Plate

July 20, 2022

Plate Market Report: Delta Unsustainable, Bound to Fall

Written by David Schollaert

US plate prices have been holding steady and bucking the downtrend presently seen across sheet and coated products. Plate demand has remained largely steady, while buyers have maintained lean inventories, only taking volumes to fill gaps.

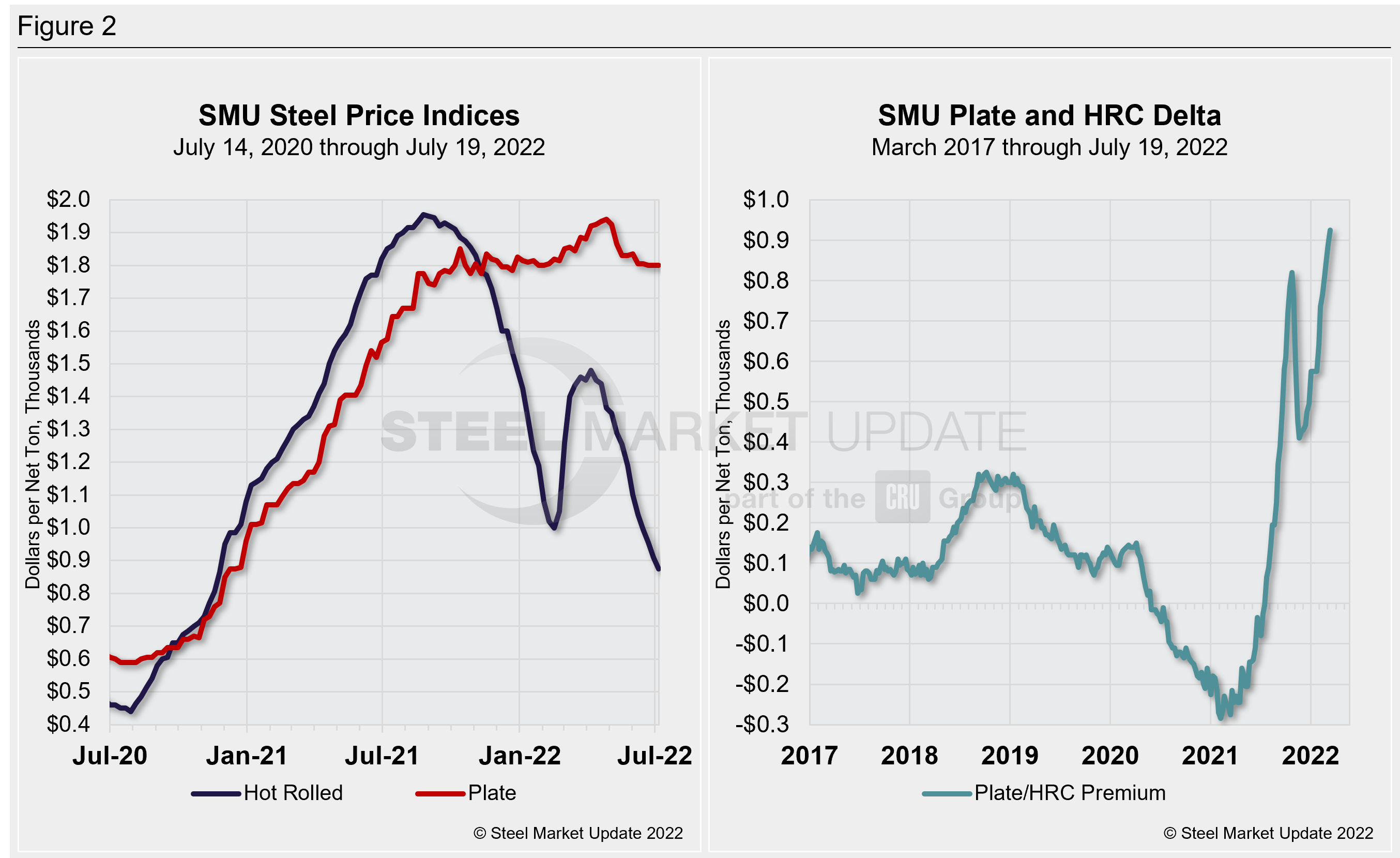

The price dynamic has led to historically high premiums over hot-rolled coil (HRC) prices. Presently, plate prices are more than double the tags for HRC, pushing premiums roughly four times higher than the historic average.

