Analysis

June 16, 2022

Final Thoughts

Written by Michael Cowden

There have been some interesting developments in the plate market lately if you’ve been paying close attention.

Let’s start with Nucor’s price decrease on cut-to-length (CTL) plate. For starters, let’s be clear that it’s only CTL prices that were dropped. Prices for discrete plate are unchanged.

First, a little background. CTL plate refers to material that is produced as coil. That coil is then leveled and cut to length. Discrete plate, in contrast, is produced as plate – it doesn’t originate in coil form.

That distinction is worth emphasizing. But what’s more interesting are the dimensions of the CTL products on which Nucor chose to cut pricing.

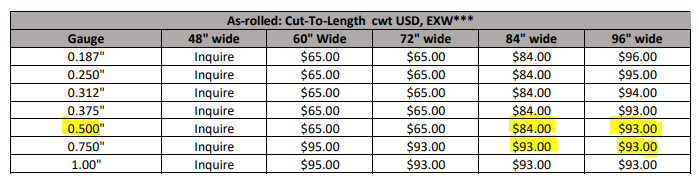

Nucor dropped prices on material less than 72 inches wide and a ½ inch thick by $125 per ton ($6.25 per cwt). Prices for material 73-84 inches wide and up to or less than ½ inch thick were cut by $85 per ton ($4.25 per cwt).

Check out the snip below from Nucor’s updated price list:

As mentioned above, prices for discrete plate are unchanged. As for CTL plate, it really depends on the item.

Prices are unchanged for CTL material more than a half inch thick or more than 96 inches wide. But why would anyone pay $93 cwt ($1,860 per ton) for CTL plate 84-inch wide that is ¾ inch thick but only $84 per cwt ($1,680 per ton) for 84-inch wide ½ inch or less thick.

Our best guess is that this might be tacit acknowledgement by Nucor that there is competition on sizes up to 1/2-inch thick from SDI’s new mill in Sinton, Texas. Recall that Sinton, as any recent lead time sheet might tell you, makes what it calls “HR – Plate”. Basically, coil in much thicker sizes than traditional HRC.

Plate has held a very high premium over sheet products such as HRC lately. Could SDI be charging a HR base for what is typically considered a plate product – thereby offering a significantly lower price for an that item than what might be offered by plate mills?

I can’t say that with 100% certainty. But, again, I think it’s possible that Nucor’s CTL plate price reduction on the sizes mentioned above is the first acknowledgement by a major plate mill that adjustments because of competition from Sinton need to be made.

To be clear, I’m not saying that this is the beginning of a price war. Equity prices might be collapsing and sheet prices might be falling. But activity is not terrible depending on who you talk to. I’d interpret this as yet another sign that there is once again healthy competition for new business, particularly when it comes to plate.

I should also add that Nucor declined to comment for this article. Mills do not typically comment on pricing matters.

By Michael Cowden, Michael@SteelMarketUpdate.com