Prices

July 11, 2022

US Steel Exports Down 4% in May, 12MMA Climbs to 40-Month High

Written by Brett Linton

US steel exports fell 4% in May to 793,000 net tons, further declining from a 45-month high in March, according to the latest US Commerce Department data. On a 12-month moving average (12MMA), May exports have reached a 3+ year record high. Total May exports are 7% higher than levels seen one year ago.

As shown in Figure 1, May exports are at the fourth-highest monthly level seen in the past four years. Prior to March’s high, the previous multiyear high was 790,000 tons in March 2021. Recall that in May 2020, total steel exports had fallen to a 24-year low of 374,000 tons.

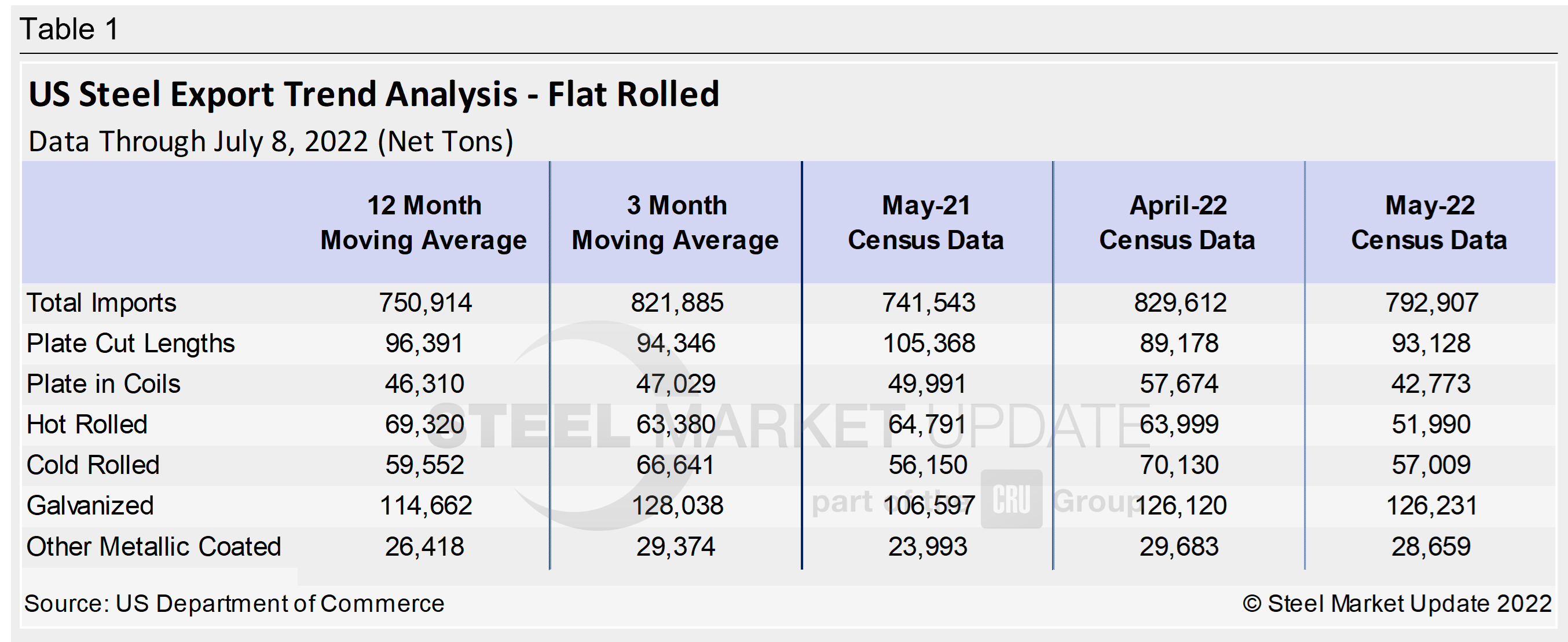

Of our six monitored product groups, four decreased month-over-month in May, one increased, and one was flat (Table 1).

On a year-to-date basis, export levels for the first five months of 2022 now average 777,000 tons per month. This is up from an average of 728,000 tons in the same period of 2021, up from an average of 572,000 tons in 2020 YTD, and up from an average of 653,000 tons in 2019 YTD.

On a rolling 12MMA, May exports are now at a 40-month high of 751,000 tons (Figure 2). Recall the August 2020 record low 12MMA of 577,000 tons. Total exports averaged 731,000 tons per month in 2021, compared to 591,000 tons in 2020, 648,000 tons in 2019, and 775,000 tons in 2018.