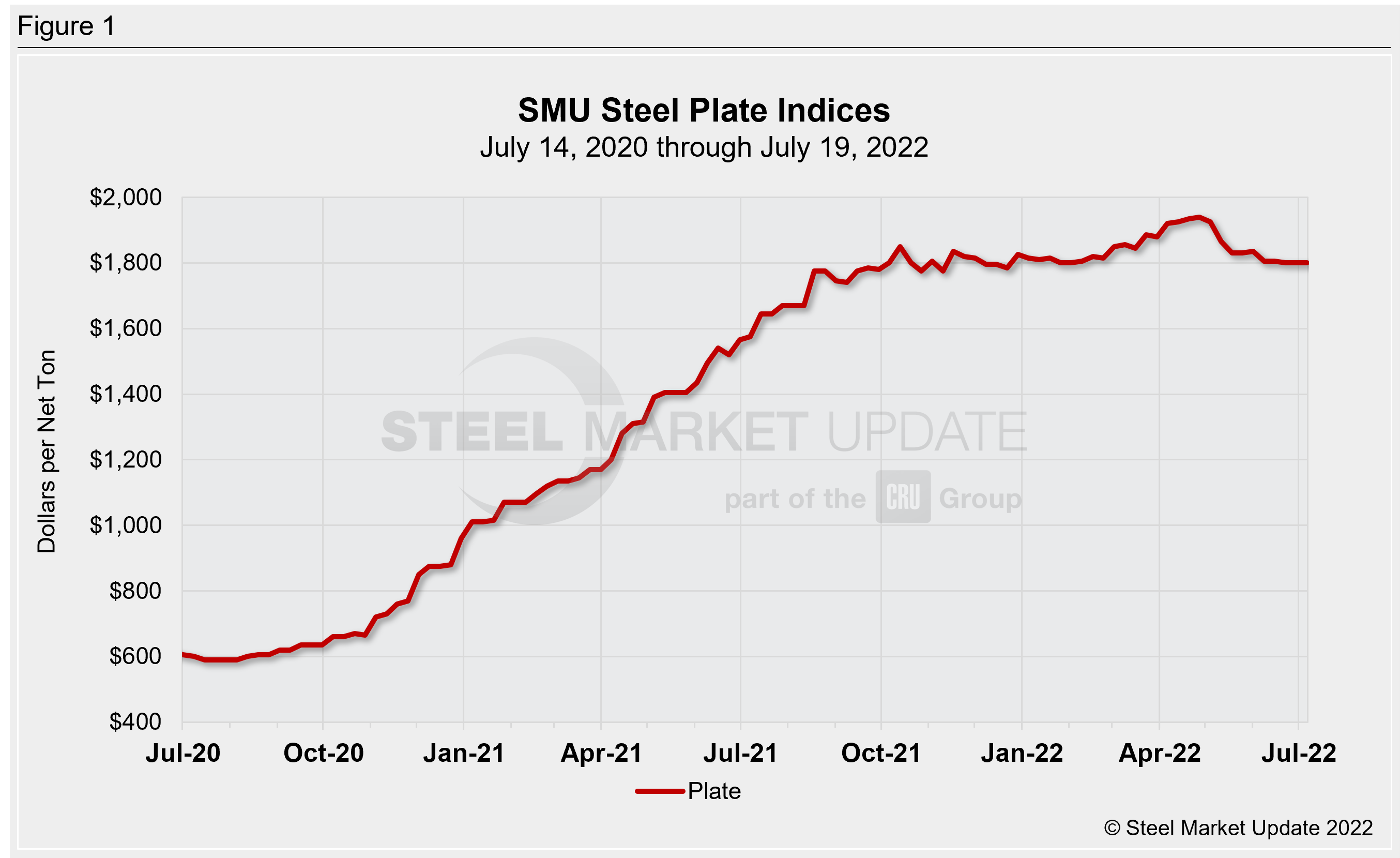

Steel Market Update’s (SMU) most recent check of the market on July 19 places plate prices between $1,740-1,860 per net ton ($87-93/cwt) with an average of $1,800 per ton ($90/cwt) FOB mill, according to our interactive pricing tool (Figure 1).

SMU’s average plate price of $1,800 per ton ($90/cwt) has not moved in three weeks and is only down $30 per ton ($1.50/cwt) over the past eight weeks. SMU’s HRC price, in contrast, has declined by roughly $315 per ton ($15.75/cwt) over the same period, falling from an average of $1,190 per ton in early June to $875 per ton, FOB mill, on July 19.

The historical delta between HRC and plate prices has hovered on average around $100-200 per ton. The delta presently stands at $925 per ton – an all-time high for SMU’s price tags and the market overall. A comparison between plate and HRC prices is shown in Figure 2 below. Also shown is the delta spread over the past two years.

Though prices have been stable of late, our price momentum indicator on plate steel is pointing lower, because we expect prices to decrease over the next 30 days, given current market sentiment.

SMU sources generally agree that the steel plate market is stable. Demand is likely to tail off slightly while prices should correct and follow a similar move seen across sheet and coated products. The decline is not expected to be as precipitous as we’ve seen for HRC.

The bulk of plate transactions are running at the top of SMU’s range, in line with published and ‘unofficial’ prices from the likes of Nucor, Cleveland-Cliffs, and SSAB. But some deals are being confirmed at the lower end of the range for standard volumes. Import offers are presently between $1,400-1,460 per ton ($70-73/cwt), DDP US port, for late fourth quarter arrival.

Sources have also noted that some mills seem more willing to negotiate, a trend not seen in quite a while for plate products.

While cut-to-length and discrete plate lead times are running between 4-7 weeks, a number of sources stated that in many cases plate is arriving sooner, between 3-4 week lead times. This is another indicator that fundamental steel plate demand is steady but slowing down.

Current plate premiums are not expected to last. The existing spread is unsustainable, according to several SMU sources. The tightening spread will likely be driven by declining plate prices rather than rebounding HRC tags. But sources stress the decline will be controlled. Most speculate that plate places will fall by approximately $50 per ton ($2.5/cwt) per month between now and the end of the fourth quarter.

By David Schollaert, David@SteelMarketUpdate.com