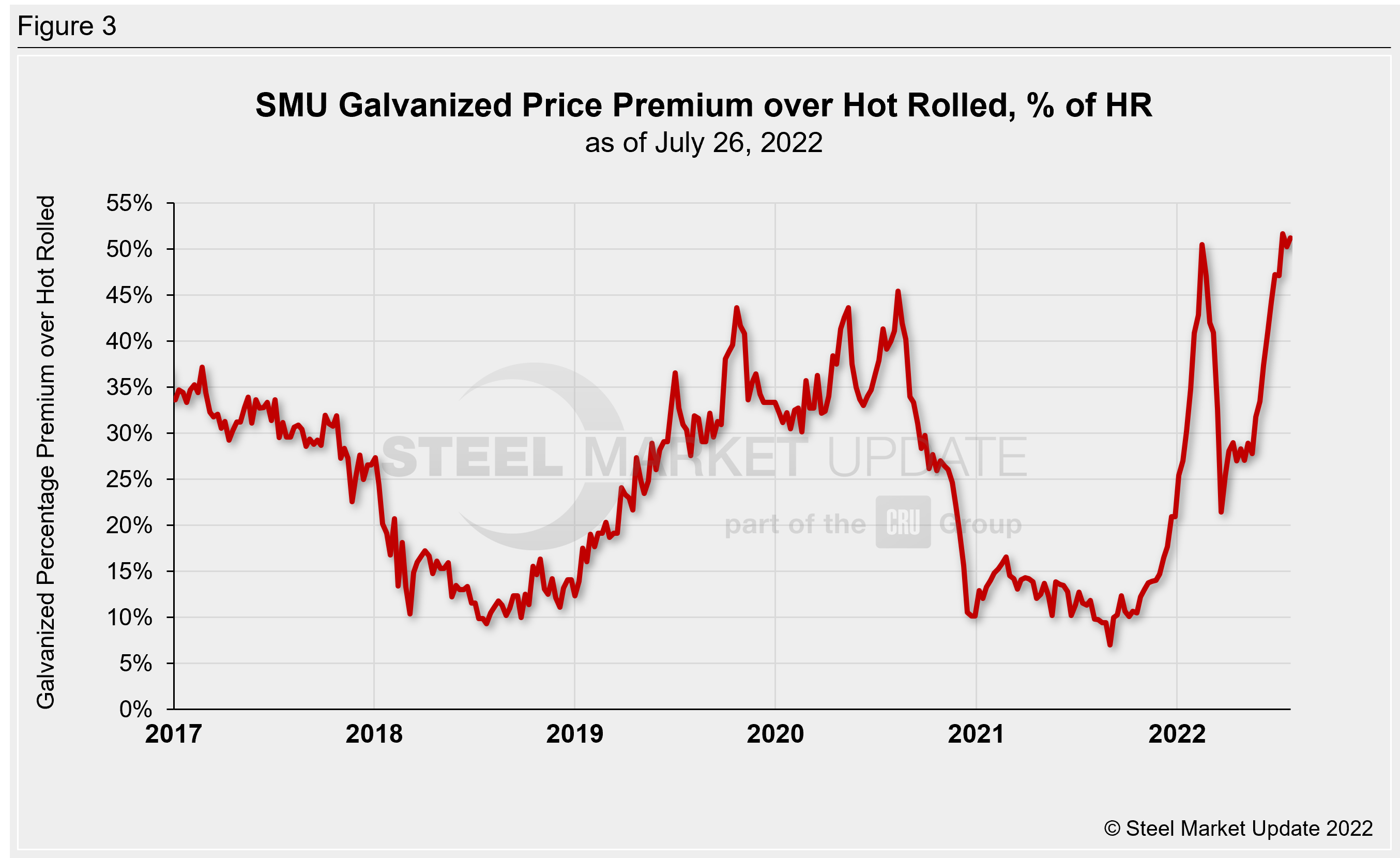

To better compare this price spread, we graphed the galvanized price premium over hot rolled as a percentage of the hot rolled price. This is an attempt to paint a clearer comparison against historical pricing data. As shown in the graphic below, the percentage premium is not as alarming compared to the dollar value premium, but it is still significantly higher compared to most past cycles. Galvanized prices held an average premium of 24% above hot rolled prices from 2017 through the end of 2021. In 2021, that premium averaged just 13%, while 2022 YTD now averages a 36% premium through last week. The premium rose to a (then) record high in mid-February 2022 of 50%. We surpassed that high in mid-July at 52%. The latest premium (51%) remains near that high. The average premium in July was 50%, up from 42% in June and 30% in May.

By Brett Linton, Brett@SteelMarketUpdate.com