Total May exports are 4% below the 3MMA (average of March through May 2022), but 6% above the 12MMA (average of June 2021 through May 2022). Here is a detailed breakdown by product:

Cut-to-length plate exports fell to 93,128 tons in May, up 4% compared to April but down 12% compared to May 2021.

Exports of coiled plate were 42,773 tons in May, down 26% from the prior month and down 14% from May of last year.

May hot rolled steel exports declined 19% from April to 51,990 tons and were down 20% from one year prior.

Exports of cold rolled products were 57,009 tons in May, 19% lower than April but 2% higher than the same month last year.

Galvanized exports were 126,231 tons, relatively stable compared to April and up 18% year-over-year.

Exports of all other metallic-coated products decreased 3% month-over-month to 28,659 tons. Compared to levels one year ago, May is up 19%.

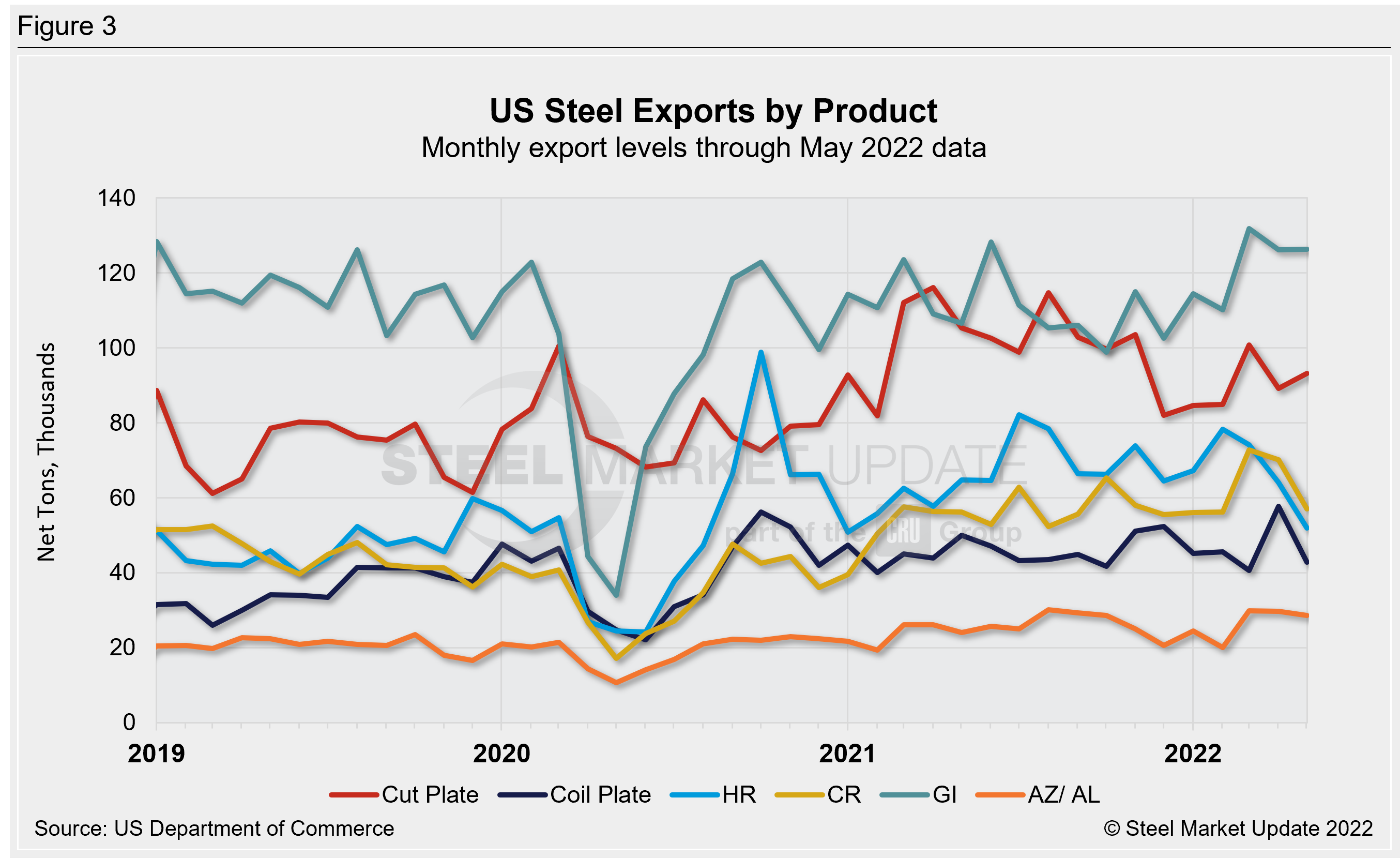

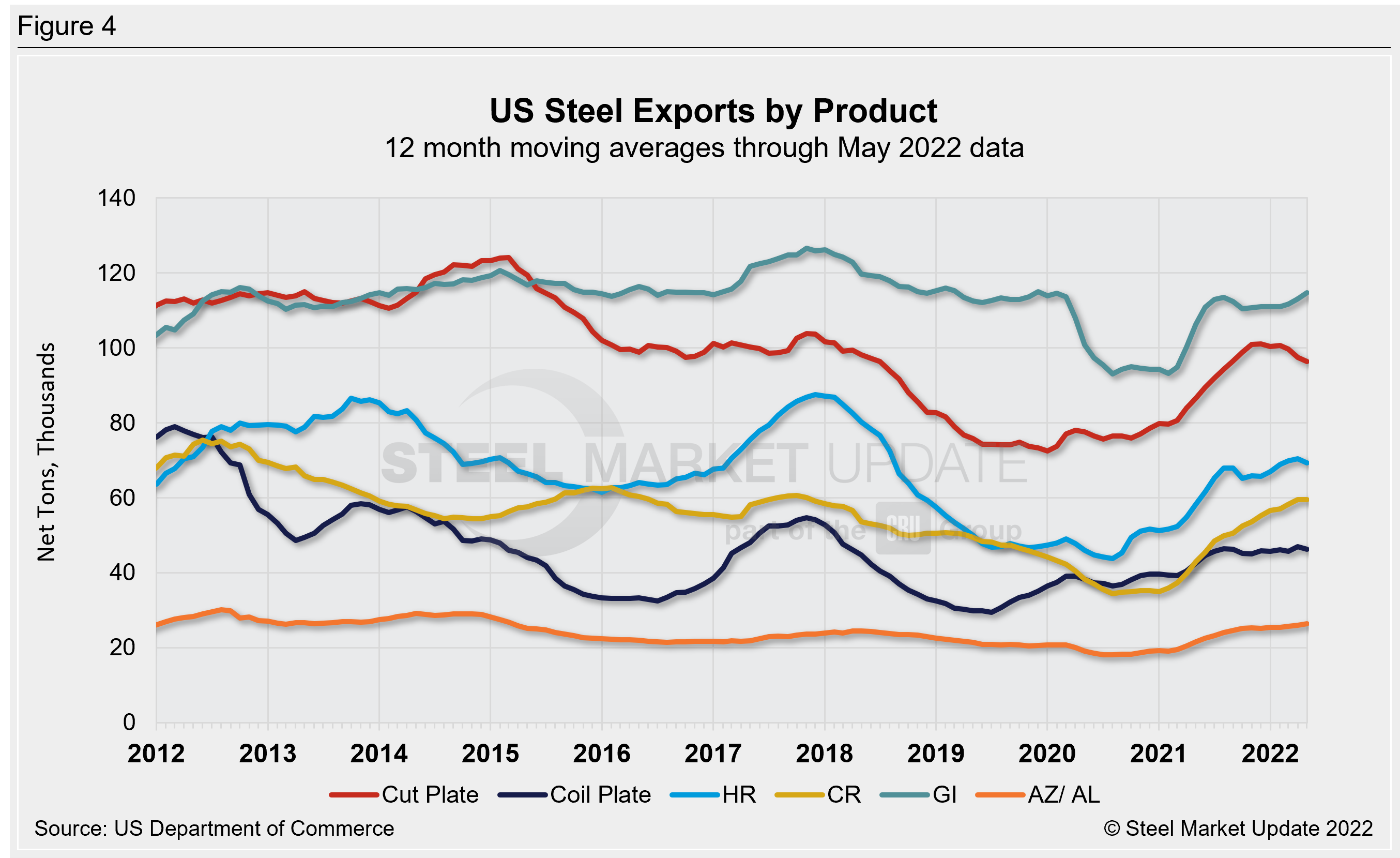

Figures 3 and 4 show US exports by product, both monthly levels and as a 12MMA.

We have an interactive graphing tool available on our website here. Readers can further investigate historical export data in total and by product. If you need assistance logging into or navigating the website, contact us at Info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com