Market Data

July 18, 2022

Service Center Shipments and Inventories Report for June

Written by Estelle Tran

Flat Rolled = 55 Shipping Days of Supply

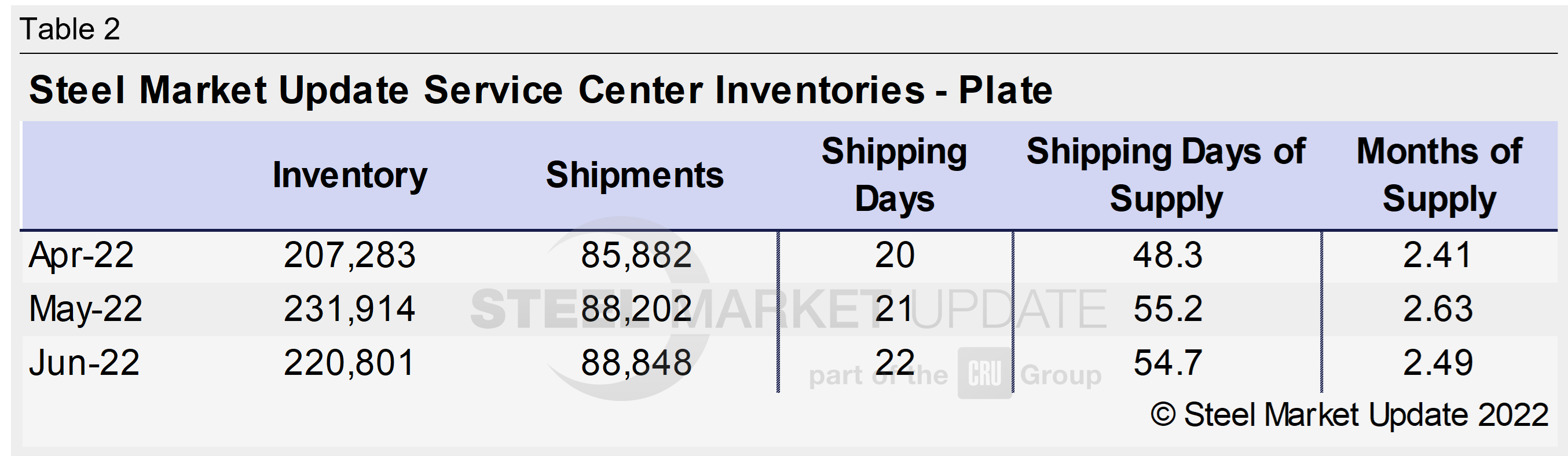

Plate = 54.7 Shipping Days of Supply

Flat Rolled

US service center flat rolled inventories edged up in June. At the end of June, service centers carried 55 shipping days of supply on an adjusted basis, according to SMU data. This was up from 54.7 shipping days of supply in May. In terms of months of supply, service centers had 2.5 months of supply on hand, down from 2.6 in May. June had 22 shipping days, one more than the 21 in May.

The daily shipping rate eased back in June, and some service centers observed an early arrival of the summer slowdown. Service center contacts reported steady demand in June but concerns about the pipeline of orders. Manufacturers have been holding back on purchases as prices have declined, and uncertainty about supply chains at the beginning of the war in Ukraine pulled some orders forward. Slowing demand amid fears of a possible recession is pointing to a supply-demand imbalance.

We are also hearing of more inquiries from mills seeking orders. The latest SMU lead time survey published July 7th pegged HRC lead times at 4 weeks, down from 4.28 weeks a month ago.

The amount of material on order fell in June, though remains elevated. This, coupled with slowing demand, could be an indication of a future inventory glut.

While there are some large volume deals taking place, most buyers remain hesitant about placing orders for unsold material with prices falling fast. Plummeting scrap prices and slowing demand in the summer could continue a declining price trend for sheet. We do not view inventories as lean but instead as less bloated. Stronger demand or reduced supply will be needed to change the current downward pricing trend.

Plate

US service center plate inventories decreased in June. Stable shipments contributed to the number of shipping days of plate supply falling to 54.7 days in June. In May, service centers carried 55.2 shipping days of supply. Supplies in June represented 2.49 months on hand, down from 2.63 months in May.

We think there is still intertrade among service centers to manage gaps in inventory, but demand has also been steady. Inventories appear to be balanced with shipments as well.

In June, the amount of material on order fell month-on-month. This is reflected in the mill lead times. The latest SMU survey found plate mill lead times fell to 5.11 weeks from 5.46 weeks a month ago.

We are starting to hear about some deals for heavy plate, and increased concern about the massive spread between plate and HRC. Plate buyers might consider imports given the excessive spread between HRC and plate and the high premium for domestic plate relative to global prices.

Service centers have also expressed worry about projects in the pipeline. That could point to a decline in demand. With the expected seasonal slowdown in outbound shipments and shortening lead times, intake could pick up in July.

By Estelle Tran, Estelle.Tran@CRUGroup.com